The Independence and Objectivity are fundamental principles essential to the role of internal auditing. You’ll explore the importance of maintaining unbiased perspectives and avoiding conflicts of interest. This topic covers standards for organizational independence, auditor independence, and measures to uphold objectivity in auditing processes. Understanding these principles is crucial for mastering internal audit practices and for ensuring ethical compliance and reliability in audit engagements. Proficiency in these concepts is key to excelling in the Essentials of Internal Auditing section of the exam.CIA

Learning Objectives

In studying “1.2 Independence and Objectivity” for the CIA exam, you should learn to understand the fundamental principles of independence and objectivity in internal auditing. Recognize the importance of auditors being free from conflicts of interest and personal biases to provide unbiased assessments. Understand the criteria that ensure organizational independence, including the reporting structure and the auditor’s role within the organization. Evaluate the impact of independence and objectivity on the credibility and reliability of audit results. Additionally, identify situations that could compromise these principles and develop strategies to maintain high standards of impartiality in various audit engagements. This knowledge is essential for ensuring the integrity and effectiveness of the internal audit function.

Understanding the Principles of Independence and Objectivity in Internal Auditing

Independence and objectivity are foundational principles in internal auditing, ensuring that auditors provide unbiased, reliable insights that stakeholders can trust. These principles safeguard the integrity of the internal audit function, allowing auditors to conduct their work without undue influence from management or other internal and external parties. Here’s an in-depth look at these two principles and how they are upheld within internal auditing:

1. Independence in Internal Auditing

Independence refers to the freedom from conditions that threaten the internal auditor’s ability to carry out duties impartially. For internal auditors, independence is both a structural and psychological concept, protecting their work from influence that could compromise audit findings and recommendations.

a. Organizational Independence

Organizational independence means that the internal audit function is positioned to report objectively without interference. It is generally achieved by placing the internal audit function at a high level within the organization, such as under the direct authority of the audit committee or board of directors.

- Purpose: Ensures that the internal audit function can operate without fear of reprisal or influence from management.

- Implementation: Internal auditors often report directly to the audit committee, which provides oversight and independence from operational management.

Example: The chief audit executive (CAE) reports audit findings directly to the audit committee, rather than to an operational manager, reducing the risk of bias or influence over audit results.

b. Functional Independence

Functional independence refers to the ability of internal auditors to decide on the scope, methods, and timing of audit engagements without external interference.

- Purpose: Allows auditors to make independent judgments about the focus and depth of each audit, based on risk and organizational priorities.

- Implementation: The audit committee approves the internal audit plan, ensuring that the auditors have control over the scope and resources required to complete audits effectively.

Example: An internal audit team sets its audit plan and approach without direction from operational management, allowing them to focus on high-risk areas aligned with organizational priorities.

2. Objectivity in Internal Auditing

Objectivity in internal auditing is the unbiased mental attitude that enables auditors to perform engagements in an honest, fair, and balanced manner. While independence is about freedom from influence, objectivity is about the auditor’s mindset and approach to conducting each audit.

a. Avoiding Conflicts of Interest

Objectivity requires that internal auditors avoid situations where personal or financial interests could influence https://images.examples.com/wp-content/uploads/2024/11/Importance-of-Avoiding-Conflicts-of-Interest-and-Personal-Bias.pngaudit outcomes. Even the appearance of a conflict of interest can compromise an auditor’s objectivity.

- Purpose: Ensures that auditors make impartial decisions based solely on facts and evidence, without any bias or favoritism.

- Implementation: Internal auditors should disclose any potential conflicts of interest and recuse themselves from engagements where objectivity may be compromised.

Example: An auditor who previously worked in the procurement department is assigned to audit procurement processes. To maintain objectivity, the auditor discloses the potential conflict, and the assignment is reassigned to another team member.

b. Objective Assessment of Evidence

Objectivity requires that internal auditors base their findings and conclusions strictly on verifiable evidence, rather than assumptions or influence from management.

- Purpose: To ensure that audit results are reliable, unbiased, and free from subjective opinions.

- Implementation: Internal auditors use standardized procedures for gathering, analyzing, and validating evidence, ensuring that conclusions are based on objective facts.

Example: In a financial audit, the internal auditor verifies all supporting documents for expense claims before drawing conclusions, relying on documentation rather than relying on management’s verbal explanations alone.

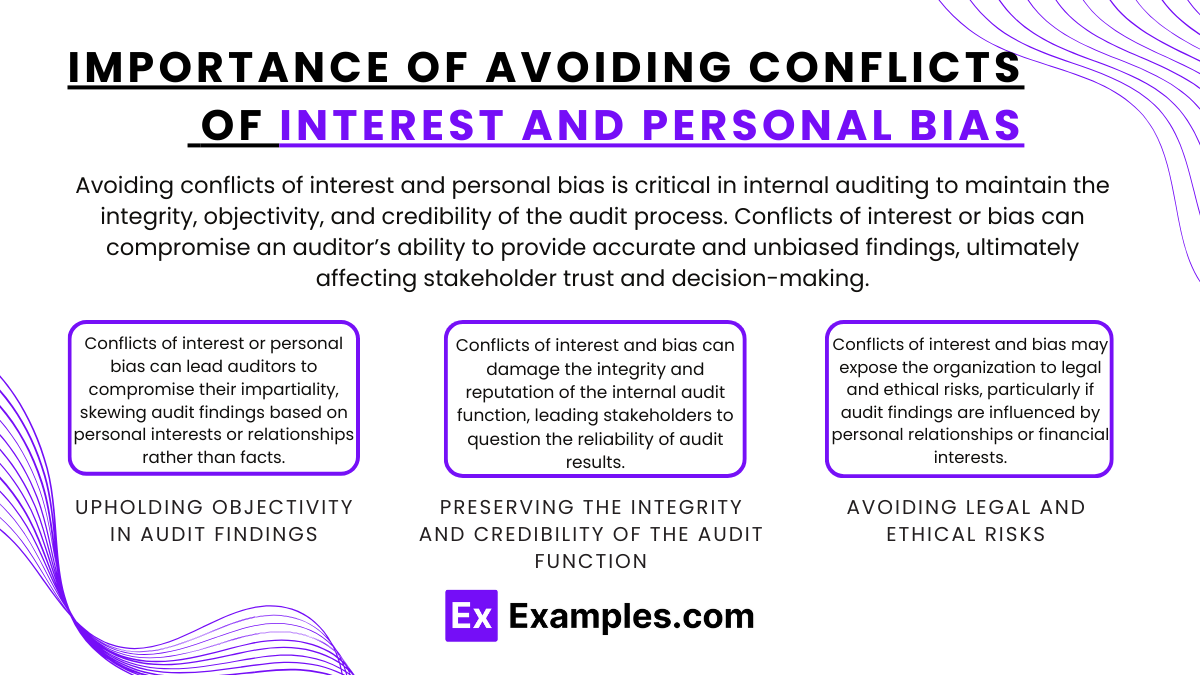

Importance of Avoiding Conflicts of Interest and Personal Bias

Avoiding conflicts of interest and personal bias is critical in internal auditing to maintain the integrity, objectivity, and credibility of the audit process. Conflicts of interest or bias can compromise an auditor’s ability to provide accurate and unbiased findings, ultimately affecting stakeholder trust and decision-making. Here’s an overview of why it is essential to avoid conflicts of interest and personal bias in internal auditing and how these practices benefit both the auditor and the organization.

1. Upholding Objectivity in Audit Findings

Conflicts of interest or personal bias can lead auditors to compromise their impartiality, skewing audit findings based on personal interests or relationships rather than facts.

- Importance: Objectivity is essential in internal auditing to provide reliable, unbiased insights that stakeholders can trust. Auditors who maintain objectivity are more effective in identifying issues accurately and offering useful recommendations.

- Outcome: Objective audit findings ensure that management and the board receive accurate information to make well-informed decisions.

Example: An internal auditor who avoids auditing areas where they have personal connections ensures that their findings remain fair and unbiased, promoting trust in the audit process.

2. Preserving the Integrity and Credibility of the Audit Function

Conflicts of interest and bias can damage the integrity and reputation of the internal audit function, leading stakeholders to question the reliability of audit results.

- Importance: Internal auditors play a crucial role in providing assurance and identifying risks; compromised integrity undermines the audit’s purpose and can affect the organization’s trust in the audit function.

- Outcome: By avoiding conflicts of interest and personal bias, auditors maintain the integrity and credibility of their work, reinforcing their role as objective advisors.

Example: If an auditor refrains from auditing departments where they have personal interests, stakeholders are more likely to view the audit findings as credible and act on the recommendations.

3. Avoiding Legal and Ethical Risks

Conflicts of interest and bias may expose the organization to legal and ethical risks, particularly if audit findings are influenced by personal relationships or financial interests.

- Importance: Ethical conduct is fundamental to internal auditing. Avoiding conflicts of interest ensures that the audit team adheres to professional ethics, reducing the risk of regulatory scrutiny and potential legal consequences.

- Outcome: When auditors prioritize ethical standards, they protect the organization from reputational and legal damage, contributing to a culture of accountability.

Example: An auditor discloses a potential conflict of interest related to a personal investment in a company vendor, ensuring transparency and preventing any legal complications from biased auditing.

Ensuring Organizational Independence: Reporting Structure and Auditor’s Role

Organizational independence is essential for internal auditors to conduct their work without undue influence or bias, enabling them to provide objective, reliable assessments that stakeholders can trust. A clear reporting structure and defined roles support this independence, ensuring that internal auditors can evaluate risks, controls, and governance processes effectively. Here’s how reporting structure and auditor roles contribute to organizational independence and strengthen the internal audit function.

1. Establishing a Strong Reporting Structure

A reporting structure that supports organizational independence involves positioning the internal audit function at a level that protects it from interference by management. This setup typically includes direct reporting to the board of directors or audit committee.

a. Direct Access to the Audit Committee or Board of Directors

Direct access to the audit committee or board of directors allows internal auditors to report findings independently, without management’s influence.

- Importance: Ensures that audit results are communicated openly, free from any potential bias from management.

- Implementation: The chief audit executive (CAE) reports audit plans, results, and recommendations directly to the audit committee, bypassing operational management.

Example: The CAE presents findings on compliance issues directly to the audit committee, even if those findings involve senior management, ensuring transparency and independence.

b. Dual Reporting Structure

In many organizations, internal auditors have a dual reporting structure, where they report functionally to the audit committee and administratively to the CEO or another senior executive.

- Importance: Functional reporting to the audit committee reinforces independence, while administrative reporting provides necessary resources and support.

- Implementation: The audit committee oversees the internal audit plan, budget, and performance, while administrative reporting to the CEO ensures alignment with organizational objectives.

Example: The CAE reports functionally to the audit committee for audit results and resources, while also reporting administratively to the CEO for operational support, maintaining both independence and organizational alignment.

2. Role of the Chief Audit Executive (CAE)

The CAE plays a critical role in establishing and maintaining organizational independence. As the leader of the internal audit function, the CAE is responsible for ensuring that the audit team operates without bias and provides objective insights.

a. Developing an Independent Audit Plan

The CAE creates an audit plan based on a risk assessment, prioritizing areas that align with organizational objectives and potential risks rather than management’s preferences.

- Importance: An independent audit plan enables auditors to focus on high-risk areas without interference from management.

- Implementation: The audit committee reviews and approves the audit plan, ensuring that it aligns with strategic priorities and organizational risks.

Example: The CAE includes cybersecurity and data protection as priority areas in the audit plan based on risk assessments, without influence from other departments.

b. Communicating Audit Findings Directly to the Board or Audit Committee

The CAE is responsible for presenting audit results directly to the audit committee, providing an unbiased view of the organization’s control environment and risk profile.

- Importance: Direct communication with the audit committee ensures that findings are transparently reported, supporting independent oversight.

- Implementation: The CAE regularly meets with the audit committee to discuss audit findings, recommendations, and progress on previous audit issues.

Example: The CAE reports audit findings related to financial reporting risks to the audit committee, ensuring that board members are aware of any significant control issues.

Impact of Independence and Objectivity on Audit Credibility and Reliability

Independence and objectivity are critical to the credibility and reliability of the internal audit function. These principles ensure that internal auditors can provide unbiased, accurate, and trustworthy assessments of an organization’s operations, controls, and risk management practices. When auditors maintain independence and objectivity, their findings and recommendations hold more weight, fostering stakeholder confidence and supporting sound decision-making. Here’s a closer look at how independence and objectivity affect audit credibility and reliability.

1. Enhancing Stakeholder Trust and Confidence

Stakeholders, including management, the board, and investors, rely on internal audits for insights into risk, compliance, and efficiency. Independence and objectivity increase the credibility of audit reports, making stakeholders more likely to trust and act on the findings.

- Impact: Audits that are free from influence or bias are viewed as more credible, fostering confidence in the audit function’s ability to provide accurate assessments.

- Outcome: Increased stakeholder trust leads to greater receptivity to audit recommendations, enhancing organizational accountability and continuous improvement.

Example: When an internal audit team provides objective findings on cybersecurity risks, the board and management are more likely to trust and prioritize these recommendations, ensuring that necessary improvements are made.

2. Ensuring Reliable and Unbiased Findings

Independence and objectivity prevent auditors from being swayed by internal pressures, allowing them to report findings based solely on evidence and facts. This impartiality ensures that the audit results reflect the true state of the organization’s controls and risk posture.

- Impact: Unbiased findings improve the reliability of audit conclusions, providing stakeholders with a clear and accurate view of organizational risks and opportunities.

- Outcome: Reliable findings help the organization make informed decisions and allocate resources more effectively, especially in high-risk areas.

Example: An internal auditor reports financial control weaknesses despite management pressure to downplay issues, ensuring that the findings accurately reflect potential financial risks.

3. Supporting Effective Risk Management and Control Improvement

When internal auditors maintain independence and objectivity, their recommendations are based on an unbiased assessment of risks and controls. This approach allows auditors to identify real vulnerabilities and suggest meaningful improvements, supporting more effective risk management.

- Impact: Independent and objective auditors are better positioned to evaluate risk management practices critically and recommend necessary changes.

- Outcome: Effective risk management helps the organization minimize exposure to operational, financial, and compliance risks, promoting long-term stability and resilience.

Example: An objective assessment of supply chain risks identifies control weaknesses that, if addressed, can reduce exposure to potential disruptions, supporting continuity and organizational resilience.

Examples

Example 1: Scientific Research Funding

In scientific research, independence is crucial when receiving funding from external sources, such as government agencies or private corporations. For instance, a researcher studying the effects of a new drug should disclose any financial support received from the pharmaceutical company that produces the drug. This transparency helps ensure objectivity by allowing peers and the public to evaluate potential biases that may influence the research outcomes.

Example 2: Journalistic Reporting

In journalism, maintaining independence and objectivity is vital for credible reporting. A journalist covering a political event should strive to present facts and viewpoints from all sides without personal bias or favoritism. For example, when reporting on a political debate, the journalist should include perspectives from both candidates equally, allowing the audience to form their own opinions based on balanced information.

Example 3: Peer Review Process

The peer review process in academic publishing is designed to uphold independence and objectivity. When a manuscript is submitted for publication, independent experts in the field evaluate the research for quality, validity, and adherence to ethical standards. This process helps eliminate personal biases and ensures that the published work meets the scientific community’s rigorous standards, fostering trust in the findings.

Example 4: Ethical Guidelines in Research

Many research institutions implement ethical guidelines to promote independence and objectivity. For instance, guidelines may require researchers to avoid conflicts of interest by disclosing any personal relationships or financial interests that could influence their work. By adhering to these guidelines, researchers can maintain the integrity of their studies and ensure that their findings are viewed as credible and unbiased.

Example 5: Data Transparency in Studies

Independence and objectivity are enhanced by the practice of data transparency, where researchers share their raw data and methodologies with the public. For example, a study investigating climate change impacts may publish its datasets and analysis methods, allowing other scientists to verify the results and conclusions independently. This openness fosters trust and accountability in the research process, ensuring that findings can be scrutinized without personal or institutional biases affecting interpretation.

Practice Questions

Question 1

What is the primary purpose of maintaining independence in research and reporting?

A) To ensure financial profitability

B) To avoid conflicts of interest

C) To increase the number of publications

D) To enhance personal reputation

Correct Answer: B) To avoid conflicts of interest.

Explanation: Maintaining independence in research and reporting is essential to avoid conflicts of interest that could bias the findings or conclusions. Independence allows researchers and journalists to present their work objectively and honestly, ensuring that the results are credible and reliable. This principle is crucial for maintaining trust with the audience, stakeholders, and the broader scientific community.

Question 2

Which of the following best describes objectivity in the context of research and reporting?

A) Making decisions based on personal beliefs

B) Presenting information without bias or personal influence

C) Focusing solely on quantitative data

D) Ensuring that all findings are favorable to the research sponsor

Correct Answer: B) Presenting information without bias or personal influence.

Explanation: Objectivity refers to the practice of presenting information and findings in a manner that is free from bias or personal influence. It involves relying on empirical evidence and data while ensuring that interpretations and conclusions are based on facts rather than subjective opinions. This quality is vital for producing credible research and informative reporting, distinguishing it from approaches influenced by personal beliefs or external pressures.

Question 3

How can researchers ensure objectivity in their studies?

A) By only selecting data that supports their hypothesis

B) By using peer review and external audits

C) By conducting research in isolation without collaboration

D) By avoiding the publication of contradictory findings

Correct Answer: B) By using peer review and external audits.

Explanation: Researchers can ensure objectivity by subjecting their work to peer review and external audits, which involve independent experts evaluating the research methodology, data, and conclusions. This process helps identify any biases, flaws, or conflicts of interest that may affect the integrity of the study. In contrast, options A, C, and D represent practices that undermine objectivity and the credibility of the research.