In the Risk Management is essential for ensuring effective organizational governance and strategic decision-making. You’ll delve into risk identification, assessment, and mitigation strategies that safeguard organizational assets and enhance resilience. Topics include enterprise risk management frameworks, internal controls, and the role of risk in performance measurement. Understanding these components is critical for excelling in the financial planning and analysis section, as it equips candidates with tools to proactively address uncertainties and optimize financial outcomes.

Learning Objectives

In studying “Risk Management” for the CMA, you should learn to identify various types of risks that organizations face, including financial, operational, strategic, and compliance risks. Understand the processes involved in risk assessment, such as identifying, analyzing, and prioritizing risks based on their potential impact and likelihood. Explore risk mitigation techniques, including avoidance, transfer, reduction, and acceptance. Evaluate the role of internal controls and risk management frameworks, such as COSO, in minimizing risk exposure. Additionally, gain insight into the importance of risk management in strategic planning and decision-making to ensure organizational stability and long-term success.

Identifying Types of Risks Organizations Face

Organizations face a variety of risks that can impact their operations, financial health, reputation, and overall success. Recognizing these risks allows organizations to develop strategies to mitigate and manage them effectively. Here are the primary types of risks organizations commonly encounter:

1. Strategic Risk

Strategic risks arise from decisions related to the organization’s long-term goals, including market position, competitive advantage, and growth.

- Examples:

- Market Risks: Changes in consumer preferences or market dynamics.

- Competitive Risks: Losing market share to competitors or failing to innovate.

- Regulatory Changes: New laws or industry regulations that affect operations.

Impact: Strategic risks can hinder growth, reduce competitiveness, and damage an organization’s ability to achieve its objectives.

2. Operational Risk

Operational risks are associated with day-to-day business activities and can result from failures in processes, systems, or human error.

- Examples:

- Process Failures: Breakdowns in production or delivery processes.

- System Failures: IT disruptions, data breaches, or cybersecurity threats.

- Human Error: Mistakes made by employees or management.

Impact: Operational risks can lead to financial losses, disruptions in service, and reputational damage.

3. Financial Risk

Financial risks relate to an organization’s financial stability and its ability to manage its financial obligations, investments, and liquidity.

- Examples:

- Market Risk: Changes in interest rates, foreign exchange rates, or stock prices.

- Credit Risk: Potential losses from customers or partners failing to fulfill financial obligations.

- Liquidity Risk: The risk of being unable to meet short-term financial obligations.

Impact: Financial risks can threaten cash flow, profitability, and overall financial health.

4. Compliance and Legal Risk

Compliance and legal risks stem from failing to comply with laws, regulations, or industry standards, which can result in legal consequences and penalties.

- Examples:

- Regulatory Compliance: Failure to meet standards set by regulatory bodies.

- Litigation Risk: Legal disputes with employees, customers, or partners.

- Environmental Compliance: Non-compliance with environmental laws or sustainability standards.

Impact: Compliance risks can lead to fines, legal costs, reputational damage, and loss of operating licenses.

Understanding the Risk Assessment Process

The risk assessment process is a systematic approach to identifying, analyzing, and prioritizing risks within an organization. This process helps organizations understand potential threats, evaluate their impact, and take measures to mitigate or manage risks effectively. Here’s a breakdown of the key steps in the risk assessment process:

1. Identify Risks

The first step is to identify the risks the organization faces in its operations, finances, reputation, and external environment. This includes gathering information on potential events or circumstances that could impact the organization’s objectives.

- Methods: Risk identification techniques can include brainstorming sessions, employee interviews, audits, and reviewing historical data.

- Examples: Potential risks may include cybersecurity threats, supply chain disruptions, financial instability, or regulatory changes.

Outcome: A comprehensive list of risks, often organized by category (e.g., operational, financial, strategic).

2. Analyze Risks

Once risks are identified, the next step is to analyze their potential impact and likelihood. This helps prioritize risks based on their potential effect on the organization.

- Impact Assessment: Determine the severity of each risk. How damaging would it be if it occurred? Consider financial, reputational, operational, and compliance impacts.

- Likelihood Assessment: Estimate the probability of each risk occurring, based on historical data, industry trends, and expert judgment.

Outcome: Each risk is assigned an impact and likelihood level, often resulting in a risk matrix.

3. Evaluate and Prioritize Risks

In this step, organizations assess the significance of each risk to determine which ones require immediate attention. Prioritizing risks allows organizations to allocate resources efficiently.

- Risk Matrix: A tool often used to visually represent risks based on their impact and likelihood. Risks with high impact and high likelihood are given the highest priority.

- Risk Ranking: Risks are ranked from highest to lowest based on the combination of their impact and likelihood.

Outcome: A prioritized list of risks, allowing management to focus on the most critical threats.

Exploring Risk Mitigation Techniques

Risk mitigation techniques help organizations reduce the impact or likelihood of risks. By applying different strategies, companies can protect their assets, enhance resilience, and ensure business continuity. Here are some commonly used risk mitigation techniques:

1. Risk Avoidance

Risk avoidance involves taking actions to completely eliminate a risk by not engaging in high-risk activities or changing plans to sidestep it.

- Example: A company decides not to expand into a politically unstable region, avoiding the risk of political disruption entirely.

When to Use: If the risk is too high and avoidance does not critically impact the organization’s goals.

2. Risk Reduction

Risk reduction, or risk control, aims to lower the impact or likelihood of a risk by implementing preventive measures.

- Example: A manufacturing company installs safety equipment and provides training to reduce the likelihood of workplace accidents.

When to Use: When a risk cannot be eliminated but can be minimized to acceptable levels.

3. Risk Transfer

Risk transfer involves shifting the risk to a third party, often through insurance or contractual agreements, so that the organization is not solely responsible for any potential losses.

- Example: A company buys cybersecurity insurance to cover potential data breach losses, effectively transferring the financial risk to the insurer.

When to Use: For risks that are difficult to control internally or are outside the organization’s expertise.

Risk acceptance means acknowledging the risk and deciding not to take any action to mitigate it, often because the potential impact is minor or the cost of mitigation is too high.

- Example: A small business accepts the risk of minor fluctuations in raw material prices as it has a minimal impact on their operations.

When to Use: When the risk has a low likelihood or impact, and the cost of mitigation outweighs the potential benefits.

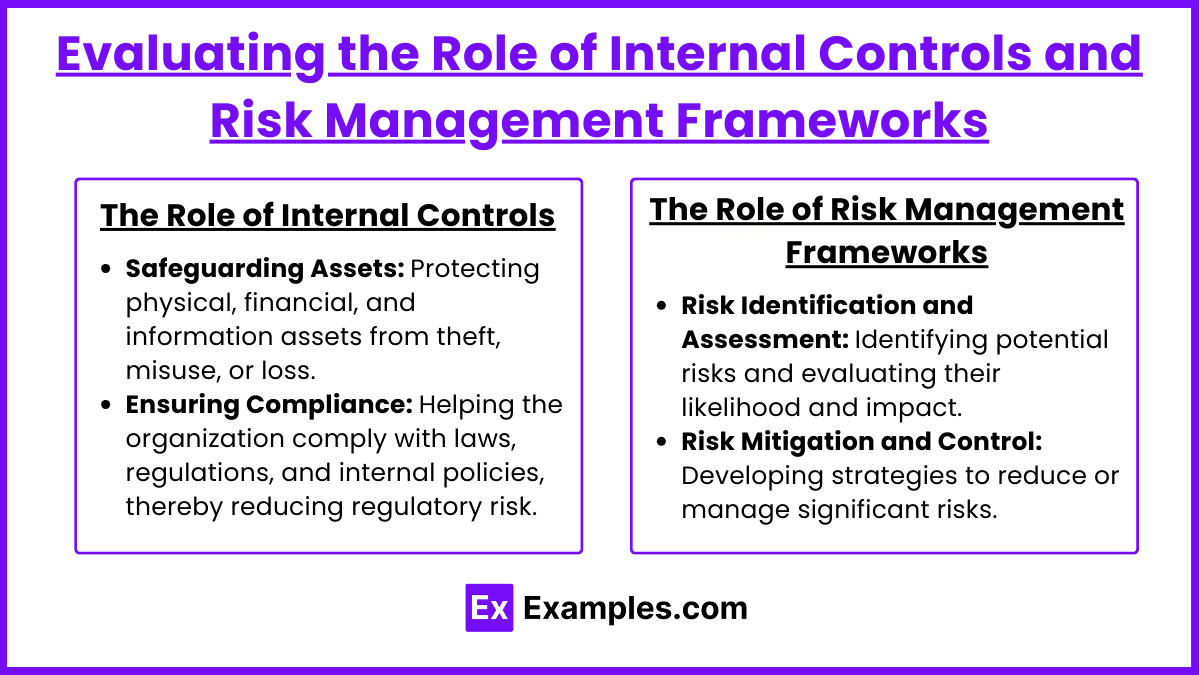

Evaluating the Role of Internal Controls and Risk Management Frameworks

1. The Role of Internal Controls

Internal controls are the processes and policies that an organization puts in place to protect its assets, ensure the accuracy of financial reporting, and enhance operational efficiency. They play a key role in managing day-to-day risks and establishing a secure operating environment.

Key Functions of Internal Controls:

- Safeguarding Assets: Protecting physical, financial, and information assets from theft, misuse, or loss.

- Ensuring Compliance: Helping the organization comply with laws, regulations, and internal policies, thereby reducing regulatory risk.

- Promoting Operational Efficiency: Streamlining processes to prevent inefficiencies, errors, and unnecessary costs.

- Preventing and Detecting Errors and Fraud: Identifying risks of fraud or mistakes early through monitoring and periodic checks.

Examples of Internal Controls:

- Physical Controls: Security cameras, locks, and restricted access to sensitive areas.

- Authorization Controls: Approval processes for high-value transactions, such as requiring manager authorization for purchases over a certain threshold.

- Segregation of Duties: Dividing responsibilities so that no single person has control over an entire process, reducing fraud risk.

- IT Controls: Password protections, firewalls, and regular audits to safeguard data integrity and privacy.

2. The Role of Risk Management Frameworks

Key Functions of Risk Management Frameworks:

- Risk Identification and Assessment: Identifying potential risks and evaluating their likelihood and impact.

- Risk Mitigation and Control: Developing strategies to reduce or manage significant risks.

- Monitoring and Reporting: Ongoing tracking of risk levels, control effectiveness, and reporting to stakeholders for transparency.

- Alignment with Strategic Goals: Ensuring that risk management activities support the organization’s objectives and risk tolerance.

Common Risk Management Frameworks:

- COSO ERM (Committee of Sponsoring Organizations Enterprise Risk Management): A comprehensive approach to risk management that integrates with the organization’s strategy and performance.

- ISO 31000: An international standard that provides principles and guidelines for risk management, emphasizing flexibility and continuous improvement.

- NIST Framework: A cybersecurity risk management framework widely used for assessing and managing digital risks.https://images.examples.com/wp-content/uploads/2024/11/Understanding-the-Risk-Assessment-Process.png

Examples

Example 1: Financial Risk Management in Investments

Investment firms often implement risk management strategies to mitigate potential losses in volatile markets. For example, a firm may use diversification to spread investments across various asset classes, reducing the impact of poor performance in any single investment. Additionally, financial derivatives like options and futures can be employed to hedge against unfavorable market movements, ensuring that the firm’s portfolio remains resilient in changing economic conditions.

Example 2: Health and Safety Risk Management in Construction

Construction companies prioritize health and safety risk management to protect workers and minimize accidents on job sites. This involves conducting risk assessments to identify potential hazards, such as falling objects or machinery malfunctions. Implementing safety protocols, providing training, and ensuring the proper use of personal protective equipment (PPE) are essential components of this risk management strategy, aiming to reduce injury rates and enhance overall site safety.

Example 3: IT Risk Managemenhttps://images.examples.com/wp-content/uploads/2024/11/Understanding-the-Risk-Assessment-Process.pngt in Cybersecurity

Organizations are increasingly focusing on IT risk management to protect against cybersecurity threats. This includes conducting regular vulnerability assessments to identify weaknesses in their systems and implementing firewalls, encryption, and intrusion detection systems to safeguard sensitive data. Additionally, employee training on phishing scams and other cyber threats is crucial to mitigate risks associated with human error, helping organizations maintain data integrity and prevent breaches.

Example 4: Natural Disaster Risk Management for Businesses

Companies located in areas prone to natural disasters, such as hurricanes or earthquakes, develop risk management plans to ensure business continuity. This includes assessing potential risks, creating emergency response plans, and establishing backup systems for data and operations. By investing in disaster recovery strategies and insurance coverage, businesses can mitigate the financial impact of natural disasters and ensure that they can quickly recover and resume operations.

Example 5: Reputation Risk Management in Public Relations

Organizations actively manage reputation risk to protect their brand image and maintain customer trust. This involves monitoring public perception and addressing negative feedback promptly through effective communication strategies. For instance, during a crisis, companies may engage in transparent communication and provide timely updates to stakeholders. Implementing proactive measures, such as corporate social responsibility initiatives, also helps build a positive reputation and mitigate potential risks to the brand.

Practice Questions

Question 1

What is the primary goal of risk management in an organization?

A) To eliminate all risks associated with the business

B) To identify, assess, and prioritize risks to minimize their impact

C) To ensure maximum profitability without regard to risks

D) To delegate all risk-related decisions to external parties

Correct Answer: B) To identify, assess, and prioritize risks to minimize their impact.

Explanation: The primary goal of risk management is to systematically identify, assess, and prioritize risks to reduce the potential negative impacts on an organization. By understanding the risks involved, organizations can develop strategies to mitigate them, ensuring that they can achieve their objectives while minimizing losses. Options A and C are unrealistic because it is impossible to eliminate all risks, and maximizing profitability without considering risks can lead to significant problems. Option D suggests a lack of responsibility, which is not a fundamental principle of effective risk management.

Question 2

Which of the following is a common risk management strategy?

A) Risk avoidance

B) Risk acceptance

C) Risk transfer

D) All of the above

Correct Answer: D) All of the above.

Explanation: All of the options listed are valid risk management strategies. Risk avoidance involves changing plans to sidestep potential risks entirely. Risk acceptance means recognizing the risk and deciding to proceed, often because the benefits outweigh potential downsides. Risk transfer involves shifting the risk to another party, such as through insurance. An effective risk management plan often combines multiple strategies to address different types of risks appropriately.

Question 3

In the context of risk management, what is meant by “risk appetite”?

A) The total amount of risk an organization can avoid

B) The amount of risk an organization is willing to take on

C) The process of eliminating all risks

D) The measurement of risk in financial terms

Correct Answer: B) The amount of risk an organization is willing to take on.

Explanation: Risk appetite refers to the level of risk that an organization is prepared to accept in pursuit of its objectives. It reflects the organization’s tolerance for risk and guides decision-making processes. Understanding risk appetite is crucial for effective risk management, as it helps organizations determine which risks are acceptable and which require mitigation strategies. Options A, C, and D do not accurately capture the concept of risk appetite in risk management.