Preparing for the CFA Exam requires a comprehensive understanding of the “Overview of the Global Investment Performance Standards (GIPS),” a crucial component of ethical investment practice. Mastery of these standards enhances transparency and offers a standardized method for calculating and presenting investment performance, critical for achieving trust and integrity in financial reporting.

Learning Objective

In studying the “Overview of the Global Investment Performance Standards (GIPS)” for the CFA Exam, you should learn to understand the purpose and scope of these standards in promoting global ethical practices in performance reporting. Analyze how GIPS facilitates accurate and consistent performance data, providing a trustworthy basis for comparing investment managers globally. Evaluate the key components of compliance, including the creation of composites, performance calculation methodologies, and disclosure requirements. Additionally, explore how adhering to GIPS impacts the credibility and integrity of investment firms and their ability to attract and retain clients. Apply this knowledge to case studies demonstrating the application and benefits of GIPS compliance in real-world scenarios.

Introduction to GIPS

The Global Investment Performance Standards (GIPS) are a set of standardized, industry-wide ethical principles that guide investment firms on how to calculate and present their investment performance to prospective and existing clients. GIPS standards aim to promote global uniformity in performance reporting, ensuring transparency, fairness, and comparability across investment firms regardless of geographical location.

Key Features of GIPS:

- Fair Representation and Full Disclosure: GIPS require that firms present performance results that are fair, accurate, and complete. This includes disclosing all relevant information that clients would reasonably require to understand the investment results.

- Comprehensiveness: GIPS standards apply to all quantitative investment data. They require firms to include all fee-paying and non-fee-paying discretionary portfolios in composites that are defined according to similar strategy and investment objectives.

- Uniformity: GIPS standards provide a framework that standardizes the inputs and methodologies used in performance calculation. This ensures that the performance results are comparable across firms globally.

- Third-Party Verification: While not mandatory, firms are encouraged to undergo independent third-party verification of their compliance with GIPS standards. This verification provides additional credibility to the firm’s claim of compliance.

Fundamental Components of GIPS

The Global Investment Performance Standards (GIPS) are designed to provide a rigorous framework for investment performance reporting and presentation. By adhering to GIPS, investment firms can ensure their performance data is consistent, transparent, and comparable on a global scale. Here are the fundamental components of GIPS that firms must incorporate into their compliance processes:

- Composite Construction: Firms must create composites, which are aggregations of individual portfolios that represent a similar investment strategy or objective. This grouping ensures that the performance presented is representative of the firm’s capabilities in that strategy.

- Calculation Methodology: GIPS specify how firms should calculate returns, including adjustments for cash flows, accrued income, and other factors that can affect performance.

- Data Requirements: Firms are required to provide a minimum of five years of GIPS-compliant performance data, or since the firm’s inception if it has been in existence for less than five years. After presenting at least five years of compliant data, firms must present up to 10 years of historical performance data.

- Disclosure: GIPS standards require specific disclosures that ensure any relevant information that could impact a client’s understanding of reported results is shared. This includes details about the firm, the composite, and the performance calculation methodology.

- Presentation and Reporting: Performance reports under GIPS must adhere to certain formatting and content guidelines to ensure clarity and completeness of the information provided.

Creating and Defining Composites

Creating and defining composites is a crucial aspect of complying with the Global Investment Performance Standards (GIPS). Composites are groups of portfolios managed according to a similar investment mandate, objective, or strategy. Properly defining these composites allows firms to present aggregate performance data that is both meaningful and representative of their management capabilities. Here’s a guide on how to effectively create and define composites:

Steps to Create and Define Composites:

- Identify Similar Portfolios: Group portfolios that are managed under the same strategy or that have similar investment objectives. This is the first step in composite construction and helps ensure that the performance presented is applicable to all portfolios within the composite.

- Define Composite Objectives: Clearly articulate the investment objectives and strategies of the composite. This definition should include the investment style, the targeted risk and return characteristics, and any specific constraints or guidelines that govern portfolio management within the composite.

- Include All Discretionary Portfolios: To ensure fairness and consistency, all actual, fee-paying, discretionary portfolios that meet the composite definition must be included. This prevents selective performance reporting and ensures that the composite truly represents the firm’s management capabilities.

- Establish Clear Guidelines: Develop and document guidelines for including and excluding portfolios in the composite. These guidelines should cover scenarios such as new portfolios, closed portfolios, significant cash flows, and changes in portfolio management strategy.

- Continuous Update and Maintenance: Regularly review and update the composite definitions to reflect any changes in management strategy or objectives. Also, monitor the inclusion of new portfolios and the removal of those no longer active or appropriate for the composite.

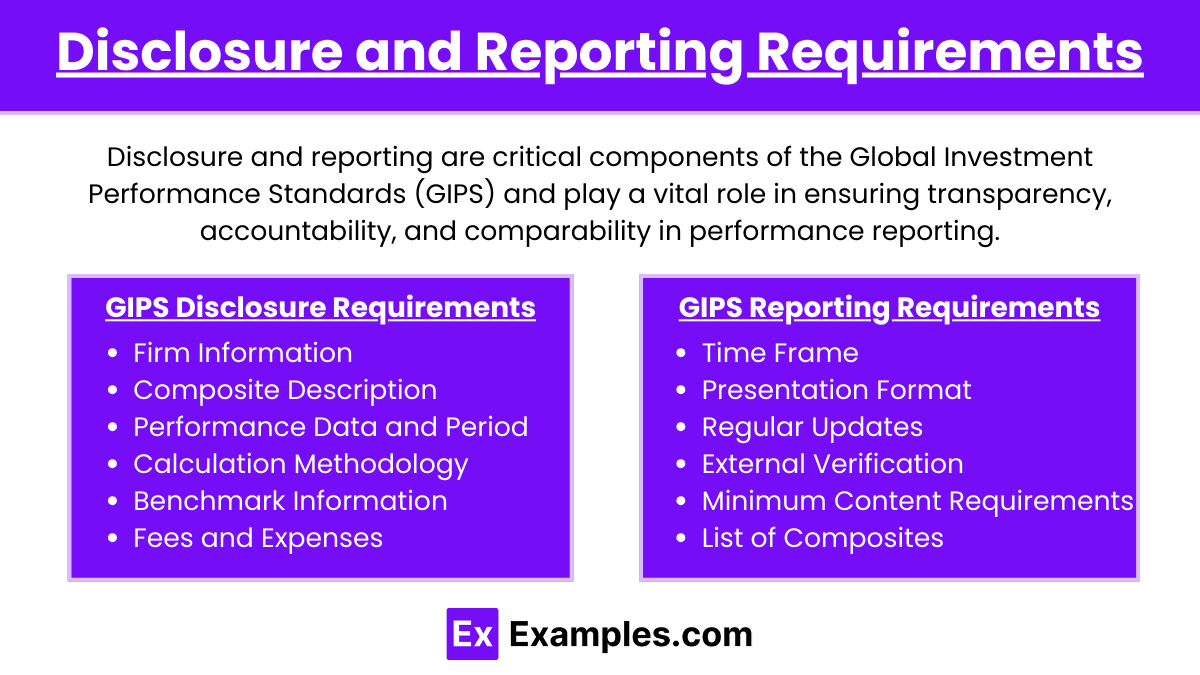

Disclosure and Reporting Requirements

Disclosure and reporting are critical components of the Global Investment Performance Standards (GIPS) and play a vital role in ensuring transparency, accountability, and comparability in performance reporting. Here’s a detailed overview of the disclosure and reporting requirements under GIPS:

GIPS Disclosure Requirements

- Firm Information: Disclose the definition of the firm, describing the entity that is claiming compliance with GIPS. This includes the firm’s history, ownership structure, and any changes over the reporting period.

- Composite Description: Provide a thorough description of the composite, including its objectives and strategies. Details about the criteria for portfolio inclusion and any changes to the composite definition must also be disclosed.

- Performance Data and Period: Present performance results over specific periods, typically annually. Disclose the total return of the composite and the benchmark for each period.

- Calculation Methodology: Explain the methodologies used for calculating returns, including the treatment of dividends, interest, and capital gains. Disclose if a time-weighted or money-weighted method is used.

- Benchmark Information: Provide details of the benchmark used for comparison, including its relevance and any differences in composition compared to the composite.

- Fees and Expenses: Disclose the fees and expenses that are included in the performance figures, such as management fees, custodial fees, and performance-based fees. Also, specify whether gross or net-of-fees performance is shown.

GIPS Reporting Requirements

- Time Frame: Firms must report at least 5 years of GIPS-compliant performance or since the firm’s inception if it has been in existence for less than 5 years. After presenting at least 5 years of compliant data, firms must present up to 10 years of historical performance data.

- Presentation Format: Performance results must be presented in a clear and fair manner, using charts or tables where appropriate to enhance clarity. Reports should be straightforward to allow for easy comparison between different time periods and against benchmarks.

- Regular Updates: Update performance presentations at least annually and provide them to prospective and existing clients upon request. All significant changes in the information must be timely updated in the reports.

- External Verification: Although not a requirement, firms are encouraged to have their GIPS compliance verified by an independent third party. This verification should be disclosed in the performance presentation.

- Minimum Content Requirements: The report must include all required disclosures and a statement claiming GIPS compliance. Any use of sub-advisors and the extent of their use must also be disclosed.

- List of Composites: Provide a complete list of all firm composites with descriptions, which is useful for current and prospective clients to understand the range of strategies managed by the firm.

Examples

Example 1: GIPS Compliance for a New Asset Management Firm

A newly established asset management firm decides to claim GIPS compliance from its inception. The firm sets up processes to create compliant composites, establish documented policies and procedures for maintaining compliance, and undergoes annual third-party verification to ensure that its marketing materials reflect its commitment to transparency and adherence to global standards.

Example 2: Revising Composites After Strategy Shift

An investment firm revises its equity fund strategy from a domestic focus to a global focus. Under GIPS, the firm must re-define the composite to reflect this change and provide transparent disclosure about the date and nature of the strategy shift, ensuring that historical performance is appropriately segmented and reported to avoid misleading current and prospective clients.

Example 3: Performance Presentation to Prospective Clients

A wealth management firm prepares a presentation for prospective clients showcasing the firm’s past performance. To comply with GIPS, the presentation includes all required disclosures such as the firm’s definition of the firm, the composite description, the benchmark used, fees, and a statement claiming GIPS compliance. This ensures that all performance data is presented in a comprehensive, fair, and comparable manner.

Example 4: Handling Large External Cash Flows

An investment manager handles a significant cash inflow into a portfolio that is part of a GIPS composite. To maintain the integrity of performance results, the manager temporarily removes the portfolio from the composite during the period of significant cash flow, as per GIPS guidelines, to prevent the large inflow from distorting the performance results of the composite.

Example 5: Annual GIPS Disclosure Updates

At the end of each fiscal year, a global investment firm updates its GIPS disclosures across all marketing and client reporting documents. This includes refreshing the list of composites, detailing any changes to composite definitions, and ensuring that all performance reports reflect the latest GIPS standards and any amendments that have taken effect during the year.

Practice Questions

Question 1

What is the primary purpose of the Global Investment Performance Standards (GIPS)?

A. To maximize the financial performance of investment firms

B. To ensure consistent and transparent reporting of investment performance globally

C. To regulate the fees investment managers can charge

D. To provide legal advice to investment firms

Answer:

B. To ensure consistent and transparent reporting of investment performance globally

Explanation:

The primary purpose of GIPS is to provide a set of standardized, ethical practices for calculating and presenting investment performance that investment management firms can voluntarily adopt to ensure fairness, transparency, and comparability. GIPS helps investors make informed decisions by creating a level playing field.

Question 2

Which of the following is required under GIPS standards for a firm that claims compliance?

A. All portfolios must outperform their benchmarks.

B. Performance results must be verified by an internal auditor.

C. Composite construction must be consistent with the definition of the firm.

D. The firm must use a specific set of approved financial instruments.

Answer:

C. Composite construction must be consistent with the definition of the firm.

Explanation:

GIPS requires that firms define clearly which portfolios are included in composites and that the composite construction is consistent with the firm’s defined policies. This is essential for ensuring that the performance results are presented fairly and that similar portfolios are grouped appropriately, enhancing transparency and comparability.

Question 3

Under GIPS, which of the following disclosures is mandatory for compliant performance presentations?

A. A list of all clients that are included in the composites

B. A narrative description of the market conditions during the performance period

C. The benchmark description, including its relevance to the composite strategy

D. Projected performance for the next reporting period

Answer:

C. The benchmark description, including its relevance to the composite strategy

Explanation:

GIPS requires that each compliant presentation include a description of the benchmark used and an explanation of why it is relevant to the composite strategy. This ensures that prospective and current clients can evaluate the performance of the composite against an appropriate benchmark, which is critical for assessing the effectiveness of the investment strategy and the manager’s performance. This disclosure aids in maintaining transparency and enhances the credibility of the performance claims.