Preparing for the CIA Exam requires a thorough understanding of “Managing the Internal Audit Activity,” a key aspect of the audit management process. Mastery of planning, directing, and monitoring internal audit operations is essential. This knowledge ensures the audit function aligns with organizational goals and adheres to professional standards, crucial for achieving a high score on the CIA Exam.

Learning Objective

In studying “Managing the Internal Audit Activity” for the CIA Exam, you should aim to understand the essential processes involved in overseeing an effective internal audit function. Analyze the key elements of strategic planning, resource management, and policy development within an audit department. Evaluate the principles behind staff training, risk assessment, and audit program development. Additionally, explore how these managerial responsibilities support compliance with international standards and contribute to organizational governance. Apply your understanding to develop strategic approaches for managing audits and prepare to address related scenarios on the CIA Exam.

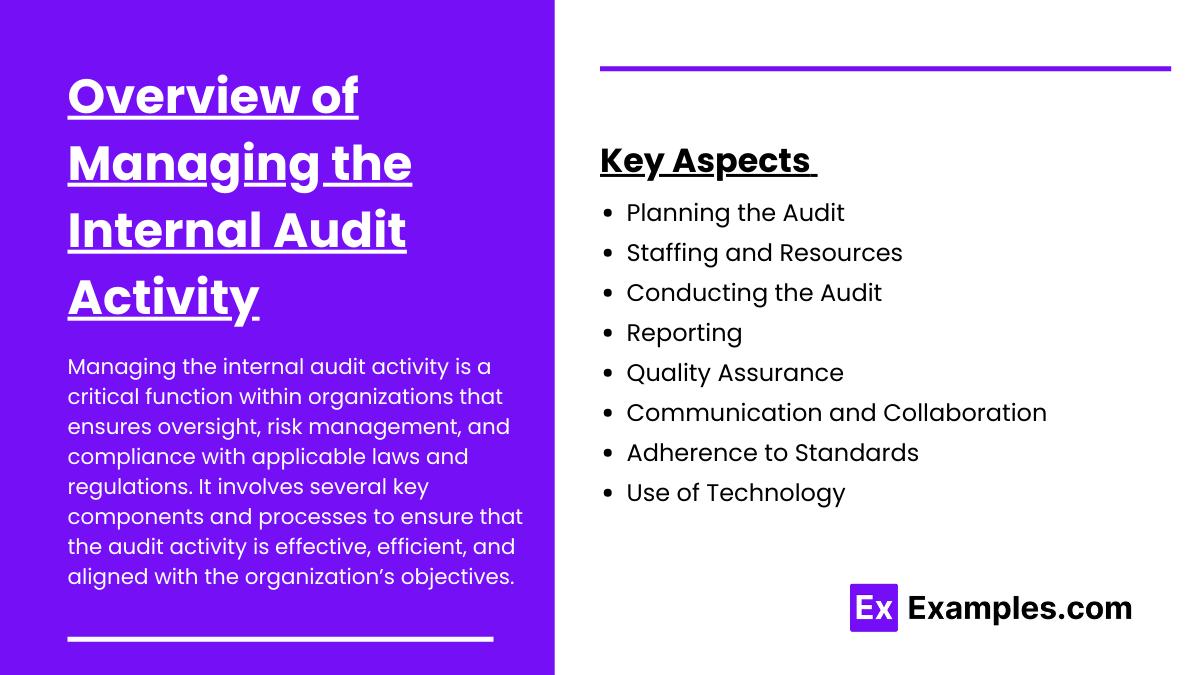

Overview of Managing the Internal Audit Activity

Managing the internal audit activity is a critical function within organizations that ensures oversight, risk management, and compliance with applicable laws and regulations. It involves several key components and processes to ensure that the audit activity is effective, efficient, and aligned with the organization’s objectives. Here’s an overview of the essential aspects involved in managing the internal audit activity:

1. Planning the Audit

- Risk-based Planning: Focuses on high-risk areas to effectively allocate audit resources.

- Annual Audit Schedule: Ensures all critical areas are audited regularly.

2. Staffing and Resources

- Qualified Personnel: Staff should be adequately qualified, such as CIAs or CPAs.

- Continuous Training: Keeps audit staff updated on the latest standards and practices.

3. Conducting the Audit

- Audit Execution: Follows a scheduled plan using standards like those from the IIA.

- Data Analysis: Involves gathering and analyzing data to assess controls and processes.

4. Reporting

- Audit Reports: Delivers detailed findings and recommendations.

- Follow-up: Ensures management addresses and rectifies audit findings.

5. Quality Assurance

- Internal and External Assessments: Regular reviews of the audit process to maintain effectiveness and compliance.

6. Communication and Collaboration

- Stakeholder Engagement: Ensures audit goals align with organizational objectives.

- Collaboration: Works with other governance functions to unify governance efforts.

7. Adherence to Standards

- Compliance: Follows international standards for internal auditing.

8. Use of Technology

- Technological Tools: Employs advanced software for improved efficiency and accuracy.

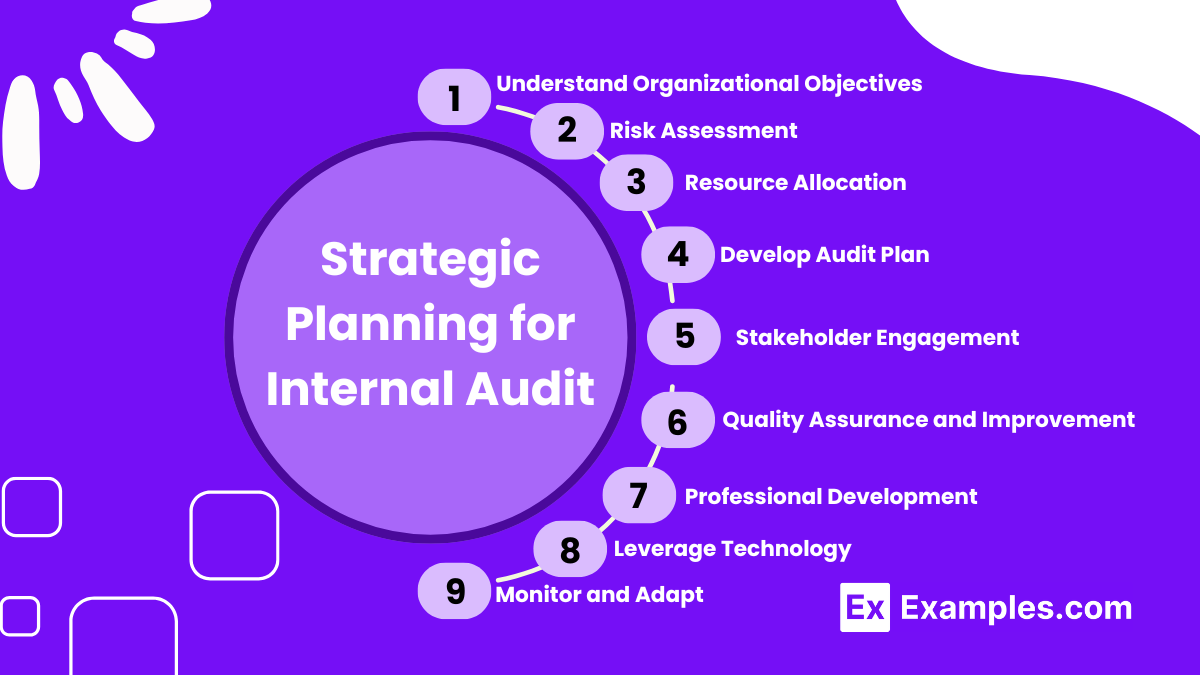

Strategic Planning for Internal Audit

Strategic planning for internal audit is crucial for aligning the audit function with the broader goals of an organization and ensuring it effectively addresses risks and adds value. Here’s how strategic planning can be effectively structured for an internal audit function:

1. Understand Organizational Objectives

- Alignment: The first step is to ensure that the internal audit strategy aligns with the organization’s strategic goals and objectives. Understanding these allows internal auditors to focus their efforts on areas that are critical to the organization’s success.

2. Risk Assessment

- Comprehensive Risk Analysis: Perform a thorough risk assessment to identify and prioritize risks based on their impact and likelihood. This risk assessment should be dynamic, updated regularly to reflect changes in the organization’s environment and risk landscape.

3. Resource Allocation

- Optimize Resources: Allocate resources effectively based on the risk assessment. This includes determining the necessary skills, tools, and number of auditors required to address the identified risks.

4. Develop Audit Plan

- Multi-Year Audit Plan: Develop a strategic audit plan that spans multiple years, providing a long-term view of the planned audit activities. This plan should be flexible to adapt to sudden changes in the organization’s priorities or risk profile.

- Annual Audit Plans: Break down the multi-year plan into detailed annual plans that outline specific audits to be conducted over the year.

5. Stakeholder Engagement

- Regular Communication: Maintain ongoing communication with stakeholders, including management and the board, to ensure the audit’s alignment with organizational needs and to manage expectations.

- Reporting and Feedback: Establish mechanisms for reporting audit findings and obtaining feedback, which can guide future audits and strategic adjustments.

6. Quality Assurance and Improvement

- Continuous Improvement: Implement a quality assurance program that regularly evaluates the performance of the internal audit function and identifies opportunities for improvement.

- Adherence to Standards: Ensure that all audit activities comply with international standards for the professional practice of internal auditing.

7. Professional Development

- Training and Development: Invest in continuous professional development for audit staff to ensure they possess the latest skills and knowledge to effectively conduct audits.

8. Leverage Technology

- Innovative Tools: Utilize advanced auditing technologies and tools for data analysis, which can enhance the efficiency and effectiveness of audit processes.

9. Monitor and Adapt

- Review and Adaptation: Regularly review the strategic audit plan to ensure it remains relevant with the evolving business landscape. Adapt the plan based on organizational changes, emerging risks, and audit outcomes.

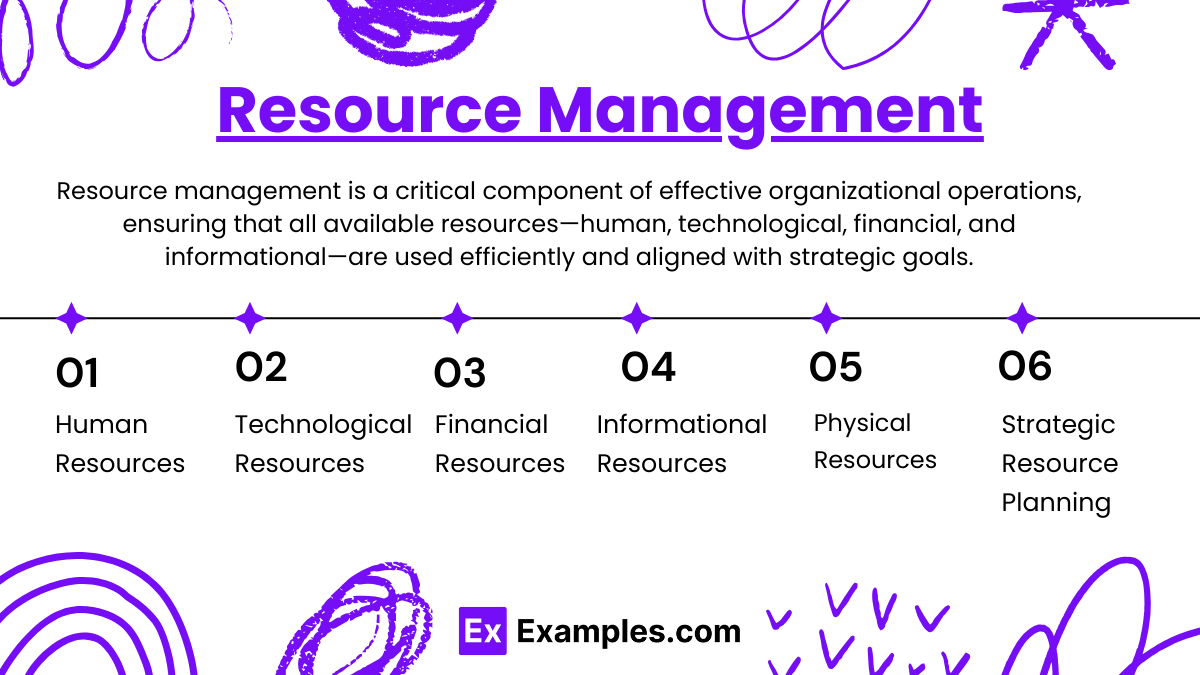

Resource Management

Resource management is a critical component of effective organizational operations, ensuring that all available resources—human, technological, financial, and informational—are used efficiently and aligned with strategic goals. Here’s a detailed overview of how resource management can be optimized in a professional setting:

1. Human Resources

- Staffing and Allocation: Recruit and assign staff based on project demands.

- Training and Development: Continuously enhance employee skills.

- Performance Management: Evaluate and improve employee productivity.

2. Technological Resources

- Technology Acquisition: Procure supportive technology.

- Maintenance and Upgrades: Keep technology updated and functional.

- Integration and Optimization: Maximize technology ROI through full integration.

3. Financial Resources

- Budgeting: Allocate finances effectively.

- Cost Control: Monitor and manage expenditures.

- Financial Planning: Support strategic goals with long-term financial strategies.

4. Informational Resources

- Data Management: Efficiently collect and analyze data.

- Information Security: Protect sensitive information.

- Knowledge Sharing: Encourage information sharing for enhanced performance.

5. Physical Resources

- Asset Management: Maintain and utilize physical assets.

- Workspace Optimization: Design productive work environments.

- Resource Allocation: Strategically allocate physical resources.

6. Strategic Resource Planning

- Forecasting: Anticipate future resource needs.

- Resource Allocation Strategy: Develop strategies that prioritize key business areas.

- Sustainability Considerations: Plan for resource use that supports long-term sustainability.

Policy and Procedure Development

Policy and procedure development is a critical aspect of organizational governance that ensures operations are consistent, compliant, and effective. These documents guide staff and align organizational activities with broader goals and regulatory requirements. Here’s a concise guide on developing effective policies and procedures:

Understanding the Need

- Identify Requirements: Assess the need for new or updated policies based on changes in laws, operations, or technology.

- Stakeholder Input: Gather insights from various organizational levels to understand necessary adjustments or additions.

Drafting Policies and Procedures

- Clear Language: Write in simple, straightforward language to ensure clarity.

- Specific Details: Clearly outline steps, roles, and responsibilities within procedures; policies should define organizational rules and positions.

- Format Consistency: Maintain a uniform format across all documents for ease of understanding and reference.

Review and Approval

- Internal Review: Review drafts with key stakeholders to ensure accuracy and relevance.

- Legal Compliance: Verify compliance with applicable legal and regulatory frameworks.

- Approval Process: Formalize approval through senior management or board of directors.

Implementation

- Communication: Effectively communicate the policies and procedures to all employees.

- Training: Provide necessary training to aid understanding and implementation.

- Accessibility: Ensure documents are easily accessible, typically via an intranet or digital system.

Monitoring and Evaluation

- Feedback Mechanism: Implement a system for collecting feedback on the practicality and impact of the documents.

- Regular Reviews: Continually review and update to align with changes within and outside the organization.

- Continuous Improvement: Adapt and refine policies and procedures based on feedback and external changes.

Documentation Control

- Version Control: Manage document versions to ensure staff use only the most current versions.

- Document Archiving: Keep archived versions for historical reference and legal compliance.

Examples

Example 1: Financial Sector – Compliance Audits

- Major banks and financial institutions often manage their internal audit activities to ensure strict compliance with financial regulations and standards, such as those imposed by the Federal Reserve or international financial authorities. This involves routine audits to monitor and verify adherence to anti-money laundering laws, KYC (Know Your Customer) standards, and other regulatory requirements.

Example 2: Healthcare – Patient Privacy and Safety Audits

- Hospitals and healthcare providers manage internal audit activities to ensure compliance with patient privacy laws like HIPAA (Health Insurance Portability and Accountability Act) in the U.S., as well as safety standards mandated by healthcare oversight bodies. These audits help protect patient information and ensure that patient care protocols are followed to maintain high standards of safety and quality in healthcare delivery.

Example 3: Technology Companies – Information Security Audits

- Tech companies, particularly those that handle large volumes of user data, manage internal audit activities focused on information security. These audits assess the effectiveness of cybersecurity measures, data protection policies, and compliance with regulations like GDPR (General Data Protection Regulation) in the EU, helping to safeguard sensitive information against data breaches and cyber threats.

Example 4: Manufacturing – Supply Chain and Quality Control Audits

- Manufacturing entities use internal audits to manage and oversee their supply chains and quality control processes. These audits ensure that all components and final products meet the required standards and specifications, which helps in reducing waste, improving product quality, and ensuring ethical sourcing practices.

Example 5: Public Sector – Resource Utilization and Performance Audits

- Governmental and other public sector organizations manage their internal audit activities to evaluate how effectively and efficiently resources are utilized. These audits often focus on performance measurement against public service delivery goals and objectives, ensuring taxpayer money is used appropriately and identifying opportunities for improvements in service delivery.

Practice Questions

Question 1

What is the primary purpose of an audit charter in the context of managing the internal audit activity?

A. To define the strategic goals of the organization

B. To outline the internal audit function’s purpose, authority, and responsibility

C. To specify the financial budget of the internal audit department

D. To list the qualifications required for internal auditors

Answer: B. To outline the internal audit function’s purpose, authority, and responsibility

Explanation:

An audit charter is a formal document that clearly defines the internal audit function’s purpose, authority, and responsibilities. It serves as a foundational framework that guides the audit function and clarifies its scope within the organization, ensuring that all stakeholders understand its role. This document does not typically detail the strategic goals of the entire organization (A), the specific financial budget (C), or the qualifications of auditors (D).

Question 2

Which of the following is a key element in the strategic planning process of managing the internal audit activity?

A. Determining the marketing strategy

B. Developing a risk-based audit plan

C. Organizing corporate social events

D. Setting IT security protocols

Answer: B. Developing a risk-based audit plan

Explanation:

A risk-based audit plan is a critical element in the strategic planning process for managing the internal audit activity. This involves assessing the various risks the organization faces and planning audit activities to address those risks effectively. This approach ensures that audit resources are prioritized and allocated based on the areas of greatest risk and impact. The other options, such as determining marketing strategies (A), organizing social events (C), and setting IT security protocols (D), are not directly related to the strategic planning of internal audit activities.

Question 3

What role does continuous improvement play in managing the internal audit activity?

A. It ensures compliance with international trade laws

B. It maintains the cafeteria menu updates

C. It enhances the efficiency and effectiveness of audit processes

D. It focuses solely on increasing the salary of auditors

Answer: C. It enhances the efficiency and effectiveness of audit processes

Explanation:

Continuous improvement in managing the internal audit activity involves regularly reviewing and enhancing the audit processes and practices to increase their efficiency and effectiveness. This approach helps in adapting to new challenges, technologies, and methodologies, ensuring that the audit function remains relevant and adds value to the organization. It is not concerned with compliance with international trade laws (A), cafeteria menus (B), or auditors’ salaries (D).