The Behavioral Biases of Individuals

- Notes

Preparing for the CFA Exam requires a thorough understanding of “The Behavioral Biases of Individuals,” a key component of behavioral finance. Mastery of these biases, including overconfidence, loss aversion, and anchoring, is essential. This knowledge provides insights into how psychological factors impact investor decision-making, crucial for achieving a high CFA score.

Learning Objective

In studying “The Behavioral Biases of Individuals” for the CFA Exam, you should aim to understand the key psychological biases that influence investor behavior, including overconfidence, loss aversion, anchoring, and herding. Analyze how these biases impact financial decision-making, potentially leading to irrational investment choices and market inefficiencies. Evaluate the principles behind common cognitive and emotional biases and their effects on risk perception, portfolio construction, and trading behavior. Additionally, explore strategies for recognizing and mitigating these biases in personal and client investment decisions. Apply this knowledge to case studies and practice scenarios, enhancing your ability to make rational, informed financial decisions in the CFA context.

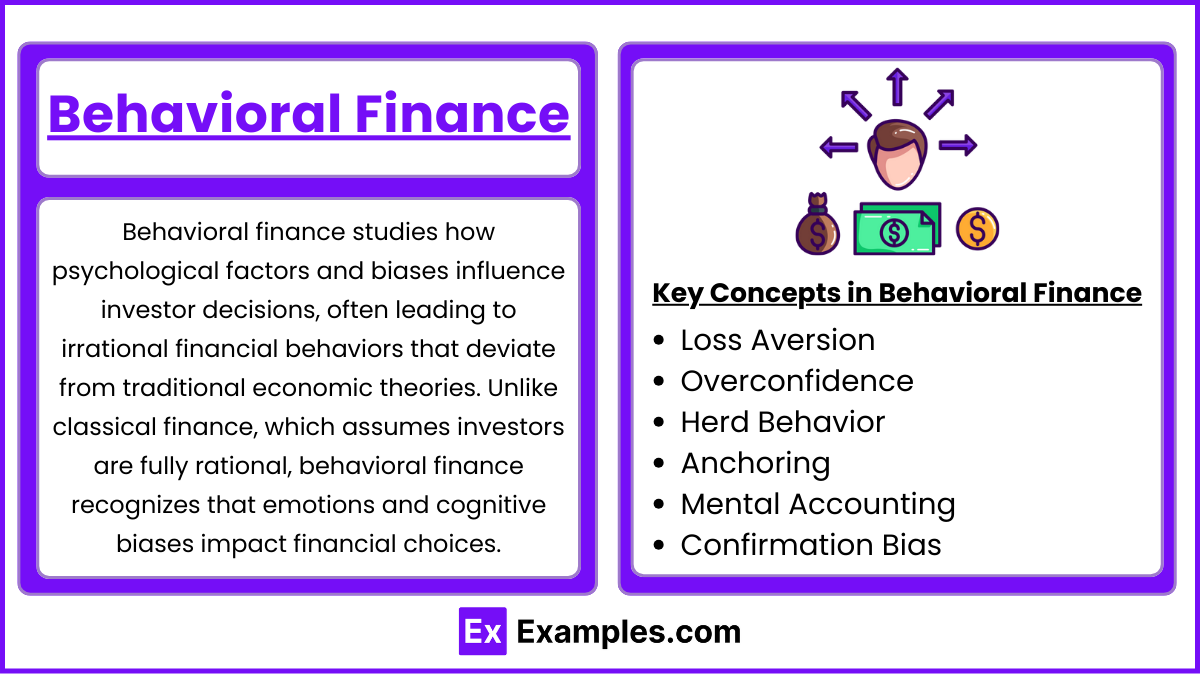

Introduction to Behavioral Finance

Behavioral finance studies how psychological factors and biases influence investor decisions, often leading to irrational financial behaviors that deviate from traditional economic theories. Unlike classical finance, which assumes investors are fully rational, behavioral finance recognizes that emotions and cognitive biases impact financial choices.

Key Concepts in Behavioral Finance:

- Loss Aversion: Investors feel the pain of losses more intensely than the pleasure of gains, often leading to risk-averse decisions or holding onto losing investments too long.

- Overconfidence: Many investors overestimate their knowledge or abilities, resulting in excessive trading and risk-taking.

- Herd Behavior: The tendency to follow the actions of others, which can drive asset bubbles or sharp market declines as people move en masse.

- Anchoring: Relying too heavily on initial information (such as a stock’s purchase price), which can prevent rational reassessment of value.

- Mental Accounting: Treating money differently based on arbitrary categories, which may lead to suboptimal investment decisions.

- Confirmation Bias: Seeking information that confirms existing beliefs, leading to narrow decision-making.

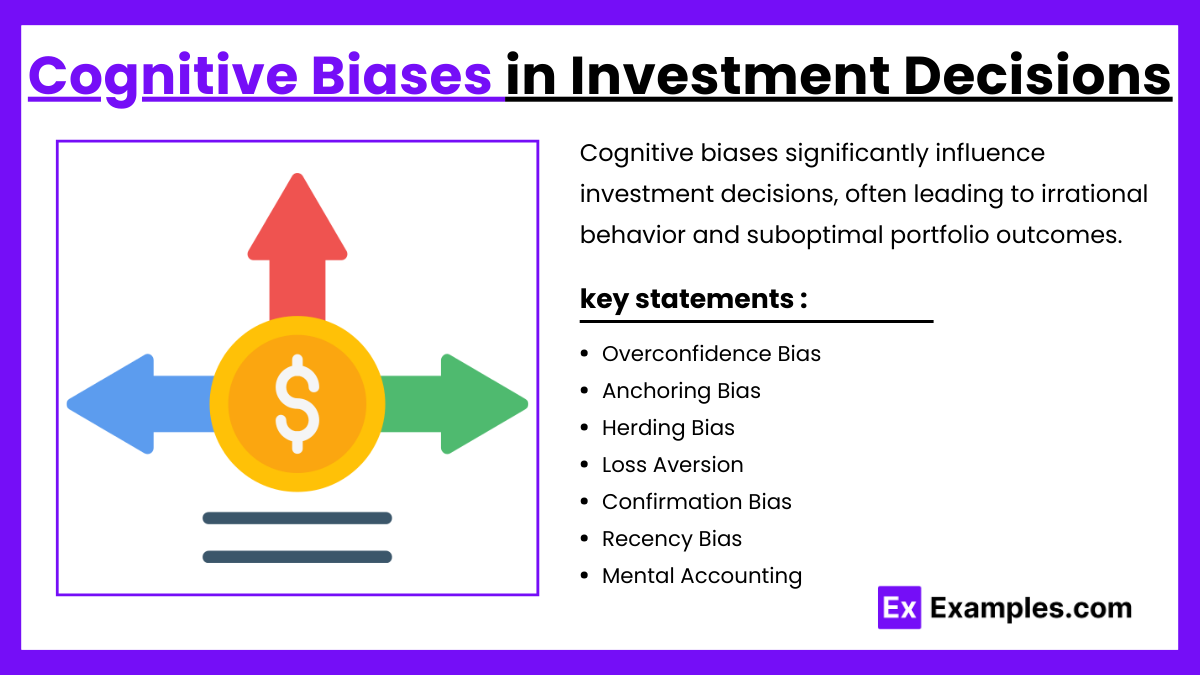

Cognitive Biases in Investment Decisions

Cognitive biases significantly influence investment decisions, often leading to irrational behavior and suboptimal portfolio outcomes. Here are some key cognitive biases and their impact on investing:

- Overconfidence Bias: Overestimating one’s abilities leads to excessive trading and risk-taking, often reducing returns.

- Anchoring Bias: Relying too heavily on initial information, like purchase price, prevents objective reassessment.

- Herding Bias: Following the crowd can cause bubbles or downturns due to trend-chasing rather than analysis.

- Loss Aversion: Fear of losses leads to holding losing investments too long or selling winners too early.

- Confirmation Bias: Seeking information that supports existing beliefs limits objective decision-making.

- Recency Bias: Overweighting recent events causes trend-chasing, increasing volatility.

- Mental Accounting: Treating money differently by source leads to inconsistent asset allocation.

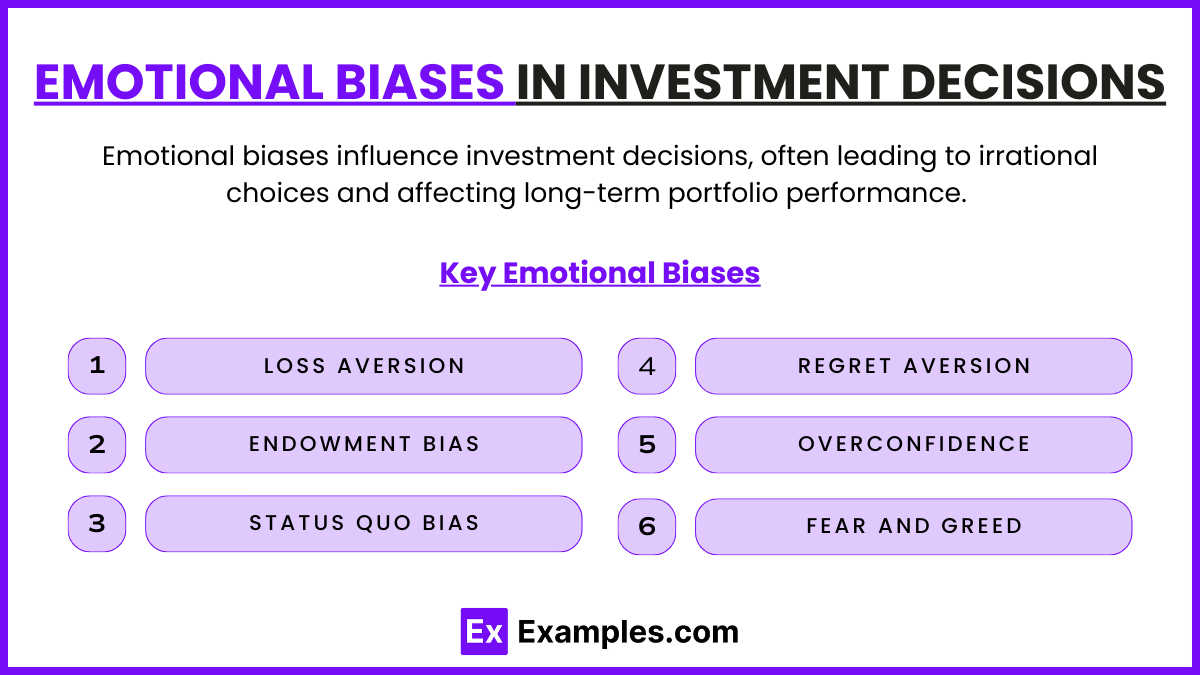

Emotional Biases in Investment Decisions

Emotional biases influence investment decisions, often leading to irrational choices and affecting long-term portfolio performance. Here are some key emotional biases:

- Loss Aversion: Fear of losses causes holding onto losers too long or selling winners too early.

- Endowment Bias: Emotional attachment to owned assets leads to overvaluation and reluctance to sell underperformers.

- Status Quo Bias: Preference for maintaining current investments can prevent rebalancing and seizing new opportunities.

- Regret Aversion: Fear of making mistakes leads to inaction, resulting in missed opportunities.

- Overconfidence: Belief in one’s abilities leads to excessive trading and higher risk.

- Fear and Greed: Fear causes panic-selling, while greed leads to overbuying, often resulting in poor timing.

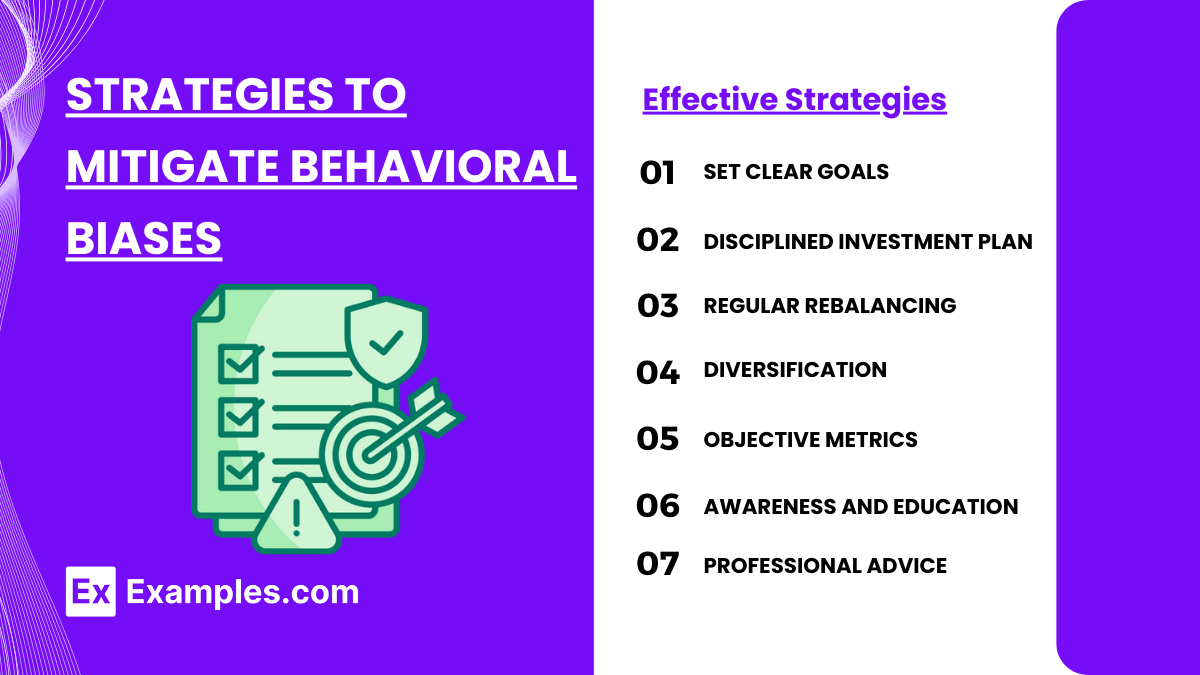

Strategies to Mitigate Behavioral Biases

Mitigating behavioral biases is essential for making rational investment decisions. Here are effective strategies to counter common biases:

- Set Clear Goals: Define measurable goals to stay focused on the long term, reducing impulsive reactions.

- Disciplined Investment Plan: Use structured approaches like dollar-cost averaging to avoid market timing and emotional decisions.

- Regular Rebalancing: Adjust allocations periodically to align with goals, countering biases like status quo.

- Diversification: Spread investments to lower dependence on individual assets, reducing overconfidence and endowment bias.

- Objective Metrics: Use performance metrics to evaluate investments objectively, limiting emotional attachment.

- Awareness and Education: Recognize common biases to consciously avoid them in decision-making.

- Professional Advice: Consult advisors for objective guidance and accountability, countering emotional influences.

Examples

Example 1: Overconfidence in Day Trading

- Analyze how overconfidence bias often leads day traders to overestimate their abilities, resulting in excessive trading and high transaction costs. Discuss the potential impact on overall portfolio returns and risk, especially during volatile market conditions.

Example 2: Anchoring in Stock Price Valuations

- Explore how anchoring bias can affect investors who fixate on a specific price point, such as the stock’s original purchase price. This can prevent investors from selling a stock at a loss, even when fundamental factors suggest further decline, potentially leading to larger losses.

Example 3: Loss Aversion in Retirement Planning

- Examine how loss aversion impacts conservative investment choices among retirement investors who may prioritize capital preservation over growth. This behavior can lead to portfolios overly concentrated in low-risk assets, which might not generate enough returns to meet long-term financial goals.

Example 4: Herding Behavior during Market Bubbles

- Discuss how herding bias contributes to asset bubbles, as investors follow the crowd and drive up asset prices beyond fundamental values. Use examples like the dot-com bubble or cryptocurrency surges to illustrate how herding can result in unsustainable price levels and eventual sharp corrections.

Example 5: Endowment Effect in Real Estate Investments

- Study the endowment effect in the context of real estate, where owners may overvalue their property compared to market assessments. This bias can lead to reluctance in adjusting asking prices, causing delays in sale and financial strain, especially in declining markets.

Practice Questions

Question 1

Which behavioral bias describes an investor’s tendency to hold onto losing investments due to an unwillingness to realize a loss?

A. Loss aversion

B. Overconfidence

C. Anchoring

D. Endowment effect

Answer:

A. Loss aversion

Explanation:

Loss aversion is the tendency to prefer avoiding losses rather than acquiring equivalent gains. This often leads investors to hold onto losing investments, hoping they will recover, rather than selling and realizing the loss. This behavior can prevent investors from reallocating assets to potentially more profitable opportunities.

Question 2

An investor refuses to sell a stock that they purchased at $50, even though it is currently valued at $35, because they are anchored to the initial purchase price. This is an example of which bias?

A. Availability bias

B. Confirmation bias

C. Anchoring bias

D. Recency bias

Answer:

C. Anchoring bias

Explanation:

Anchoring bias occurs when individuals rely too heavily on the first piece of information (in this case, the purchase price of $50) when making decisions. The investor’s attachment to the initial price influences their decision to hold the stock despite a decline in value, as they feel anchored to that original value.

Question 3

Which bias might lead investors to follow popular trends or crowd behavior, potentially causing asset bubbles?

A. Endowment effect

B. Herding bias

C. Loss aversion

D. Overconfidence

Answer:

B. Herding bias

Explanation:

Herding bias is the tendency to follow the actions or decisions of a larger group, often without independent analysis. This can lead to market phenomena such as asset bubbles, where prices are driven up unsustainably as investors “follow the crowd,” rather than making decisions based on individual analysis.