Risk management for individuals focuses on identifying, assessing, and controlling financial risks that could hinder personal financial goals. It involves creating strategies to protect and grow assets while aligning with an individual’s unique risk tolerance, time horizon, and financial needs. Key components include understanding various types of risk—such as market, credit, and longevity risks—and using diversification, asset allocation, and insurance products. Effective risk management helps individuals secure their financial future by minimizing potential losses and ensuring that their investment strategy supports long-term goals.

Learning Objectives

In studying ” Risk Management for Individuals ” for the CFA Exam, you should learn to understand various risk types that impact individual portfolios, including market, credit, liquidity, and longevity risk. Assess individual risk tolerance, capacity, and needs to align risk management strategies effectively. Evaluate techniques like diversification, asset allocation, and insurance solutions to mitigate these risks. Analyze how tools like scenario analysis, stress testing, and Monte Carlo simulations aid in assessing risk exposure. Additionally, explore how behavioral biases affect individual decision-making, and apply your knowledge to crafting personalized risk management approaches in line with CFA principles.

Introduction to Risk Management for Individuals

Risk management for individuals involves identifying, assessing, and prioritizing potential financial risks, then implementing strategies to manage these risks effectively. The objective is to align an individual’s portfolio with their unique financial goals, time horizon, and risk tolerance, minimizing the impact of adverse financial events.In the context of portfolio management, risk management for individuals focuses on protecting personal assets, meeting future financial needs, and achieving specific life goals. Individual risk management differs significantly from institutional risk management, as it must consider unique personal factors, such as lifestyle, health, employment, family obligations, and retirement goals. It also involves balancing the individual’s emotional tolerance for risk with their financial ability to absorb potential losses.

Key Aspects of Risk Management for Individuals

- Identifying Risks: Effective individual risk management starts with identifying key risks. These include market risk from price fluctuations, longevity risk from outliving financial resources, health and disability risks affecting income, credit risks from debt exposure, liquidity risk for cash access, and inflation risk that erodes purchasing power. Recognizing these risks allows for proactive strategies to protect wealth and financial security.

- Assessing Risk Tolerance and Capacity: Risk tolerance measures an individual’s emotional comfort with risk, while risk capacity reflects the financial ability to handle potential losses. Assessing both ensures a balanced approach that aligns with an individual’s willingness and ability to bear risk without jeopardizing financial goals, leading to more resilient and personalized investment strategies.

- Setting Risk Objectives and Constraints: Individuals’ risk objectives are shaped by their desired returns, time horizon, and liquidity needs, along with legal or tax constraints. Return objectives guide the required growth, while time horizons dictate suitable risk exposure. Liquidity needs ensure funds are accessible, and legal/tax constraints influence the structure of investment plans for efficiency and alignment with personal situations.

- Developing a Personalized Risk Management Strategy: A tailored risk strategy includes diversification across assets to reduce unsystematic risk and a suitable asset allocation aligned with personal goals and life stage. It may incorporate insurance for health, life, and income protection, and annuities to manage longevity risk. Estate planning and tax-efficient strategies also protect wealth and ensure alignment with long-term objectives.

- Monitoring and Adjusting the Plan: Individual risk management is dynamic, needing regular reviews and adjustments as financial goals or market conditions shift. Rebalancing the portfolio to maintain the intended asset mix ensures continued alignment with the individual’s risk profile, securing the client’s ability to meet financial goals over time.

- Behavioral Considerations: Behavioral biases, such as loss aversion and overconfidence, can influence risk decisions, often detracting from rational investment choices. Educating individuals on these biases helps improve their understanding of risk management, encouraging a disciplined approach that aligns with long-term objectives, even during volatile periods.

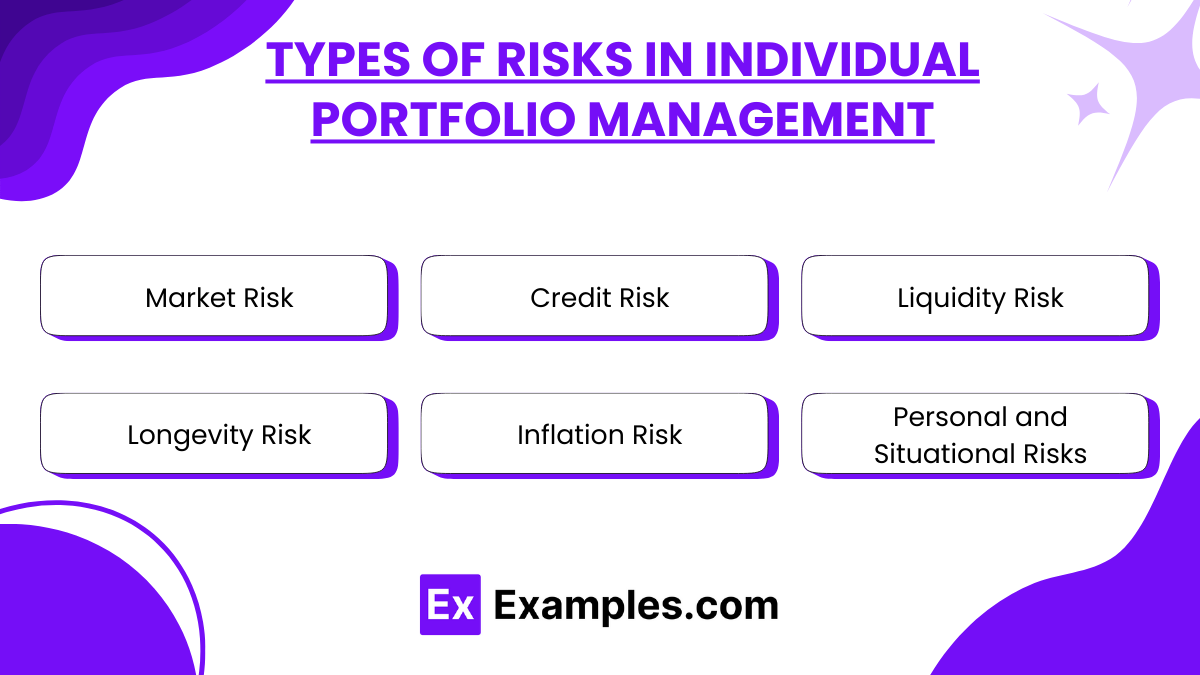

Key Types of Risks in Individual Portfolio Management

Managing risks for individual clients requires a deep understanding of various types of risks, each with distinct characteristics and implications. The main types include:

- Market Risk: The risk of losses due to changes in market prices, impacting assets like stocks and bonds. Market risks can stem from fluctuations in interest rates, foreign exchange rates, and commodity prices.

- Credit Risk: The risk of loss if a counterparty fails to fulfill its financial obligations, affecting fixed-income investments and individual credit profiles.

- Liquidity Risk: The risk of not being able to convert an investment into cash without a substantial price concession. This is particularly critical for individuals with sudden cash needs.

- Longevity Risk: The risk that individuals may outlive their assets. This risk is especially pertinent in retirement planning, as longer life expectancies can strain retirement savings.

- Inflation Risk: The risk that inflation may erode the real purchasing power of assets, affecting the ability to maintain living standards.

- Personal and Situational Risks: These are unique to the individual, such as health risks, job loss, or business failure. These risks affect one’s ability to save and invest consistently.

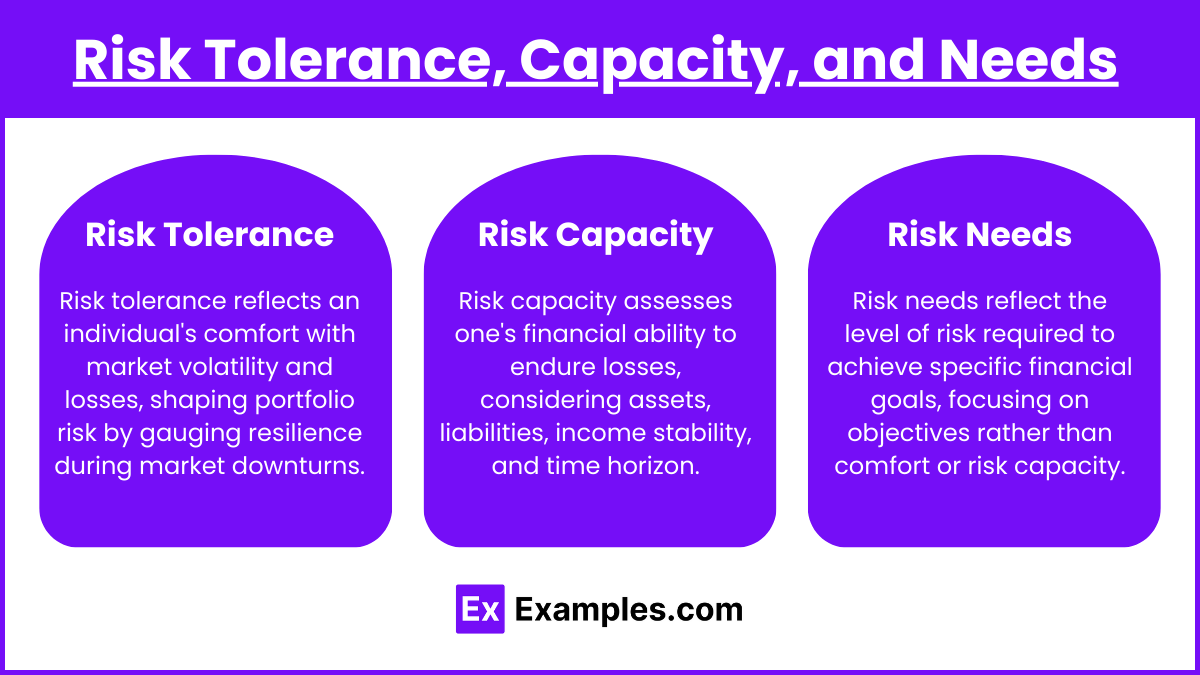

Risk Tolerance, Capacity, and Needs

- Risk Tolerance: Risk tolerance is an individual’s psychological comfort level with market volatility and potential financial losses. This innate personality trait is a crucial determinant in shaping a portfolio’s risk profile, as it represents the investor’s emotional resilience in the face of market downturns and their ability to stay invested during turbulent times.

- Risk Capacity: Risk capacity measures an individual’s financial ability to absorb losses without jeopardizing their lifestyle or goals. Unlike risk tolerance, which is psychological, risk capacity is objective and depends on an individual’s financial resources, liabilities, income stability, and time horizon.

- Risk Needs: Risk needs represent the level of risk an individual must take to achieve specific financial objectives, such as retirement savings, children’s education, or legacy planning. Risk needs are not determined by comfort or capacity but by the individual’s goals and required returns to meet those goals within a particular timeframe.

Risk Management Strategies

After identifying and assessing risks, risk management strategies are deployed based on the client’s risk profile and financial goals. Strategies include:

- Diversification: Spreading investments across asset classes and regions to reduce risk. Diversification mitigates unsystematic risk and helps stabilize returns.

- Asset Allocation: Allocating investments across asset classes (e.g., equities, bonds, real estate) based on the client’s risk tolerance, financial goals, and time horizon. This is a primary method to balance risk and return.

- Insurance Products: Life insurance, disability insurance, and annuities provide protection against unforeseen life events and longevity risk. These products are especially important for individuals who need guaranteed income or financial support.

- Hedging Techniques: Using derivatives like options and futures to mitigate market risk, especially for clients with concentrated stock holdings or other significant exposures.

- Liquidity Management: Maintaining an adequate cash or liquid asset buffer for unexpected expenses. This helps avoid the forced sale of investments during market downturns.

- Tax Optimization Strategies: Minimizing tax impact through tax-efficient investment vehicles, tax-loss harvesting, and asset location strategies. This can enhance after-tax returns, an important aspect for wealthier clients.

Investment Policy Statement (IPS) for Individuals

The Investment Policy Statement (IPS) is a key document in risk management for individuals, setting guidelines for managing a client’s portfolio. The IPS outlines:

- Client’s Financial Goals and Constraints: Including return objectives, risk tolerance, liquidity needs, and legal considerations.

- Asset Allocation Strategy: Based on the risk tolerance, time horizon, and return goals.

- Investment Constraints: Such as time horizon, tax considerations, legal restrictions, and unique preferences.

- Performance Measurement and Review Process: To ensure the portfolio meets the client’s needs and risk tolerance. Regular reviews help adjust the strategy for life events or market changes.

Examples

Example 1: Retirement Planning with Longevity Risk Mitigation

A 55-year-old individual is concerned about outliving their retirement savings. To mitigate longevity risk, the portfolio manager suggests a combination of growth-oriented assets, like equities, and income-producing assets, like bonds, for steady returns. Additionally, annuity products are recommended, providing a guaranteed income stream in retirement. This approach ensures that the client has a sustainable source of funds even if they live beyond average life expectancy, addressing both the need for growth and income.

Example 2: Managing Concentrated Stock Positions for an Executive

An executive holds a significant portion of their wealth in their company’s stock, exposing them to concentration risk. To manage this, the portfolio manager advises a diversification strategy, suggesting a gradual liquidation of shares and reallocating proceeds to a diversified portfolio across different asset classes. To manage market risk and avoid triggering large tax obligations, the manager uses options to hedge against declines in the stock’s price. This approach minimizes risk without compromising the client’s long-term financial objectives.

Example 3: Income Generation and Inflation Protection for Retirees

A retiree seeking to maintain purchasing power over time faces inflation risk. The portfolio manager recommends a diversified portfolio that includes dividend-paying stocks, inflation-protected securities (such as TIPS), and real estate investment trusts (REITs). This asset allocation provides steady income while protecting against inflation. Additionally, the portfolio’s performance is regularly reviewed to ensure it aligns with inflation rates, allowing for rebalancing to sustain purchasing power.

Example 4: Liquidity Management for a Young Professional

A young professional has a high monthly income but a variable bonus structure, creating liquidity needs for sudden expenses, like a down payment on a house or unforeseen emergencies. The portfolio manager builds a strategy with a focus on liquidity management, keeping a portion of the portfolio in cash or near-cash assets such as money market funds. This ensures that funds are readily available without having to liquidate longer-term investments at an inopportune time, preserving the portfolio’s growth potential.

Example 5: Tax-Efficient Portfolio for High-Net-Worth Individuals

A high-net-worth individual with a high marginal tax rate seeks tax efficiency to preserve wealth. The portfolio manager incorporates municipal bonds for tax-free interest income, tax-managed funds that minimize capital gains distributions, and tax-advantaged retirement accounts. Additionally, the manager uses tax-loss harvesting to offset gains with losses, further enhancing tax efficiency. This approach minimizes the client’s tax burden while meeting their risk and return objectives, allowing the individual to retain a greater portion of their wealth.

Practice Questions

Question 1

An individual has a high risk tolerance and a long time horizon for investing. Which of the following portfolio strategies would be the most appropriate for this individual?

A. High allocation to bonds, low allocation to equities

B. High allocation to equities, low allocation to bonds

C. Equal allocation to equities and bonds

D. Primarily cash and short-term instruments for liquidity

Answer: B. High allocation to equities, low allocation to bonds

Explanation: For an individual with a high risk tolerance and a long investment time horizon, a higher allocation to equities is generally suitable. Equities typically offer higher long-term returns compared to bonds but come with higher volatility. However, with a long time horizon, the individual can potentially weather short-term fluctuations and benefit from the equity market’s growth potential. Bonds, while less volatile, usually provide lower returns and may not align with the individual’s willingness and capacity to take on risk. Options A, C, and D would likely be more suitable for investors with lower risk tolerance, shorter time horizons, or liquidity needs. Therefore, B is the most appropriate answer for this profile.

Question 2

Which of the following risks is most critical to address when managing the portfolio of an individual close to retirement?

A. Market risk

B. Inflation risk

C. Longevity risk

D. Credit risk

Answer: C. Longevity risk

Explanation: Longevity risk, the risk of outliving one’s assets, is especially critical for individuals approaching or in retirement. As retirees generally rely on their portfolios to fund their living expenses without additional income, it’s crucial to ensure that their assets can last through an uncertain retirement period. Longevity risk is mitigated by planning for adequate income streams, potentially using annuities or other products that provide guaranteed income. Although market risk (A), inflation risk (B), and credit risk (D) are also relevant, longevity risk is most directly related to ensuring an individual’s financial security over a potentially long retirement period, making it the most critical in this context.

Question 3

A client is heavily invested in a single technology stock due to an employee stock ownership program. Which of the following risk management strategies would best address this situation?

A. Increase the allocation to more technology stocks to diversify within the sector

B. Sell a portion of the stock and reinvest in a diversified portfolio across sectors

C. Purchase additional shares to reduce cost basis

D. Hold the stock to avoid incurring any capital gains taxes

Answer: B. Sell a portion of the stock and reinvest in a diversified portfolio across sectors

Explanation: The client faces significant concentration risk by holding a substantial portion of their portfolio in a single stock. This concentration increases their exposure to unsystematic risk—risk specific to the technology sector and, more critically, to the particular company. The best approach to mitigate this risk is to sell part of the holding and reinvest the proceeds into a diversified portfolio across various sectors, thus reducing exposure to sector-specific or company-specific downturns. Option A (increasing allocation within the technology sector) would not reduce concentration risk. Option C (purchasing additional shares) further increases concentration risk, and option D (holding to avoid capital gains tax) prioritizes tax considerations over prudent risk management. Therefore, option B is the correct answer.