Preparing for the CMT Exam requires a solid understanding of the "Risk Control" principles that are essential for managing uncertainties and safeguarding investments. This involves evaluating various risk factors such as market volatility, credit risk, and operational risks. Candidates must also be familiar with techniques for risk assessment, including Value at Risk (VaR), stress testing, and scenario analysis. Additionally, mastering position sizing, stop-loss orders, and portfolio diversification strategies are crucial for effective risk management. A solid grasp of these concepts helps candidates mitigate potential losses, optimize returns, and ultimately contribute to sound and profitable trading decisions.

Learning Objectives

In studying Risk Control for the CMT Exam, you should learn to understand its importance in managing risks and protecting investments in real-world trading. Effective risk control involves assessing various risk factors such as market volatility, credit risks, and operational threats. Techniques like stop-loss strategies, position sizing, risk assessment models, and portfolio diversification are essential. By mastering these risk management techniques, candidates can better navigate market uncertainties, minimize potential losses, and ensure sustainable portfolio performance, which is crucial for success in the CMT Exam.

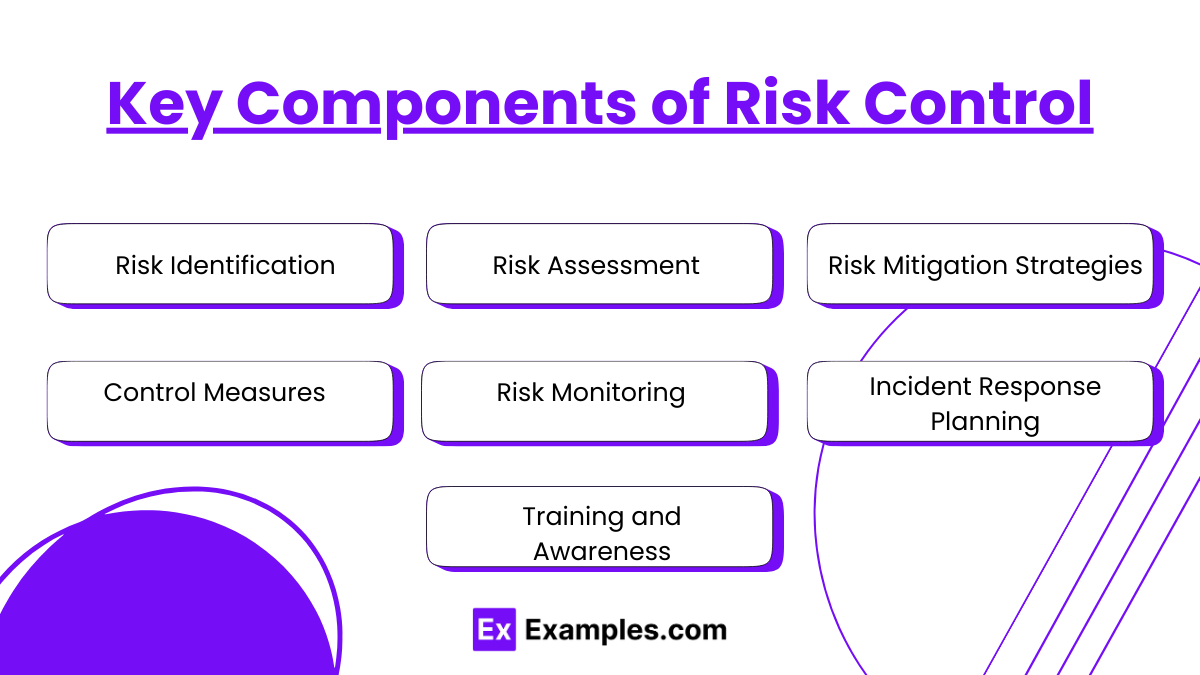

Key Components of Risk Control

The key components of risk control involve various strategies and processes designed to minimize or eliminate risks in an organization. Here are the primary components:

Risk Identification: The process of recognizing potential risks that may affect the organization, including financial, operational, strategic, or compliance risks.

Risk Assessment: Analyzing identified risks to determine their potential impact and the likelihood of occurrence. This helps prioritize risks that require attention.

Risk Mitigation Strategies: Developing and implementing strategies to reduce or eliminate the potential impact of risks. These strategies may include risk avoidance, risk transfer (e.g., insurance), risk acceptance, or risk reduction.

Control Measures: Establishing policies, procedures, and controls to monitor and manage risks effectively. This includes implementing safeguards and using technology to detect and manage risks in real-time.

Risk Monitoring: Continuously tracking and reviewing the effectiveness of risk control measures. This ensures that controls remain effective and that new risks are identified and managed appropriately.

Incident Response Planning: Preparing for unforeseen risks or incidents by creating an incident response plan that details how to address emergencies or disruptions caused by risks.

Training and Awareness: Educating employees and stakeholders about risks and the importance of risk management to ensure compliance with risk control practices.

Risk Control Techniques

Risk Control Techniques refer to the methods and strategies employed to minimize, manage, and mitigate risks within an organization or system. These techniques are integral to effective risk management and are used to reduce the impact of potential threats on the achievement of business objectives. Below are some common risk control techniques:

1. Risk Avoidance

Description: Involves changing plans or processes to eliminate risks entirely. This may include avoiding activities that introduce risk or selecting safer alternatives.

Example: A company might decide not to expand into a high-risk market to avoid potential financial losses.

2. Risk Reduction

Description: This technique aims to lessen the severity or likelihood of a risk. It involves implementing controls or strategies that minimize the impact of the risk if it occurs.

Example: Installing fire suppression systems in a factory to reduce the risk of fire damage.

3. Risk Sharing (Transfer)

Description: Involves shifting the responsibility for risk to a third party. This is typically done through insurance, outsourcing, or entering into contracts that pass the risk to others.

Example: A business purchasing insurance to cover losses from property damage.

4. Risk Retention

Description: The decision to accept the risk and bear the consequences if the risk materializes. This is often used when the cost of mitigating the risk is higher than the potential impact.

Example: A small company might choose to bear the cost of certain liabilities instead of purchasing costly insurance.

5. Risk Diversification

Description: Spreading risk across multiple projects, investments, or business lines to reduce the impact of a failure in any one area.

Example: A company diversifying its product offerings to reduce reliance on a single market segment.

6. Control Systems and Monitoring

Description: Establishing systems to monitor and control risk on an ongoing basis. This includes internal audits, security measures, and regular performance evaluations.

Example: A company using surveillance systems to monitor security risks on-site.

7. Contingency Planning

Description: Developing and maintaining contingency plans to prepare for unexpected events or risks. This includes having backup systems, emergency response teams, and predefined protocols.

Example: A business having a disaster recovery plan in place in case of a cyberattack or natural disaster.

8. Risk Acceptance

Description: The decision to accept a level of risk as part of normal operations. This is typically done when the risk is minor or the likelihood of occurrence is very low.

Example: A company may accept the risk of minor employee absences due to illness as a normal part of operations.

Importance of Risk Control

Risk control is a critical aspect of business and organizational management. Its primary goal is to identify, assess, and mitigate risks that could negatively impact the organization. By effectively managing risks, businesses can reduce the likelihood of unforeseen disruptions and financial losses, while also ensuring compliance with regulatory requirements. Below are some key points highlighting the importance of risk control:

1. Minimizes Losses

Effective risk control strategies help organizations reduce the financial and operational impact of potential risks. By addressing risks early, businesses can implement measures that prevent costly incidents, leading to significant long-term savings.

2. Ensures Business Continuity

Risk control measures contribute to maintaining business continuity during uncertain or adverse conditions. These measures allow businesses to continue operations even when faced with challenges such as market fluctuations, supply chain disruptions, or natural disasters.

3. Protects Reputation

The reputation of a company is often linked to its ability to manage risks. A well-structured risk control framework can prevent incidents that may harm the brand, enhancing trust and credibility with customers, partners, and stakeholders.

4. Improves Decision-Making

Having a clear risk control strategy in place allows for more informed decision-making. It helps executives and managers anticipate potential challenges and make proactive decisions that align with the organization’s objectives and risk appetite.

5. Promotes Regulatory Compliance

Many industries face strict regulatory requirements regarding risk management and safety. Risk control ensures that organizations meet these legal obligations, helping avoid penalties, fines, and legal issues.

Examples

Example 1. Establishing Risk Assessment Frameworks

Implementing a structured risk assessment framework is essential for identifying, assessing, and mitigating potential risks. Risk control mechanisms, such as regular risk audits, help prioritize risks based on their likelihood and impact, allowing organizations to focus resources on mitigating the most critical threats. This proactive approach ensures that all stakeholders are aware of the risks they face and can act accordingly.

Example 2. Implementing Control Measures

In financial management, risk control involves setting up policies, procedures, and limits to minimize exposure to financial loss. For example, introducing limits on stock purchases or setting stop-loss orders in investment portfolios can protect assets from major market downturns. Similarly, insurance coverage for high-value assets can provide financial protection against unforeseen events.

Example 3. Monitoring and Reviewing Risks Regularly

Risk control is an ongoing process, requiring regular monitoring of identified risks and their mitigation strategies. By reviewing the effectiveness of implemented controls through audits, feedback loops, and performance metrics, businesses can adjust their approach to risk management. This ensures that control measures remain relevant and effective in changing environments.

Example 4. Training and Awareness Programs

One critical aspect of risk control is ensuring that employees understand the risks associated with their work and are trained in risk-reduction techniques. For example, in cybersecurity, employees might undergo regular training on recognizing phishing attempts or using secure passwords. This reduces human errors and increases the overall security of the organization’s infrastructure.

Example 5. Emergency Response and Crisis Management Plans

Risk control also involves preparing for potential crises by creating emergency response protocols. For instance, businesses in high-risk industries often have detailed crisis management plans that outline how to react in the event of natural disasters, data breaches, or product recalls. These plans help minimize damage and restore operations as quickly as possible, demonstrating effective risk control through preparedness.

Practice Questions

Question 1

Which of the following is a primary objective of risk control in an organization?

a) To eliminate all risks

b) To reduce the likelihood and impact of risks

c) To transfer all risks to a third party

d) To ignore risks and continue operations

Answer: b) To reduce the likelihood and impact of risks

Explanation:

The main objective of risk control is to identify, assess, and minimize the likelihood and impact of potential risks on the organization. This doesn't mean eliminating all risks, as some risks are inherent to business operations. Risk control involves implementing strategies to manage risks effectively, either by reducing their probability, minimizing their consequences, or accepting and monitoring them if they are unavoidable.

Question 2

Which of the following is an example of risk mitigation?

a) Purchasing insurance to cover potential financial losses

b) Ignoring potential risks in a project plan

c) Increasing the exposure to high-risk activities

d) Outsourcing all decision-making processes

Answer: a) Purchasing insurance to cover potential financial losses

Explanation:

Risk mitigation refers to actions taken to reduce or control the probability or impact of a risk. Purchasing insurance is a common risk mitigation strategy, as it helps the organization financially recover from potential losses. Other strategies include diversifying investments, implementing backup systems, or strengthening security measures. Ignoring risks or increasing exposure to risks would increase the potential negative impact on the organization.

Question 3

Which of the following best describes risk control during the implementation phase of a project?

a) Risk avoidance through the cancellation of the project

b) Identifying new risks without taking any preventive measures

c) Monitoring and adjusting strategies to mitigate risks as the project progresses

d) Focusing only on major risks and ignoring minor ones

Answer: c) Monitoring and adjusting strategies to mitigate risks as the project progresses

Explanation:

During the implementation phase, it is essential to continuously monitor and assess the risks that may arise and adjust mitigation strategies accordingly. As the project progresses, new risks can emerge, and existing ones may change in severity. Risk control during implementation involves actively managing and adapting the risk response plans to ensure that risks do not derail the project's success. Risk avoidance (cancelling the project) or ignoring minor risks may not be practical or beneficial in most cases, as every project carries some level of uncertainty.