Preparing for the CPA Exam demands a thorough grasp of “Area II – Assessing Risk and Developing a Planned Response.” Mastery of risk assessment techniques and response strategies is crucial. This knowledge equips you to identify, analyze, and address potential risks in financial contexts, essential for effective auditing and achieving high CPA scores.

Learning Objective

In studying “Area II – Assessing Risk and Developing a Planned Response” for the CPA Exam, you should aim to master the methodologies for evaluating financial and operational risks within an organization. Learn to apply analytical tools to assess risk levels and understand the impact on audits and financial reporting. Develop skills in crafting strategic responses tailored to identified risks, enhancing both internal controls and compliance with regulations. Further, explore how these strategies are implemented in real-world scenarios across various industries. Apply this comprehensive understanding to solve complex problems and make informed decisions in CPA exam scenarios and professional practice.

Understanding Risk Assessment in Auditing and Financial Reporting

Understanding risk assessment in auditing and financial reporting is essential for ensuring the accuracy and reliability of financial statements. Here are the main points that highlight the importance and process of risk assessment:

- Risk Identification: Auditors begin by identifying potential risks that could materially affect the financial statements, considering factors like business operations and external economic conditions.

- Risk Analysis: After identifying risks, auditors evaluate their potential impact and likelihood, which helps in prioritizing which risks to address based on their severity.

- Control Evaluation: The effectiveness of the entity’s internal controls is assessed to determine how well they prevent or mitigate risks, involving an examination of control activities and monitoring mechanisms.

Types of Risks

- Inherent Risk: This refers to the possibility of a significant misstatement in financial statements due to error or fraud before considering the effectiveness of internal controls.

- Control Risk: The risk that potential misstatements will not be caught or corrected by the organization’s internal controls.

- Detection Risk: The risk that the audit procedures will fail to detect existing significant misstatements.

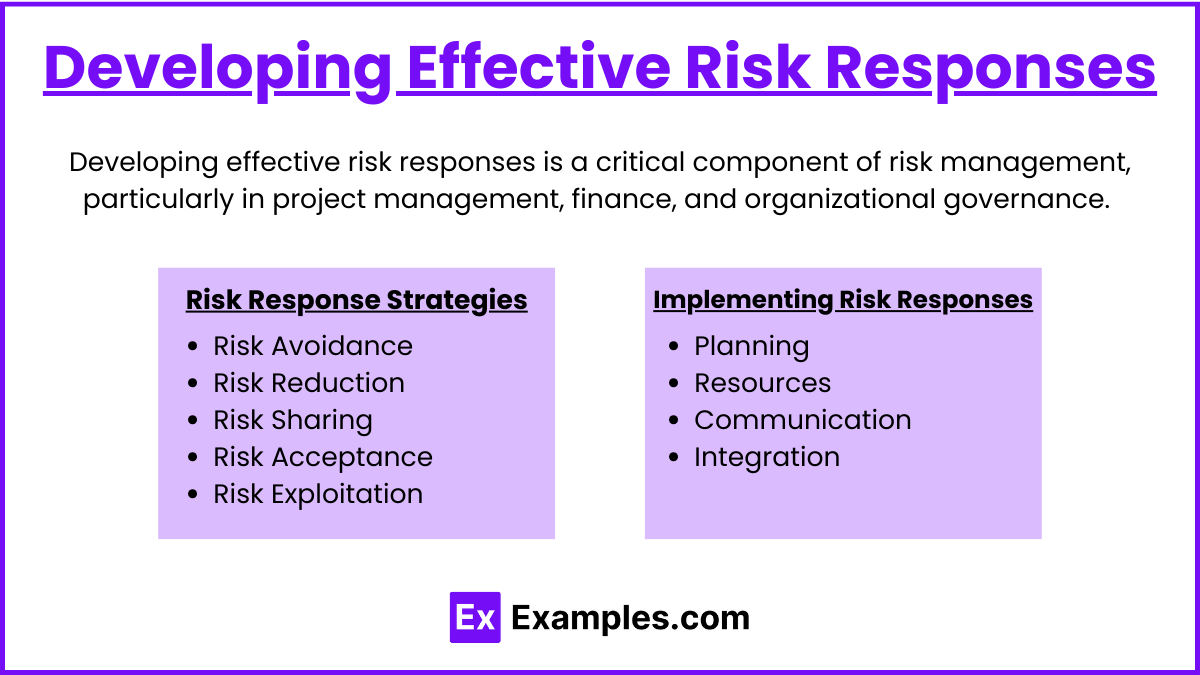

Developing Effective Risk Responses

Developing effective risk responses is a critical component of risk management, particularly in project management, finance, and organizational governance. Here are the main points on how to effectively respond to risks:

Risk Response Strategies

- Risk Avoidance: This involves altering plans to sidestep potential risks altogether, often used when the risk poses a significant threat that cannot be effectively mitigated.

- Risk Reduction: Implementing measures that reduce the likelihood of a risk occurring or minimize its impact should it occur. This often involves improving processes, training, and controls.

- Risk Sharing: Sometimes referred to as risk transfer, this involves sharing the burden of a risk with other parties, such as through outsourcing or insurance.

- Risk Acceptance: In some cases, the cost of mitigating a risk may outweigh the benefits gained from doing so. In such instances, a decision may be made to accept the risk and prepare to handle the consequences.

- Risk Exploitation: This strategy is used when the risk presents a potential gain. Steps are taken to ensure the opportunity is realized, maximizing the benefits.

Implementing Risk Responses

- Planning: Develop a detailed plan that outlines specific actions for each identified risk based on the chosen response strategy.

- Resources: Allocate the necessary resources, including time, budget, and personnel, to implement the risk responses effectively.

- Communication: Ensure clear and consistent communication with all stakeholders about the risks and how they are being managed. This transparency helps maintain trust and aids in the smooth execution of plans.

- Integration: Integrate risk responses into the overall project plan or organizational processes to ensure that they are consistently applied and monitored.

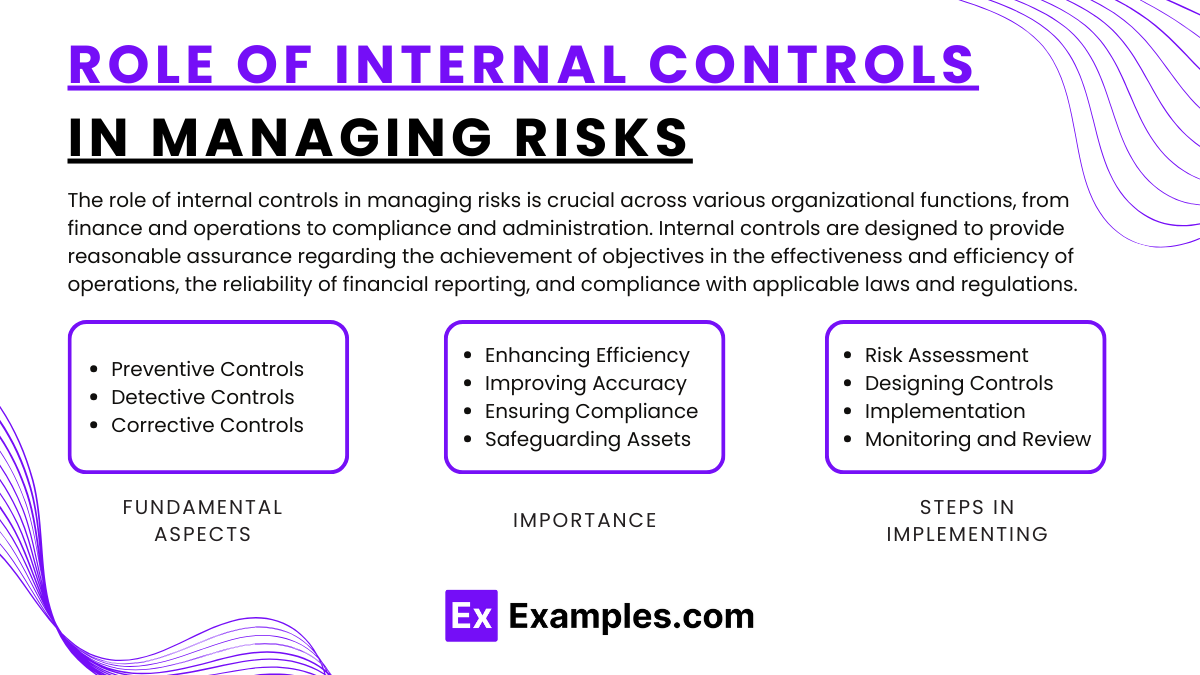

Role of Internal Controls in Managing Risks

The role of internal controls in managing risks is crucial across various organizational functions, from finance and operations to compliance and administration. Internal controls are designed to provide reasonable assurance regarding the achievement of objectives in the effectiveness and efficiency of operations, the reliability of financial reporting, and compliance with applicable laws and regulations. Here’s a concise overview of how internal controls manage risks:

Fundamental Aspects of Internal Controls

- Preventive Controls: These controls are designed to deter the occurrence of undesirable events before they happen. Examples include separation of duties, proper authorization procedures, and physical controls over assets.

- Detective Controls: These controls aim to identify and correct undesirable events that have already occurred. They include reconciliations, reviews of performance, and audits.

- Corrective Controls: Once risks are detected, corrective controls help to remedy the situation. These may involve modifying processes, enhancing security measures, or retraining employees.

Importance of Internal Controls

- Enhancing Efficiency: By standardizing procedures, internal controls ensure that operations are carried out efficiently and consistently, reducing waste and preventing errors.

- Improving Accuracy and Reliability in Financial Reporting: Internal controls help ensure that financial statements are accurate and conform to accounting standards and legal requirements.

- Ensuring Compliance: Controls are necessary for ensuring that the organization adheres to laws, regulations, and internal policies, thus avoiding fines and legal penalties.

- Safeguarding Assets: Effective controls protect physical and intangible assets from theft, misuse, and other losses.

Steps in Implementing Internal Controls

- Risk Assessment: Identify and assess risks that could affect the organization’s ability to achieve its objectives.

- Designing Controls: Develop controls that address specific risks, tailored to the complexity and size of the organization.

- Implementation: Deploy the controls throughout the organization, ensuring that they are understood and acted upon.

- Monitoring and Review: Regularly monitor the controls to assess their effectiveness and make necessary adjustments. This often involves both internal audits and external audits.

Compliance and Regulatory Considerations

Compliance and regulatory considerations are critical for any organization to operate within legal and ethical frameworks. These involve adhering to laws, regulations, and standards that govern specific industries and practices. Here’s a streamlined overview:

Key Components:

- Legal Compliance: Involves adhering to laws and regulations applicable in the jurisdictions where the organization operates, covering areas from corporate governance to data protection.

- Regulatory Compliance: Relates to industry-specific regulations such as financial reporting standards or health and safety rules.

- Ethical Standards: Involves adhering to standards set by professional bodies or self-imposed ethical codes, which are crucial for maintaining public trust and business integrity.

Importance of Compliance:

- Risk Mitigation: Helps avoid legal penalties, financial loss, and reputational damage.

- Market Integrity: Ensures fair competition and protects consumer interests, contributing to market stability.

- Sustainability and Social Responsibility: Supports sustainability goals and promotes corporate social responsibility through environmental and social regulations.

Examples

Example 1: Evaluating Financial Risk: A Tech Startup’s Dilemma

- A tech startup is exploring expansion but faces high market volatility. The CPA uses financial models to assess the risk of new investments and develops a risk mitigation strategy involving phased investment and constant market analysis to reduce potential financial losses.

Example 2: Operational Risk Assessment: Manufacturing Plant Safety

- In a manufacturing company, operational risks such as equipment failure or safety hazards are prevalent. A CPA conducts a risk assessment that leads to implementing improved safety protocols and regular equipment checks, significantly reducing workplace accidents and associated liability risks.

Example 3: Compliance Risk in Banking

- A bank faces significant compliance risks due to changing regulations in financial reporting. A CPA helps the bank to develop a compliance program that includes training for staff on new regulations, regular audits, and a system for reporting discrepancies to avoid fines and legal issues.

Example 4: Strategic Risk Response to Economic Downturn

- During an economic downturn, a retail company faces increased risk of decreased sales and excess inventory. The CPA assists in developing a strategic response that includes diversifying product lines, increasing online sales channels, and renegotiating supplier contracts to minimize risks.

Example 5: Risk of Fraud in a Non-Profit Organization

- A non-profit organization suspects fraud within its fundraising activities. The CPA uses forensic auditing techniques to assess the risk and extent of fraud. A comprehensive response plan is developed, including tighter financial controls, regular external audits, and staff training on ethical fundraising practices.

Practice Questions

Question 1:

What is the first step in a typical risk management process?

A. Implementing control measures

B. Identifying risks

C. Evaluating the effectiveness of controls

D. Prioritizing risks

Answer: B

Explanation:

Step 1: Understanding the Question

This question addresses the initial step in risk management, focusing on the sequential order of risk management actions.

Step 2: Analyzing Each Option

- A is a later step after risks have been identified and analyzed.

- B is the correct answer as identifying risks is the foundational step in any risk management process, essential before any further steps can be effectively planned or implemented.

- C and D follow the identification and sometimes the analysis of risks, respectively.

Step 3: Conclusion

Identifying risks is essential as the initial step, setting the stage for all subsequent risk management activities.

Question 2:

Which of the following best illustrates the concept of risk transfer?

A. Installing a firewall to protect against data breaches

B. Conducting regular audits of financial processes

C. Purchasing insurance to cover potential data breach losses

D. Increasing staffing in the compliance department

Answer: C

Explanation:

Step 1: Understanding the Question

This question asks to identify the option that best exemplifies the risk management strategy of transferring risk.

Step 2: Analyzing Each Option

- A and B are examples of risk mitigation and prevention, respectively.

- C is the correct answer as purchasing insurance is a classic example of risk transfer, where the financial impact of a risk (e.g., from a data breach) is transferred to an insurance company.

- D is an example of risk mitigation by enhancing internal controls.

Step 3: Conclusion

Purchasing insurance to cover specific losses transfers the financial risk to another party, thereby minimizing the company’s direct risk exposure.

Question 3:

Which strategy is primarily used to manage risks that have both a high impact and a high likelihood of occurring?

A. Avoidance

B. Acceptance

C. Mitigation

D. Transference

Answer: A

Explanation:

Step 1: Understanding the Question

This question focuses on the appropriate strategic response to risks with high impact and high probability, necessitating significant management attention.

Step 2: Analyzing Each Option

- A is the correct answer as avoidance involves changing plans or strategies to completely avoid the risk, which is often the most prudent approach when the risk is both likely and has severe consequences.

- B is typically reserved for lower impact or lower likelihood risks.

- C and D could be applicable, but they do not eliminate the risk entirely as avoidance does.

Step 3: Conclusion

Avoiding a risk entirely is often the safest strategy for high-impact, high-probability risks, thus eliminating any potential negative effects associated with it.