Understanding yield and yield spread measures for floating-rate instruments is essential for the CFA Exam, as it involves analyzing interest rate adjustments and market-driven returns. Mastery of floating-rate instruments, including pricing, spread calculations, and yield fluctuations, provides insights into risk assessment and investment strategies, crucial for achieving a high CFA score.

Learning Objective

In studying “Yield and Yield Spread Measures for Floating-Rate Instruments” for the CFA Exam, you should develop a strong understanding of how floating-rate instruments function, focusing on yield calculations and spread analysis. Analyze how interest rate fluctuations impact floating-rate securities and assess the methods used to calculate spread measures relative to reference rates like LIBOR or SOFR. Understand the dynamics between floating-rate yields and market conditions, and explore the implications of spread changes for investment risk and return. Apply this knowledge to evaluate floating-rate instruments in portfolio management and interpret yield spreads in diverse economic scenarios.

Floating-Rate Instruments

Floating-rate instruments are debt securities whose interest payments fluctuate based on a reference benchmark rate, such as LIBOR or SOFR. Unlike fixed-rate bonds, where the interest remains constant, the rates on floating-rate instruments adjust periodically. This adjustment happens at set intervals, such as monthly or quarterly, aligning the instrument’s rate with current market interest rates.

These instruments are commonly used to manage interest rate risk. Because their payments adjust with the benchmark rate, they typically exhibit lower price volatility compared to fixed-rate bonds. This makes them appealing in rising rate environments, as investors receive higher interest payments as rates increase.

Floating-rate instruments are often seen in products like floating-rate notes (FRNs), adjustable-rate mortgages, and some corporate bonds. They are valuable in portfolios for their ability to offset the impact of interest rate movements, helping investors manage duration and enhance returns in specific market conditionsThese instruments are attractive in rising interest rate environments since their yields increase with the reference rate, offering a natural hedge against interest rate risk. Common floating-rate instruments include government and corporate FRNs, asset-backed securities, and certain types of mortgages and loans.

Yield Calculations for Floating-Rate Instruments

Yield calculations for floating-rate instruments differ from fixed-rate bonds due to their adjustable interest payments, which are tied to a benchmark rate (e.g., LIBOR, SOFR). With floating-rate securities, the yield is not constant but adjusts periodically, aligning with changes in the reference rate.

The primary method for calculating the yield on a floating-rate instrument is the discount margin approach. This involves finding the spread (or margin) above the reference rate that equates the bond’s price with the present value of expected future cash flows. Here’s how it works:

- Determine the Reference Rate and Spread: At each reset period, the interest payment is recalculated as the current reference rate plus a fixed spread. For example, if the reference rate is 2% and the spread is 1%, the interest rate for that period would be 3%.

- Periodic Rate Resets: The floating rate resets at intervals (e.g., monthly or quarterly) to match the new reference rate. This means each coupon payment varies, impacting the effective yield over time.

- Yield Fluctuation: Since the rate adjusts with market movements, the yield on floating-rate instruments changes over the life of the security. When the reference rate rises, the yield increases, and when it falls, the yield decreases.

- Implications of Caps and Floors: Some floating-rate instruments include interest rate caps (limits on maximum interest) or floors (minimum limits). These affect yield calculations, as the payment will not exceed the cap or drop below the floor, even if the reference rate changes substantially.

The discount margin method allows investors to compare floating-rate instruments with similar securities by estimating an average yield above the reference rate. This approach is particularly useful for assessing risk and return on floating-rate notes in varying market conditions

Spread Measures and Market Analysis

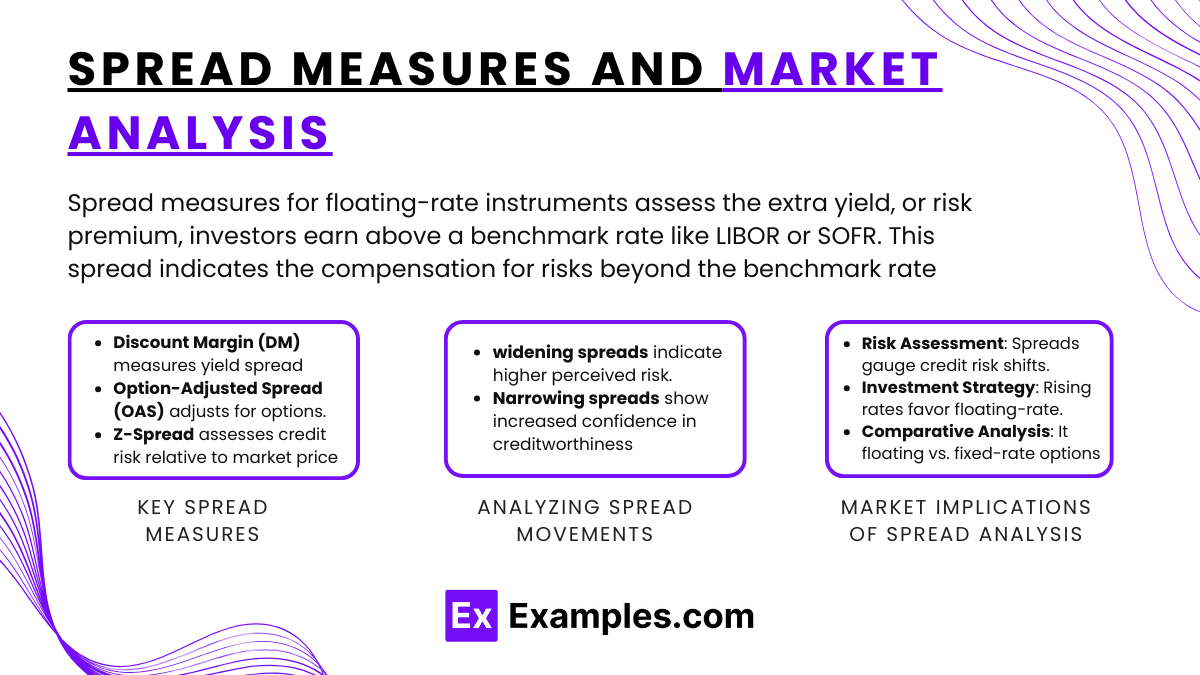

Spread measures for floating-rate instruments are essential in evaluating the additional yield—or risk premium—an investor earns over a reference rate, such as LIBOR or SOFR. This spread reflects the compensation investors demand for taking on risks beyond what the benchmark rate represents.

Key Spread Measures:

- Discount Margin: The discount margin (DM) is a common measure used for floating-rate instruments. It represents the fixed spread above the reference rate that equates the bond’s price to the present value of its expected cash flows. Calculating the DM helps investors gauge the effective yield relative to the instrument’s price, accounting for the periodic reset of rates.

- Option-Adjusted Spread (OAS): For floating-rate instruments with embedded options (like call or put options), the option-adjusted spread is used. The OAS adjusts for the cost or benefit of the option, providing a “clean” spread over the reference rate that removes the impact of optionality. This measure is especially relevant for comparing bonds with and without embedded options on an equal basis.

- Z-Spread: The Z-spread (or zero-volatility spread) represents the constant spread that would need to be added to the risk-free rate (often a yield curve) to discount a bond’s cash flows to its market price. While more common for fixed-rate bonds, it can be used with floating-rate instruments to measure credit risk and liquidity relative to the broader market.

Analyzing Spread Movements:

Spread changes are a critical indicator of market conditions and investor sentiment:

- Widening Spreads: A wider spread over the benchmark rate suggests increased perceived risk, often due to credit concerns or market uncertainty. Investors demand a higher yield as compensation for taking on additional risk, signaling cautious sentiment.

- Narrowing Spreads: Narrower spreads indicate decreased perceived risk or higher confidence in the issuer’s creditworthiness. This can reflect improved economic conditions, better credit ratings, or strong investor demand for the security.

Market Implications of Spread Analysis:

For portfolio managers, analyzing spreads helps in several ways:

- Risk Assessment: Spreads serve as a barometer for credit risk, allowing investors to monitor shifts in issuer or sector risk.

- Investment Strategy: In an environment of rising interest rates, floating-rate instruments with favorable spreads may offer more attractive yields and lower price volatility than fixed-rate bonds.

- Comparative Analysis: Spread measures enable comparisons between similar floating-rate instruments or against fixed-rate alternatives, guiding allocation decisions based on risk-return profiles.

Spread measures and their analysis provide valuable insights into both the relative attractiveness of floating-rate instruments and broader market conditions, making them crucial for informed investment decisions in the fixed-income market

Floating-Rate Instruments in Portfolio Management

Floating-rate instruments play a valuable role in portfolio management, especially in managing interest rate risk and enhancing returns in certain economic conditions. Their unique structure, with interest payments that adjust to a reference rate, makes them particularly attractive in rising interest rate environments and for investors seeking lower price volatility.

Key Roles in Portfolio Management:

- Hedging Against Interest Rate Risk: Floating-rate instruments are often used to reduce interest rate risk. Since their interest payments increase as benchmark rates rise, they help offset the impact of rate hikes that typically hurt fixed-rate bonds. By incorporating floating-rate securities, portfolio managers can mitigate the adverse effects of rising rates on the portfolio’s value.

- Reducing Duration: Floating-rate instruments generally have shorter effective durations compared to fixed-rate bonds, as their periodic rate resets align closely with market rates. Lower duration means less sensitivity to interest rate changes, which can be beneficial in volatile markets or during periods when rates are expected to increase.

- Income in Rising Rate Environments: In times of increasing interest rates, floating-rate instruments offer potentially higher income since their coupons adjust upward with the benchmark rate. This feature makes them an attractive option for generating income in a portfolio without taking on the same level of price risk seen in fixed-rate bonds.

- Diversification of Fixed-Income Exposure: Adding floating-rate instruments diversifies a fixed-income portfolio, balancing exposure between securities that perform well in different rate environments. For instance, while fixed-rate bonds may outperform in declining rate scenarios, floating-rate bonds provide benefits when rates are rising, helping to stabilize returns.

Strategic Considerations:

Portfolio managers must also consider the relative spreads on floating-rate instruments, as spreads reflect market perceptions of credit and liquidity risks. Choosing instruments with favorable spreads over the benchmark rate can enhance portfolio returns, especially when managing a mix of credit quality and maturity profiles.

Examples

Example 1: Calculating the Discount Margin for a Floating-Rate Note (FRN)

An investor purchases a floating-rate note that pays interest at LIBOR + 1% with a face value of $1,000. LIBOR is currently 2%, so the initial interest rate is 3%. To calculate the discount margin, the investor would need to find the spread (1%) above LIBOR that equates the bond’s price with the present value of its future cash flows. The discount margin provides insight into the bond’s effective yield compared to the market rate.

Example 2: Analyzing Yield Spread Widening in Response to Credit Risk

A corporate FRN initially issued at LIBOR + 0.5% has recently seen its spread widen to LIBOR + 1% due to deteriorating credit conditions for the issuer. This widening indicates that the market perceives higher risk and demands additional compensation. Portfolio managers use this change in spread as a signal for potential increased credit risk or liquidity concerns, which might impact future investment decisions.

Example 3: Impact of Rate Floors on Yield

Consider an FRN with an embedded floor of 1%, meaning the interest rate cannot drop below this level even if the reference rate falls. If LIBOR drops to 0.5%, the floor protects the investor by ensuring a minimum interest rate of 1%, thus maintaining yield stability. This is especially beneficial in low-interest-rate environments, as the floor prevents the yield from falling too low.

Example 4: Comparing Option-Adjusted Spread (OAS) for Floating-Rate Securities

An investor evaluates two FRNs with similar credit quality, but one is callable by the issuer. To assess the fair yield of the callable FRN, the investor calculates the option-adjusted spread (OAS), which adjusts the spread to account for the call option’s value. This OAS helps compare the yield of callable versus non-callable FRNs, enabling more accurate comparisons based on risk-adjusted returns.

Example 5: Using Z-Spread to Measure Liquidity Risk

A portfolio manager examines the Z-spread of a floating-rate corporate bond to assess its liquidity risk. The Z-spread represents the constant spread over the yield curve that would make the bond’s price equal to the present value of its cash flows. A higher Z-spread can indicate lower liquidity or higher market risk associated with the bond, guiding the manager’s decision on whether to hold or sell the instrument

Practice Questions

Question 1

A floating-rate note (FRN) is issued with a reference rate of LIBOR + 1%. If LIBOR is currently 2.5%, what will be the interest rate for this FRN?

A. 2.5%

B. 3.0%

C. 3.5%

D. 4.0%

Answer: C. 3.5%

Explanation:

The interest rate on a floating-rate note is determined by adding the spread (1%) to the current LIBOR rate (2.5%). Therefore, the interest rate for this period will be 2.5% + 1% = 3.5%.

Question 2

An investor purchases an FRN with a current discount margin of 1.5%. If market conditions worsen and the spread widens to 2%, what does this change in spread indicate?

A. Improved credit quality of the issuer

B. Decreased credit risk

C. Increased perceived risk by investors

D. Fixed interest payment adjustment

Answer: C. Increased perceived risk by investors

Explanation:

A widening spread (from 1.5% to 2%) indicates that investors perceive a higher risk associated with the issuer. This increased spread is a risk premium, reflecting a higher required yield to compensate for perceived credit or market risk.

Question 3

Which of the following measures is used to assess the spread of a floating-rate instrument after adjusting for embedded options, such as calls or puts?

A. Discount margin

B. Z-spread

C. Yield-to-maturity

D. Option-adjusted spread (OAS)

Answer: D. Option-adjusted spread (OAS)

Explanation:

The option-adjusted spread (OAS) accounts for the value of any embedded options (e.g., calls or puts) in a floating-rate instrument. This measure allows for a fair comparison with non-callable securities by adjusting the spread to reflect the impact of optionality.