Preparing for the CIA Exam requires a solid understanding of “Business Acumen,” a vital component of internal auditing. This area emphasizes an auditor’s ability to comprehend and analyze the business environment, including financial, operational, and strategic aspects, to make informed decisions. Furthermore, it involves understanding organizational goals, industry trends, and regulatory factors that influence business performance. Mastering these skills enables auditors to align audit objectives with business strategies, provide valuable insights to stakeholders, and enhance decision-making processes. Strengthening business acumen is essential for fostering adaptability, driving strategic growth, and ensuring success on the CIA Exam.

Learning Objectives

In studying “Business Acumen” for the CIA exam, you should learn to understand the foundational principles of business operations and strategic decision-making. Focus on gaining knowledge of key business functions such as finance, marketing, operations, and human resources, and how they interrelate to support organizational goals. Develop an understanding of financial statements, budgeting, and performance metrics to assess organizational health. Analyze the impact of external factors, such as economic trends and regulatory changes, on business performance and risk management. Additionally, emphasize the importance of aligning audit activities with the organization’s strategic objectives to add value and support long-term growth and sustainability.

Core Concepts in Business Acumen

- Strategic Insight

- Understands the company’s mission, vision, and core objectives.

- Recognizes how these objectives drive operational decisions.

- Aligns audit strategies with strategic goals to provide valuable insights.

- Financial Literacy

- Strongly grasps key financial statements (income statement, balance sheet, cash flow).

- Evaluates company financial health, recognizing signs of fiscal stress or opportunity.

- Provides audit recommendations that consider financial impacts on business.

- Operational Knowledge

- Familiarizes with core processes, workflows, and supply chains within the organization.

- Identifies areas where efficiencies can be improved.

- Aligns audit practices with operations to identify risks and suggest process improvements.

- Market Awareness

- Keeps informed about industry trends, competition, and regulatory environments.

- Understands how external factors may impact business strategy and operations.

- Provides audits that consider external risks and changes in market conditions.

- Customer and Product Insight

- Understands customer needs, product development cycles, and market positioning.

- Recognizes the importance of customer satisfaction and product quality.

- Ensures audits are aligned with customer-centric practices and product quality assurance.

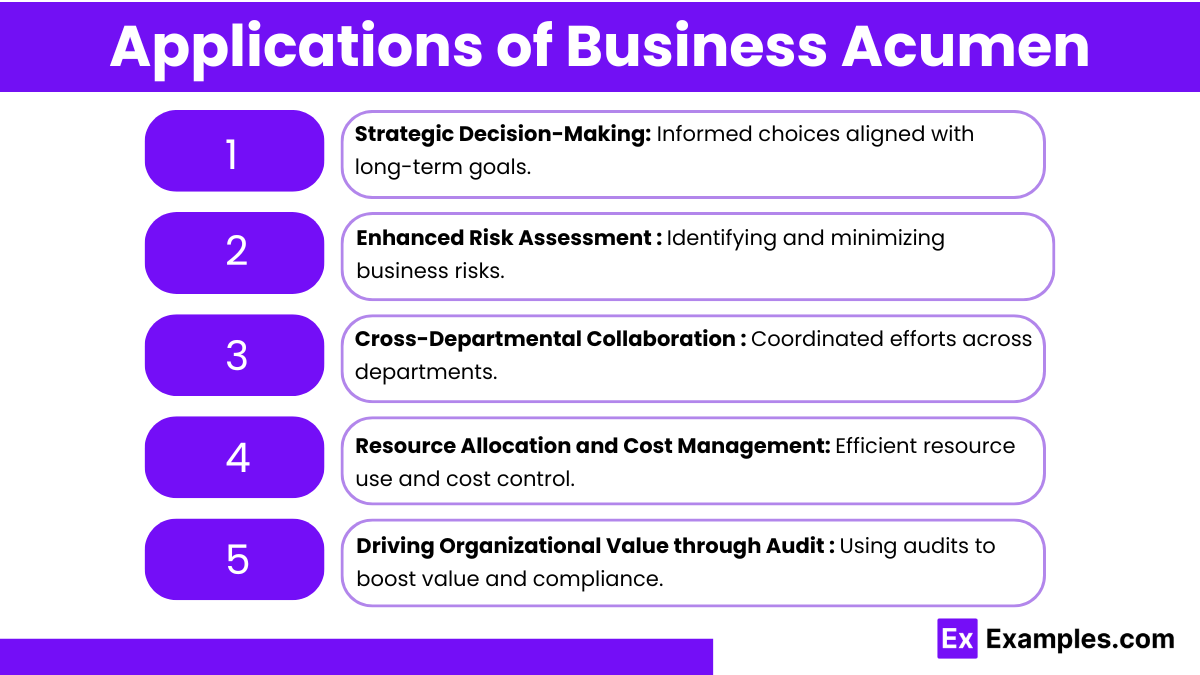

Applications of Business Acumen

- Strategic Decision-Making

- Apply business acumen to evaluate management’s decisions and their alignment with goals.

- Assess how well risk management practices align with the company’s strategic direction.

- Enhanced Risk Assessment

- Integrate business acumen to foresee risks beyond traditional financial risks, including operational and strategic risks.

- Use this knowledge to implement audit processes that better predict and mitigate potential threats.

- Cross-Departmental Collaboration

- Develop strong interdepartmental relationships to understand each unit’s role in achieving business objectives.

- Use insights to improve audit recommendations, encouraging cooperative risk management practices.

- Resource Allocation and Cost Management

- Leverage financial literacy to assess whether resources are being used efficiently.

- Provide audits that reflect a clear understanding of budgeting and financial management.

- Driving Organizational Value through Audit

- Use business acumen to focus audits on areas that directly add value.

- Communicate findings in terms that highlight both risk mitigation and value creation, enhancing the audit function’s credibility.

Types of Business Acumen

- Financial Acumen

- Involves understanding financial statements, key metrics, and the financial implications of business decisions. This includes interpreting balance sheets, income statements, and cash flow.

- Strategic Thinking

- Refers to the ability to see the bigger picture and forecast long-term effects of actions. Strategic thinkers assess competitive landscape, market trends, and industry dynamics to guide business growth.

- Market Awareness

- Encompasses knowledge of industry trends, competitor activities, and customer preferences. This helps businesses stay relevant and responsive to changes in demand or emerging technologies.

- Operational Insight

- Focuses on understanding business operations, efficiency, and process optimization. Operational insight ensures smooth workflow and helps in managing resources effectively.

- Customer-Centric Perspective

- Understanding customer needs and behaviors is crucial for offering value and retaining clients. This type of acumen is essential for sales, marketing, and product development.

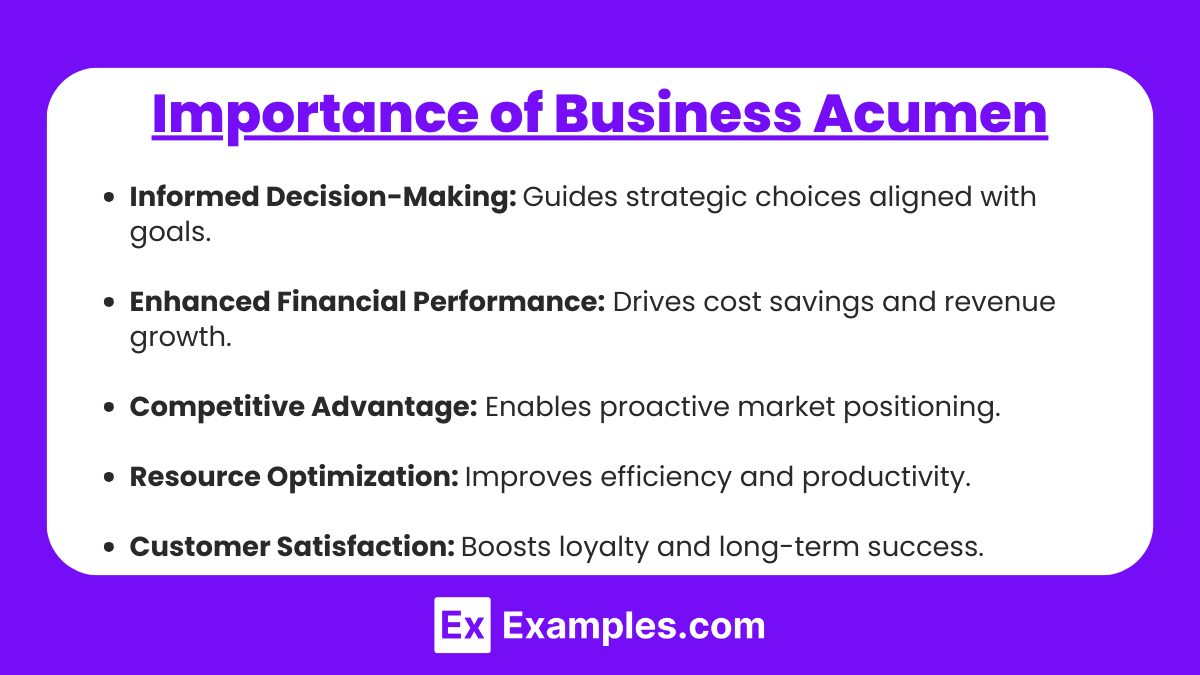

Importance of Business Acumen

- Informed Decision-Making

- Business acumen provides the knowledge base for making strategic, financial, and operational decisions that align with organizational goals and improve overall outcomes.

- Enhanced Financial Performance

- Professionals with strong financial acumen can optimize budgets, reduce costs, and drive revenue growth, impacting profitability positively.

- Competitive Advantage

- Market and industry awareness enable companies to identify opportunities and anticipate trends, keeping them ahead of competitors.

- Resource Optimization

- Operational insight allows for efficient use of resources, minimizing waste and maximizing productivity, which is vital for sustaining growth.

- Customer Satisfaction and Retention

- A customer-centric approach drives loyalty by addressing client needs effectively, contributing to long-term business success.

Examples

Example 1. Understanding Market Trends and Customer Needs

Using business acumen involves staying aware of market trends, shifts in customer behavior, and evolving needs within your industry. For example, a product manager in an eCommerce company might analyze recent buying patterns and customer feedback to adjust the product lineup or introduce new offerings that align with current market demands. This proactive approach enhances customer satisfaction and positions the business competitively.

Example 2. Evaluating Financial Health and Investment Opportunities

Business acumen is crucial in assessing a company’s financial position to make sound investment decisions. A financial analyst might review financial statements, cash flow patterns, and key performance indicators to determine if the company should reinvest profits, expand operations, or hold back due to market uncertainties. Such evaluations ensure that resources are allocated strategically, maximizing potential returns.

Example 3. Anticipating Competitive Moves

A strategic thinker with strong business acumen observes competitors’ actions and industry shifts, anticipating changes that could impact market positioning. For instance, a marketing director might notice a competitor’s increased social media presence and launch targeted campaigns to maintain brand visibility and customer loyalty. Understanding and predicting competitive behaviors allows companies to respond proactively rather than reactively.

Example 4. Building Cross-Functional Relationships

Business acumen involves understanding how different departments within an organization contribute to overall success. A project manager with this skillset might foster strong communication with finance, marketing, and operations teams to ensure that resources align with project goals, timelines, and budgets. This collaboration enhances project efficiency and helps achieve objectives that support the company’s strategic priorities.

Example 5. Recognizing and Mitigating Risks

Effective use of business acumen includes identifying and managing potential risks. A risk manager might assess external factors—like regulatory changes or economic fluctuations—that could impact the business. By understanding the broader business landscape, they can develop contingency plans, such as diversifying suppliers or adjusting product offerings, to safeguard the organization’s financial stability and operational continuity.

Practice Questions

Question 1

What does “business acumen” primarily involve?

A. Developing deep technical skills in a specific field

B. Understanding and making decisions based on the financial, strategic, and operational aspects of a business

C. Focusing only on customer service and satisfaction

D. Specializing in digital transformation and technology adoption

Answer: B. Understanding and making decisions based on the financial, strategic, and operational aspects of a business

Explanation:

Business acumen is the ability to understand how a business operates in a broader sense, including its financial, strategic, and operational components. This skill involves comprehending how various parts of an organization interconnect to achieve profitability and growth. Unlike focusing solely on technical expertise or specific areas like digital transformation, business acumen is holistic, allowing professionals to make informed decisions that align with the business’s strategic objectives.

Question 2

Which of the following actions best demonstrates strong business acumen?

A. Prioritizing the use of industry jargon when speaking to clients

B. Making a decision that considers both short-term profitability and long-term sustainability

C. Taking on multiple projects without assessing resource availability

D. Focusing exclusively on increasing sales volume, regardless of margins

Answer: B. Making a decision that considers both short-term profitability and long-term sustainability

Explanation:

Demonstrating business acumen involves making well-rounded decisions that balance short-term and long-term objectives. By considering both profitability and sustainability, a leader or professional shows an understanding of how immediate actions impact the business’s future health. Focusing solely on sales volume or adopting industry jargon without understanding the larger context does not reflect business acumen, as these actions do not necessarily align with the broader goals and strategic direction of the business.

Question 3

Why is financial literacy an essential component of business acumen?

A. It enables individuals to create complex budgets without understanding cash flow

B. It helps individuals avoid taking any financial risks

C. It allows individuals to understand and interpret financial statements, aiding in decision-making

D. It replaces the need for strategic planning and analysis

Answer: C. It allows individuals to understand and interpret financial statements, aiding in decision-making

Explanation:

Financial literacy is crucial to business acumen because it provides insight into a company’s financial health, supporting informed decision-making. Understanding financial statements like income statements, balance sheets, and cash flow statements enables professionals to assess profitability, manage expenses, and forecast future growth. Unlike avoiding financial risk or bypassing strategic planning, financial literacy enhances one’s ability to contribute effectively to an organization’s strategic goals and operational efficiency, forming a foundation for sound business decisions.