Residual Income Valuation is a method used in equity analysis for the CFA Exam that calculates a company’s intrinsic value by focusing on the economic profit generated above the required return on equity. Unlike traditional models that rely on cash flows, residual income focuses on accounting profits and book values, making it useful for companies with negative cash flows or high reinvestment needs. This method is particularly valuable for assessing firms in capital-intensive industries or financial institutions, providing a nuanced view of shareholder value creation.

Learning Objectives

In studying "Equity: Residual Income Valuation" for the CFA Exam, you should learn to understand how residual income valuation assesses a company's intrinsic value based on economic profit generated over the required return on equity. Analyze how residual income is calculated, incorporating net income, book value, and the cost of equity. Evaluate the model's application in valuing companies with limited cash flows, high capital expenditure needs, or significant intangible assets. Additionally, explore the impact of factors like the persistence factor and forecast horizon on valuation accuracy, and apply these concepts to determine if a stock is overvalued or undervalued in CFA practice scenarios.

1. Understanding Residual Income Valuation

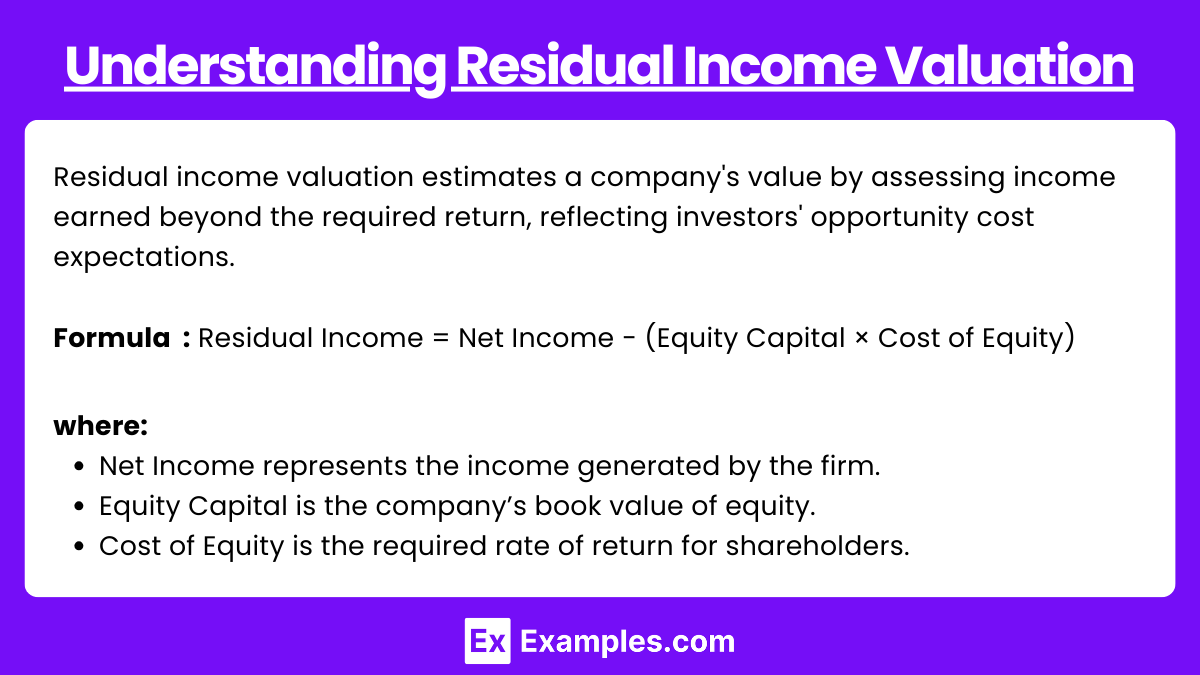

Residual income valuation estimates a company’s value based on the income it generates over and above the required return on equity. The required return is the minimum rate of return demanded by investors, reflecting the opportunity cost of investing in that equity. In this approach, the valuation of equity combines the current book value of the company and the discounted value of expected residual incomes.

The residual income formula is expressed as:

Residual Income = Net Income − (Equity Capital × Cost of Equity)

where:

Net Income represents the income generated by the firm.

Equity Capital is the company’s book value of equity.

Cost of Equity is the required rate of return for shareholders.

Residual income is the income left after paying for the cost of capital, essentially capturing the "excess" profit.

2. Key Components and Assumptions of Residual Income Valuation

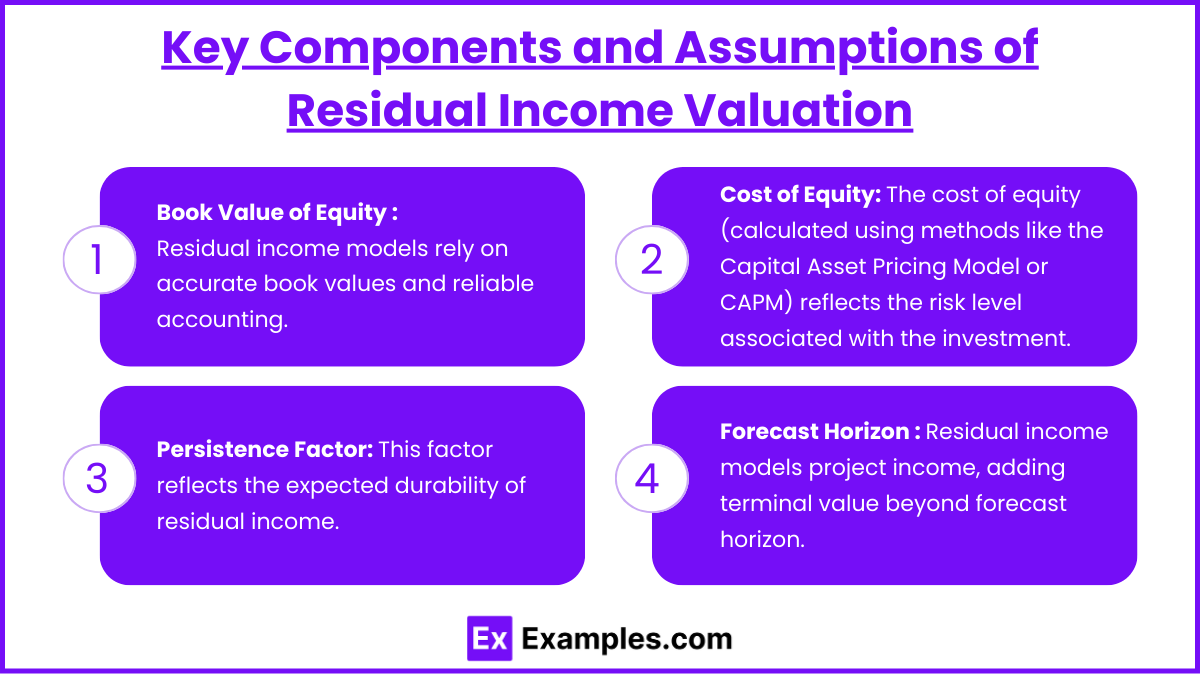

Book Value of Equity: Residual income models start with the current book value of equity. Since this method is rooted in accounting data, the quality and accuracy of the book value are important, making it well-suited for companies with reliable accounting records.

Cost of Equity: The cost of equity (calculated using methods like the Capital Asset Pricing Model or CAPM) reflects the risk level associated with the investment. A higher cost of equity decreases residual income, as more is subtracted from net income.

Persistence Factor: This factor reflects the expected durability of residual income. Companies with high competitive advantages or stable markets are assumed to maintain residual income for longer periods, resulting in higher valuations. Analysts often assign a persistence factor between 0 and 1, with 1 indicating indefinite persistence.

Forecast Horizon: Residual income models project income over a forecast period and often include a terminal value, which represents the perpetuation of residual income beyond the forecast horizon. The quality of forecasted residual income estimates is critical for model accuracy.

3. Applications of Residual Income Valuation

Residual income valuation is highly effective in certain scenarios where traditional methods may fall short, such as:

Firms with Negative Cash Flows: For companies with negative cash flows or volatile earnings, residual income can provide a more consistent measure of intrinsic value, as it accounts for returns over the cost of equity rather than raw earnings or cash flows.

High Capital Expenditure Companies: Companies with significant reinvestment needs may struggle to show strong free cash flows in the near term. By focusing on residual income rather than cash flows, this method accommodates high-capital industries.

Financial Institutions: Due to complex regulatory and capital structures, financial institutions like banks are often valued using residual income, as book values and accounting-based income metrics provide a clearer view than cash flows.

4. Advantages and Limitations of Residual Income Valuation

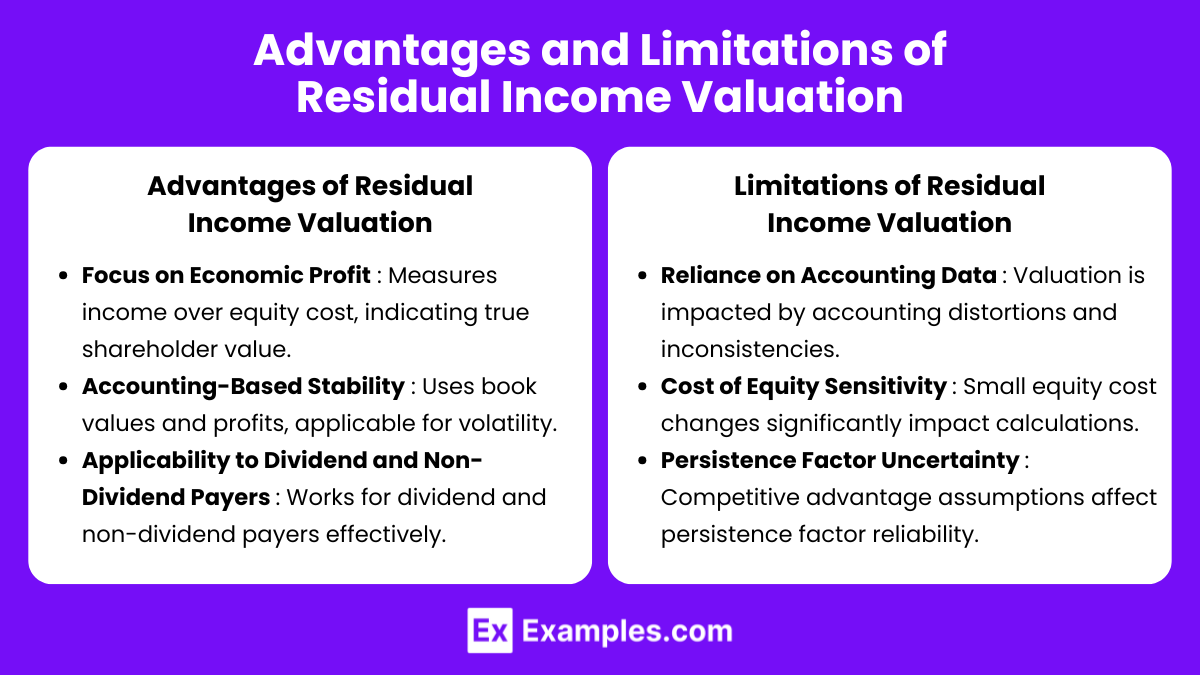

Advantages:

Focus on Economic Profit: By measuring income over the cost of equity, residual income highlights whether a company generates true economic value for its shareholders.

Accounting-Based Stability: Residual income models use book values and accounting profits, making them more applicable to companies where cash flow is difficult to estimate or volatile.

Applicability to Dividend and Non-Dividend Payers: Residual income is not dependent on dividend payouts, making it versatile for companies with varied dividend policies.

Limitations:

Reliance on Accounting Data: Since residual income relies on book values and accounting profits, any accounting distortions or inconsistencies can affect valuation.

Cost of Equity Sensitivity: The model is highly sensitive to the cost of equity, which can be challenging to estimate accurately. Small changes in the cost of equity can significantly impact residual income calculations.

Persistence Factor Uncertainty: Estimating the persistence factor is difficult, as it depends on assumptions about competitive advantage, market stability, and economic conditions.

Examples

Example 1: Valuing a Bank Using Residual Income

Banks and financial institutions are often challenging to value using traditional cash flow models due to complex capital structures and regulatory requirements. Instead, residual income valuation can be effective because it focuses on accounting-based metrics like book value and net income. By subtracting the required return on equity from net income, analysts can estimate the bank’s economic profit and gain a better understanding of whether it’s generating value over its capital cost.

Example 2: Assessing a Tech Start-Up with Negative Cash Flows

A tech start-up that is reinvesting heavily for growth may have negative or inconsistent cash flows, making traditional DCF valuation difficult. Residual income valuation, which focuses on book value and net income, can provide an alternative measure of value. For example, even if the start-up is not generating positive cash flows, the residual income model can reveal whether the company is creating economic profit above its cost of equity, especially if it has strong revenue growth potential and high margins.

Example 3: Analyzing a Utility Company with High Capital Expenditure

Utility companies typically have high capital requirements, meaning free cash flow may be low or inconsistent due to ongoing reinvestment needs. Residual income valuation can capture the economic profit generated after meeting equity costs without relying solely on cash flows. By focusing on book value and earnings, the model helps analysts assess whether the utility’s investments are generating returns above the required rate, even in the face of heavy capital spending.

Example 4: Valuing a Retail Chain with Intangible Assets

A retail chain with a strong brand and customer loyalty may have intangible assets that aren’t fully captured by book value or DCF models. Residual income valuation can help assess the true value generated by these intangible assets. By calculating residual income over the company’s cost of equity, analysts can determine whether the brand strength and customer loyalty translate into economic profit, helping investors value the brand’s impact more effectively.

Example 5: Evaluating a Mature Manufacturing Company with Stable Earnings

For a manufacturing company with stable earnings and a predictable return on equity, residual income valuation can provide a straightforward measure of economic profit. By examining the residual income generated over time, analysts can assess the sustainability of the company’s performance and understand how much of its earnings contribute to shareholder value after accounting for the required return. This approach is particularly useful for mature companies with reliable net income but limited growth prospects.

Practice Questions

Question 1

Which of the following best describes the residual income approach to equity valuation?

A) It calculates the present value of all future free cash flows of a company.

B) It values a company based on its book value and the income generated over its cost of equity.

C) It uses projected dividends to determine the intrinsic value of a company’s equity.

D) It values a company by capitalizing earnings at a discount rate.

Answer: B) It values a company based on its book value and the income generated over its cost of equity.

Explanation: The residual income approach values a company by combining its current book value with the residual income generated over time. Residual income is calculated as net income minus the cost of equity, which represents the required return by shareholders. Unlike other models, such as DCF (which relies on cash flows) or dividend discount models (which use dividends), residual income focuses on economic profit, or income above the cost of equity. This makes it especially useful for firms with irregular dividends or negative cash flows.

Question 2

Which type of company is most suitable for residual income valuation?

A) A start-up with high growth potential but negative cash flows

B) A company that does not reinvest in its assets and returns all profits as dividends

C) A mature company with low return on equity

D) A high-growth company with minimal assets and significant intangible value

Answer: A) A start-up with high growth potential but negative cash flows

Explanation: Residual income valuation is particularly useful for companies that may have negative or inconsistent cash flows, such as start-ups or companies with high growth potential but heavy reinvestment. This method focuses on book value and net income, making it suitable for firms where cash flows are unreliable. Additionally, it works well for companies with strong intangible assets, as residual income can reflect economic profit even when traditional cash flows are low or negative. Companies with low return on equity or limited reinvestment would generally not benefit as much from a residual income approach.

Question 3

What does a positive residual income indicate about a company?

A) The company is undervalued relative to its competitors

B) The company is generating returns greater than the cost of equity

C) The company is paying dividends above its sustainable growth rate

D) The company’s assets are worth more than their book value

Answer: B) The company is generating returns greater than the cost of equity

Explanation: A positive residual income means the company’s net income exceeds the cost of equity, indicating that it is generating economic profit above the required return for investors. This suggests that the company is creating value for shareholders, as it can cover the opportunity cost of equity capital. Positive residual income does not directly indicate undervaluation, dividend policy, or asset value; rather, it reflects the company’s ability to generate returns above the minimum rate of return expected by equity investors.