Preparing for the CFA Exam requires a comprehensive understanding of "Real Estate and Infrastructure," key components of alternative investments. Mastery of these asset classes, including their unique characteristics, valuation methods, and role in portfolio diversification, is essential. This knowledge provides insights into income generation, inflation protection, and long-term growth, critical for achieving a high CFA score.

Learning Objective

In studying "Real Estate and Infrastructure" for the CFA Exam, you should aim to understand the unique characteristics, valuation methods, and performance drivers of real estate and infrastructure investments. Analyze the key attributes of different types of real estate, such as commercial, residential, and industrial properties, along with infrastructure assets like transportation, utilities, and energy facilities. Evaluate income generation, capital appreciation, and inflation protection benefits, as well as the risks associated with illiquidity and regulatory factors. Apply this knowledge to assess how real estate and infrastructure contribute to portfolio diversification, stability, and long-term growth, preparing for practical application on the CFA Exam.

Overview of Real Estate and Infrastructure as Alternative Investments

Real estate and infrastructure represent two significant categories of alternative investments, each offering distinct characteristics and opportunities for investors. Here’s an overview of both:

Real Estate Investments

Real estate involves investing in physical properties or land. The investment can generate returns through income (rents or leases) and appreciation of property value.

Key Features:

Cash Flow: Steady income from rents or leases.

Appreciation: Potential increase in property value over time.

Tax Advantages: Depreciation, mortgage interest deductions, and other benefits.

Leverage: Ability to use debt to finance property purchases, potentially enhancing returns.

Infrastructure Investments

Infrastructure involves projects that are essential for the economy, including transportation, energy, water, and telecommunications systems. These investments are typically large-scale and involve significant capital expenditures.

Key Features:

Long-Term Returns: Extended depreciation schedules and long-term usage.

Public-Private Partnerships (PPPs): Collaboration between government entities and private investors, often involving significant regulatory oversight.

Essential Services: Infrastructure is critical for basic societal functions, providing a stable demand.

Types of Real Estate Investments

Real estate investments come in various forms, each offering different benefits and risks. Here's a detailed overview of the primary types of real estate investments:

1. Residential Real Estate

Involves properties where people live, such as single-family homes, apartments, condos, townhouses, and multifamily residences.

Investors can earn returns through rental income and appreciation in property values. Residential properties are often easier to finance and can provide a steady cash flow.

2. Commercial Real Estate

Includes office buildings, retail spaces, shopping centers, and malls.

Commercial leases typically last longer than residential leases, providing a more extended stable income. Returns are generated through rent payments and property value appreciation.

3. Industrial Real Estate

Comprises properties used for industrial activities, such as factories, warehouses, and distribution centers.

Industrial properties often have longer lease terms and fewer tenant turnover issues, offering a steady income stream. They may also include built-in rent escalations.

4. Retail Real Estate

Encompasses storefronts, strip malls, and large shopping centers.

Retail properties can offer significant returns but are sensitive to economic cycles. Rent is often supplemented with a percentage of the retailer’s sales, linking the investment’s performance to the success of the tenants.

5. Mixed-Use Real Estate

Combines two or more of the above categories into a single project, such as a building with retail space on the ground floor and apartments above.

Mixed-use developments can attract a diverse range of tenants, potentially reducing investment risk by diversifying income sources.

6. Real Estate Investment Trusts (REITs)

Companies that own, operate, or finance income-producing real estate. REITs are traded on major exchanges like stocks, making them highly liquid compared to other real estate investments.

Investors can buy shares in REITs, allowing them to earn dividends from the trust’s operational income and potentially profit from appreciation in the value of its shares.

7. Real Estate Limited Partnerships (RELPs)

Investment structures that allow investors to pool their money to invest in real estate projects. The partnership is typically managed by a general partner who handles day-to-day operations.

RELPs often focus on developing or managing properties for a term, after which the real estate is sold and profits are distributed among the partners.

8. Land Investment

Involves purchasing raw or undeveloped land with the expectation that it will increase in value as it is developed or as the area around it grows.

Land can be held for long-term appreciation or developed to enhance its value. It requires a significant understanding of real estate and development trends to manage effectively.

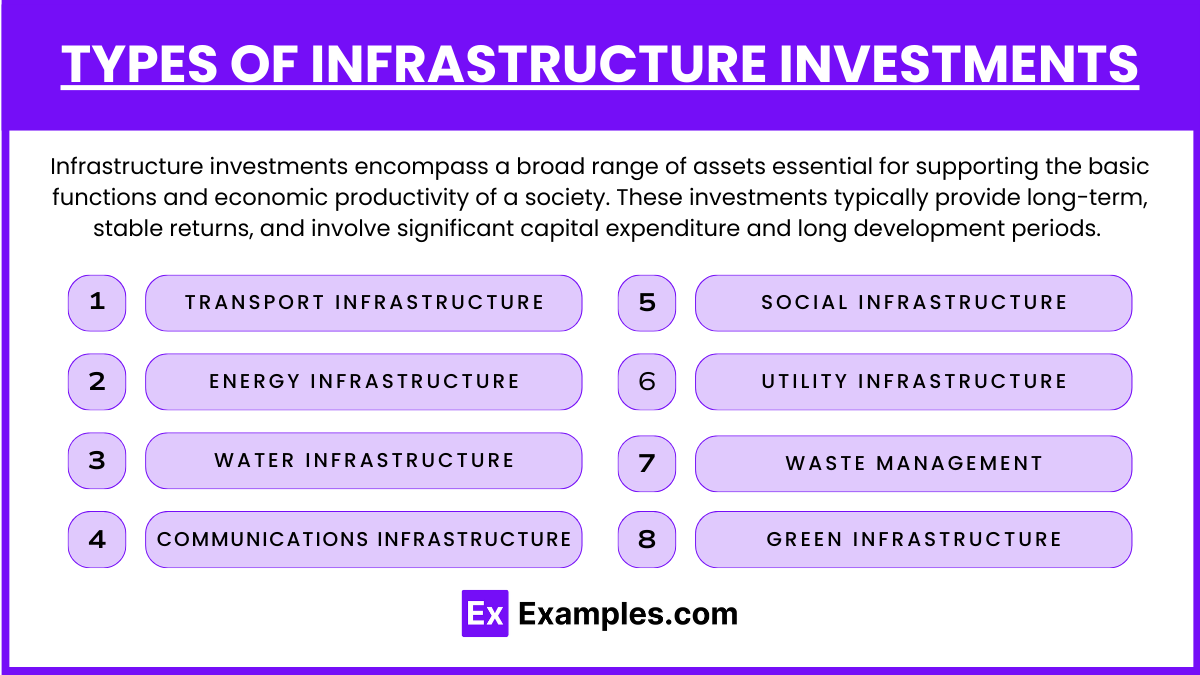

Types of Infrastructure Investments

Infrastructure investments encompass a broad range of assets essential for supporting the basic functions and economic productivity of a society. These investments typically provide long-term, stable returns, and involve significant capital expenditure and long development periods. Here’s an overview of the main types of infrastructure investments:

1. Transport Infrastructure

Roads, bridges, tunnels, railways, airports, and ports.

Often funded through public-private partnerships (PPPs), these projects can offer steady, long-term income through tolls, fees, or governmental payments.

2. Energy Infrastructure

Power generation plants (including renewable energy facilities like wind farms and solar parks), transmission lines, and distribution networks.

Critical for economic stability and growth, providing potential returns through energy sales and government-regulated tariffs.

3. Water Infrastructure

Water supply systems, sewage treatment facilities, and flood management systems.

Considered lower-risk, as water services are essential and usually regulated, providing consistent revenue streams.

4. Communications Infrastructure

Telecommunications networks, data centers, broadcasting facilities, and satellite communications.

Offers significant growth potential, often driven by user fees and service contracts due to increasing demand for data and connectivity.

5. Social Infrastructure

Hospitals, schools, prisons, and public housing.

Typically funded and sponsored by government entities, providing essential public services with returns often generated through government payments under contractual arrangements.

6. Utility Infrastructure

Electrical grids, gas distribution networks, and renewable energy utilities.

Offers stable returns due to regulatory frameworks that ensure predictable revenue streams and consistent demand.

7. Waste Management Infrastructure

Recycling facilities, waste processing plants, and landfill operations.

Critical for environmental health and urban management, generating returns through service fees, government contracts, and by-products like energy from waste-to-energy plants.

8. Green Infrastructure

Sustainable water management systems, eco-friendly urban planning, and green roofs.

Increasingly important due to climate change concerns, with potential for government incentives and support.

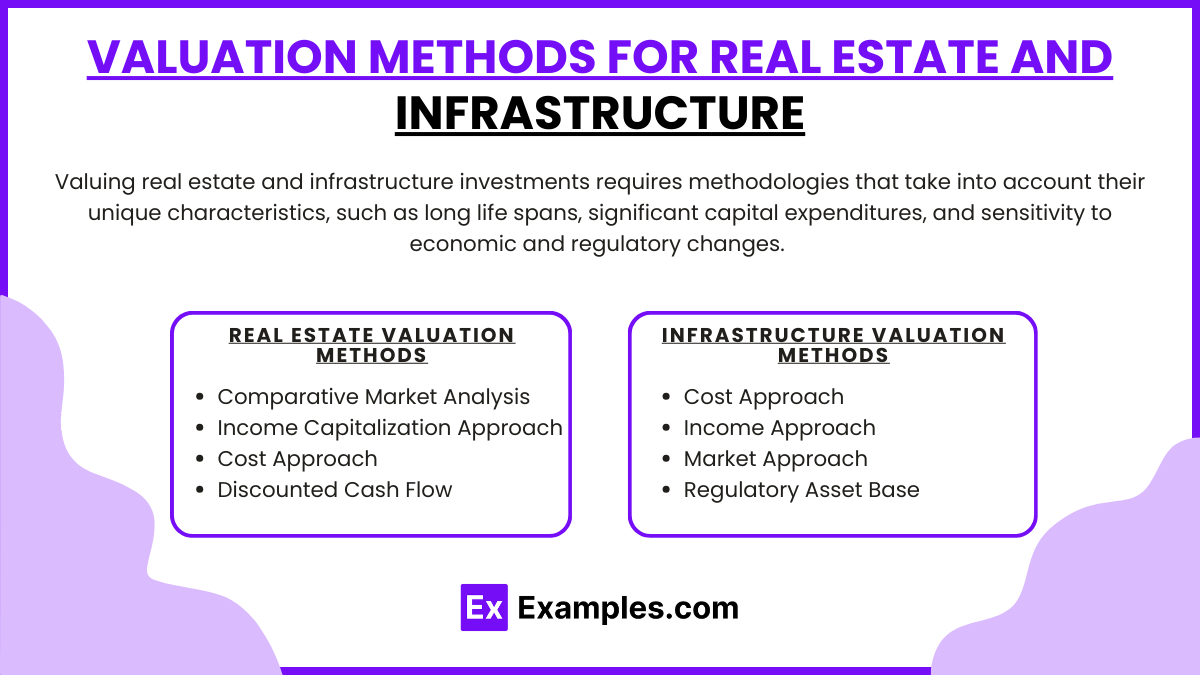

Valuation Methods for Real Estate and Infrastructure

Valuing real estate and infrastructure investments requires methodologies that take into account their unique characteristics, such as long life spans, significant capital expenditures, and sensitivity to economic and regulatory changes. Here are the common valuation methods for real estate and infrastructure investments:

Real Estate Valuation Methods

Comparative Market Analysis (CMA)

Compares the property in question with similar properties that have recently sold in the same area.

Application: Most commonly used for residential real estate to determine market value based on active, pending, and sold listings.

Income Capitalization Approach

Calculates value based on the income the property generates, which is then divided by a capitalization rate (cap rate).

Application: Suitable for commercial and investment properties where steady income streams are available, such as rental units or office buildings.

Cost Approach

The value of the property is estimated based on the cost to replace or reproduce the improvements minus depreciation, plus the land value.

Application: Useful for new constructions or unique properties where no comparable sales exist, or where the property does not generate income.

Discounted Cash Flow (DCF) Analysis

Projects future cash flows and discounts them back to the present value using a required rate of return.

Application: Appropriate for large and complex income-generating properties, particularly in commercial real estate.

Infrastructure Valuation Methods

Cost Approach

Estimates the current cost to construct a similar new infrastructure asset and then deducts accumulated depreciation.

Application: Effective for newly constructed infrastructure or when minimal market data exists.

Income Approach

Similar to real estate's income capitalization, this method values an asset based on the cash flows it can generate, discounted back to their present value.

Application: Commonly used for operational infrastructure like toll roads, utilities, or any project with predictable, long-term cash flows.

Market Approach

Uses transaction data from sales of comparable infrastructure assets to establish a market-based value.

Application: Practical when there is sufficient data from sales of similar assets, which is less common but still relevant for privatized infrastructure.

Regulatory Asset Base (RAB) Valuation

Commonly used in regulated utilities, where the value is based on the investment base permitted by regulatory bodies.

Application: Suitable for infrastructure assets like water, gas, and electricity networks where investments and returns are regulated.

Examples

Example 1: Commercial Real Estate Investment in Office Buildings

Analyze an investment in a commercial office building, focusing on rental income, occupancy rates, and market demand. Discuss the impact of economic cycles on occupancy and rental rates, and evaluate the potential for capital appreciation and risks associated with tenant turnover and lease terms.

Example 2: Investing in a Renewable Energy Infrastructure Project

Study the investment in a wind farm or solar energy project. Explore the potential for stable, long-term cash flows through power purchase agreements (PPAs) and the role of government incentives. Evaluate environmental, social, and governance (ESG) benefits, as well as the risks related to regulatory changes and market demand.

Example 3: Residential Real Estate as a Hedge Against Inflation

Examine the role of residential real estate as an inflation hedge, particularly through rental income that tends to increase with inflation. Use historical data to show how residential properties have protected purchasing power over time, balancing income generation with appreciation potential.

Example 4: Public-Private Partnership (PPP) in Infrastructure

Evaluate a public-private partnership for building a toll road or airport. Discuss the structure of PPPs, long-term concessions, and revenue-sharing agreements with the government. Highlight the benefits of stable cash flows and the risks associated with regulatory changes and demand for services.

Example 5: REIT Investment in Retail Properties

Explore a REIT focused on retail properties such as shopping malls and outlets. Analyze the impact of changing consumer habits, including the growth of e-commerce, on retail space demand. Evaluate how the REIT structure provides liquidity and income through dividends, but also faces risks related to market cycles and tenant quality.

Practice Questions

Question 1

Which of the following best describes one of the primary benefits of including infrastructure assets in a diversified investment portfolio?

A. High liquidity and frequent trading

B. Potential for stable, long-term cash flows

C. High sensitivity to short-term economic cycles

D. Low correlation with inflation

Answer:

B. Potential for stable, long-term cash flows

Explanation:

Infrastructure assets, such as utilities and transportation facilities, typically provide stable, predictable cash flows over the long term due to long-term contracts or government concessions. These assets are often less sensitive to short-term economic cycles and are used to enhance portfolio stability and provide inflation protection.

Question 2

Which valuation method is most commonly used to assess the value of income-generating real estate properties?

A. Cost approach

B. Sales comparison approach

C. Income approach

D. Replacement cost method

Answer:

C. Income approach

Explanation:

The income approach is commonly used to value income-generating properties, such as commercial real estate. This method involves calculating the property's value based on expected future cash flows (rental income) and applying a capitalization rate to determine its present value. This approach is particularly relevant for properties purchased for their income potential.

Question 3

What is one of the main risks associated with direct investments in real estate?

A. High liquidity

B. Low correlation with inflation

C. Illiquidity

D. Minimal regulatory risk

Answer:

C. Illiquidity

Explanation:

Direct real estate investments are typically illiquid, meaning they cannot be easily or quickly sold without potentially impacting the asset’s value. Real estate transactions often require time and significant resources, making it challenging to divest properties quickly, especially during market downturns. This lack of liquidity is a key risk factor for direct real estate investors.