Preparing for the CFA Exam requires a comprehensive understanding of Passive Equity Investing, a key aspect of portfolio management. Mastery of index replication, tracking error management, and cost efficiency is essential. This knowledge aids in constructing portfolios that mirror benchmark performance, providing low-cost market exposure, and achieving long-term investment objectives.

Learning Objective

In studying “Passive Equity Investing” for the CFA Exam, you should understand the methods used to replicate and track market indices, including full replication, sampling, and optimization techniques. Evaluate the impact of tracking error, cost efficiency, and risk control in constructing passive portfolios. Analyze factors that influence index construction, benchmark selection, and the advantages and limitations of passive strategies. Additionally, explore how passive investing aligns with client objectives, market efficiency theories, and portfolio management practices, and apply this knowledge in the context of investment policy statements and client-specific needs in CFA practice scenarios.

Methods of Passive Equity Investing

Passive equity investing involves replicating the performance of a specific market index to achieve market-level returns while minimizing costs and active management risks. The primary goal is to match the index’s performance as closely as possible with low tracking error. Here is an explanation of the key methods used in passive equity investing:

1. Full Replication:

This approach involves holding all of the securities in a market index in the exact proportions as the index itself. Full replication ensures the portfolio mirrors the index’s returns precisely with minimal tracking error. It is commonly used for indices with highly liquid and widely traded securities, such as the S&P 500. However, it can be costly for indices with many constituents due to high transaction and rebalancing costs.

2. Sampling Techniques:

In cases where it is not feasible or cost-effective to replicate an index fully, a representative sample of the index’s securities may be selected. The aim is to achieve similar risk and return characteristics as the entire index with fewer holdings, thus reducing transaction costs. Sampling is particularly useful for indices with numerous securities or when dealing with illiquid or less accessible markets.

3. Optimization Techniques:

Optimization uses mathematical and statistical models to select a portfolio of securities that closely matches the characteristics (e.g., risk, return, sector exposures) of the target index while minimizing tracking error. Factors such as correlation, volatility, and liquidity are considered to construct a portfolio that aims to replicate index performance efficiently. This method reduces costs and can accommodate constraints like liquidity or capital limitations.

4. Rebalancing Considerations:

Passive portfolios need periodic rebalancing to align with changes in the underlying index, such as adjustments to constituent weights, additions, and deletions of securities. The rebalancing frequency and costs can impact performance, and managers seek to minimize trading costs while maintaining an accurate replication of the index.

These methods help achieve the core objective of passive equity investing: to match the performance of a chosen market index as closely as possible while minimizing costs and risk deviations.

Tracking Error and Cost Efficiency

Tracking Error and Cost Efficiency are critical considerations in passive equity investing, as they directly impact a portfolio’s ability to replicate the performance of its chosen benchmark while minimizing costs. Here is a detailed explanation of these concepts:

1. Definition and Measurement of Tracking Error:

Tracking error is a measure of how closely a passive portfolio follows the performance of its benchmark index. It represents the standard deviation of the differences between the portfolio’s returns and the index returns. The lower the tracking error, the more accurately the portfolio replicates the index’s performance. Tracking error can arise from various factors, including transaction costs, rebalancing delays, and liquidity constraints.

2. Causes of Tracking Error:

There are several reasons why a passive portfolio might not perfectly replicate an index, such as:

- Transaction Costs: Buying and selling securities to match index changes can incur costs, impacting the portfolio’s performance.

- Management Fees: Passive funds often charge lower fees than active funds, but even small fees can create a deviation from index returns over time.

- Dividend Reinvestment Timing: Differences in when dividends are received and reinvested can cause discrepancies between portfolio and index performance.

- Index Changes: Indices periodically update their constituents, requiring passive funds to rebalance. Delays or variations in rebalancing can lead to performance differences.

3. Managing Tracking Error:

Minimizing tracking error is a key goal for passive portfolio managers. Strategies to reduce tracking error include:

- Efficient Replication Techniques: Full replication, sampling, or optimization can be chosen based on the nature of the index to minimize deviations.

- Timely Rebalancing: Ensuring the portfolio is promptly adjusted in response to index changes helps maintain alignment.

- Cost Control Measures: Reducing transaction and management fees can lower the impact on performance.

4. Cost Considerations in Passive Investing:

Cost efficiency is a major advantage of passive equity investing. Low-cost structures are achieved through:

- Lower Management Fees: Passive funds, such as index funds or ETFs, typically charge lower fees than actively managed funds due to their straightforward strategy.

- Reduced Turnover Costs: Passive funds have lower portfolio turnover since they only adjust holdings in response to index changes, minimizing transaction costs.

- Tax Efficiency: Passive funds may incur fewer taxable events compared to actively managed funds, leading to lower tax liabilities for investors.

5. Balancing Cost Efficiency and Tracking Error:

There is often a trade-off between minimizing tracking error and achieving cost efficiency. For example, full replication of an index minimizes tracking error but may be costly due to high transaction costs. Alternatively, sampling or optimization techniques can reduce costs but may introduce higher tracking error. Portfolio managers must carefully balance these factors to meet the overall investment objectives.

6. Impact on Portfolio Performance:

Efficient management of tracking error and costs is crucial for delivering returns that closely match the benchmark index. High tracking error or excessive costs can erode returns, undermining the benefits of passive investing. By focusing on both tracking error minimization and cost control, passive portfolio managers can maximize the value delivered to investors while maintaining market exposure.

In summary, managing tracking error and optimizing cost efficiency are essential for passive equity investing success

Index Construction and Benchmark Selection

Index Construction and Benchmark Selection are fundamental aspects of passive equity investing, providing a basis for measuring portfolio performance and aligning investment strategies. Understanding how indices are constructed and how benchmarks are chosen is crucial for achieving effective market exposure and meeting client objectives. Here’s an in-depth look at these key concepts:

1. Types of Market Indices:

Indices represent a specific market or market segment and serve as benchmarks for passive portfolios. Key types of indices include:

- Market-Capitalization-Weighted Indices: These indices, such as the S&P 500, weight constituents based on their market capitalization, meaning larger companies have a greater influence on the index’s performance.

- Equal-Weighted Indices: Every constituent is given an equal weight, regardless of its market size, which reduces concentration in large-cap stocks and increases exposure to smaller stocks.

- Fundamental-Weighted Indices: Weights are based on economic factors like sales, earnings, or dividends instead of market cap. This approach emphasizes fundamentals over market price.

2. Factors Influencing Index Construction:

Indices are created based on specific rules and methodologies that determine which securities are included and how they are weighted. Factors influencing index construction include:

- Selection Criteria: Indices may include only companies that meet specific criteria, such as size, sector, or geographic region.

- Weighting Methodology: As discussed, indices may be weighted by market cap, equally, or by fundamentals, depending on the purpose of the index.

- Rebalancing Rules: Indices are periodically reviewed and adjusted to reflect market changes. This may involve adding or removing securities or updating weights based on changes in constituent characteristics.

- Coverage: Some indices, like the MSCI All Country World Index (ACWI), offer broad market coverage, while others focus on specific segments, such as small-cap or emerging markets.

3. Choosing the Right Benchmark:

Selecting an appropriate benchmark is crucial for assessing the performance of a passive portfolio. The benchmark should align with the portfolio’s investment objective and strategy. Important considerations include:

- Relevance: The benchmark must accurately represent the market segment or asset class in which the portfolio is invested. For example, a large-cap U.S. equity portfolio should not be benchmarked against a global index.

- Investability: The benchmark should be investable, meaning that a portfolio can reasonably be constructed to replicate its performance.

- Transparency and Rules-Based Structure: The methodology for index construction and maintenance should be transparent, with clear rules guiding the inclusion and weighting of securities.

4. Importance of Benchmark Selection:

Benchmarks serve as the primary reference point for evaluating portfolio performance and tracking error. The choice of benchmark impacts the risk and return characteristics of the portfolio and the effectiveness of performance measurement. For passive investors, aligning the portfolio with a relevant benchmark ensures that market exposure meets investor expectations and objectives.

5. Custom Benchmarks and Peer Group Comparisons:

In addition to traditional market indices, some portfolios use custom benchmarks designed to reflect specific investment constraints, client preferences, or unique strategies. Peer group comparisons may also be used to evaluate how a portfolio performs relative to similar funds or investment approaches.

6. Index Construction Impact on Performance:

The construction methodology of an index influences its risk, return, and diversification characteristics. For instance, a market-cap-weighted index may become concentrated in a few large stocks during market rallies, while an equal-weighted index offers broader exposure. Understanding how an index is constructed helps investors anticipate potential risks and returns.

In summary, Index Construction and Benchmark Selection form the foundation of passive equity investing, guiding portfolio structure and performance measurement.

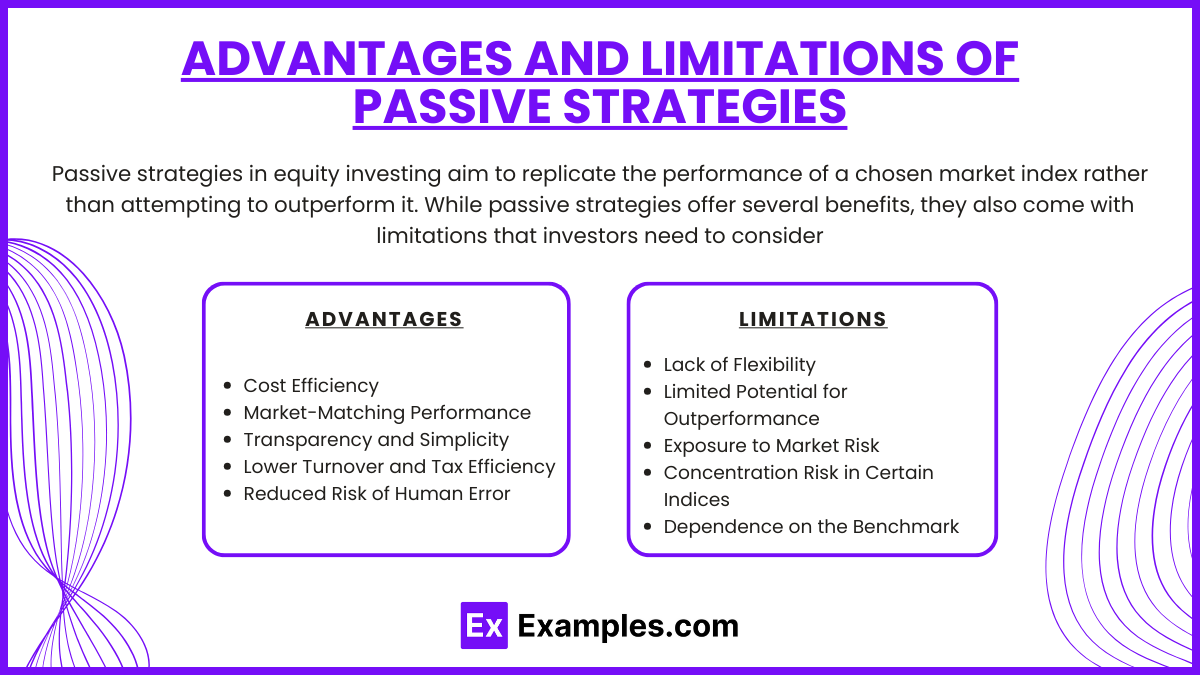

Advantages and Limitations of Passive Strategies

Passive strategies in equity investing aim to replicate the performance of a chosen market index rather than attempting to outperform it. While passive strategies offer several benefits, they also come with limitations that investors need to consider. Here’s a detailed explanation of the advantages and limitations of passive investing:

Advantages of Passive Strategies

1. Cost Efficiency:

Passive strategies typically have lower management fees compared to active strategies since they require less research, analysis, and trading activity. Exchange-Traded Funds (ETFs) and index funds often have expense ratios that are a fraction of those for actively managed funds, making passive investing more cost-effective for long-term investors.

2. Market-Matching Performance:

By design, passive strategies aim to track a market index, providing returns that closely mirror overall market performance. This means investors can achieve market-level returns, which research has shown to outperform the majority of actively managed funds over the long term, after costs are considered.

3. Transparency and Simplicity:

Passive funds are easy to understand because they follow a rules-based approach to replicating an index. Investors know exactly what assets they are investing in and how the portfolio is constructed. This simplicity makes passive investing appealing to many investors seeking a straightforward approach.

4. Lower Turnover and Tax Efficiency:

Because passive funds only make trades when the underlying index changes, they tend to have lower portfolio turnover than actively managed funds. This reduces transaction costs and minimizes the likelihood of realizing taxable capital gains, making passive funds more tax-efficient.

5. Reduced Risk of Human Error:

Active management is subject to potential errors in judgment, biases, and timing mistakes made by fund managers. Passive strategies eliminate the influence of such human decisions by simply following the rules of the index, leading to a more consistent and predictable investment approach.

Limitations of Passive Strategies

1. Lack of Flexibility:

Passive funds are rigidly tied to the performance of the benchmark index. They do not have the flexibility to adapt to changing market conditions, identify undervalued opportunities, or avoid overvalued or declining sectors. This limitation can be a disadvantage during periods of market volatility or downturns.

2. Limited Potential for Outperformance:

Since passive strategies are designed to match, not exceed, market performance, they do not provide an opportunity to achieve alpha (excess returns above the benchmark). Investors seeking to outperform the market may find passive investing unsatisfactory.

3. Exposure to Market Risk:

Passive funds fully reflect the performance of their index, which means they are exposed to the same market risks. If the market declines, the value of the passive fund will also decline, as there is no active management to mitigate losses or hedge risks.

4. Concentration Risk in Certain Indices:

Market-cap-weighted indices, which are common in passive investing, may become concentrated in a few large stocks. As a result, investors may have unintended exposure to individual companies or sectors, particularly if they represent a significant portion of the index.

5. Dependence on the Benchmark:

The effectiveness of passive strategies depends heavily on the choice of benchmark. An inappropriate or poorly constructed benchmark can lead to suboptimal investment performance. Additionally, indices may not always represent the best mix of assets for a particular investor’s goals or risk tolerance.

6. Limited Customization:

Passive funds are designed to track a broad market index, which may not align perfectly with the specific needs, goals, or preferences of individual investors. Active strategies, by contrast, offer more customization and potential to tailor portfolios to meet unique client requirements.

Examples

Example 1: Replicating a Market Index

An investor purchases an S&P 500 index fund, which holds all 500 companies in the same proportion as the index. This passive strategy aims to replicate the index’s performance, providing broad exposure to U.S. large-cap equities with minimal management fees and low tracking error.

Example 2: ETF Tracking a Sector-Specific Index

A healthcare sector ETF passively tracks the performance of a healthcare-specific index, such as the Health Care Select Sector Index. Investors use this ETF to gain exposure to the healthcare industry while maintaining low costs and diversification across various healthcare companies.

Example 3: Global Market Exposure

An investor chooses an MSCI All Country World Index (ACWI) ETF for global equity market exposure. This passive investment provides access to thousands of companies across developed and emerging markets, offering diversification and market-matching returns for a broad equity portfolio.

Example 4: Fundamental-Weighted Index Fund

An investor buys into a fundamental-weighted index fund that selects and weights securities based on financial metrics such as sales, cash flow, and dividends, rather than market capitalization. This strategy offers an alternative to market-cap weighting, focusing on underlying fundamentals.

Example 5: Equal-Weighted Index Strategy

A fund tracking an equal-weighted version of the S&P 500 holds each of the 500 companies in equal proportion, unlike a market-cap-weighted index. This strategy provides greater exposure to smaller companies within the index, reducing concentration risk and offering a different risk-return profile compared to traditional market-cap weighting.

Practice Questions

Question 1:

Which of the following is a key characteristic of passive equity investing?

A) Frequent portfolio rebalancing to take advantage of market trends

B) Actively selecting stocks based on fundamental analysis

C) Achieving market-level returns with low management fees

D) Outperforming the market through tactical asset allocation

Answer: C) Achieving market-level returns with low management fees

Explanation:

Passive equity investing focuses on replicating the performance of a market index, often using strategies like index funds or ETFs. This approach is characterized by lower management fees, minimal trading, and a goal of achieving returns that match, not exceed, the index’s performance. Active management, on the other hand, seeks to outperform the market through tactical decisions.

Question 2:

A common method for reducing costs and tracking error in passive equity investing is:

A) Market timing

B) Full replication of the index

C) Stock picking based on growth metrics

D) Diversifying into alternative assets

Answer: B) Full replication of the index

Explanation:

Full replication involves holding all securities in the index in the same proportions, minimizing tracking error and reducing costs associated with active decision-making. While it may incur higher transaction costs for complex indices, it is the most straightforward way to achieve close alignment with the benchmark’s performance without engaging in active market timing or stock selection.

Question 3:

Passive equity strategies primarily benefit investors by:

A) Providing flexibility to switch sectors based on market trends

B) Minimizing exposure to market volatility through active trades

C) Offering transparency and lower expenses

D) Ensuring consistent outperformance of market benchmarks

Answer: C) Offering transparency and lower expenses

Explanation:

Passive strategies offer transparency because they follow a rules-based approach tied to replicating an index. They also feature lower expenses due to reduced trading, minimal research costs, and simpler management. Unlike active strategies, passive investing does not seek to outperform the benchmark but rather mirrors its performance at a lower cost.