Preparing for the CMA Exam necessitates a profound comprehension of external financial reporting decisions, essential for mastering financial accounting and reporting. Understanding the mechanisms of financial statement preparation, recognition principles, and disclosure requirements equips you with crucial insights into accurate financial reporting, vital for excelling on the CPA and understanding complex financial data.

Learning Objective

In studying "External Financial Reporting Decisions" for the CMA Exam, you should develop an understanding of the principles governing financial statement presentation, including the recognition, measurement, and disclosure requirements under GAAP and IFRS. Explore the roles of various financial statements, accounting policies, and regulatory frameworks in enhancing transparency and comparability. Evaluate how these reporting standards ensure accurate financial representation for stakeholders. Additionally, understand how these principles form the foundation of ethical financial reporting and investor decision-making. Apply this knowledge to interpreting financial statements, analyzing financial ratios, and solving CMA practice questions on complex reporting issues and compliance with financial regulations.

1. Purpose and Scope of Financial Reporting

Objective: Provide useful financial information to various stakeholders (investors, creditors, and others) to make informed economic decisions.

Framework: Governed by generally accepted accounting principles (GAAP) in the U.S. and International Financial Reporting Standards (IFRS) globally.

Key Qualitative Characteristics: Includes relevance, reliability, comparability, and understandability. These characteristics ensure that financial reports meet users' needs.

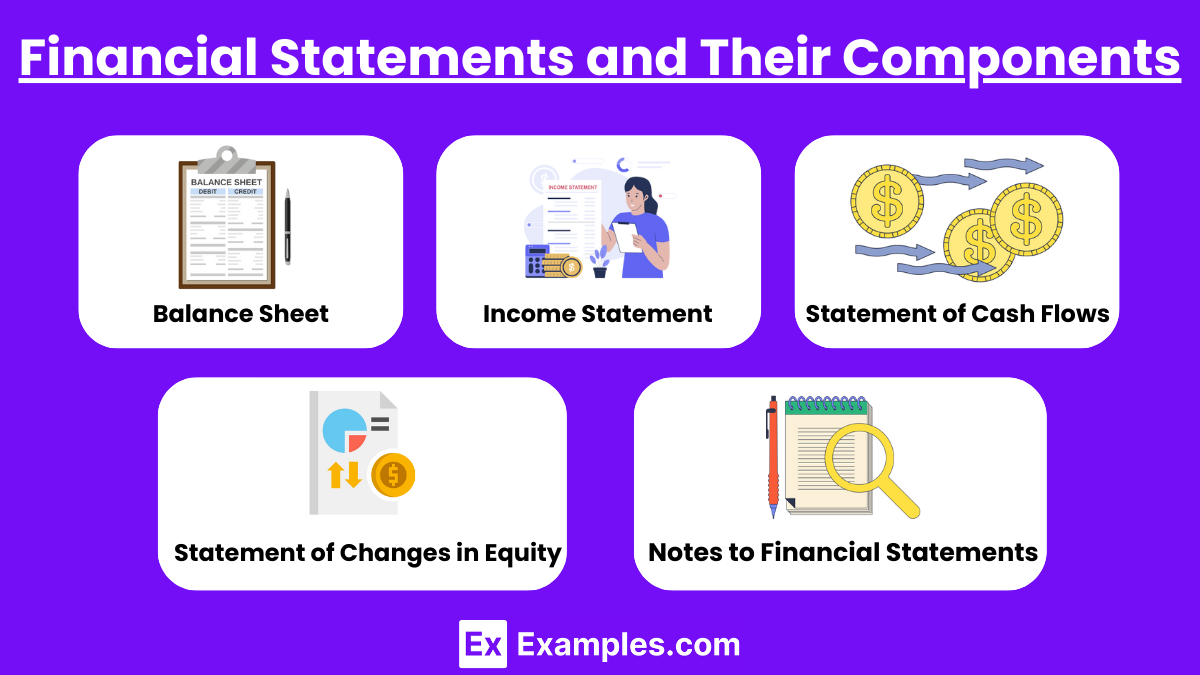

2. Financial Statements and Their Components

Balance Sheet: Reports an entity’s financial position at a specific point in time, detailing assets, liabilities, and equity.

Income Statement: Summarizes revenue, expenses, and profits over a period, showing operational success and efficiency.

Statement of Cash Flows: Outlines cash inflows and outflows, categorized into operating, investing, and financing activities.

Statement of Changes in Equity: Shows changes in owners’ equity over a period, including profits, dividends, and any new capital contributions or withdrawals.

Notes to Financial Statements: Provide additional disclosures to ensure comprehensive understanding of financial data presented.

3. Recognition, Measurement, and Disclosure Concepts

Revenue Recognition (ASC 606): Revenue is recognized when control of goods or services is transferred to the customer, typically at the transaction price.

Measurement Bases: Includes historical cost, fair value, net realizable value, and present value, each serving different financial reporting needs.

Disclosure Requirements: Specific information is required to enhance financial statements' transparency, including details about accounting policies, risks, and contingencies.

4. Financial Statement Analysis Techniques

Ratio Analysis: Key ratios (liquidity, solvency, profitability) help evaluate financial performance and compare it with industry benchmarks.

Trend Analysis: Examines financial data over multiple periods to identify growth patterns, stability, and performance trends.

Common-Size Analysis: Converts financial statements into percentages for easier cross-company and cross-period comparison.

Variance Analysis: Compares actual results with budgets or forecasts to assess management's effectiveness in achieving goals.

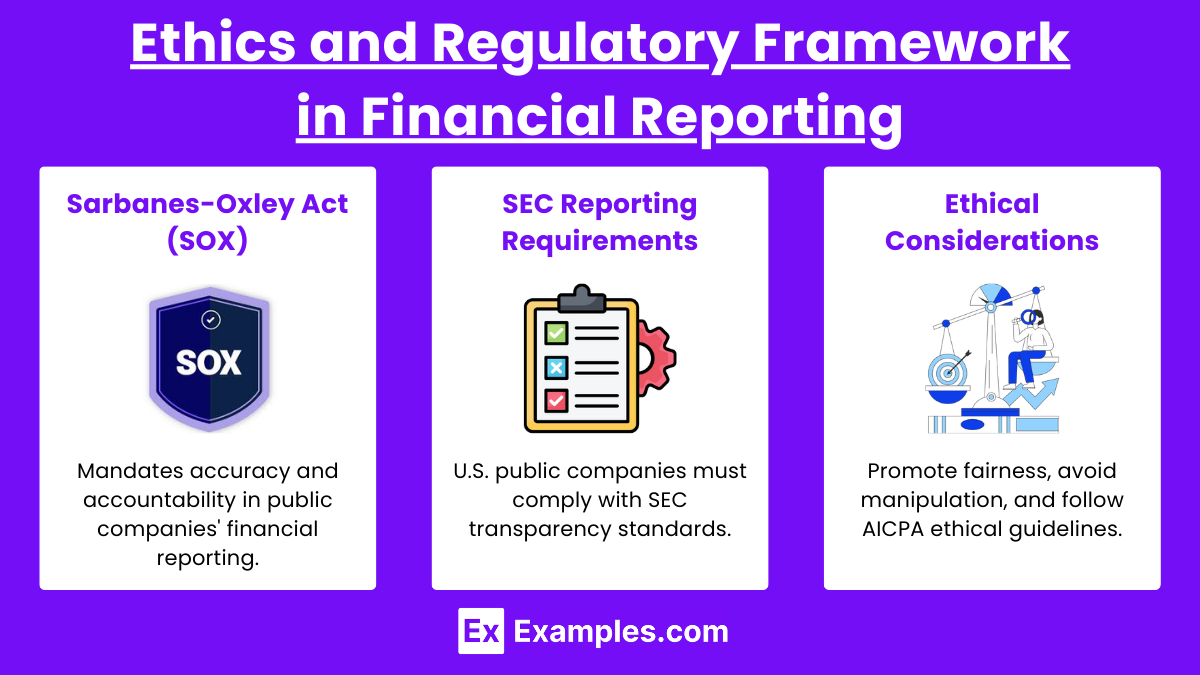

5. Ethics and Regulatory Framework in Financial Reporting

Sarbanes-Oxley Act (SOX): Imposes regulations to ensure accuracy, reliability, and accountability in financial reporting for public companies.

SEC Reporting Requirements: Public companies in the U.S. are required to follow SEC regulations for transparency and investor protection.

Ethical Considerations: Ensuring truthful, fair representation of financial information, avoiding earnings management, and adhering to ethical guidelines set by AICPA.

Examples

Example 1: Recognizing Revenue in Financial Statements

Revenue Recognition Process: Revenue is recognized when a performance obligation is satisfied, meaning control of goods or services has been transferred to the customer.

Application of Revenue Recognition Standard (ASC 606): This standard provides a five-step model for recognizing revenue, crucial for consistency and transparency in financial reporting.

Example 2: Role of Fair Value Measurements

Maintaining Fair Value Reporting for Assets and Liabilities: Fair value reporting provides stakeholders with real-time, market-based valuations.

Valuation Methods: The fair value framework includes techniques like market, cost, and income approaches to ensure accurate and relevant valuations in financial statements.

Example 3: Impact of Disclosure Requirements on Transparency

Disclosure of Key Financial Data: Disclosures, including notes and supplementary information, add depth to financial statements, clarifying accounting policies, risks, and uncertainties.

Regulatory Compliance: Adhering to disclosure requirements improves stakeholder trust and fulfills regulatory obligations for public companies, like SEC regulations in the U.S.

Example 4: Summarizing Financial Ratios for Performance Analysis

Ratio Analysis: Financial ratios, such as profitability, liquidity, and leverage ratios, are used to interpret company performance and financial health.

Comparative Analysis: Ratios allow for performance comparisons over time or against industry benchmarks, helping stakeholders assess operational efficiency and risk levels.

Example 5: Effect of Changes in Accounting Policies on Financial Statements

Changes in Accounting Estimates and Policies: Adjustments to accounting policies (e.g., revenue recognition, inventory valuation) must be disclosed to reflect consistent, transparent reporting.

Impact of Policy Changes: Significant policy changes can affect comparability across periods and may influence key metrics, like earnings per share, which investors use for decision-making.

Practice Questions

Question 1:

What primarily ensures the accuracy and consistency of external financial statements over time?

A) Internal audits conducted periodically

B) Disclosure of accounting policies in footnotes

C) The use of fair value measurements consistently

D) Adherence to GAAP or IFRS standards

Answer: D) Adherence to GAAP or IFRS standards

Explanation: Adhering to recognized accounting standards (GAAP or IFRS) ensures that financial statements are consistently prepared, fostering comparability and accuracy for stakeholders.

Question 2:

During the preparation of financial statements, what element is critical in determining when revenue should be recognized?

A) The timing of cash collection from customers

B) When the performance obligation is satisfied

C) The date of the invoice issuance

D) The customer’s creditworthiness

Answer: B) When the performance obligation is satisfied

Explanation: Revenue is recognized when the entity fulfills its obligation to the customer, aligning with the five-step revenue recognition model to ensure that reported revenue reflects actual earnings.

Question 3:

Which of the following actions would most likely improve transparency in financial reporting for investors?

A) Simplifying the format of financial statements

B) Enhancing disclosures regarding financial risks

C) Reducing the frequency of earnings reports

D) Increasing dividend payouts

Answer: B) Enhancing disclosures regarding financial risks

Explanation: Comprehensive disclosures provide stakeholders with valuable context, such as potential financial risks and uncertainties, improving transparency and allowing for better-informed decisions.