Quickly convert electronvolts to US therms and vice versa at Examples.com. Get precise energy conversions instantly by entering your data.

eV to US Therm

Formula: Energy in US Therms = Energy in Electronvolts (eV) x 1.51857e-26

Electronvolt :

US Therm :

| Electronvolts | US Therms |

|---|---|

| 1 | 1.51857e-26 |

US Therm to eV

Formula: Energy in Electronvolts (eV) = Energy in US Therms ÷ 1.51857e-26

US Therm :

Electronvolt :

| US Therms | Electronvolts |

|---|---|

| 1 | 6.585142601263031e+25 |

Energy Converters to Electronvolt

Energy Converters to US Therm

Conversion Factors:

- Electronvolts to US Therms: 1 electronvolt = 1.5189e-27 US therms

- US Therms to Electronvolts: 1 US therm = 6.584e+26 electronvolts

How to Convert Electronvolts to US Therms:

To convert electronvolts to US therms, multiply the number of electronvolts by 1.5189e-27.

US Therms=Electronvolts×1.5189e−27

Example:

Convert 2000 electronvolts to US therms.

US Therms=2000×1.5189e−27=3.0378e−24

Result: 2000 electronvolts = 3.0378e-24 US therms

How to Convert US Therms to Electronvolts:

To convert US therms to electronvolts, divide the number of US therms by 1.5189e-27.

Electronvolts=US Therms/1.5189e−27

Example:

Convert 3 US therms to electronvolts.

Electronvolts=3/1.5189e−27=1.9752e+27

Result: 3 US therms = 1.9752e+27 electronvolts

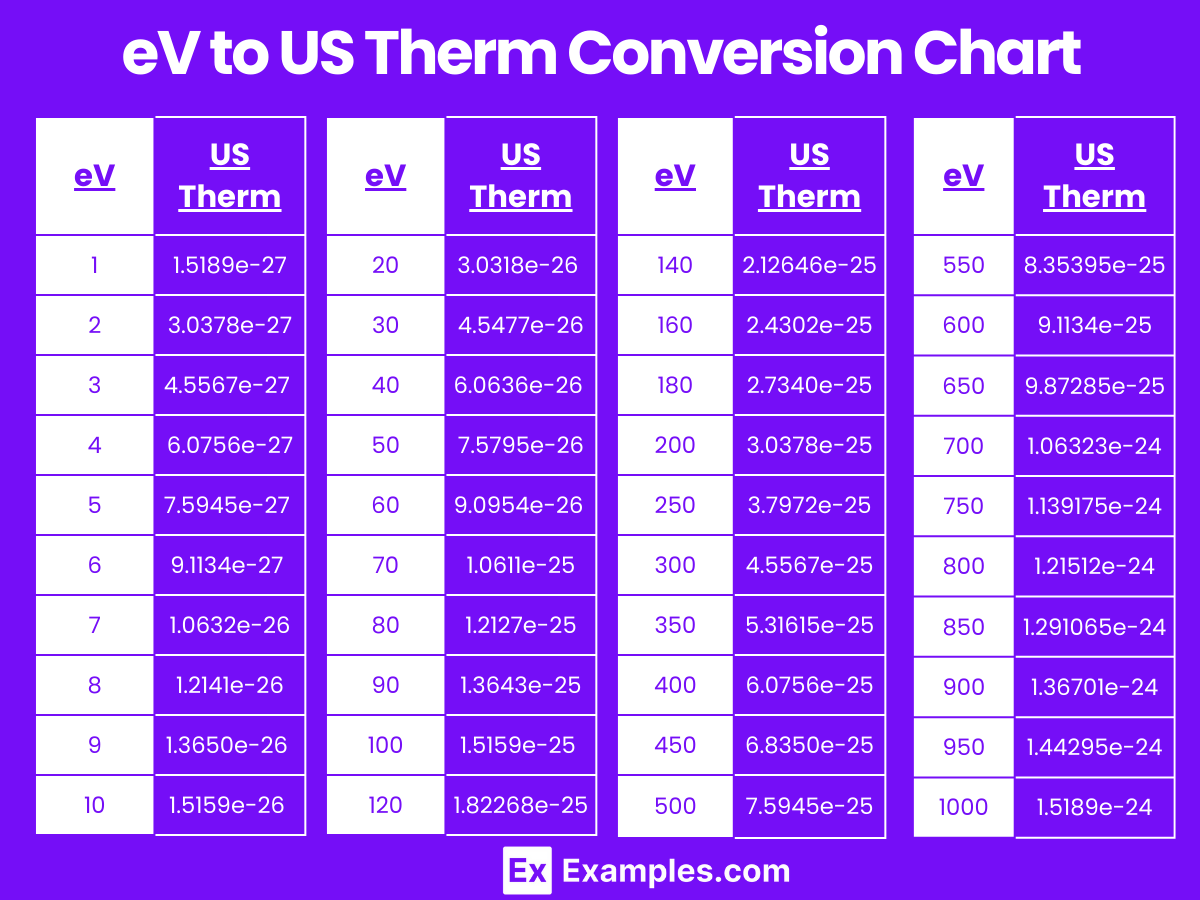

Electronvolt to US Therm Conversion Table

| Electronvolts (eV) | US Therms |

|---|---|

| 1 eV | 1.5189e-27 US Therms |

| 2 eV | 3.0378e-27 US Therms |

| 3 eV | 4.5567e-27 US Therms |

| 4 eV | 6.0756e-27 US Therms |

| 5 eV | 7.5945e-27 US Therms |

| 6 eV | 9.1134e-27 US Therms |

| 7 eV | 1.0632e-26 US Therms |

| 8 eV | 1.2141e-26 US Therms |

| 9 eV | 1.3650e-26 US Therms |

| 10 eV | 1.5159e-26 US Therms |

| 20 eV | 3.0318e-26 US Therms |

| 30 eV | 4.5477e-26 US Therms |

| 40 eV | 6.0636e-26 US Therms |

| 50 eV | 7.5795e-26 US Therms |

| 60 eV | 9.0954e-26 US Therms |

| 70 eV | 1.0611e-25 US Therms |

| 80 eV | 1.2127e-25 US Therms |

| 90 eV | 1.3643e-25 US Therms |

| 100 eV | 1.5159e-25 US Therms |

eV to US Therm Conversion Chart

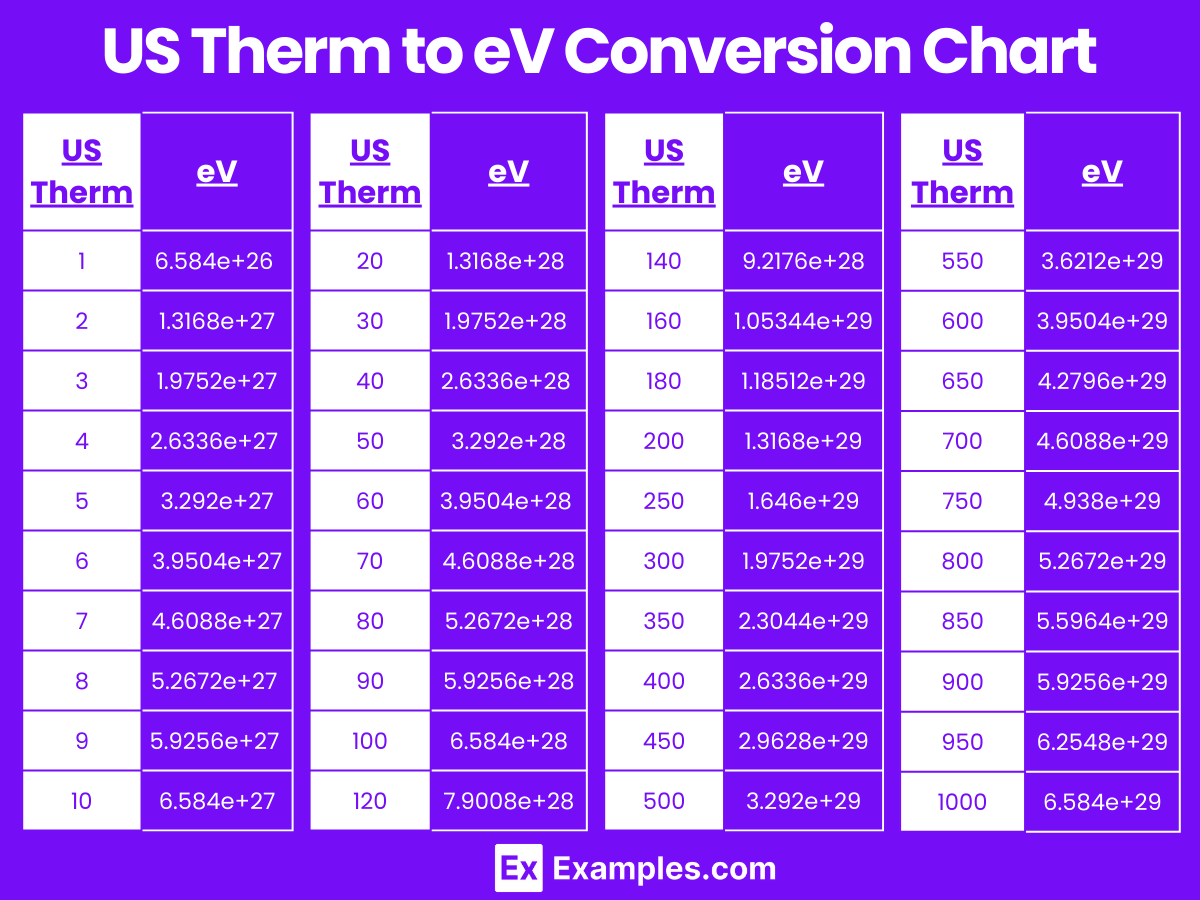

US Therm to Electronvolt Conversion Table

| US Therms | Electronvolts (eV) |

|---|---|

| 1 US Therm | 6.584e+26 eV |

| 2 US Therms | 1.3168e+27 eV |

| 3 US Therms | 1.9752e+27 eV |

| 4 US Therms | 2.6336e+27 eV |

| 5 US Therms | 3.292e+27 eV |

| 6 US Therms | 3.9504e+27 eV |

| 7 US Therms | 4.6088e+27 eV |

| 8 US Therms | 5.2672e+27 eV |

| 9 US Therms | 5.9256e+27 eV |

| 10 US Therms | 6.584e+27 eV |

| 20 US Therms | 1.3168e+28 eV |

| 30 US Therms | 1.9752e+28 eV |

| 40 US Therms | 2.6336e+28 eV |

| 50 US Therms | 3.292e+28 eV |

| 60 US Therms | 3.9504e+28 eV |

| 70 US Therms | 4.6088e+28 eV |

| 80 US Therms | 5.2672e+28 eV |

| 90 US Therms | 5.9256e+28 eV |

| 100 US Therms | 6.584e+28 eV |

US Therm to eV Conversion Chart

Difference Between Electronvolt to US Therm

| Aspect | Electronvolts | US Therms |

|---|---|---|

| Definition | A unit of energy equal to the work done by an electron moving through an electric potential difference of one volt. | A unit of heat energy commonly used to measure natural gas consumption. |

| Usage | Primarily used in physics, especially in the field of particle physics and condensed matter physics. | Used in the energy industry, particularly for measuring the energy content of natural gas. |

| Magnitude | Extremely small, suitable for atomic and subatomic scale measurements. | Much larger, suitable for practical energy measurements in everyday use. |

| Conversion Factor | 1 electronvolt = 1.5189e-27 US therms | 1 US therm = 6.584e+26 electronvolts |

| Measurement Context | Commonly used to describe energies of particles, atoms, and molecules. | Commonly used to describe energy consumption in heating and natural gas usage. |

| Scientific Relevance | Vital for calculations in quantum mechanics and other advanced scientific fields. | Important for energy consumption tracking and billing in households and industries. |

| Energy Scale | Atomic and subatomic scale | Macroscopic, practical energy scale |

| Field of Application | Theoretical and experimental physics | Energy and utility sectors |

1. Solved Examples on Converting Electronvolt to US Therm

Example 1:

Convert 1 electronvolt to US therms.

US Therms=1×1.5189e−27=1.5189e−27

Result: 1 electronvolt = 1.5189e-27 US therms

Example 2:

Convert 5 electronvolts to US therms.

US Therms=5×1.5189e−27=7.5945e−27

Result: 5 electronvolts = 7.5945e-27 US therms

Example 3:

Convert 10 electronvolts to US therms.

US Therms=10×1.5189e−27=1.5189e−26

Result: 10 electronvolts = 1.5189e-26 US therms

Example 4:

Convert 20 electronvolts to US therms.

US Therms=20×1.5189e−27=3.0378e−26

Result: 20 electronvolts = 3.0378e-26 US therms

Example 5:

Convert 50 electronvolts to US therms.

US Therms=50×1.5189e−27=7.5945e−26

Result: 50 electronvolts = 7.5945e-26 US therms

2. Solved Examples on Converting US Therm to Electronvolt

Example 1:

Convert 1 US therm to electronvolts.

Electronvolts=1/1.5189e−27=6.584e+26

Result: 1 US therm = 6.584e+26 electronvolts

Example 2:

Convert 5 US therms to electronvolts.

Electronvolts=5/1.5189e−27=3.292e+27

Result: 5 US therms = 3.292e+27 electronvolts

Example 3:

Convert 10 US therms to electronvolts.

Electronvolts=10/1.5189e−27=6.584e+27

Result: 10 US therms = 6.584e+27 electronvolts

Example 4:

Convert 20 US therms to electronvolts.

Electronvolts=20/1.5189e−27=1.3168e+28

Result: 20 US therms = 1.3168e+28 electronvolts

Example 5:

Convert 50 US therms to electronvolts.

Electronvolts=50/1.5189e−27=3.292e+28

Result: 50 US therms = 3.292e+28 electronvolts

What are the typical uses of electronvolts and US therms?

Electronvolts are typically used in physics to describe the energy of particles, atoms, and molecules. They are vital for calculations in quantum mechanics and other advanced scientific fields. US therms are used in the energy industry to measure the energy content of natural gas and track energy consumption for billing purposes.

How accurate is the conversion between electronvolts and US therms?

The conversion is accurate based on the defined conversion factor (1 eV = 1.5189e-27 US therms). However, due to the significant difference in magnitudes between these units, calculations should be done with appropriate precision, especially for very small or very large values.

Are there tools or calculators available for these conversions?

Yes, there are many online tools and calculators that can help you convert between electronvolts and US therms. These tools can simplify the process and ensure accuracy.

Why is it important to understand the conversion between electronvolts and US therms?

Understanding this conversion is important for scientists and engineers who work with energy at different scales. It helps in comparing and translating energy measurements from atomic and subatomic scales to practical, macroscopic scales.

Can I use this conversion for other types of energy measurements?

The conversion factor provided is specific to converting electronvolts to US therms. For other types of energy measurements, appropriate conversion factors and units should be used. Always ensure you are using the correct conversion factor for the specific units involved in your calculation.