Equities are a core focus of technical analysis, offering insights into market dynamics, price behavior, and investor sentiment. This topic covers the characteristics and classifications of equities, including common and preferred stocks, and delves into various equity markets and their structures. It emphasizes the use of technical indicators and chart patterns to analyze price movements, trends, and volume in equity markets. Mastery of equity analysis is essential for identifying trading opportunities, assessing market conditions, and applying technical analysis strategies effectively. Understanding equities provides a foundational element for informed investment decisions and market forecasting.

Learning Objectives

In studying "Equities" for the CMT, you should learn to understand the characteristics, valuation, and performance of equity securities in financial markets. Gain insights into different types of equities, including common and preferred stocks, and their respective roles in portfolios. Analyze key valuation methods, such as fundamental and technical analysis, to assess stock performance and potential return. Develop proficiency in interpreting stock market indices, trends, and indicators that influence equity prices. Evaluate factors affecting equity markets, such as economic cycles, industry dynamics, and investor sentiment. Additionally, apply these concepts to identify investment opportunities, assess risk, and develop equity trading strategies aligned with market trends and technical indicators.

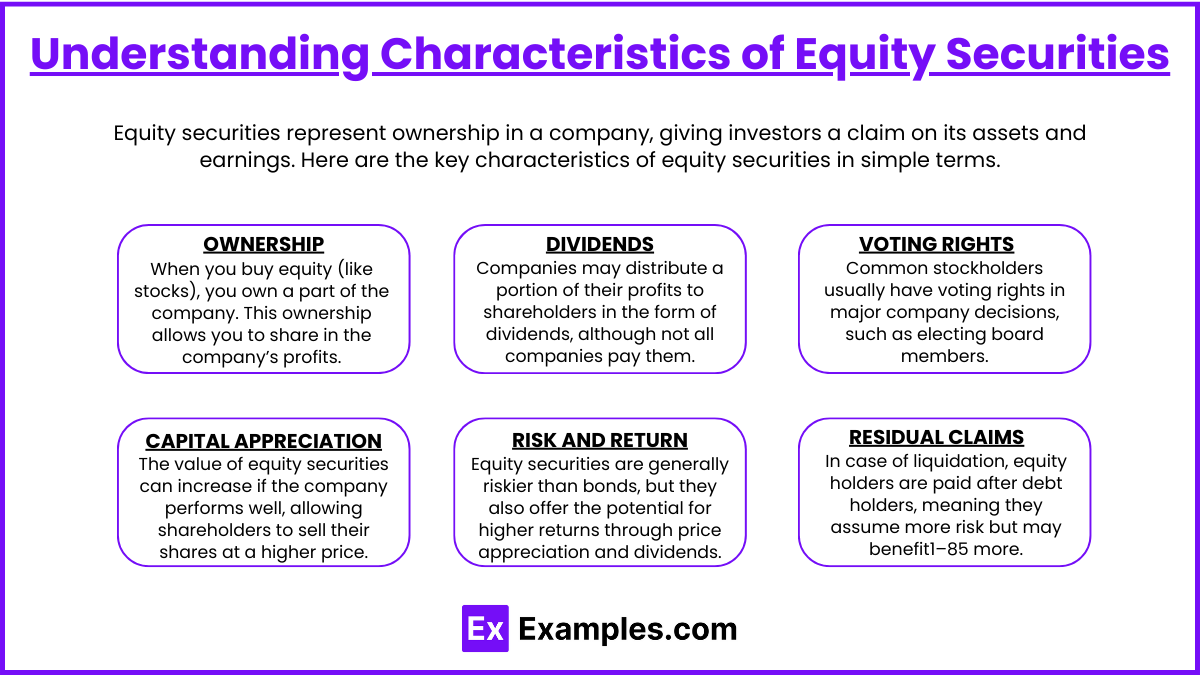

Understanding Characteristics of Equity Securities

Equity securities represent ownership in a company, giving investors a claim on its assets and earnings. Here are the key characteristics of equity securities in simple terms:

Ownership: When you buy equity (like stocks), you own a part of the company. This ownership allows you to share in the company’s profits.

Dividends: Companies may distribute a portion of their profits to shareholders in the form of dividends, although not all companies pay them.

Voting Rights: Common stockholders usually have voting rights in major company decisions, such as electing board members.

Capital Appreciation: The value of equity securities can increase if the company performs well, allowing shareholders to sell their shares at a higher price.

Risk and Return: Equity securities are generally riskier than bonds, but they also offer the potential for higher returns through price appreciation and dividends.

Residual Claims: In case of liquidation, equity holders are paid after debt holders, meaning they assume more risk but may benefit1–85 more if the company is successful.

Types of Equities and Their Roles in Portfolios

Equities come in various types, each serving specific roles in an investment portfolio. Different equity types provide unique benefits, such as growth, income, and stability, helping investors achieve diverse financial goals. Here’s an overview of the main types of equities and how they function in portfolios:

1. Common Stock

Role in Portfolio: Common stock represents the basic form of ownership in a company, offering potential for capital appreciation and, sometimes, dividends. It is typically used to drive growth within a portfolio.

2. Preferred Stock

Role in Portfolio: Preferred stock combines features of both equities and bonds, offering fixed dividend payments with priority over common stock in dividend payouts and liquidation. It is used to provide stable income with lower volatility.

3. Growth Stocks

Role in Portfolio: Growth stocks are shares in companies expected to grow at an above-average rate compared to the market. These stocks generally reinvest profits rather than paying dividends, aiming for capital appreciation.

4. Value Stocks

Role in Portfolio: Value stocks are shares of companies considered undervalued in price relative to their fundamentals. They are typically well-established companies with steady cash flows and dividends, offering both growth potential and income.

5. Income Stocks

Role in Portfolio: Income stocks are shares in companies that consistently pay high dividends, making them ideal for investors focused on generating income rather than capital gains.

6. Blue-Chip Stocks

Role in Portfolio: Blue-chip stocks are shares in large, reputable companies with a history of stable performance, making them a reliable choice for conservative investors seeking stability and steady returns.

7. Small-Cap Stocks

Role in Portfolio: Small-cap stocks represent companies with a smaller market capitalization, offering high growth potential but with increased volatility. They are used for portfolio diversification and long-term growth.

8. International Stocks

Role in Portfolio: International stocks are equities issued by companies outside an investor’s home country, adding global diversification and exposure to foreign markets.

9. Dividend Growth Stocks

Role in Portfolio: Dividend growth stocks are companies with a track record of consistently increasing dividends, combining income with the potential for capital appreciation.

Key Valuation Methods: Fundamental vs. Technical Analysis

Fundamental and technical analysis are two main approaches used to evaluate and value financial assets. Each method has a distinct focus and is used by investors and traders to make informed decisions based on either the intrinsic value of an asset or its price movement trends. Here’s a breakdown of both methods in simple terms:

1. Fundamental Analysis

Fundamental analysis focuses on evaluating an asset’s intrinsic value by examining financial and economic factors. This method is commonly used to assess a company’s long-term potential and involves looking at financial statements, industry trends, and economic conditions.

Purpose: To determine an asset’s true or “fair” value based on its financial health and future growth potential.

Key Factors: Financial statements (income, balance sheet, cash flow), industry position, economic indicators, and management quality.

Example: Analyzing Apple’s revenue growth, profit margins, and product innovation to decide if its stock is undervalued or overvalued.

2. Technical Analysis

Technical analysis, on the other hand, focuses on price movement and market behavior. Instead of looking at a company’s fundamentals, it studies historical price charts, trading volume, and various technical indicators to predict future price trends. It’s mostly used for short- to medium-term trading.

Purpose: To identify trading opportunities by examining historical price patterns and market trends.

Key Tools: Price charts, moving averages, Relative Strength Index (RSI), and support/resistance levels.

Example: Using chart patterns and RSI to predict whether Tesla’s stock price is likely to increase or decrease in the near future.

Interpreting Stock Market Indices, Trends, and Indicators

Stock market indices, trends, and indicators provide valuable insights into the overall market, sectors, and individual stock performance. By understanding these components, investors can gauge market sentiment, identify economic conditions, and make informed investment decisions.

1. Stock Market Indices

Market indices represent the performance of a group of stocks and serve as a benchmark for the overall market or specific sectors. Examples include the S&P 500, Dow Jones Industrial Average (DJIA), and NASDAQ Composite.

Purpose: To track the performance of specific segments of the market and provide a snapshot of market trends.

Interpretation: A rising index suggests an overall positive market sentiment, while a declining index indicates bearish sentiment or economic concerns.

Example: If the S&P 500 is consistently rising, it indicates that large-cap stocks in the U.S. are generally performing well.

2. Market Trends

Market trends reflect the general direction in which stock prices are moving over time. They can be bullish (upward), bearish (downward), or neutral (sideways), helping investors decide when to buy or sell.

Bull Market: An upward trend characterized by rising stock prices, often fueled by strong economic growth and positive investor sentiment.

Bear Market: A downward trend with falling stock prices, usually driven by economic downturns or negative market sentiment.

Sideways/Range-Bound Market: A period when stock prices move within a narrow range, signaling market indecision.

Example: In a bullish trend, investors might feel confident in buying stocks, expecting prices to continue rising.

3. Technical Indicators

Technical indicators are tools used to analyze stock price movements, volume, and momentum. They help traders and analysts predict potential price movements and identify market conditions.

Moving Averages: Help smooth out price data and identify the direction of a trend. A stock trading above its moving average is generally in an uptrend.

Relative Strength Index (RSI): An oscillator that shows overbought (above 70) or oversold (below 30) conditions, helping predict potential reversals.

MACD (Moving Average Convergence Divergence): Indicates trend changes and momentum, with a bullish signal when the MACD line crosses above the signal line.

Example: If a stock’s RSI is below 30, it may be considered oversold, potentially signaling a buying opportunity.

Examples

Example 1: Common Stocks

Common stocks represent ownership in a company and provide shareholders with voting rights at annual meetings. For example, if an investor purchases common stock in a technology company, they have a claim on a portion of the company's assets and earnings. Common stockholders may receive dividends, although these payments are not guaranteed and depend on the company’s profitability and board decisions.

Example 2: Preferred Stocks

Preferred stocks are a type of equity that typically provides shareholders with fixed dividends and priority over common stockholders in the event of liquidation. For instance, if a company goes bankrupt, preferred shareholders will be paid before common shareholders. While preferred stocks often do not carry voting rights, they are an attractive option for investors seeking stable income.

Example 3: Exchange-Traded Funds (ETFs)

Equity ETFs are investment funds that trade on stock exchanges, similar to individual stocks. They typically hold a diversified portfolio of equities, allowing investors to gain exposure to a specific market sector or index without having to purchase each stock individually. For example, an investor might buy an ETF that tracks the S&P 500, gaining exposure to 500 of the largest U.S. companies through a single investment.

Example 4: Initial Public Offerings (IPOs)

An IPO occurs when a company offers its shares to the public for the first time. This event allows the company to raise capital for growth and development. For example, a startup may decide to go public to fund its expansion plans. Investors who purchase shares during the IPO may benefit if the company's stock price rises after the initial offering.

Example 5:

Dividend stocks are shares of companies that pay regular dividends to their shareholders. These stocks are often sought after by income-focused investors looking for a steady cash flow in addition to potential capital appreciation. For instance, a utility company may provide consistent dividends due to its stable revenue stream, making it an attractive equity option for those seeking reliable income.

Practice Questions

Question 1

What does owning equity in a company typically grant an investor?

A) A fixed return on investment

B) Voting rights in company decisions

C) Priority in receiving dividends over debt holders

D) Guaranteed repayment of the initial investment

Correct Answer: B) Voting rights in company decisions.

Explanation: Owning equity, or shares, in a company generally provides shareholders with voting rights, allowing them to participate in important company decisions, such as electing the board of directors or approving major corporate policies. Unlike debt holders, equity investors do not have a fixed return or guaranteed repayment of their initial investment, and dividends are not prioritized over debt obligations.

Question 2

Which of the following best describes the primary market in relation to equities?

A) A market where previously issued shares are traded

B) A market where new shares are issued to the public for the first time

C) A market focused on the trading of bonds

D) A market primarily for derivatives and options trading

Correct Answer: B) A market where new shares are issued to the public for the first time.

Explanation: The primary market is where companies issue new shares to raise capital, typically through an Initial Public Offering (IPO). Investors purchase these shares directly from the company. In contrast, the secondary market is where existing shares are traded between investors. This distinction is essential for understanding how equity financing works.

Question 3

What is a common reason for a company to issue additional equity?

A) To reduce its tax liabilities

B) To pay off existing debt

C) To raise funds for expansion or new projects

D) To increase the price of existing shares

Correct Answer: C) To raise funds for expansion or new projects.

Explanation: Companies often issue additional equity to raise capital for various purposes, including funding expansion, investing in new projects, or acquiring other businesses. Issuing equity provides companies with necessary financial resources without incurring additional debt. While paying off existing debt can be a motive, it is not the primary reason for issuing new equity. Additionally, issuing more shares does not inherently increase the price of existing shares, as it can dilute ownership.