Efficiently and precisely convert length measurements between meters and feet on Examples.com

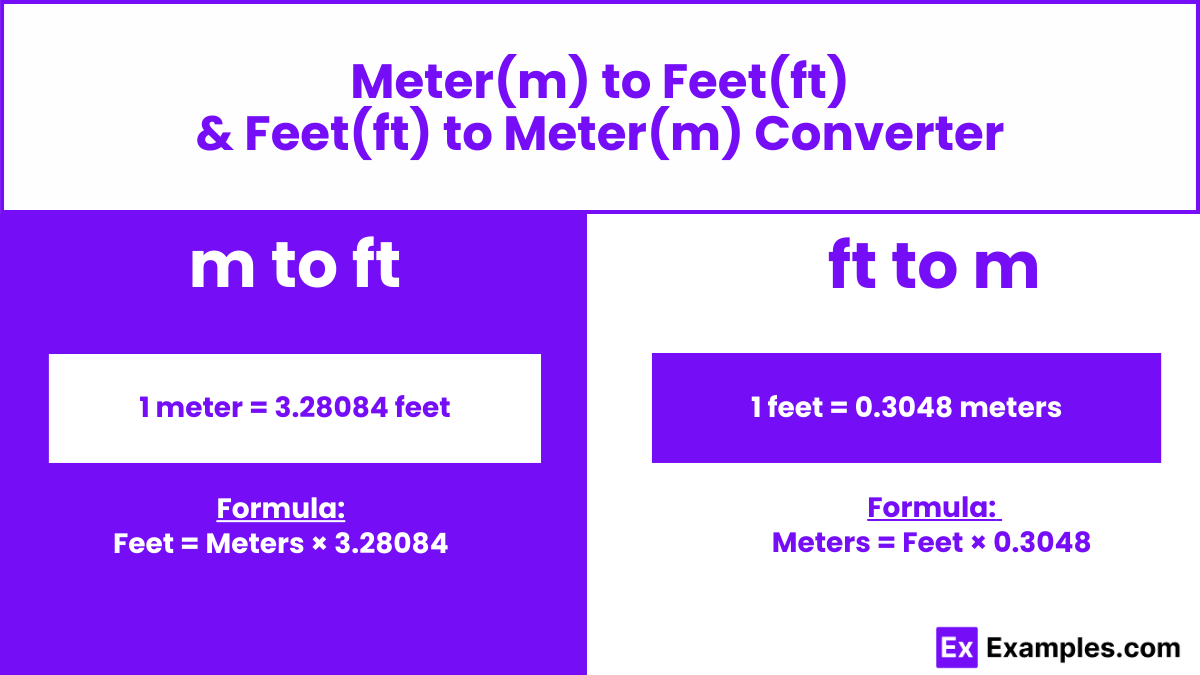

m to ft

Formula: Length in foot (ft) = Length in meters (m) × 3.28084

Meter:

Foot:

| Meters | Foot |

|---|---|

| 1 | 3.280840 |

ft to m

Formula: Length in meters (m) = Length in foot (ft) ÷ 3.28084

Foot:

Meter:

| Foot | Meters |

|---|---|

| 1 | 0.304800 |

Length Converters to Meter (m)

| Centimeter to Meter | Millimeter to Meter | Micrometer to Meter |

| Nanometer to Meter | Mile to Meter | Yard to Meter |

| Feet to Meter | Inch to Meter | Nautical Mile to Meter |

| Kilometer to Meter |

Length Converters to Feet (ft)

| Kilometer to Feet | Meter to Feet | Centimeter to Feet |

| Millimeter to Feet | Micrometer to Feet | Nanometer to Feet |

| Mile to Feet | Yard to Feet | Inch to Feet |

| Nautical Mile to Feet |

Conversion Factors:

Meters to Feet: 1 meter = 3.28084 feet

Feet to Meters: 1 foot = 0.3048 meters

How to Convert Meters to Feet:

To convert meters to feet, multiply the number of meters by 3.28084.

Feet = Meters × 3.28084

Example: Convert 5 meters to feet.

Feet = 5 × 3.28084 ≈ 16.4042 feet

How to Convert Feet to Meters:

To convert feet to meters, multiply the number of feet by 0.3048.

Meters = Feet × 0.3048

Example: Convert 10 feet to meters.

Meters = 10 × 0.3048 = 3.048 meters.

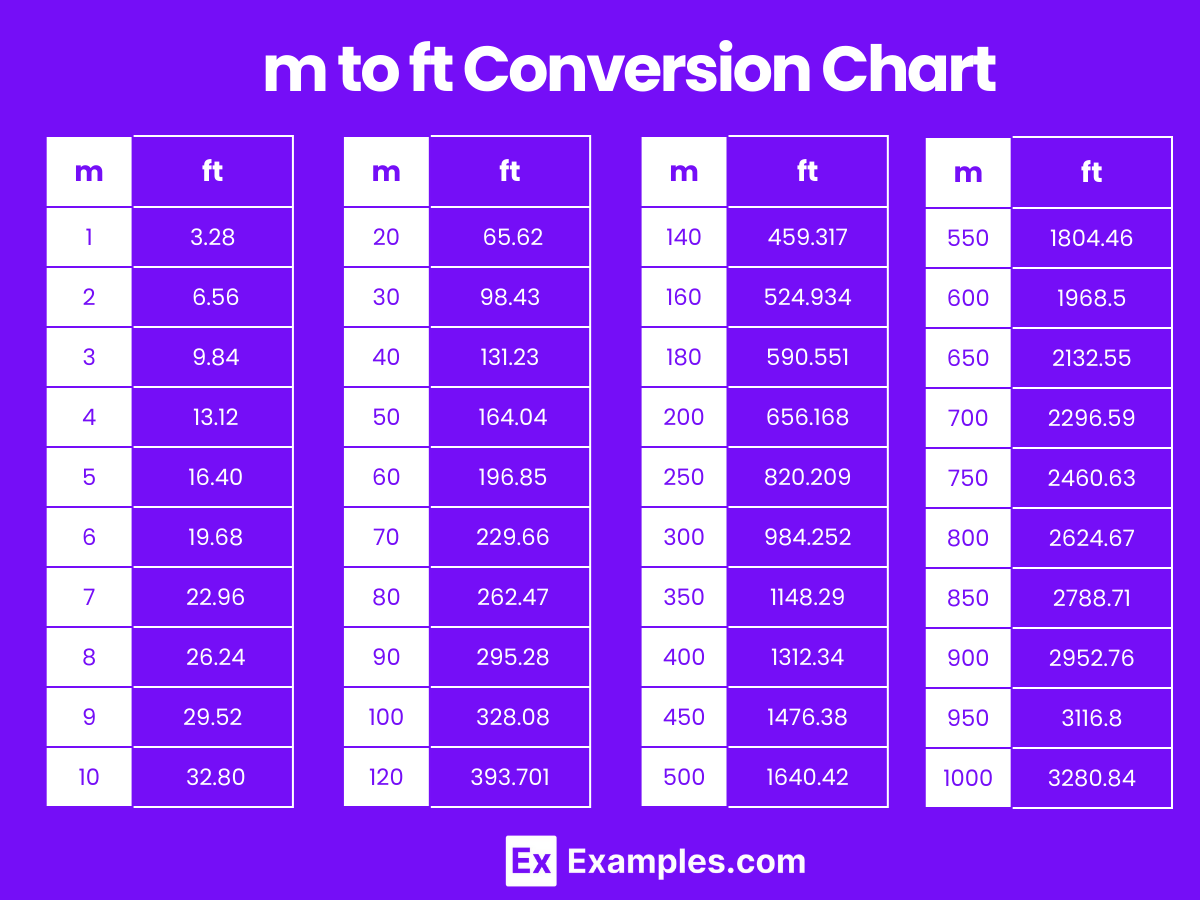

Meters to Feet Conversion Table

| Meters | Feet |

|---|---|

| 1m | 3.28ft |

| 2m | 6.56ft |

| 3m | 9.84ft |

| 4m | 13.12ft |

| 5m | 16.40ft |

| 6m | 19.68ft |

| 7m | 22.96ft |

| 8m | 26.24ft |

| 9m | 29.52ft |

| 10m | 32.80ft |

| 20m | 65.62ft |

| 30m | 98.43ft |

| 40m | 131.23ft |

| 50m | 164.04ft |

| 60m | 196.85ft |

| 70m | 229.66ft |

| 80m | 262.47ft |

| 90m | 295.28ft |

| 100m | 328.08ft |

m to ft Conversion Chart

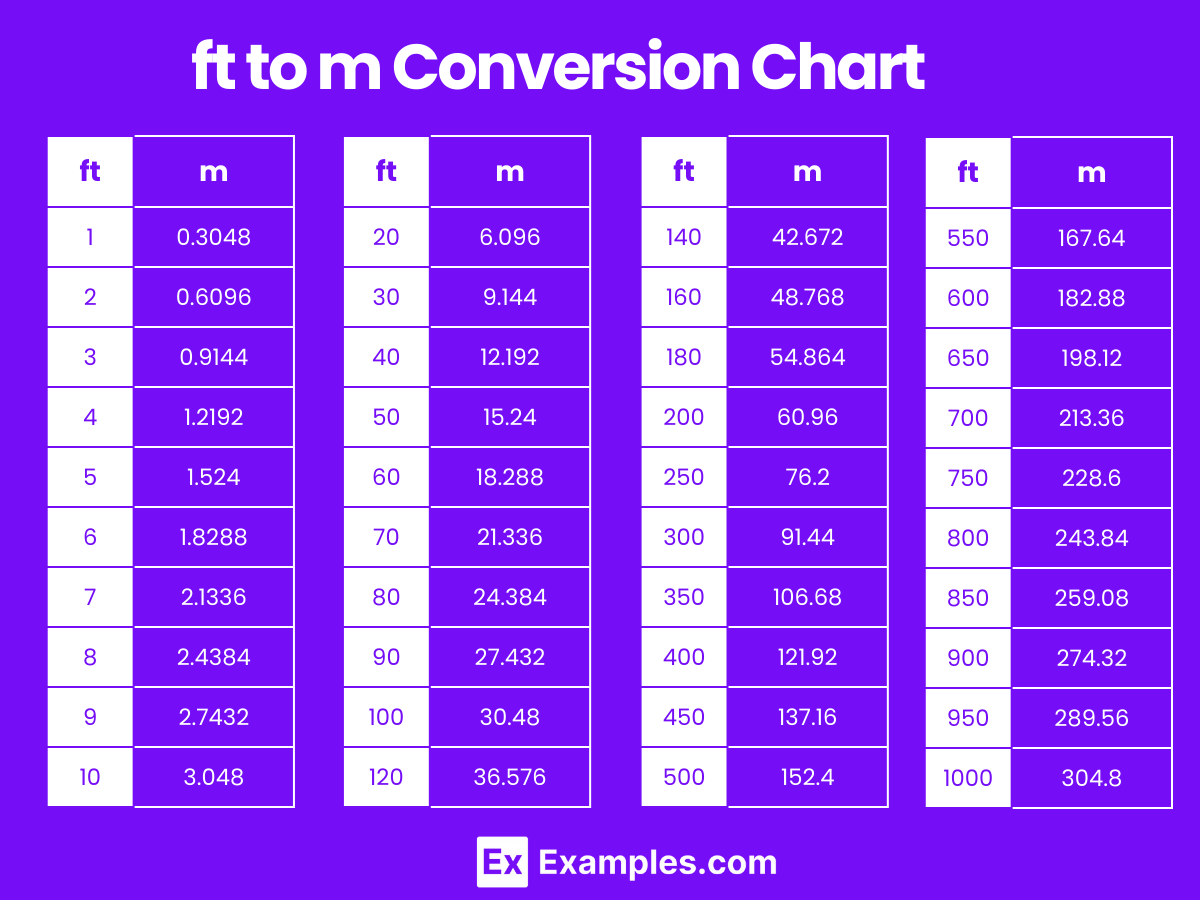

Feet to Meters Conversion Table

| Feet | Meters (m) |

|---|---|

| 1 ft | 0.3048 m |

| 2 ft | 0.6096 m |

| 3 ft | 0.9144 m |

| 4 ft | 1.2192 m |

| 5 ft | 1.524 m |

| 6 ft | 1.8288 m |

| 7 ft | 2.1336 m |

| 8 ft | 2.4384 m |

| 9 ft | 2.7432 m |

| 10 ft | 3.048 m |

| 20 ft | 6.096 m |

| 30 ft | 9.144 m |

| 40 ft | 12.192 m |

| 50 ft | 15.24 m |

| 60 ft | 18.288 m |

| 70 ft | 21.336 m |

| 80 ft | 24.384 m |

| 90 ft | 27.432 m |

| 100 ft | 30.48 m |

ft to m Conversion Chart

Difference Between Meters to Feet

| Aspect | Meters (m) | Feet (ft) |

|---|---|---|

| Conversion | 1 meter is equal to 3.28084 feet. | 1 foot is approximately 0.3048 meters. |

| Length | Meters are used for longer distances. | Feet are commonly used for shorter measurements. |

| Metric | Meters are a unit of the metric system. | Feet are part of the imperial system. |

| Symbol | The symbol for meters is “m”. | The symbol for feet is “ft”. |

| Precision | Meters are often used in scientific and engineering contexts for precise measurements. | Feet are more commonly used in everyday measurements such as height and room dimensions. |

1. Solved Examples on Converting Meters to Feet

Example 1: Convert 10 mm to Inches

10 mm / 25.4 = 0.3937 inches

Result: 10 mm is approximately 0.3937 inches.

Example 2: Convert 85 mm to Inches

85 mm / 25.4 = 3.3465 inches

Result: 85 mm is approximately 3.3465 inches.

Example 3: Convert 200 mm to Inches

200 mm / 25.4 = 7.8740 inches

Result: 200 mm equals about 7.8740 inches.

Example 4: Convert 456 mm to Inches

456 mm / 25.4 = 17.9528 inches

Result: 456 mm is approximately 17.9528 inches.

Example 5: Convert 1220 mm to Inches

1220 mm / 25.4 = 48.0315 inches

Result: 1220 mm equals about 48.0315 inches.

2. Solved Examples on Converting Feet to Meters

Example 1: Convert 3 feet to Meters

3 feet × 0.3048 meters/foot = 0.9144 meters

Result: 3 feet is approximately 0.9144 meters.

Example 2: Convert 6 feet to Meters

6 feet × 0.3048 meters/foot = 1.8288 meters

Result: 6 feet is approximately 1.8288 meters.

Example 3: Convert 9 feet to Meters

9 feet × 0.3048 meters/foot = 2.7432 meters

Result: 9 feet is approximately 2.7432 meters.

Example 4: Convert 12 feet to Meters

12 feet × 0.3048 meters/foot = 3.6576 meters

Result: 12 feet is approximately 3.6576 meters.

Example 5: Convert 15 feet to Meters

15 feet × 0.3048 meters/foot = 4.572 meters

Result: 15 feet is approximately 4.572 meters.

1. Why do we need to convert meters to feet?

Converting meters to feet is necessary for communicating measurements in different systems, as feet are commonly used in the United States and some other countries, while meters are used in the metric system.

2. Are meters and feet used interchangeably in all countries?

No, different countries have different preferences for units of measurement, but meters are widely used in the scientific community and many countries, while feet are more common in the United States and a few others.

3. Can I convert meters to feet for architectural or construction purposes?

Yes, architects, engineers, and construction professionals often convert measurements between meters and feet when designing and building structures.

4. Is the conversion from meters to feet reversible?

Yes, you can convert feet back to meters using the inverse of the conversion factor, which is approximately 0.3048

5. Can I use a calculator for converting meters to feet?

Yes, you can use a calculator or an online conversion tool for quick and accurate conversions.

6. What does 1 meter look like?

One meter is approximately the length from the tip of your fingers to your elbow. It’s slightly longer than a standard yardstick and roughly equivalent to three feet. Visualize a tall person standing upright, and their height from the ground to just above the waist is about one meter.