Analyzing the Macro-Finance Environment involves assessing broad economic and financial factors that impact asset classes, investment strategies, and market behavior. This analysis includes evaluating economic indicators, such as GDP growth, inflation, interest rates, and employment, as well as examining fiscal and monetary policies, geopolitical risks, and global market trends. By understanding how these elements interact, portfolio managers can make informed decisions, optimize asset allocation, and effectively manage risks, ultimately aiming to enhance portfolio performance and navigate changing economic cycles.

Learning Objectives

In studying “Analyzing the Macro-Finance Environment” for the CMT Exam, you should learn to assess how macroeconomic indicators and financial conditions impact markets and asset classes. Understand key metrics like GDP, inflation, interest rates, and employment, and evaluate how these factors influence equities, bonds, and commodities. Analyze the effects of monetary and fiscal policies on market cycles, and explore the impact of global events and geopolitical trends on portfolio performance. Additionally, apply insights from these analyses to adjust asset allocation and risk management strategies, considering both long-term economic outlooks and short-term tactical opportunities.

Introduction to Macro-Finance Environment

In the context of portfolio management, the macro-finance environment refers to the broader economic factors and financial conditions that influence asset prices and market trends. This analysis focuses on understanding how economic cycles, central bank policies, fiscal measures, inflation, and global events impact the financial markets. By evaluating these factors, portfolio managers can anticipate potential risks and opportunities and align their investment strategies to achieve optimal performance.

Key Components of Macro-Finance Analysis

- Economic Indicators and Business Cycles

- Gross Domestic Product (GDP): GDP growth or contraction provides insight into economic health and can signal phases in the business cycle—expansion, peak, contraction, and trough. Asset classes react differently to each phase.

- Employment Data: Unemployment rates and job creation data indicate economic strength or weakness, affecting consumer spending and corporate earnings.

- Inflation and Deflation: Price level changes influence purchasing power, interest rates, and central bank actions. High inflation often leads to interest rate hikes, which can negatively impact bond and equity prices.

- Central Bank Policies

- Interest Rate Policy: Central banks adjust interest rates to control inflation and stimulate or cool the economy. Rate hikes generally depress bond prices and can increase the cost of equity capital.

- Quantitative Easing (QE) and Tightening: QE increases liquidity and can boost asset prices by making borrowing cheaper, whereas tightening reduces liquidity, impacting high-risk assets first.

- Monetary Policy Cycles: Recognizing shifts from accommodative to restrictive policies helps investors reposition assets to mitigate risks.

- Fiscal Policies and Government Spending

- Tax Policies: Changes in corporate or personal taxes impact disposable income, corporate earnings, and consumer spending. Lower taxes can drive equity markets up, while tax hikes may dampen market sentiment.

- Government Spending Programs: Investments in infrastructure, defense, or social programs can stimulate growth in specific sectors, creating sector-specific investment opportunities.

- Deficits and Debt Levels: High government debt and deficits influence creditworthiness, interest rates, and can lead to changes in fiscal policies affecting economic growth.

- Global Economic Trends and Geopolitical Factors

- Trade Policies and International Relations: Trade agreements, tariffs, and sanctions affect global supply chains and corporate profits, particularly for multinational companies.

- Geopolitical Risks: Political instability, elections, wars, and conflicts can create volatility, especially in commodities, forex, and emerging markets.

- Globalization and De-Globalization: Trends in globalization affect corporate profitability, while de-globalization may lead to supply chain disruptions and inflationary pressures.

- Commodity Prices and Inflationary Pressure

- Energy Prices: Oil and natural gas prices influence inflation, corporate costs, and consumer spending. Rising energy costs are often inflationary, impacting interest rates and the valuation of certain sectors.

- Raw Material and Food Prices: Fluctuations in raw materials like metals or agricultural commodities can affect inflation and are crucial for sectors relying heavily on these inputs.

Application of Macro-Finance Analysis in Portfolio Management

Macro-finance analysis plays a crucial role in portfolio management by aligning investment strategies with broader economic and financial trends. It involves evaluating economic indicators, such as GDP growth, inflation, interest rates, and unemployment, as well as examining monetary and fiscal policies and global events.

- Asset Allocation Decisions

- Understanding macroeconomic conditions helps in adjusting asset allocation between stocks, bonds, commodities, and cash. For example, during economic expansion, equities may be preferred, while bonds might be more favorable during slowdowns.

- Sector rotation, based on economic cycles, allows portfolio managers to overweight or underweight specific sectors aligned with the economic phase (e.g., utilities during recessions, technology in expansions).

- Risk Management and Hedging Strategies

- Macro analysis enables proactive risk management. In times of potential market volatility, portfolio managers can reduce exposure to risky assets or use derivatives to hedge against market downturns.

- Identifying inflationary or deflationary trends helps in selecting suitable hedging strategies, such as inflation-protected bonds (TIPS) or commodities.

- Scenario Analysis and Stress Testing

- Portfolio managers conduct scenario analysis to evaluate the potential impact of various macroeconomic events, like an interest rate hike or trade war, on portfolio returns.

- Stress testing portfolios for extreme conditions (e.g., sudden inflation spike, recession) allows for proactive adjustments, ensuring alignment with client risk tolerance and return objectives.

- Market Sentiment and Behavioral Analysis

- Sentiment indicators like consumer confidence, investor sentiment, and market volatility indexes (e.g., VIX) provide additional context for interpreting macroeconomic data.

- Behavioral factors often amplify the impact of macro events, as investor fear or greed can lead to overreactions in asset prices, which portfolio managers need to account for in decision-making.

- Use of Quantitative Models in Macro Analysis

- Quantitative models, such as econometric forecasting, help analyze the relationships between macroeconomic variables and market performance. For instance, the relationship between interest rates and equity valuations or between GDP growth and bond yields.

- Factor models may be used to dissect how macroeconomic factors influence individual asset classes or sectors, aiding in refining portfolio strategy.

- Global Diversification Strategy

- Macro-finance analysis supports global diversification by identifying economic regions or countries expected to perform well under specific conditions. For example, in periods of strong global growth, emerging markets may offer high returns, while developed markets might be more resilient during economic slowdowns. Portfolio managers use this insight to allocate assets across various geographies, balancing exposure to global risks while capitalizing on regional growth opportunities and mitigating volatility through diversified holdings.

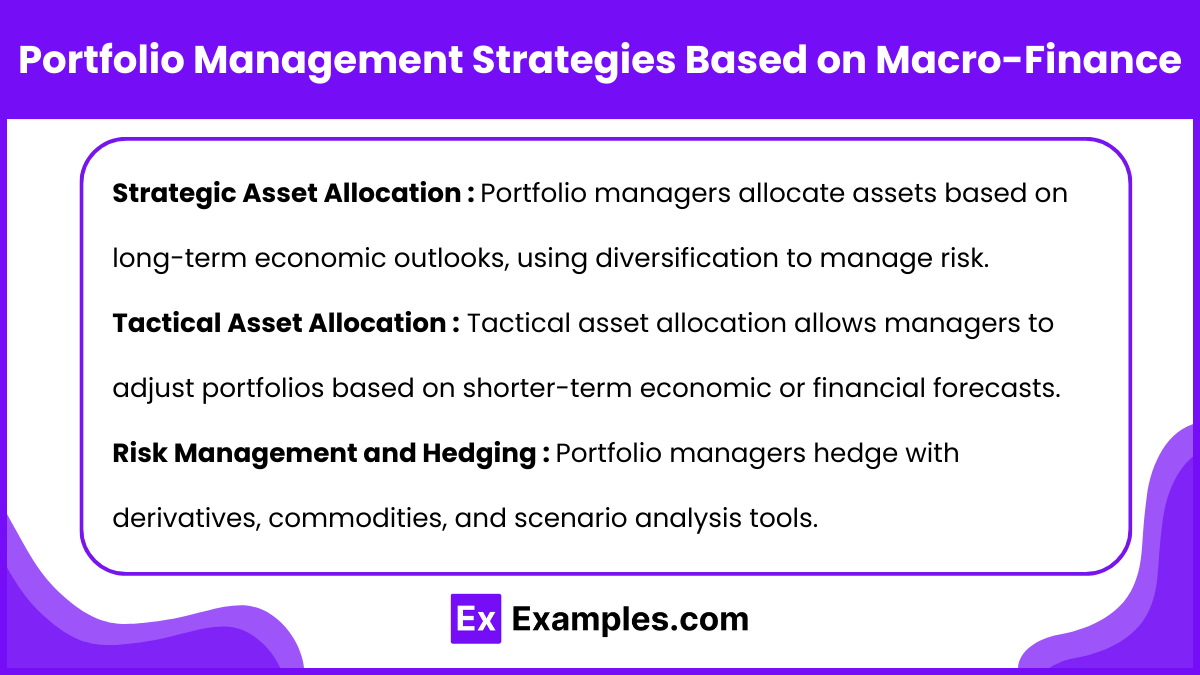

Portfolio Management Strategies Based on Macro-Finance

- Strategic Asset Allocation:

- Macro-finance insights guide long-term asset allocation by identifying which asset classes are likely to outperform in different macroeconomic conditions.

- Portfolio managers allocate assets based on long-term economic outlooks, using diversification to manage risk.

- Tactical Asset Allocation:

- Tactical asset allocation allows managers to adjust portfolios based on shorter-term economic or financial forecasts.

- For instance, during a rate hike cycle, portfolios may shift to shorter-duration bonds or sectors less impacted by high-interest rates.

- Risk Management and Hedging:

- Portfolio managers use hedging strategies, including derivatives, currency hedges, and commodities, to protect against macro risks like inflation or currency depreciation.

- They also employ scenario analysis and stress testing to understand the potential impacts of various macroeconomic shifts on portfolio performance.

Examples

Example 1: Interest Rate Shifts and Bond Portfolio Adjustments

When central banks signal an increase in interest rates to control inflation, bond prices typically decline because newer bonds offer higher yields, making existing bonds less attractive. Portfolio managers anticipating a rate hike might reduce exposure to long-term bonds, which are more sensitive to interest rate changes, and increase allocation to short-term bonds or cash equivalents. Additionally, they might look to inflation-protected securities or floating-rate notes, which provide a hedge against rising interest rates. By adjusting bond portfolios accordingly, managers can protect against potential losses associated with higher rates.

Example 2: Equity Sector Rotation During Economic Cycles

During an economic expansion, consumer spending tends to increase, benefitting cyclical sectors like consumer discretionary, industrials, and technology. Conversely, in a downturn, sectors such as consumer staples, healthcare, and utilities often perform better due to their essential nature, regardless of economic conditions. Portfolio managers conduct macro-finance analysis to assess the current phase of the economic cycle and rotate assets toward sectors likely to benefit. For instance, if economic data indicates a slowdown, a manager may increase holdings in defensive sectors and reduce exposure to cyclicals to maintain portfolio resilience.

Example 3: Currency Fluctuations and International Investment Decisions

Currency volatility, driven by economic indicators or geopolitical events, impacts returns on international investments. A strong U.S. dollar, for example, may reduce the value of foreign earnings for U.S.-based investors, while a weaker dollar benefits exports and enhances returns on foreign investments. Portfolio managers monitoring currency trends may decide to hedge currency exposure in foreign investments or adjust allocations to regions with stable or appreciating currencies. For example, if the euro is expected to weaken due to political instability, a manager may reduce euro-denominated holdings or apply currency hedges to mitigate exchange rate risks.

Example 4: Commodity Price Movements and Inflation Protection

Rising commodity prices often signal inflation, impacting sectors like energy, mining, and agriculture. When commodity prices rise, portfolio managers may increase allocations to commodities as an inflation hedge or invest in commodity-producing companies likely to benefit. For instance, if oil prices surge due to supply constraints or geopolitical tensions, managers may increase holdings in energy companies or consider energy-focused ETFs. Conversely, when commodity prices fall, they may reduce such allocations. By monitoring commodity trends, managers protect portfolios from inflationary pressures and capitalize on sector-specific opportunities.

Example 5: Impact of Fiscal Stimulus on Market Sentiment and Asset Allocation

Government fiscal policies, such as stimulus packages or infrastructure spending, can significantly affect economic growth and market sentiment. For example, a large infrastructure bill may benefit sectors like construction, materials, and industrials. Portfolio managers analyze such fiscal policy shifts to adjust asset allocation, increasing investments in sectors likely to benefit from increased government spending. In addition, they may add cyclical stocks or small-cap stocks, which often perform well during fiscal expansion. Anticipating these fiscal impacts helps managers align portfolios with favorable macroeconomic conditions and enhance long-term returns.

Practice Questions

Question 1

Which of the following statements best describes the impact of a rising inflation rate on bond prices and yields?

A) Bond prices generally increase, and yields decrease when inflation rises.

B) Bond prices generally decrease, and yields increase when inflation rises.

C) Bond prices are unaffected, but yields increase when inflation rises.

D) Both bond prices and yields increase when inflation rises.

Correct Answer: B) Bond prices generally decrease, and yields increase when inflation rises.

Explanation: Inflation erodes the purchasing power of future cash flows, making fixed-income assets like bonds less attractive. When inflation rises, investors demand higher yields to compensate for the decreased value of future payments, leading to a decrease in bond prices. This inverse relationship between bond prices and yields is central to understanding fixed-income investments. As inflation expectations increase, new bonds are issued with higher interest rates, causing the market prices of existing lower-yielding bonds to fall to maintain competitive yields. Thus, the correct answer is B.

Question 2

Which economic indicator would a portfolio manager most likely monitor to assess future consumer spending trends?

A) Gross Domestic Product (GDP) growth rate

B) Consumer Price Index (CPI)

C) Unemployment rate

D) Consumer Confidence Index (CCI)

Answer: D) Consumer Confidence Index (CCI)

Explanation: The Consumer Confidence Index (CCI) is a leading economic indicator that gauges consumer optimism about the state of the economy. A high or rising CCI suggests that consumers are more likely to increase their spending, which can stimulate economic growth and benefit sectors reliant on consumer spending, like retail and technology. While GDP, CPI, and unemployment are important economic indicators, they do not directly measure consumer sentiment. The CCI is the best choice for understanding future consumer spending trends, making D the correct answer.

Question 3

A portfolio manager anticipates an economic downturn. Based on this macro-finance outlook, which asset class is the portfolio manager most likely to favor?

A) High-yield corporate bonds

B) Equities, particularly growth stocks

C) Government bonds

D) Commodities

Answer: C) Government bonds

Explanation: During economic downturns, investors typically seek safer assets, and government bonds are considered low-risk compared to corporate bonds or equities. Government bonds, especially those issued by stable economies, are highly regarded for their relative safety and tend to perform well during recessions due to their fixed income and the likelihood of central banks reducing interest rates to stimulate the economy. This often causes bond prices to increase as yields fall, making government bonds attractive in such environments. High-yield corporate bonds and equities generally carry higher risk and may perform poorly in downturns, while commodities can be volatile. Therefore, the correct answer is C.