Preparing for the CMT Exam requires a comprehensive understanding of “The Statistics of Backtesting,” a crucial component of technical analysis. Mastery of statistical methods used to evaluate the historical performance of trading strategies is essential. This knowledge provides insights into the reliability and predictive power of these strategies, critical for achieving high scores on the CMT Exam.

Learning Objective

In studying “The Statistics of Backtesting” for the CMT Exam, you should learn to understand the statistical tools and methodologies used to evaluate the effectiveness of trading strategies based on historical data. Analyze how key metrics such as Sharpe ratio, maximum drawdown, and win-loss ratios are used to determine a strategy’s risk-adjusted returns and sustainability. Evaluate the principles behind curve fitting and data snooping risks. Additionally, explore how backtesting contributes to strategy refinement by identifying potential improvements and weaknesses. Apply this knowledge to assess the reliability and potential future performance of trading strategies, ensuring robustness before live implementation.

Introduction to Backtesting

Backtesting is a crucial technique in finance, used to evaluate the effectiveness of trading strategies and financial models by testing them against historical data. This process helps traders and investors gauge how a strategy would have performed in the past, providing insights into its potential future performance under similar conditions. Here’s an introduction to the fundamental aspects of backtesting:

Purpose of Backtesting

The primary purpose of backtesting is to assess the viability of a trading strategy or model by simulating its application to historical financial data. This allows investors to:

- Evaluate Performance: Determine the potential returns and the risk associated with a strategy.

- Identify Strengths and Weaknesses: Understand under what market conditions a strategy performs well or poorly.

- Optimize Strategies: Modify parameters of the strategy to achieve better performance based on historical results.

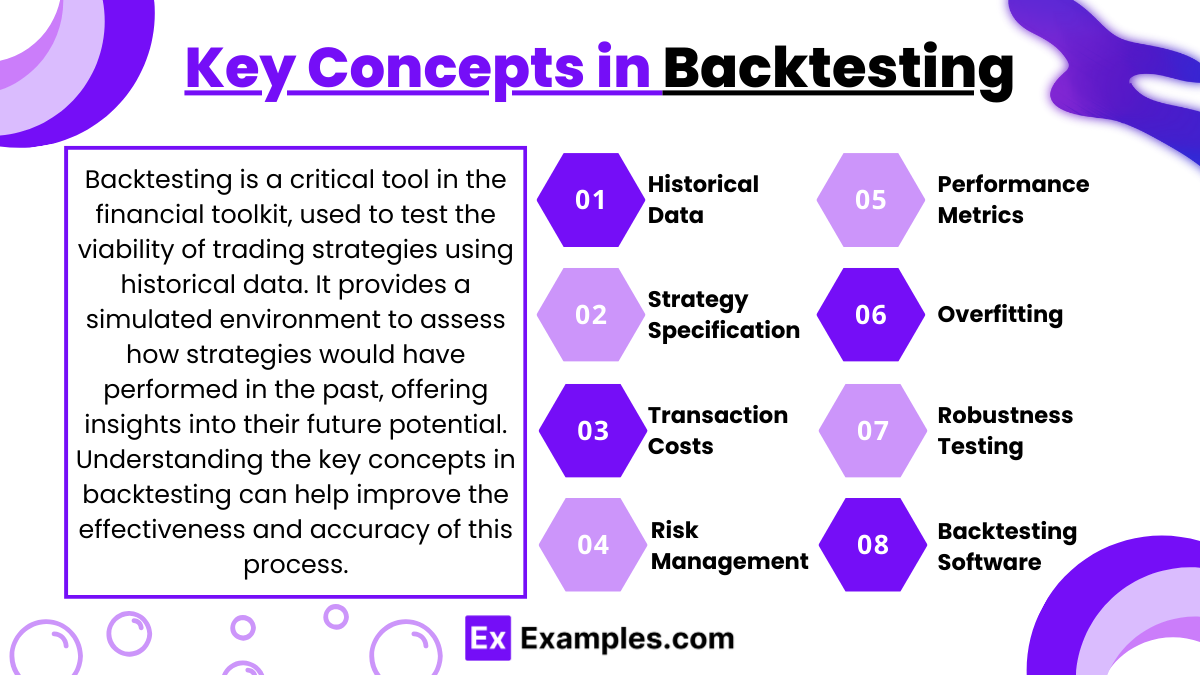

Key Concepts in Backtesting

Backtesting is a critical tool in the financial toolkit, used to test the viability of trading strategies using historical data. It provides a simulated environment to assess how strategies would have performed in the past, offering insights into their future potential. Understanding the key concepts in backtesting can help improve the effectiveness and accuracy of this process. Here are the essential concepts involved in backtesting:

- Historical Data

- Use accurate and comprehensive data.

- Avoid look-ahead bias to ensure data was available at the time of trading.

- Strategy Specification

- Define clear, consistent rules for entry, exit, and position sizing.

- Transaction Costs

- Include all relevant costs like spreads, commissions, and slippage.

- Assess how these costs impact the strategy’s profitability.

- Risk Management

- Calculate risk metrics such as maximum drawdown and Sharpe ratio.

- Perform stress testing to evaluate performance in extreme market conditions.

- Performance Metrics

- Measure profitability, consistency, and compare against benchmarks.

- Overfitting

- Avoid complex models that fit too closely to historical data.

- Use techniques like cross-validation to test generalizability.

- Robustness Testing

- Test sensitivity to changes in parameters.

- Conduct out-of-sample testing to ensure the strategy performs well on unseen data.

- Backtesting Software and Tools

- Utilize automated backtesting tools for efficiency.

- Consider custom software for complex strategies.

Statistical Techniques for Backtesting

Statistical techniques play a critical role in backtesting trading strategies, providing a framework to rigorously assess and refine these strategies based on historical data. These techniques help quantify the performance, validate the assumptions, and evaluate the robustness of trading models. Here’s a breakdown of some key statistical techniques used in backtesting:

- Hypothesis Testing

- Determines if strategy results are due to skill or luck using t-tests to assess statistical significance.

- Confidence Intervals

- Provides a range for expected performance metrics, helping quantify the uncertainty in strategy returns.

- Sharpe and Sortino Ratios

- Measures risk-adjusted returns, with Sharpe using total volatility and Sortino focusing on downside risk.

- Monte Carlo Simulations

- Simulates various outcome probabilities using random return paths to estimate performance thresholds.

- Regression Analysis

- Explores relationships between returns and predictive factors; adjusts for market conditions and risk factors.

- Backtest Overfitting

- Uses cross-validation and walk-forward analysis to ensure robust performance on out-of-sample data.

- Variance Ratio Test

- Tests for autocorrelations in returns, indicating potential exploitable non-random patterns.

- Stationarity Tests

- Checks if the series’ statistical properties like mean and variance are constant over time, crucial for time series models (e.g., Augmented Dickey-Fuller and KPSS tests).

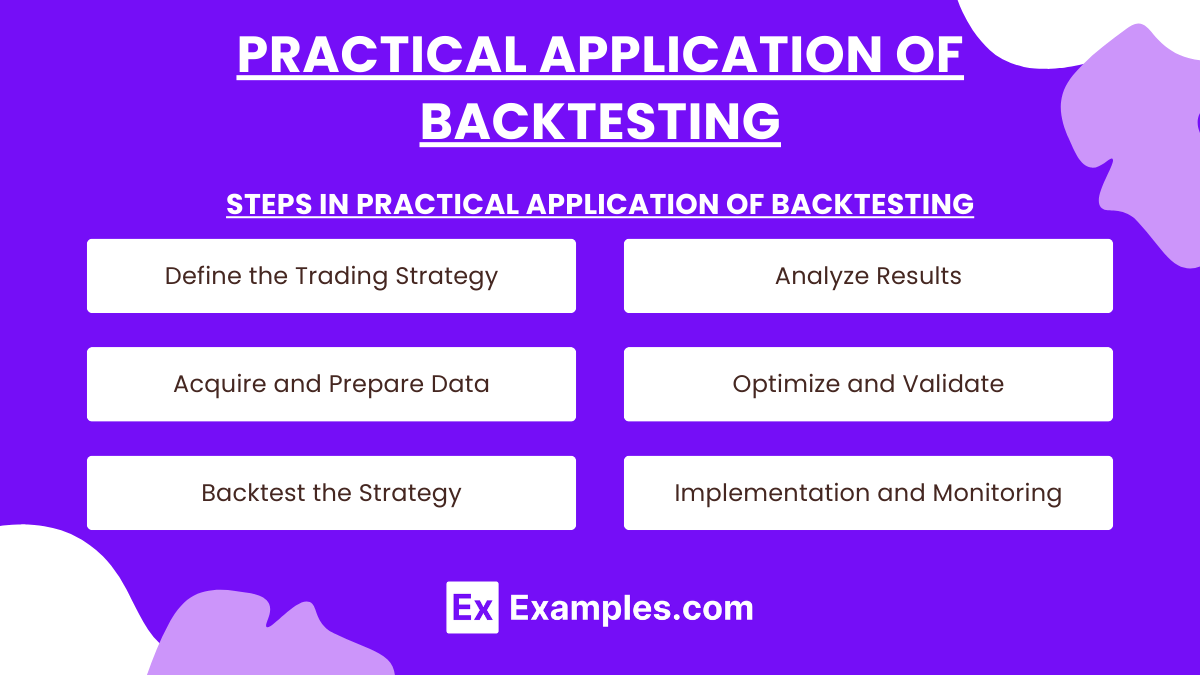

Practical Application of Backtesting

The practical application of backtesting in finance is a systematic approach that traders and portfolio managers use to validate the effectiveness of trading strategies based on historical data. This method allows for assessing potential strategies before risking actual capital. Here’s how backtesting is practically applied in the financial industry:

Steps in Practical Application of Backtesting

- Define the Trading Strategy: Clearly articulate rules for trade entries and exits based on specific conditions like technical indicators or economic data.

- Acquire and Prepare Data: Ensure data is accurate and adjusted for corporate actions. Choose the appropriate frequency (minute, hourly, daily) matching the trading frequency.

- Backtest the Strategy: Use backtesting software or programming frameworks to simulate trading using historical data.

- Analyze Results: Evaluate using metrics such as net profit, maximum drawdown, and Sharpe ratio. Assess risk and consistency across different market conditions.

- Optimize and Validate: Adjust parameters to improve strategy efficacy, conduct robustness testing, and perform out-of-sample and forward testing to validate performance.

- Implementation and Monitoring: If validated, implement the strategy in live trading but continue monitoring and adjusting as market conditions change.

Examples

Example 1: Evaluating a Moving Average Crossover Strategy

Backtesting a simple moving average crossover strategy where a short-term moving average crossing above a long-term moving average signals a buy, and vice versa for a sell signal. The backtest evaluates performance metrics over 10 years of daily stock data to determine the strategy’s profitability and drawdown periods.

Example 2: Testing Volatility Breakout Systems

A trader uses backtesting to assess a volatility breakout system where trades are initiated when price moves more than a set percentage from a moving average. Historical forex market data is used to test how often these breakouts result in profitable trades versus false signals.

Example 3: Risk-Adjusted Return Analysis

Backtesting a portfolio of mixed assets (stocks, bonds, commodities) with a focus on maximizing the Sharpe Ratio. The strategy tests different asset allocations to find the combination that provides the best return per unit of risk as measured by historical volatility and correlation data.

Example 4: Sector Rotation Strategy Evaluation

Implementing backtesting on a sector rotation strategy based on economic cycle phases. The strategy allocates capital to different sectors (e.g., technology, industrials, consumer goods) depending on the stage of the economic cycle. Historical sector performance data and macroeconomic indicators are used to test the strategy’s effectiveness over multiple cycles.

Example 5: Effect of Transaction Costs on Strategy Returns

A backtest that includes various levels of transaction costs to evaluate how these expenses impact the net returns of a day trading strategy. This involves simulating trades with increasing transaction cost percentages to identify the point at which the strategy becomes unprofitable.

Practice Questions

Question 1

What is the primary ethical consideration when presenting backtesting results to potential clients?

A. Ensuring that the backtested performance is based on the most profitable strategies.

B. Including the maximum number of backtested strategies to demonstrate extensive research.

C. Disclosing all relevant assumptions and limitations of the backtesting process.

D. Highlighting only those results that match or exceed industry benchmarks.

Answer:

C. Disclosing all relevant assumptions and limitations of the backtesting process.

Explanation:

Ethically presenting backtesting results requires full transparency about the assumptions, methodologies, and limitations involved in the backtesting process. This ensures that clients or potential investors have a clear understanding of how the results were derived and the potential risks or inaccuracies these results may entail. Disclosing all relevant information upholds the integrity of the financial analysis and adheres to ethical standards by preventing misleading presentations.

Question 2

What should a technician do to avoid data-snooping bias when backtesting a trading strategy?

A. Test the strategy on multiple data sets, including out-of-sample periods.

B. Use a single highly successful historical period for testing.

C. Adjust the strategy parameters until desired results are achieved.

D. Focus on short-term trading periods to minimize the risk of bias.

Answer:

A. Test the strategy on multiple data sets, including out-of-sample periods.

Explanation:

To avoid data-snooping bias, which occurs when a strategy is overly tailored to fit historical data, it is ethical and effective to test the strategy across multiple and diverse data sets. This should include out-of-sample data to ensure that the strategy’s effectiveness is not just a result of overfitting to a specific historical dataset. This approach enhances the credibility and robustness of the backtesting results.

Question 3

Which of the following best demonstrates ethical backtesting practices?

A. Optimizing the strategy parameters until past performance projections meet the client’s expectations.

B. Regularly updating backtesting parameters to align with changing market conditions.

C. Presenting both successful and unsuccessful past performance results of the strategy.

D. Using proprietary software tools to ensure competitors cannot replicate the results.

Answer:

C. Presenting both successful and unsuccessful past performance results of the strategy.

Explanation:

Ethically sound backtesting practices involve presenting a balanced view of a strategy’s past performance, including both its successes and failures. This comprehensive disclosure provides clients with a realistic understanding of what to expect and the potential risks involved, thus supporting informed decision-making. It also demonstrates the analyst’s commitment to transparency and honesty, key components of ethical conduct in financial services.