Preparing for the CFA Exam requires a thorough understanding of “Portfolio Risk & Return: Part I,” a foundational element of investment management. Mastery of risk assessment, diversification strategies, and return measures is essential. This knowledge provides insights into optimizing portfolio performance and achieving financial objectives, crucial for a high CFA score.

Learning Objective

In studying “Portfolio Risk & Return: Part I” for the CFA Exam, you should aim to understand the fundamental concepts of risk and return in investment portfolios. Analyze various risk measures, including standard deviation, beta, and Value at Risk (VaR). Evaluate the impact of diversification on portfolio risk and the role of correlation between assets. Additionally, explore the different types of returns, such as expected return, realized return, and excess return. Apply this knowledge to assess the risk-return trade-off in constructing and managing portfolios, using case studies and real-world scenarios to enhance your ability to make informed investment decisions.

Understanding Risk in Investment Portfolios

Understanding risk in investment portfolios is crucial for effective portfolio management. Risk refers to the uncertainty surrounding the returns that investments might yield and the potential for loss. Key risk types include:

- Market Risk: The risk of investments losing value due to economic developments affecting the entire market.

- Credit Risk: The danger that a borrower will default on any type of debt by failing to make required payments.

- Liquidity Risk: The risk that an asset cannot be sold quickly enough in the market to prevent a loss.

- Operational Risk: Risks arising from the internal failures of a company, such as process errors, failed systems, or external events that affect operations.

- Systemic Risk: The risk of collapse of an entire financial system or entire market, due to the interconnectedness of financial institutions and markets.

- Concentration Risk: The risk associated with any single exposure or group of exposures with the potential to produce large enough losses to threaten a financial institution’s core operations.

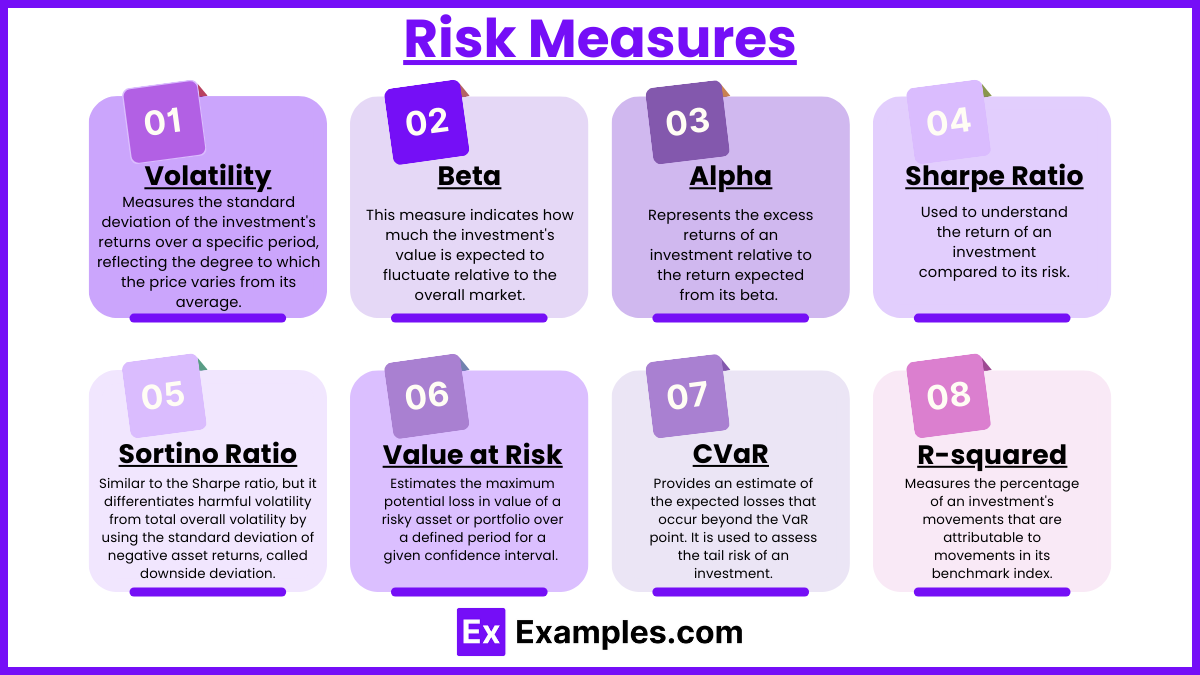

Risk Measures

In investment management, several key measures are used to quantify and manage risk effectively. Here’s a breakdown of the most common risk measures:

- Volatility: Measures the standard deviation of the investment’s returns over a specific period, reflecting the degree to which the price varies from its average. High volatility indicates higher risk but also potential for high returns.

- Beta: This measure indicates how much the investment’s value is expected to fluctuate relative to the overall market. A beta higher than 1 means the asset is more volatile than the market, while a beta less than 1 means it is less volatile.

- Alpha: Represents the excess returns of an investment relative to the return expected from its beta. A positive alpha indicates the investment has outperformed its benchmark, adjusted for risk, whereas a negative alpha indicates underperformance.

- Sharpe Ratio: Used to understand the return of an investment compared to its risk. It is calculated by subtracting the risk-free rate from the return of the investment, then dividing by the investment’s standard deviation of returns. Higher values indicate better risk-adjusted returns.

- Sortino Ratio: Similar to the Sharpe ratio, but it differentiates harmful volatility from total overall volatility by using the standard deviation of negative asset returns, called downside deviation. It’s particularly useful for investors who are concerned about downside risk.

- Value at Risk (VaR): Estimates the maximum potential loss in value of a risky asset or portfolio over a defined period for a given confidence interval. It’s a statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over a specific time frame.

- Conditional Value at Risk (CVaR): Provides an estimate of the expected losses that occur beyond the VaR point. It is used to assess the tail risk of an investment.

- R-squared: Measures the percentage of an investment’s movements that are attributable to movements in its benchmark index. A high R-squared, between 85% and 100%, indicates the performance patterns are closely correlated to the index.

Portfolio Diversification

Portfolio diversification is a critical strategy in investment management aimed at reducing risk and maximizing returns by allocating investments among various financial instruments, industries, and other categories. Here’s how diversification works and why it’s important:

- Risk Spreading: Diversification reduces the impact of any single investment’s poor performance on the overall portfolio.

- Asset Allocation: Investments are distributed across different asset classes (stocks, bonds, real estate, commodities), geographic regions, and sectors to mitigate region-specific and industry-specific risks.

- Correlation: Choosing investments with low or negative correlations helps ensure that not all investments will decline simultaneously, providing stability to the portfolio.

- Benefits:

- Reduced Volatility: A diversified portfolio usually experiences lower fluctuations in value.

- Improved Returns: Diversification allows investors to capture returns from different sources as market conditions change.

- Considerations:

- Avoid Over-Diversification: Too much diversification can dilute potential returns.

- Regular Rebalancing: To maintain the intended level of risk and return, portfolios need regular adjustments.

Portfolio Management Strategies

Portfolio management involves a blend of strategies tailored to meet investment goals, manage risk, and optimize returns. Here are some fundamental portfolio management strategies:

- Strategic Asset Allocation: Setting long-term target allocations for various asset classes based on risk tolerance and investment goals, with periodic rebalancing.

- Tactical Asset Allocation: Adjusting allocations short-term to exploit market opportunities, diverging temporarily from standard asset mixes.

- Dynamic Asset Allocation: Continuously adjusting the investment mix in response to market conditions to manage risk and capture opportunities.

- Insured Asset Allocation: Ensuring the portfolio’s value does not fall below a predetermined threshold, protecting against significant losses.

- Modern Portfolio Theory (MPT): Aiming to maximize returns for a given risk level through diversified asset allocation.

- Behavioral Finance Strategies: Leveraging insights from investor psychology to exploit market inefficiencies and improve returns.

- Risk Management Techniques: Using tools like stop-loss orders and options to hedge against losses, and employing risk assessment methods like Value at Risk (VaR).

- Performance Measurement: Regularly evaluating performance against benchmarks using metrics like the Sharpe ratio to assess risk-adjusted returns.

- Sustainable and Responsible Investing (SRI): Integrating environmental, social, and governance (ESG) considerations into investment decisions to align with investor values and potentially enhance long-term returns.

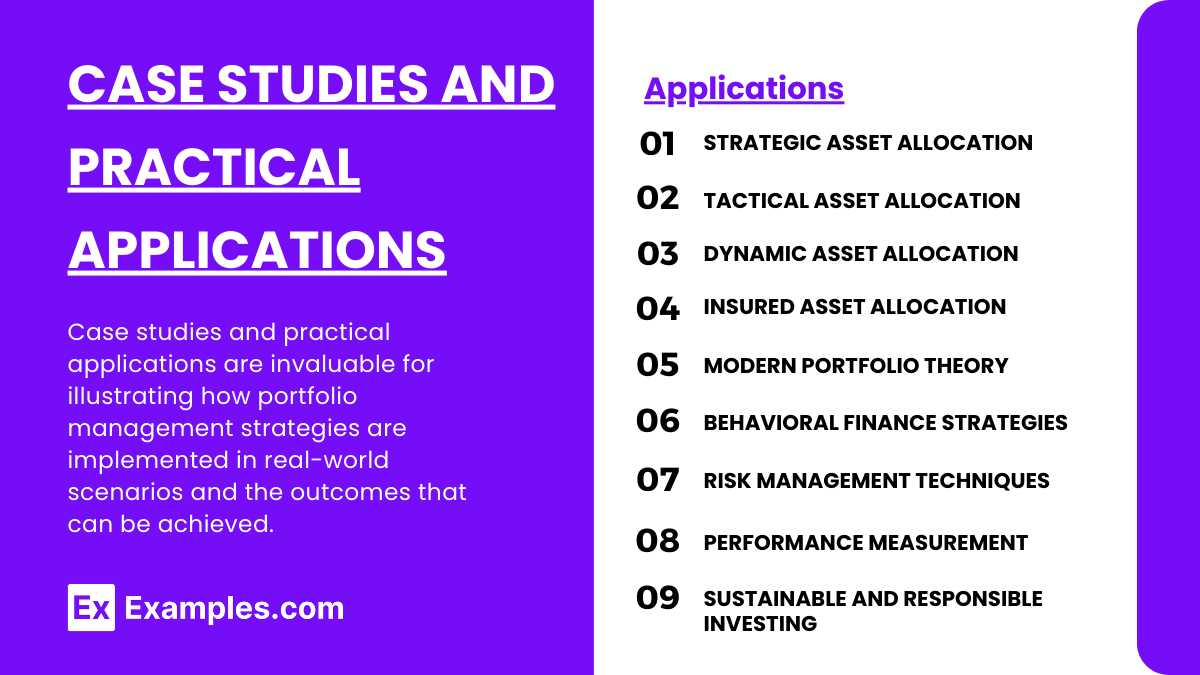

Case Studies and Practical Applications

Case studies and practical applications are invaluable for illustrating how portfolio management strategies are implemented in real-world scenarios and the outcomes that can be achieved. Here are a few examples that demonstrate the effectiveness and diversity of portfolio management strategies:

- Strategic Asset Allocation: A university endowment fund maintains a 50% equities, 30% bonds, and 20% alternatives allocation, using annual rebalancing to manage risk and promote stable growth.

- Tactical Asset Allocation: A manager capitalized on the tech bubble by increasing allocations to technology stocks, then reduced exposure post-bubble to mitigate losses.

- Dynamic Asset Allocation: In response to the 2008 financial crisis, a shift from stocks to safer government bonds protected a portfolio from severe market downturns.

- Insured Asset Allocation: An investor sets a minimum floor value for their retirement portfolio, investing conservatively when the portfolio nears this floor to preserve capital.

- Modern Portfolio Theory (MPT): An investment firm diversifies client portfolios across asset classes to optimize risk-reward ratios, enhancing performance over market cycles.

- Behavioral Finance Strategies: A fund manager buys undervalued stocks due to investor overreaction, profiting from the eventual market correction.

- Risk Management Techniques: Options were used during the European debt crisis to hedge against potential losses, protecting the portfolio.

- Performance Measurement: Regular assessments against benchmarks like the S&P 500 help adjust strategies and maintain competitive performance.

- Sustainable and Responsible Investing (SRI): Investing in companies with strong ESG practices aligns with investor values and can lead to sustainable long-term returns.

Examples

Example 1: Tech Stock Volatility

- Analyze the high volatility in technology stocks and the impact on portfolio risk. Study how the beta of tech stocks compared to the broader market influences portfolio systematic risk, and discuss strategies for diversifying to mitigate unsystematic risk.

Example 2: Emerging Market Investment

- Explore investments in emerging markets, known for their high return potential accompanied by high risk. Examine the role of diversification in such investments and the significance of understanding currency risks, political risks, and economic stability.

Example 3: Fixed-Income Securities during Interest Rate Changes

- Study how interest rate changes affect the prices of fixed-income securities and the overall return on a bond portfolio. Evaluate the importance of duration and convexity in managing portfolio risk in a changing rate environment.

Example 4: Real Estate Investment Trusts (REITs)

- Discuss the role of Real Estate Investment Trusts in a diversified portfolio, focusing on how they provide returns through both rental income and property appreciation. Analyze their risk profile compared to equities and bonds, particularly through economic cycles.

Example 5: Hedge Funds and Alternative Investments

- Analyze the risk-return profiles of hedge funds and other alternative investments, including private equity and commodities. Explore how these assets can be used to achieve higher returns or reduce overall portfolio risk through low correlations with traditional stock and bond investments.

Practice Questions

Question 1

What is the primary purpose of calculating the Sharpe Ratio in portfolio management?

A. To measure the portfolio’s total return

B. To assess the risk associated with the portfolio

C. To evaluate the portfolio’s performance relative to a risk-free rate

D. To determine the portfolio’s diversification benefits

Answer:

C. To evaluate the portfolio’s performance relative to a risk-free rate

Explanation:

The Sharpe Ratio is used to assess how much return a portfolio is generating in excess of the risk-free rate relative to its volatility. It is a common measure for comparing the risk-adjusted performance of various portfolios, indicating how well the excess returns compensate for the additional risk taken.

Question 2

Which risk measure is specifically used to assess the systematic risk of a stock or portfolio?

A. Alpha

B. Beta

C. R-squared

D. Standard deviation

Answer:

B. Beta

Explanation:

Beta is a measure of the systematic risk of a stock or portfolio in relation to the overall market. A beta greater than 1 indicates greater volatility than the market, while a beta less than 1 indicates less volatility. This measure helps investors understand how changes in market performance could affect the stock or portfolio.

Question 3

What concept explains the reduction of unsystematic risk in a portfolio through the inclusion of a large number of diverse investments?

A. Efficient frontier

B. Capital allocation line

C. Diversification

D. Capital market line

Answer:

C. Diversification

Explanation:

Diversification involves spreading investments across various financial instruments, industries, and other categories to reduce the impact of any single investment’s poor performance on the overall portfolio. This strategy specifically targets and mitigates unsystematic risk, which is unique to individual investments or specific industries.