Preparing for the CIA Exam requires a thorough understanding of "Planning the Engagement," a fundamental aspect of the auditing process. Mastery of audit objectives, scope, and resource allocation is essential. This knowledge ensures effective audit planning, critical for enhancing the efficiency and effectiveness of the audit engagement, crucial for achieving a high score on the CIA Exam.

Learning Objective

In studying "Planning the Engagement" for the CIA Exam, you should aim to understand the essential components and methodologies used in audit engagement planning. Analyze the steps involved in defining audit objectives, scope, and timing. Evaluate the principles behind resource allocation and the determination of audit methods. Additionally, explore how effective engagement planning influences the success of audit outcomes and the efficiency of audit processes. Apply your understanding to assess risk assessments, develop audit programs, and prepare to address related scenarios on the CIA Exam, ensuring a thorough grasp of strategic audit planning.

Introduction to Audit Engagement Planning

Audit engagement planning is a critical phase in the audit process, setting the stage for how an audit will be conducted, ensuring efficiency, and maximizing the effectiveness of the audit's outcomes. Effective planning helps auditors identify key areas of risk, allocate resources appropriately, and set clear objectives for the audit. Here’s an introduction to the essential elements of audit engagement planning:

Purpose: Establishes a clear roadmap for the audit, focusing efforts on areas of high importance and potential risk.

Key Components:

Understanding the Entity and Environment: Gain in-depth knowledge of the organization’s operations, industry context, and regulatory requirements.

Review of Past Audits: Analyze prior audits to identify recurring issues and new focus areas.

Objectives and Scope:

Define Audit Objectives: Determine what the audit aims to achieve (e.g., assess financial accuracy, compliance, or internal controls).

Set Audit Scope: Establish the boundaries, including specific areas, functions, and time periods to be covered.

Risk Assessment:

Identify Risks: Recognize risks specific to the organization that could affect its financial statements or operational objectives.

Evaluate Risk Levels: Assess the likelihood and impact of these risks to prioritize audit focus.

Audit Plan Development:

Methodology Selection: Decide on audit methodologies and tools based on the audit’s objectives.

Documentation: Prepare an audit plan that details the procedures, resources, and approach to managing identified risks.

Quality Assurance:

Standards Compliance: Ensure the audit plan aligns with auditing standards and ethical guidelines.

Plan Review and Adjustment: Regularly review the audit plan and make necessary adjustments based on ongoing findings.

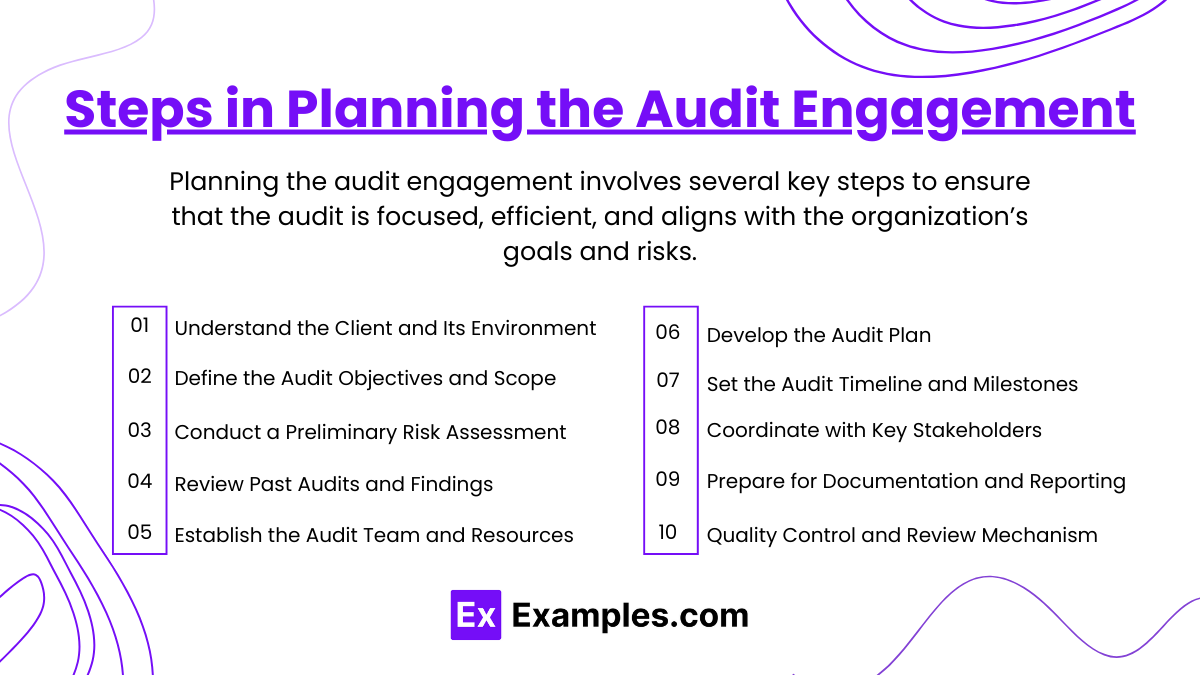

Steps in Planning the Audit Engagement

Planning the audit engagement involves several key steps to ensure that the audit is focused, efficient, and aligns with the organization’s goals and risks. Here are the essential steps:

Understand the Client and Its Environment

Gain an understanding of the client’s industry, business operations, and regulatory environment.

Review organizational structure, key processes, and any recent changes affecting the business.

Define the Audit Objectives and Scope

Set clear objectives based on what the audit intends to achieve, such as assessing financial accuracy, compliance, or internal control effectiveness.

Define the audit scope, including the specific areas, departments, or processes to be covered and the time period of review.

Conduct a Preliminary Risk Assessment

Identify risks specific to the organization that may affect financial statements or business operations.

Assess the likelihood and potential impact of these risks to focus the audit on high-priority areas.

Review Past Audits and Findings

Analyze previous audit reports to identify any recurring issues, prior audit recommendations, and improvements made.

Use this information to determine areas that may need additional attention in the current audit.

Establish the Audit Team and Resources

Select auditors with the right skills and expertise for the engagement, considering the complexity of the audit areas.

Allocate necessary resources, including technological tools and support, to ensure efficient execution.

Develop the Audit Plan

Outline a detailed audit plan that includes audit procedures, methods for data collection and analysis, and timelines.

Ensure the plan addresses identified risks and is flexible enough to adjust if new risks emerge.

Set the Audit Timeline and Milestones

Create a timeline for the audit with key milestones and deadlines for each phase, including data gathering, testing, and reporting.

Allow time for management review and ensure sufficient time for addressing potential issues.

Coordinate with Key Stakeholders

Communicate with key stakeholders, including management and relevant departments, to clarify expectations and understand their concerns.

Confirm access to necessary information and schedule any required meetings or interviews.

Prepare for Documentation and Reporting

Set up documentation standards to record findings, evidence, and audit steps for transparency and compliance with standards.

Plan for the final audit report structure, outlining how findings, conclusions, and recommendations will be presented.

Quality Control and Review Mechanism

Establish a process for ongoing review of the audit engagement to ensure compliance with auditing standards.

Include a plan for quality assurance reviews throughout the audit to maintain audit integrity and accuracy.

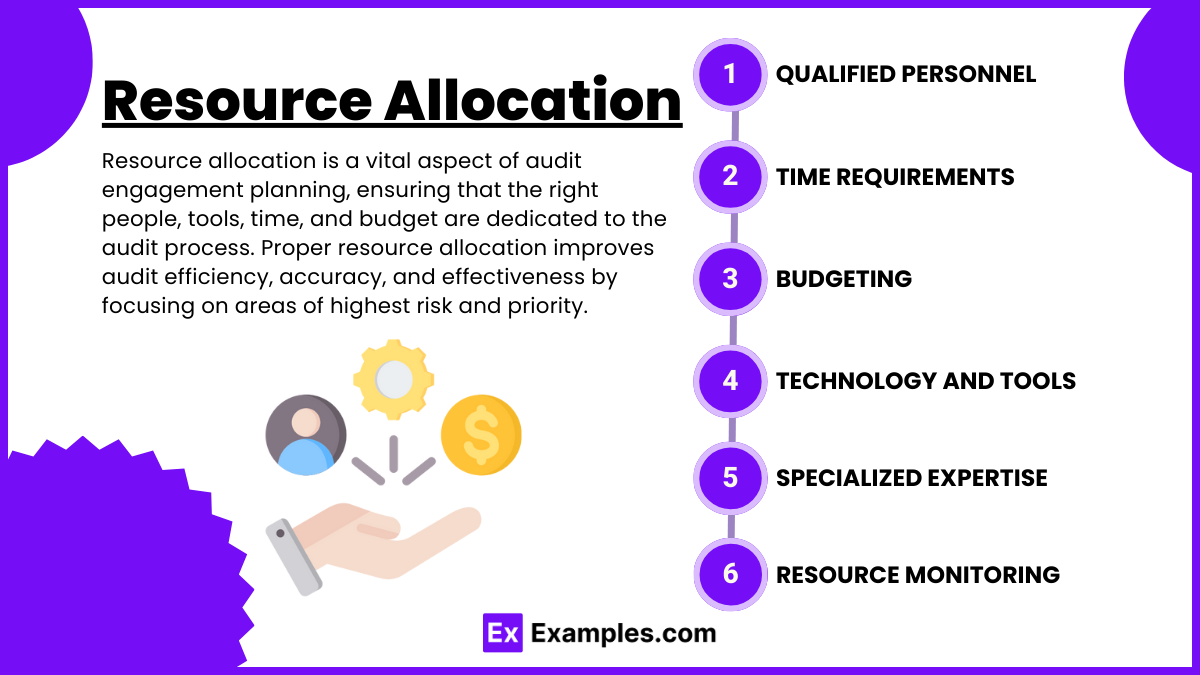

Resource Allocation

Resource allocation is a vital aspect of audit engagement planning, ensuring that the right people, tools, time, and budget are dedicated to the audit process. Proper resource allocation improves audit efficiency, accuracy, and effectiveness by focusing on areas of highest risk and priority. Here’s a breakdown of the essential components of resource allocation in an audit:

Qualified Personnel

Skill Matching: Select auditors with expertise suited to specific audit areas.

Team Composition: Form a balanced team with leads, specialists, and general auditors as needed.

Time Requirements

Realistic Timeline: Set a practical timeline for all audit stages.

Flexible Scheduling: Allow time for adjustments if new risks or issues arise.

Budgeting

Cost Estimation: Plan a budget covering staffing, tools, and resources.

Expense Monitoring: Track costs to avoid budget overruns.

Technology and Tools

Audit Software: Use tools for data analysis and documentation to improve efficiency.

Data Security: Ensure audit tools meet data privacy and security standards.

Specialized Expertise

External Experts: Bring in consultants or specialists as needed.

Training: Invest in training to keep the team updated on relevant skills.

Resource Monitoring

Progress Tracking: Review resource allocation throughout the audit.

Adjust as Needed: Reallocate if new priorities or risks emerge.

Coordination and Communication

Coordination and communication are essential to the success of an audit engagement, ensuring that the audit team and stakeholders are aligned and informed throughout the process. Here’s a concise overview of these key components:

Clear Communication with Stakeholders

Expectation Setting: Discuss audit objectives, scope, and timelines with stakeholders to establish clear expectations.

Regular Updates: Provide stakeholders with consistent updates on audit progress, findings, and any issues encountered.

Team Coordination

Defined Roles: Clarify roles and responsibilities within the audit team to prevent overlap and ensure accountability.

Team Meetings: Schedule regular team meetings to discuss progress, address challenges, and align on key activities.

Client Engagement

Information Sharing: Coordinate with the client to gain timely access to necessary information and documents.

Feedback Mechanism: Establish channels for clients to provide feedback, ensuring any concerns are addressed.

Issue Resolution

Open Communication Channels: Maintain open channels for team members and stakeholders to discuss and resolve issues as they arise.

Timely Responses: Address issues promptly to keep the audit on track and maintain trust.

Documentation of Communication

Record Keeping: Document key communications and agreements to maintain a clear audit trail and ensure accountability.

Reporting: Create reports summarizing significant communications and findings for final review.

Examples

Example 1: Financial Services - Regulatory Compliance Audit

Banks and financial institutions routinely conduct regulatory compliance audits to ensure adherence to laws such as the Dodd-Frank Act or the Bank Secrecy Act. Effective planning for these audits includes determining the scope to cover relevant regulations, allocating resources with expertise in regulatory matters, and timing the audit to precede regulatory reviews for timely compliance.

Example 2: Healthcare - Patient Privacy and Security Audit

Hospitals and other healthcare providers plan audits to ensure compliance with the Health Insurance Portability and Accountability Act (HIPAA). Planning involves assessing areas of highest risk such as electronic health record systems, training audit staff on the specifics of healthcare regulations, and scheduling audits to minimize disruption to clinical operations.

Example 3: Technology Sector - Cybersecurity Audit

Technology companies, especially those dealing with sensitive user data, plan cybersecurity audits to assess the integrity and security of their information systems. Audit planning includes identifying critical IT assets, choosing auditors with specialized IT and cybersecurity knowledge, and coordinating the audit timing to align with software release cycles.

Example 4: Manufacturing - Supply Chain Audit

Manufacturing firms conduct supply chain audits to ensure the quality and integrity of their products throughout the production cycle. Effective planning for these audits entails defining the scope to include key suppliers, timing audits to coincide with major procurement phases, and deploying auditors with experience in manufacturing and quality control.

Example 5: Non-Profit Organizations - Grant Utilization Audit

Non-profits often receive grants that are earmarked for specific purposes. Planning audits for grant utilization involves ensuring that funds are used as intended, defining the scope to cover all activities funded by the grant, scheduling audits soon after grant activities conclude, and using auditors familiar with non-profit finance and operations.

Practice Questions

Question 1

What is the primary purpose of defining the audit scope in the planning phase of an audit engagement?

A. To determine the audit fee

B. To identify the necessary resources and expertise required

C. To establish the timeline for the audit completion

D. To specify the areas to be covered during the audit

Answer: D. To specify the areas to be covered during the audit

Explanation:

The primary purpose of defining the audit scope during the planning phase is to clearly specify which areas, functions, or processes of the organization will be examined. This helps ensure that the audit focuses on relevant aspects that need assessment and ensures all critical areas are covered, thereby maximizing the effectiveness of the audit. The scope influences, but is distinct from, resource identification (B), timeline establishment (C), and fee determination (A).

Question 2

Which of the following best describes the importance of risk assessment during the audit planning process?

A. It helps in promoting the audit internally within the organization

B. It determines the high-risk areas that should receive more attention during the audit

C. It is used to train new auditors

D. It provides a social proof to external stakeholders

Answer: B. It determines the high-risk areas that should receive more attention during the audit

Explanation:

Risk assessment during the audit planning process is crucial as it helps in identifying and prioritizing areas that pose higher risks to the organization. By focusing more resources and attention on these high-risk areas, auditors can more effectively manage and mitigate potential impacts on the organization. This ensures that the audit is efficient and effective, rather than focusing on training (C), internal promotion (A), or providing social proof (D).

Question 3

Why is it important to allocate the right resources during the planning phase of an audit engagement?

A. To reduce the cost of the audit

B. To ensure the audit is completed on schedule

C. To match the skills and expertise of the audit team with the audit needs

D. To guarantee the audit will not require any additional work post-completion

Answer: C. To match the skills and expertise of the audit team with the audit needs

Explanation:

Allocating the right resources during the planning phase is crucial for matching the skills and expertise of the audit team with the specific requirements of the audit. This alignment is essential for ensuring that the audit team can effectively identify and address the risks and areas of concern specific to the audit scope. Proper resource allocation aids in completing the audit on schedule (B) and reducing costs (A), but its primary importance lies in the effectiveness of the audit process rather than guaranteeing no post-completion work (D).