On the CPA Exam, ethics and professional responsibilities are fundamental to the practice of public accounting, ensuring integrity and public trust. You’ll explore ethical frameworks, the AICPA Code of Professional Conduct, and responsibilities toward clients and the public. This area also covers federal tax procedures, including compliance, audits, appeals, and penalties. Understanding professional conduct, ethical obligations, and tax regulations is essential for mastering the Regulation (REG) section of the exam, as these concepts are crucial to practicing accounting with accountability and adherence to legal standards.

Learning Objectives

In studying “Area I – Ethics, Professional Responsibilities, and Federal Tax Procedures” for the CPA exam, you should learn to identify the ethical standards and professional responsibilities required of certified public accountants. Understand the AICPA Code of Professional Conduct, including principles related to integrity, objectivity, independence, and due care. Analyze how accountants must manage conflicts of interest and maintain confidentiality in various professional scenarios. Evaluate the consequences of unethical behavior and violations of professional standards. Develop a thorough understanding of federal tax procedures, including taxpayer rights, penalties, and the IRS’s audit process. Additionally, master the roles and responsibilities of tax practitioners under Circular 230, focusing on due diligence, practice standards, and the legal implications of noncompliance.

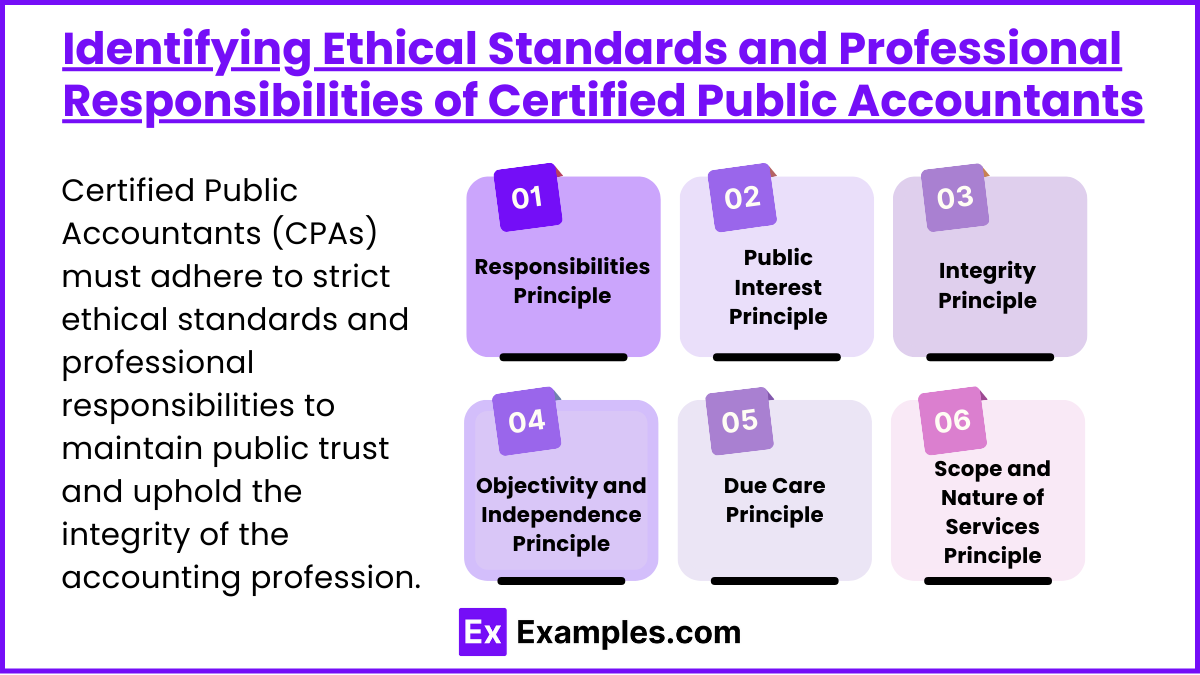

Identifying Ethical Standards and Professional Responsibilities of Certified Public Accountants

Certified Public Accountants (CPAs) must adhere to strict ethical standards and professional responsibilities to maintain public trust and uphold the integrity of the accounting profession. These ethical principles are guided by professional organizations like the American Institute of Certified Public Accountants (AICPA), State Boards of Accountancy, and regulatory frameworks such as the Sarbanes-Oxley Act.

AICPA Code of Professional Conduct: Key Ethical Principles

AICPA Code of Professional Conduct: Key Ethical Principles:

The AICPA’s Code of Professional Conduct outlines the ethical standards that CPAs must follow. The core principles include:

a. Responsibilities Principle: CPAs should act with integrity, professional competence, and diligence in performing their duties, exercising sound judgment.

b. Public Interest Principle: CPAs have a duty to serve the public interest and act in ways that maintain public confidence in the accounting profession.

c. Integrity Principle: CPAs must perform all professional activities with honesty and fairness, avoiding conduct that could discredit the profession.

d. Objectivity and Independence Principle: CPAs must remain impartial and free from conflicts of interest, especially when performing audits. Independence is required both in fact and appearance to maintain objectivity, particularly for auditors and assurance professionals.

e. Due Care Principle: CPAs must strive to achieve high standards of competence, perform services to the best of their ability, and maintain professional knowledge through continuous education.

f. Scope and Nature of Services Principle: The CPA should ensure that the nature of services provided does not compromise their professional responsibilities or ethical standards.

Understanding the AICPA Code of Professional Conduct

The The AICPA Code of Professional Conduct establishes ethical guidelines and professional responsibilities for Certified Public Accountants (CPAs). These standards are designed to ensure that CPAs act with integrity, objectivity, and independence, promoting trust and confidence in the accounting profession. The code is essential for guiding CPAs in resolving ethical dilemmas and fulfilling their professional obligations.

Structure of the AICPA Code of Professional Conduct

The AICPA Code is organized into several sections that apply based on the CPA’s role, such as:

- Members in Public Practice (e.g., auditors and tax advisors).

- Members in Business (e.g., corporate accountants, CFOs).

- Other Members (CPAs not currently in practice or business).

Each section provides rules, principles, and interpretations to guide behavior. Below are the key principles governing the conduct of all members.

Principles of the AICPA Code of Professional Conduct

a. Responsibilities Principle

- CPAs have a duty to exercise professional competence and uphold the public trust.

- They must use sound judgment, recognizing their responsibilities to clients, colleagues, and society.

Example: A CPA must exercise care and skill in providing tax advice, ensuring accuracy and compliance with tax laws.

b. Public Interest Principle

- The CPA’s role extends beyond clients to serve the public interest, ensuring transparency and reliability in financial reporting.

Example: In an audit, the CPA must issue an unbiased opinion on financial statements, regardless of client pressure to alter findings.

c. Integrity Principle

- CPAs must act with honesty and fairness, avoiding actions that could discredit the profession. Integrity ensures trust in all interactions.

Example: A CPA should never falsify financial reports or overlook discrepancies to benefit a client.

d. Objectivity and Independence Principle

- CPAs must remain free from conflicts of interest and exercise unbiased judgment. Independence is critical, particularly in auditing and assurance engagements.

Independence Requirements:

- Independence in Fact: Actual impartiality.

- Independence in Appearance: Avoiding relationships or actions that might suggest a conflict of interest to third parties.

Example: A CPA cannot audit a company in which they hold a financial interest, as this compromises objectivity.

e. Due Care Principle

- CPAs must strive to maintain professional excellence through continuous education and perform their duties to the best of their ability.

Example: CPAs must complete Continuing Professional Education (CPE) requirements to stay updated on changes in tax laws and accounting standards.

f. Scope and Nature of Services Principle

- The CPA must ensure that the services provided do not compromise their ethical responsibilities or objectivity.

Example: A CPA should not provide both management consulting and audit services to the same client, as this may impair independence.

Managing Conflicts of Interest and Maintaining Confidentiality

Conflicts of interest and confidentiality are critical ethical concerns for Certified Public Accountants (CPAs). Effectively addressing these issues ensures compliance with professional standards, fosters trust with clients, and upholds the integrity of the accounting profession. CPAs must remain objective, avoid conflicts of interest, and protect sensitive information obtained during their engagements.

Managing Conflicts of Interest

A conflict of interest arises when a CPA’s personal or financial interests could impair their professional judgment, objectivity, or ability to act in the best interests of a client or employer.

A. Common Types of Conflicts of Interest

- Personal Financial Interest: The CPA holds a financial interest (e.g., stock ownership) in a client or employer, which could influence decision-making.

- Multiple Client Relationships: The CPA provides services to two clients with opposing interests (e.g., representing both buyer and seller in a transaction).

- Family or Personal Relationships: Close relationships with individuals within a client organization (e.g., a relative working as the CFO) may impair the CPA’s objectivity.https://images.examples.com/wp-content/uploads/2024/10/Evaluating-the-Consequences-of-Unethical-Behavior-and-Violations-of-Professional-Standards.png

- Competing Business Interests: The CPA is involved in a business that competes with a client’s business, creating a risk of divided loyalties.

Maintaining Confidentiality

Confidentiality refers to the duty of CPAs to protect all non-public information obtained during professional engagements. The AICPA Code of Professional Conduct mandates that CPAs do not disclose confidential client or employer information without proper authorization, except under specific circumstances.

Principles of Confidentiality

- Non-Disclosure: CPAs must not disclose confidential information to third parties unless explicitly authorized by the client or employer.

- Use of Information: Confidential information obtained during engagements must only be used for the purpose for which it was intended.

- Third-Party Disclosures: CPAs must ensure that subcontractors or external consultants engaged during an assignment also comply with confidentiality requirements.

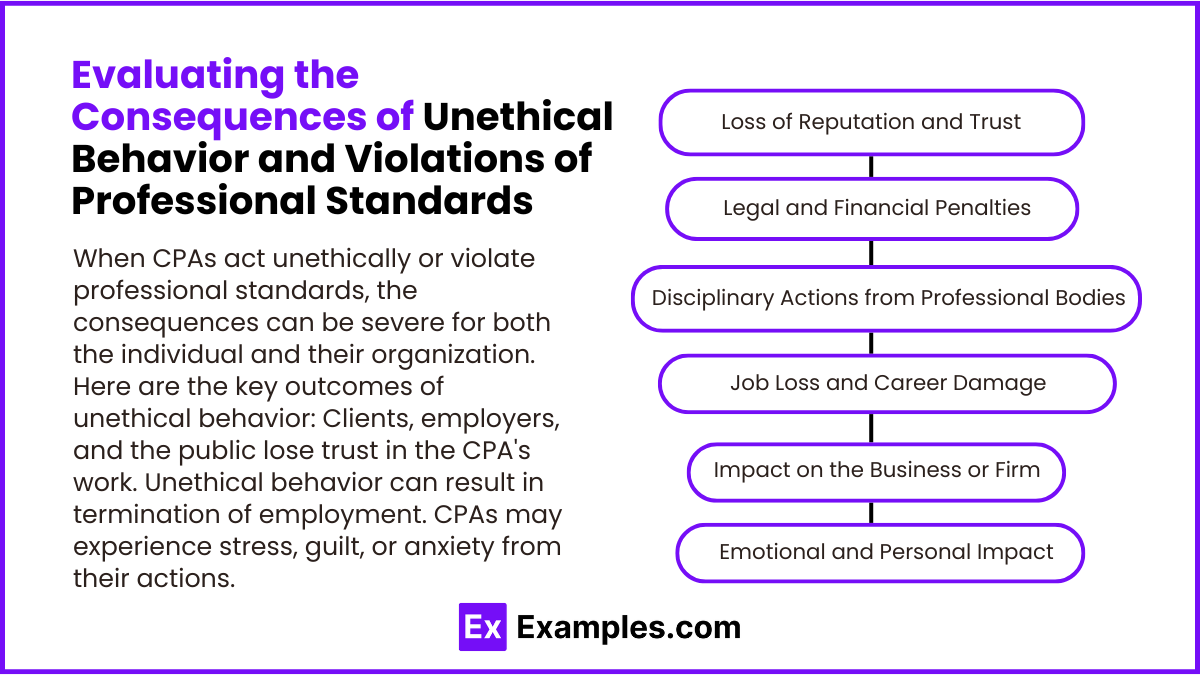

Evaluating the Consequences of Unethical Behavior and Violations of Professional Standards

When CPAs act unethically or violate professional standards, the consequences can be severe for both the individual and their organization. Here are the key outcomes of unethical behavior:

1. Loss of Reputation and Trust

- Clients, employers, and the public lose trust in the CPA’s work.

- It can be hard to regain credibility once trust is broken.

Example: An accountant caught falsifying financial records may struggle to get new clients.

2. Legal and Financial Penalties

- CPAs can face fines, lawsuits, or legal action if they engage in fraud or negligence.

- Regulators may impose penalties for violating rules or laws.

Example: Filing false tax returns could result in heavy fines or imprisonment.

3. Disciplinary Actions from Professional Bodies

- CPAs may face suspension or revocation of their license by state boards or the AICPA.

- Professional bodies can remove membership for serious violations.

4. Job Loss and Career Damage

- Unethical behavior can result in termination of employment.

- It may be difficult to find new job opportunities in the accounting field.

Example: A CPA dismissed for conflict of interest may find it hard to secure a role at other firms.

5. Impact on the Business or Firm

- Clients may leave, and the firm’s reputation may suffer.

- The company may lose business or face higher regulatory scrutiny.

Example: Audit firms that fail to detect fraud may lose major clients or face public backlash.

6. Emotional and Personal Impact

- CPAs may experience stress, guilt, or anxiety from their actions.

- The consequences can also affect personal relationships and well-being.

Examples

Example 1: Confidentiality in Client Information

Tax professionals are ethically obligated to protect their clients’ sensitive financial information. For instance, a CPA must ensure that any data shared with third parties, such as software providers or colleagues, is done with explicit consent from the client. This commitment to confidentiality builds trust and complies with legal regulations governing client privacy.

Example 2: Due Diligence in Tax Preparation

Tax preparers are responsible for exercising due diligence when preparing tax returns. This includes verifying the accuracy of the information provided by clients, such as income and deductions. For example, if a client claims a significant business expense, the preparer must obtain adequate documentation to support the deduction. Failing to do so could lead to penalties and a breach of ethical standards.

Example 3: Conflict of Interest

Tax professionals must identify and address potential conflicts of interest when representing clients. For example, if a tax advisor is also a shareholder in a company that a client is investing in, they must disclose this relationship to the client and ensure that their advice does not compromise the client’s interests. This transparency is crucial for maintaining ethical integrity and professionalism.

Example 4: Compliance with Circular 230

Circular 230 outlines the regulations for practice before the IRS, including ethical standards for tax professionals. For instance, tax advisors must avoid making false or misleading statements and should ensure that their tax positions are well-founded. Following these guidelines helps maintain the integrity of the tax profession and fosters trust between practitioners and the IRS.

Example 5: Tax Planning vs. Tax Evasion

Ethical tax planning involves using legal methods to minimize tax liabilities, whereas tax evasion is illegal and unethical. For instance, a tax professional may suggest strategies such as maximizing deductions or contributing to retirement accounts to reduce taxable income. However, if the advisor encourages a client to hide income or fabricate expenses, this crosses the line into tax evasion, which can result in severe legal consequences for both the advisor and the client. Maintaining ethical boundaries in tax planning is crucial for the reputation of tax professionals.

Practice Questions

Question 1

Which of the following principles is fundamental to the ethical responsibilities of tax professionals?

A) Confidentiality

B) Profit maximization

C) Aggressive tax planning

D) Minimizing compliance costs

Correct Answer: A) Confidentiality.

Explanation: Confidentiality is a fundamental ethical principle that tax professionals must uphold. This principle requires tax preparers to protect their clients’ sensitive financial information and not disclose it without proper consent. Maintaining confidentiality fosters trust between the professional and the client. Options B and C may lead to ethical dilemmas, and option D, while important, does not align with the core ethical responsibilities in tax practice.

Question 2

What is the primary purpose of the Circular 230 regulations issued by the IRS?

A) To establish tax rates for various income brackets.

B) To outline the ethical standards and responsibilities for tax practitioners.

C) To provide a framework for tax return preparation software.

D) To dictate the procedures for filing tax returns electronically.

Correct Answer: B) To outline the ethical standards and responsibilities for tax practitioners.

Explanation: Circular 230 is a publication by the IRS that establishes the rules governing the practice of tax professionals before the IRS. It sets forth ethical standards, including duties of competence, diligence, and integrity. These regulations aim to ensure that tax practitioners act in the best interests of their clients while maintaining high ethical standards. Options A, C, and D do not accurately reflect the purpose of Circular 230.

Question 3

Which of the following actions could potentially violate a tax professional’s ethical responsibilities?

A) Advising a client to report all income accurately.

B) Encouraging a client to take a tax deduction they are not entitled to.

C) Maintaining detailed records of client communications.

D) Refusing to represent a client in a tax audit.

Correct Answer: B) Encouraging a client to take a tax deduction they are not entitled to.

Explanation: Encouraging a client to take a tax deduction that they are not entitled to is a violation of a tax professional’s ethical responsibilities. This action could be considered as promoting dishonest behavior and could lead to legal consequences for both the professional and the client. On the other hand, options A and C reflect responsible and ethical practices, and option D, while it may not demonstrate a commitment to representation, is not inherently unethical.