Preparing for the CIA Exam necessitates a comprehensive grasp of “Financial Management,” which plays a pivotal role in internal auditing. This domain focuses on the effective stewardship of an organization’s financial resources and the strategic allocation of funds to ensure long-term sustainability. It encompasses the evaluation of financial statements, budgetary processes, and financial forecasting, aiming to identify inefficiencies and enhance fiscal performance. Understanding financial management principles equips auditors to provide insights into financial health, assess risks associated with financial decisions, and ensure compliance with relevant regulations. Cultivating financial management expertise is essential for promoting sound financial practices, optimizing resource utilization, and achieving excellence on the CIA Exam.

Learning Objectives

In studying “Financial Management” for the CIA exam, you should learn the principles and practices that support an organization’s financial health and strategic goals. Key areas include budgeting, forecasting, and financial analysis, which help organizations allocate resources effectively and make informed decisions. Learn about financial statement analysis, including income statements, balance sheets, and cash flow statements, to assess profitability, liquidity, and solvency. Understanding cost management and capital budgeting is essential, as these tools guide investment decisions and operational efficiency. Additionally, learn about risk management practices that address financial risks, such as credit, market, and operational risks. This foundational knowledge is crucial for auditors to evaluate financial processes, ensure compliance, and support the organization’s long-term financial stability.

What is Financial Management?

Financial management involves the strategic oversight of an organization’s financial activities to ensure the effective use of financial resources. This includes a wide range of functions such as budgeting, forecasting, financial analysis, investment decisions, and risk management. The primary goal of financial management is to maximize an organization’s value and ensure its long-term sustainability by maintaining a balance between risk and profitability. Understanding financial management enables auditors to evaluate the financial performance of an organization, identify weaknesses, and suggest improvements.

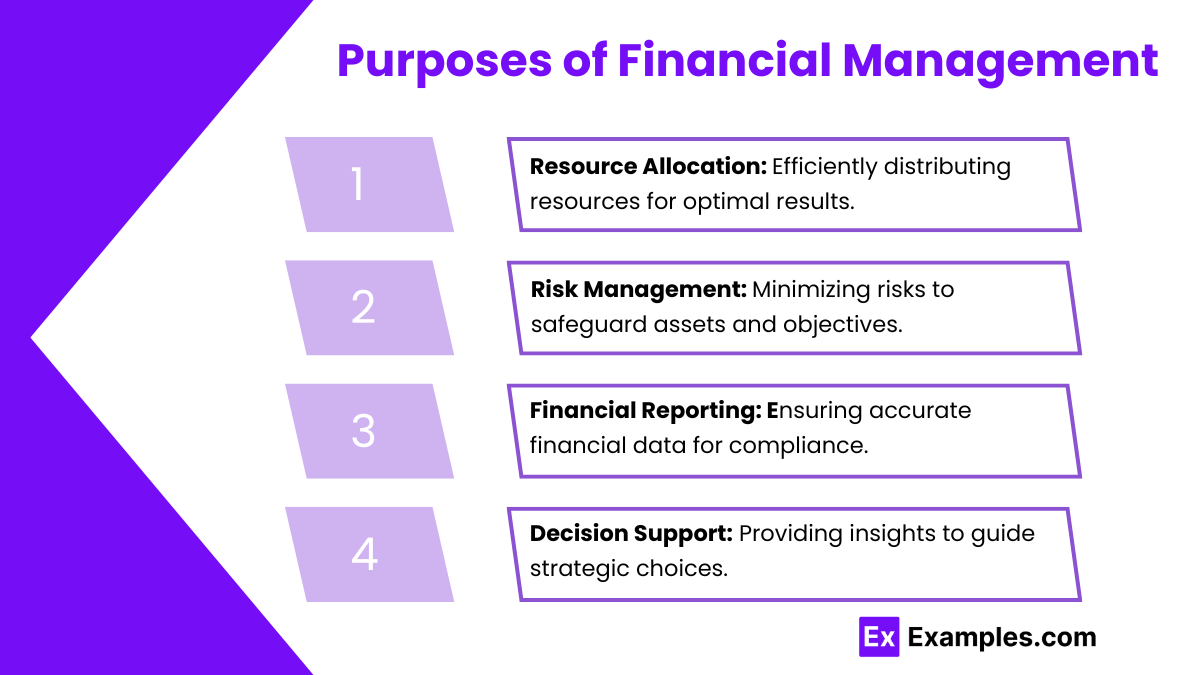

Purposes of Financial Management

- Resource Allocation: Financial management ensures that resources are allocated efficiently and effectively to various departments or projects. This involves prioritizing spending based on strategic objectives and ensuring that financial resources are utilized to achieve maximum return on investment (ROI).

- Risk Management: A critical purpose of financial management is identifying and mitigating financial risks that can affect the organization’s stability. This includes managing credit risk, market risk, liquidity risk, and operational risks through careful analysis and planning.

- Financial Reporting: Accurate financial reporting is essential for transparency and accountability. Financial management entails preparing financial statements that reflect the organization’s performance, providing stakeholders with vital information for decision-making.

- Decision Support: Financial management provides the necessary data and analytical tools to support strategic decision-making. This includes assessing the financial implications of business decisions, evaluating investment opportunities, and developing strategies for cost reduction.

Types of Financial Management

Financial management encompasses a range of activities that aim to manage an organization’s finances effectively. Here are the primary types of financial management:

- Capital Budgeting: This involves evaluating and selecting long-term investment projects. Financial managers analyze potential projects to determine their profitability and risk.

- Capital Structure Management: This focuses on determining the optimal mix of debt and equity financing for a business. It involves assessing how to finance assets to minimize costs and maximize shareholder value.

- Working Capital Management: This area deals with managing short-term assets and liabilities to ensure the company has sufficient liquidity to meet its operational needs. It involves managing cash, inventories, receivables, and payables.

- Financial Risk Management: This involves identifying, analyzing, and mitigating risks that could affect the financial health of an organization. It includes managing risks related to currency fluctuations, interest rates, and credit.

- Financial Planning and Analysis (FP&A): This type involves budgeting, forecasting, and analyzing financial performance. FP&A professionals work to develop financial strategies that align with the organization’s goals.

- Investment Management: This includes managing a company’s investment portfolio to achieve the best possible return while managing risk. It involves selecting, monitoring, and analyzing investment opportunities.

- Performance Management: This focuses on measuring and improving the financial performance of the organization. It includes setting financial targets, evaluating financial results, and making strategic adjustments as necessary.

- Cost Management: This involves controlling and reducing costs to enhance profitability. It includes budgeting, forecasting, and financial reporting to keep expenditures within limits.

Examples

Example 1. Budgeting and Forecasting

Financial management involves the creation of budgets and financial forecasts that help businesses plan their future expenditures and revenues. By analyzing historical data and market trends, companies can develop realistic budgets that guide their spending and investment strategies. This proactive approach ensures that resources are allocated efficiently, allowing organizations to adapt to changing economic conditions and seize new opportunities for growth.

Example 2. Cash Flow Management

Effective financial management is critical for maintaining healthy cash flow within a business. By closely monitoring inflows and outflows of cash, organizations can identify potential shortfalls and take corrective actions before they impact operations. Implementing strategies such as optimizing accounts receivable processes and managing inventory levels helps businesses ensure they have sufficient liquidity to meet their obligations while supporting operational efficiency.

Example 3. Investment Analysis

Financial management plays a vital role in evaluating potential investment opportunities. Through methods such as net present value (NPV) analysis and internal rate of return (IRR) calculations, financial managers can assess the profitability of various projects and investments. This analytical approach enables organizations to prioritize their investment strategies, ensuring that funds are directed towards initiatives that offer the best potential returns while aligning with overall business objectives.

Example 4. Risk Management

Financial management encompasses the identification and mitigation of financial risks that could affect a business’s stability and growth. By employing tools such as diversification, hedging, and insurance, financial managers can protect the organization against adverse events, including market fluctuations and economic downturns. A robust risk management framework helps businesses maintain resilience, ensuring they can navigate uncertainties while capitalizing on opportunities.

Example 5. Performance Measurement and Analysis

To ensure financial health and operational efficiency, organizations rely on financial management to establish key performance indicators (KPIs) and analyze financial statements. By tracking metrics such as return on equity (ROE) and profit margins, financial managers can evaluate the company’s performance relative to industry benchmarks. This ongoing analysis allows for informed decision-making and strategic adjustments that drive long-term success and sustainability.

Practice Questions

Question 1

What is the primary goal of financial management?

A) Maximizing profits

B) Minimizing costs

C) Maximizing shareholder wealth

D) Ensuring liquidity

Correct Answer: C) Maximizing shareholder wealth

Explanation:

The primary goal of financial management is to maximize shareholder wealth. This involves making decisions that lead to an increase in the value of the company’s stock and ultimately benefit the shareholders. While maximizing profits (Option A) is important, it doesn’t consider the timing of those profits or the risk involved. Minimizing costs (Option B) is a useful strategy, but it can lead to reduced quality or long-term viability if taken to an extreme. Ensuring liquidity (Option D) is essential for operational stability but is more of a short-term objective rather than the overarching goal of financial management.

Question 2

Which of the following financial statements provides a snapshot of a company’s financial position at a specific point in time?

A) Income Statement

B) Statement of Cash Flows

C) Balance Sheet

D) Retained Earnings Statement

Correct Answer: C) Balance Sheet

Explanation:

The Balance Sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It summarizes the company’s assets, liabilities, and equity, allowing stakeholders to assess the company’s net worth and financial health. The Income Statement (Option A) covers a period of time and shows revenues and expenses, leading to net income. The Statement of Cash Flows (Option B) reports the cash inflows and outflows over a period, while the Retained Earnings Statement (Option D) summarizes the changes in retained earnings over a specific period, making them less suitable for assessing the financial position at a single point in time.

Question 3

Which of the following is an example of a fixed cost?

A) Direct materials

B) Direct labor

C) Rent for factory space

D) Sales commissions

Correct Answer: C) Rent for factory space

Explanation:

Fixed costs are expenses that do not change with the level of production or sales. Rent for factory space (Option C) is a classic example of a fixed cost because it remains constant regardless of how much product is manufactured. Direct materials (Option A) and direct labor (Option B) are variable costs, as they fluctuate with production levels—more production means higher costs for materials and labor. Sales commissions (Option D) are also variable costs since they are typically based on the volume of sales made, thus changing with sales performance.