Preparing for the CPA Exam requires a thorough understanding of “Area I – Financial Reporting.” Mastery of financial reporting standards, including GAAP and IFRS, is essential. This knowledge equips you to interpret and prepare accurate financial statements, assess financial performance, and ensure compliance, critical for achieving a high CPA score.

Learning Objective

In studying “Area I – Financial Reporting” for the CPA Exam, you should aim to understand and apply key principles of financial reporting standards, including GAAP and IFRS. Learn how to accurately interpret and prepare financial statements, such as balance sheets, income statements, and cash flow statements. Evaluate and apply standards governing revenue recognition, asset valuation, and liabilities, and explore consolidation and equity accounting principles. Additionally, develop skills to analyze financial disclosures for transparency and compliance. Apply this knowledge to assess financial performance, support decision-making, and ensure compliance, critical for accurate financial reporting in CPA exam scenarios and professional practice.

Understanding Financial Reporting Frameworks

Financial reporting frameworks serve as the structured system of rules and conventions governing the preparation and presentation of financial statements. These frameworks are essential for ensuring consistency, transparency, and comparability of financial information across different organizations. Here are the key aspects of financial reporting frameworks that you should be aware of:

- Purpose: Provide useful financial information to investors and creditors for decision-making.

- Major Frameworks:

- IFRS: International standards emphasizing principles for general purpose financial statements.

- GAAP: U.S. standards detailing accounting rules for business and corporate accounting.

- Core Financial Statements: Include the Balance Sheet, Income Statement, and Statement of Cash Flows.

- Recognition and Measurement: Guidelines on how and when to record and measure financial items.

- Fair Presentation: Ensures financial statements accurately reflect the entity’s financial status in accordance with the applicable standards.

- Key Assumptions:

- Accrual Basis: Transactions are recorded when they occur, not upon cash exchange.

- Going Concern: Assumes the entity will continue operating in the foreseeable future.

- Consistency and Comparability: Essential for reliable comparisons over time and across entities.

- Disclosure and Transparency: Necessary for clarity on financial figures and associated risks.

- Regulatory Oversight: Bodies like the SEC ensure compliance with these frameworks to protect investors and maintain market integrity.

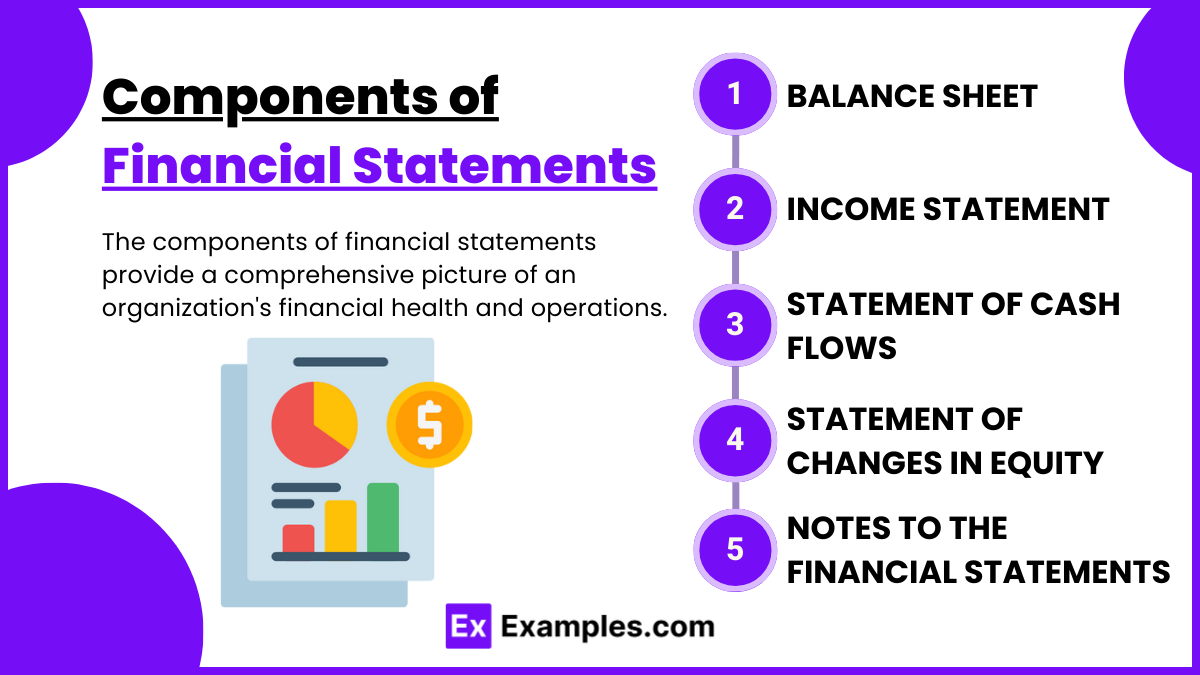

Components of Financial Statements

The components of financial statements provide a comprehensive picture of an organization’s financial health and operations. Here are the main components typically included in financial statements:

- Balance Sheet (Statement of Financial Position):

- Assets: Resources owned by the company that are expected to bring future economic benefits.

- Liabilities: Obligations the company owes to outsiders that will require future economic sacrifices.

- Equity: The residual interest in the assets of the entity after deducting liabilities, representing the owners’ share.

- Income Statement (Statement of Profit and Loss):

- Revenues: The total amount of money received or receivable from the company’s primary activities.

- Expenses: Costs incurred in generating the revenue, including cost of goods sold, administrative expenses, and other operational costs.

- Profits/Losses: The net result after all revenues are matched with expenses for the period.

- Statement of Cash Flows:

- Operating Activities: Cash flows from the primary revenue-generating activities of the business.

- Investing Activities: Cash flows from the acquisition and disposal of long-term assets and other investments not included in cash equivalents.

- Financing Activities: Cash flows related to transactions with the owners or creditors, such as issuing shares, borrowing, and repaying debts.

- Statement of Changes in Equity:

- Details changes in the company’s equity from transactions with owners (contributions and distributions) and from earnings or losses during the period.

- Notes to the Financial Statements:

- Provide additional information that is essential to a full understanding of the financial statements, such as accounting policies, contingencies, and financial risks.

Advanced Financial Reporting Topics

Advanced financial reporting topics delve deeper into complex areas that require specialized knowledge beyond basic financial statement preparation. These topics often involve nuanced accounting standards and practices designed to address specific situations in financial reporting. Here’s a look at some of these advanced topics:

- Consolidation and Group Financial Statements: Focuses on reporting for entities under common control, including elimination of inter-company transactions.

- Revenue Recognition: Provides guidelines on recognizing revenue, especially for complex, multi-element contracts.

- Financial Instruments: Concerns the handling of financial instruments, such as derivatives and hedging, including measurement and disclosure.

- Leases: Addresses lease accounting for both lessees and lessors, detailing the recognition of lease assets and liabilities.

- Foreign Currency Transactions: Covers accounting for foreign currency dealings and financial statement translation in hyperinflationary economies.

- Employee Benefits: Involves accounting for all types of employee benefits, including pensions and other long-term benefits.

- Segment Reporting: Requires financial information to be presented by business segments to provide insight into different areas of a company.

- Intangible Assets and Goodwill: Focuses on the accounting for intangible assets, including impairment testing and amortization.

- ESG Reporting: Emerging field dealing with the disclosure of environmental, social, and governance factors.

- Impairment of Assets: Details the procedures for recognizing and measuring impairment losses on assets.

Consolidation and Financial Disclosure

Consolidation and financial disclosure are two fundamental aspects of financial reporting that help stakeholders understand the economic activities and health of a company, especially when it controls other entities. Here’s an overview of each:

Consolidation

Consolidation involves combining the financial statements of a parent company with those of its subsidiaries to present as if the group is a single entity. Key points include:

- Purpose: Provides a true and fair view of the financial position and performance of a group as a single economic entity.

- Scope: Includes all entities that the parent controls, typically where the parent owns more than 50% of the voting rights or otherwise has control.

- Process: Involves adding together like items of assets, liabilities, equity, income, expenses, and cash flows. Inter-company transactions and balances between the entities within the group are eliminated.

Financial Disclosure

Financial disclosure encompasses all the information a company provides about its financial performance, position, and changes in financial position. This can include both quantitative financial data and qualitative information. Key aspects include:

- Annual Reports: Comprehensive reports that include financial statements, management’s discussion and analysis (MD&A), notes to the financial statements, and auditor’s reports.

- Notes to Financial Statements: Provide additional detail and context about the figures in the financial statements, including accounting policies, contingencies, and risks.

- Management’s Discussion and Analysis (MD&A): Offers management’s perspective on the business results, trends, and future outlook.

- Regulatory Filings: Such as the SEC filings in the U.S., including forms like 10-K and 10-Q, which provide a regular update of company performance and financial condition.

- Ad Hoc Disclosures: Include press releases and other communications regarding important events that may affect the financial status of the company.

Examples

Example 1: Revenue Recognition for a Software Company

- A software company offers annual licenses and must determine when to recognize revenue. Applying ASC 606, the company recognizes revenue as the software is delivered over the license term, rather than at the point of sale, ensuring earnings reflect ongoing obligations.

Example 2: Lease Accounting for a Retail Chain

- A retail chain enters a 10-year lease for store space. Under the new lease accounting standards (IFRS 16/ASC 842), the company recognizes a right-of-use asset and a lease liability on the balance sheet, transforming how lease obligations are reported.

Example 3: Consolidation of Financial Statements

- A multinational corporation acquires 80% of a foreign company. For financial reporting, the parent company must consolidate the subsidiary’s financials into its own statements, including adjusting for minority interests and eliminating intercompany transactions.

Example 4: Impairment of Long-Lived Assets

- An energy company assesses its equipment for impairment due to a downturn in the market. The company conducts an impairment test and determines that the carrying amount exceeds the recoverable amount, requiring a write-down of the asset on the balance sheet.

Example 5: Fair Value Measurement of Financial Instruments

- A bank holds various financial derivatives that must be reported at fair value. The bank uses market prices and valuation models to determine fair values, which are then reported in the financial statements, impacting both the balance sheet and income statement based on market fluctuations.

Practice Questions

Question 1:

Which of the following is true under IFRS when accounting for inventory?

A. Inventory is always valued at the lower of cost or market value.

B. Inventory is valued at the lower of cost or net realizable value.

C. LIFO (last in, first out) method is preferred for inventory valuation.

D. Inventory valuation can fluctuate with market trends without limitation.

Answer: B

Explanation:

Step 1: Understanding the Question

This question asks about the correct method for inventory valuation under IFRS.

Step 2: Analyzing Each Option

- A is incorrect because under IFRS, inventory is valued at the lower of cost and net realizable value, not market value.

- B is correct as IFRS stipulates that inventory should be carried at the lower of cost and net realizable value.

- C is incorrect because IFRS does not allow the use of the LIFO method.

- D is incorrect as inventory valuation must adhere to specific accounting rules and cannot simply follow market trends.

Step 3: Conclusion

IFRS requires that inventory be valued at the lower of cost or net realizable value, ensuring that inventory is not overstated on the financial statements.

Question 2:

When preparing financial statements, which of the following is an example of a disclosure that must be made according to GAAP?

A. The CEO’s personal financial statement.

B. The accounting policies adopted by the company.

C. The forecasted profits for the next five years.

D. Informal notes from the CFO about market conditions.

Answer: B

Explanation:

Step 1: Understanding the Question

The question concerns what types of disclosures are required by GAAP in the financial statements.

Step 2: Analyzing Each Option

- A is incorrect because personal financial statements of the CEO are not relevant.

- B is correct as GAAP requires disclosure of the accounting policies adopted by the company to clarify how certain transactions are recorded.

- C and D are incorrect because GAAP does not require speculative or informal narrative forecasts or notes to be included as mandatory disclosures.

Step 3: Conclusion

Disclosure of accounting policies is essential under GAAP to ensure transparency and consistency in financial reporting.

Question 3:

Under which circumstances might a company need to issue a restatement of its previously issued financial statements?

A. The discovery of an error that is immaterial to the financial statements.

B. Periodic changes in the board of directors.

C. The discovery of a material misstatement due to fraud or error.

D. Changes in market conditions affecting the company’s stock price.

Answer: C

Explanation:

Step 1: Understanding the Question

This question is about the reasons a company would need to restate its financial statements.

Step 2: Analyzing Each Option

- A is incorrect because immaterial errors typically do not require a restatement.

- B is irrelevant to financial statement accuracy.

- C is correct as the discovery of a material misstatement, whether due to fraud or error, necessitates a restatement to correct the inaccuracies in the financial records.

- D is incorrect because changes in market conditions do not directly impact the historical financial statements.

Step 3: Conclusion

A restatement is required when a material misstatement is discovered, ensuring that the financial statements provide a true and fair view of the company’s financial position and performance.