On the CPA Exam, Business Law focuses on essential legal concepts that underpin business operations and decision-making. You’ll explore topics such as contracts, agency relationships, and the Uniform Commercial Code (UCC). This area covers legal structures of businesses, debtor-creditor relationships, and regulations impacting business transactions. Understanding corporate governance, legal responsibilities, and ethical frameworks is crucial, as these concepts are key to mastering the Regulation (REG) section of the exam.

Learning Objectives

In studying “Area II – Business Law” for the CPA exam, you should learn to understand the legal principles governing business organizations, including the formation, operation, and dissolution of entities such as corporations, partnerships, and limited liability companies. Analyze the roles and responsibilities of business agents, officers, and directors, focusing on agency relationships and fiduciary duties. Evaluate contracts and their enforceability by studying essential elements, defenses to enforcement, and remedies for breach. Develop proficiency in laws governing commercial transactions, including the Uniform Commercial Code (UCC) provisions on sales, negotiable instruments, and secured transactions. Additionally, understand legal issues related to debtor-creditor relationships, bankruptcy, and government regulation to effectively answer business law questions on the CPA exam.

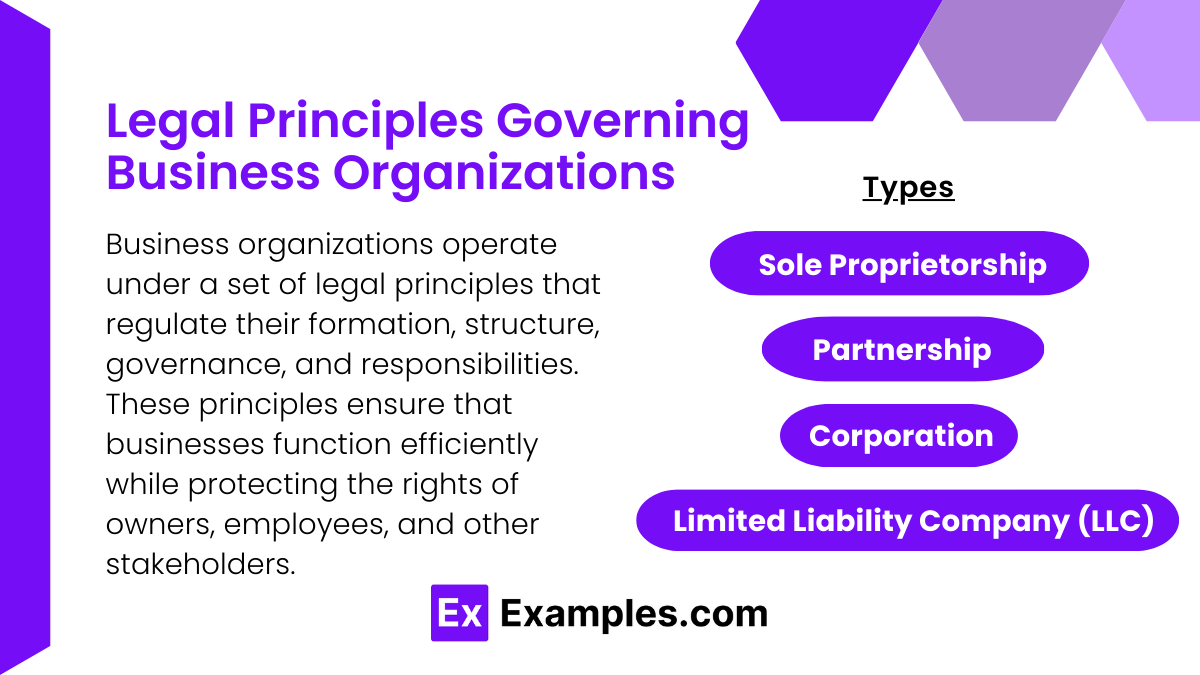

Legal Principles Governing Business Organizations

Business organizations operate under a set of legal principles that regulate their formation, structure, governance, and responsibilities. These principles ensure that businesses function efficiently while protecting the rights of owners, employees, and other stakeholders.

Types of Business Organizations

- Sole Proprietorship: A business owned and run by one individual.

- Key Principle: The owner has unlimited liability, meaning personal assets can be used to settle business debts.

- Partnership: A business owned by two or more individuals.

- Key Principle: Partners share profits, losses, and joint liability for debts.

- Types:

- General Partnership: All partners have equal responsibility and liability.

- Limited Partnership (LP): Some partners have limited liability up to their investment amount.

- Corporation: A legal entity separate from its owners (shareholders).

- Key Principle: Owners enjoy limited liability—they are only responsible for debts up to the amount they invested.

- Governance: Managed by a board of directors and officers, with shareholders owning shares of the business.

- Limited Liability Company (LLC): Combines the flexibility of a partnership with the limited liability of a corporation.

- Key Principle: Members are not personally liable for business debts, and the company can choose how to be taxed.

Roles and Responsibilities of Business Agents, Officers, and Directors

In business organizations, agents, officers, and directors play critical roles in ensuring smooth operations, proper governance, and strategic decision-making. Each role has distinct responsibilities, legal duties, and authority, ensuring the organization functions effectively and complies with relevant laws and regulations.

1. Business Agents

A business agent is an individual or entity authorized to act on behalf of a business. Agents can bind the business to contracts and represent it in various dealings.

Roles and Responsibilities of Business Agents

- Authority to Act: Agents act under express, implied, or apparent authority, entering contracts or making decisions on behalf of the business.

- Fiduciary Duty:

- Agents must act in the best interests of the business, avoiding conflicts of interest.

- They must not use the company’s assets or information for personal gain.

- Duty of Loyalty: gents must prioritize the organization’s goals over their own interests when representing the business.

- Duty of Care: Agents are expected to exercise reasonable care and competence in their duties, ensuring they act responsibly.

- Contractual Obligations: Agents can bind the business to contracts within the scope of their authority.

Example: A sales agent may sign agreements with customers, binding the business to those contracts.

2. Business Officers

Officers are executives appointed by the board of directors to manage the day-to-day operations of a corporation or organization. Common officer roles include CEO, CFO, COO, and Treasurer.

Roles and Responsibilities of Officers

- Execution of Policies:

- Officers are responsible for implementing the board’s policies and strategies.

- They ensure that operations align with the company’s mission and goals.

- Day-to-Day Management: Officers oversee departments such as finance, marketing, and operations, ensuring smooth business processes.

- Fiduciary Duties: Officers must act in good faith and in the best interest of the business, following the duty of care and duty of loyalty.

- Reporting to the Board: Officers regularly update the board of directors on the company’s performance and financial status.

- Financial Management: The CFO ensures compliance with financial reporting standards and oversees budgeting, taxes, and financial planning.

- Regulatory Compliance: Officers ensure the business complies with industry regulations, employment laws, and government policies.

Example: The CEO of a corporation develops business strategies and oversees department heads to achieve long-term goals.

3. Board of Directors

The board of directors governs the organization, representing the interests of shareholders or stakeholders. Directors provide oversight and strategic direction but do not handle daily operations.

Roles and Responsibilities of Directors

- Setting Strategic Goals: Directors define the business’s strategic vision, setting goals and objectives for management.

- Appointment and Oversight of Officers: The board appoints senior officers (like the CEO) and evaluates their performance.

- Fiduciary Duties: Directors owe a duty of care and duty of loyalty to the company and its shareholders.

- Duty of Care: Directors must make informed decisions by reviewing relevant information.

- Duty of Loyalty: Directors must avoid conflicts of interest and act in the company’s best interest.

- Corporate Governance: The board ensures that the company follows internal policies and external regulations, such as financial reporting laws.

- Financial Oversight:

- Directors approve major financial transactions, such as mergers or large investments.

- They also ensure that financial statements are accurate and transparent.

- Risk Management: Directors oversee the company’s risk management policies, ensuring risks are mitigated effectively.

- Representation of Shareholders: Directors act on behalf of shareholders, balancing their interests with long-term company growth.

Example: A board of directors may decide to approve a merger with another company after evaluating financial and market reports.

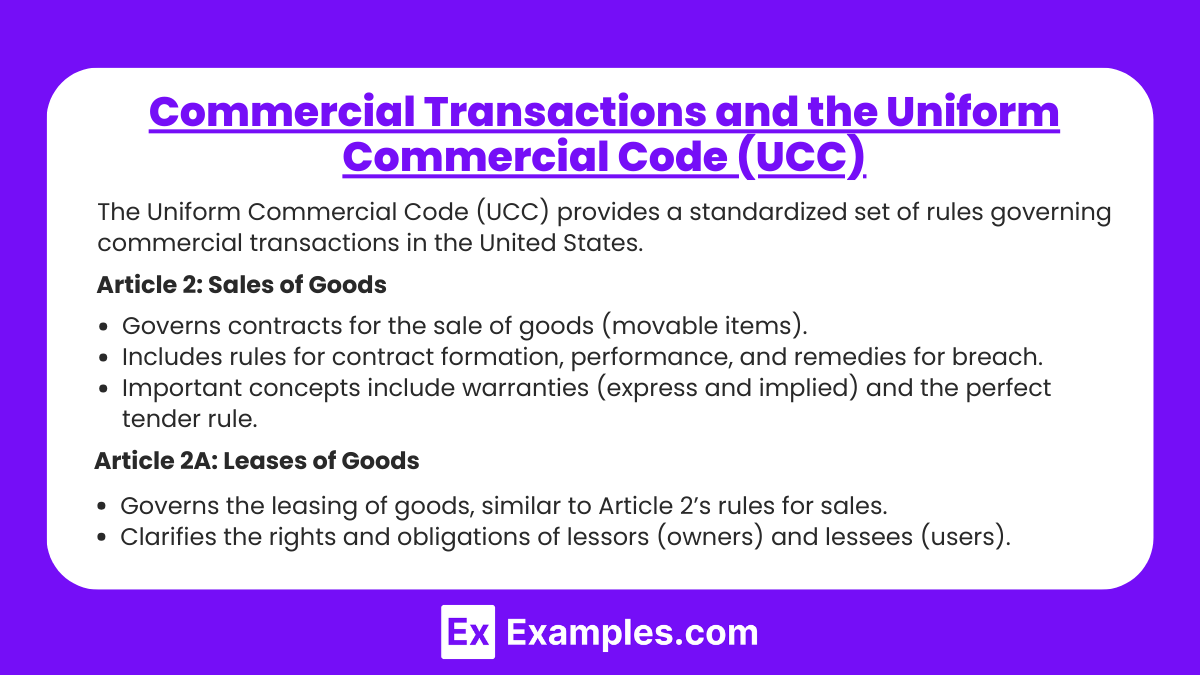

Commercial Transactions and the Uniform Commercial Code (UCC)

The Uniform Commercial Code (UCC) provides a standardized set of rules governing commercial transactions in the United States. The UCC promotes consistency and efficiency in business practices across states, ensuring fair and predictable outcomes for transactions. It covers various aspects of commercial law, such as the sale of goods, negotiable instruments, and secured transactions.

Article 2: Sales of Goods

- Governs contracts for the sale of goods (movable items).

- Includes rules for contract formation, performance, and remedies for breach.

- Important concepts include warranties (express and implied) and the perfect tender rule.

Example: A retailer purchases 1,000 units of inventory from a supplier. If the units do not conform to the contract, the buyer can reject the shipment under the UCC.

Article 2A: Leases of Goods

- Governs the leasing of goods, similar to Article 2’s rules for sales.

- Clarifies the rights and obligations of lessors (owners) and lessees (users).

Example: A business leases office equipment for five years. If the equipment fails to meet specifications, the lessee may have remedies under Article 2A.

Example: A business issues a promissory note promising to pay a lender $100,000 in six months. The lender can transfer this note to another party by endorsement.

Article 4: Bank Deposits and Collections

- Governs the relationship between banks and their customers in handling checks and electronic payments.

- Includes rules for processing checks, endorsements, and bank liability for errors.

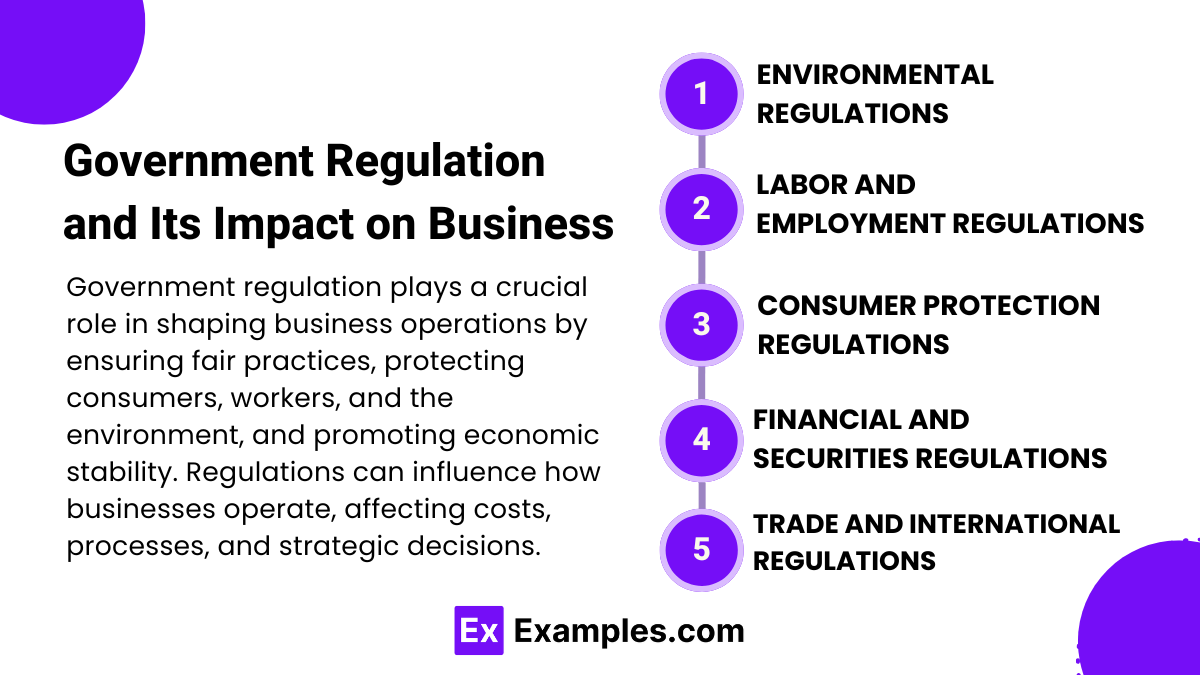

Government Regulation and Its Impact on Business

Government regulation plays a crucial role in shaping business operations by ensuring fair practices, protecting consumers, workers, and the environment, and promoting economic stability. Regulations can influence how businesses operate, affecting costs, processes, and strategic decisions. While compliance may pose challenges, regulation also fosters trust, competition, and sustainability in the marketplace.

a. Environmental Regulations

- Laws: Clean Air Act, Clean Water Act, and Environmental Protection Agency (EPA) regulations.

- Impact: Businesses must limit pollution and reduce waste. Non-compliance can result in fines or closure.

- Example: Manufacturing companies must install pollution control systems to meet emission standards.

b. Labor and Employment Regulations

- Laws: Fair Labor Standards Act (FLSA), Occupational Safety and Health Act (OSHA), Equal Employment Opportunity (EEO) laws.

- Impact: Employers must provide safe workplaces, fair wages, and prevent discrimination.

- Example: OSHA regulations require businesses to follow safety protocols to protect workers from injuries.

c. Consumer Protection Regulations

- Laws: Consumer Product Safety Act, Federal Trade Commission (FTC) regulations.

- Impact: Businesses must ensure product safety, truth in advertising, and fair pricing.

- Example: Retailers must label products accurately and recall defective items.

d. Financial and Securities Regulations

- Laws: Sarbanes-Oxley Act (SOX), Dodd-Frank Act, Securities and Exchange Commission (SEC) rules.

- Impact: Companies must follow transparency rules, report accurate financial data, and prevent insider trading.

- Example: Public companies must issue quarterly financial statements to shareholders under SEC guidelines.

e. Trade and International Regulations

- Laws: Import-export laws, tariffs, and trade agreements like NAFTA/USMCA.

- Impact: Businesses engaged in international trade must comply with tariffs, customs, and trade sanctions.

- Example: A company importing electronics must follow customs procedures and pay applicable tariffs.

Examples

Example 1: Contract Law

Contract law governs the agreements made between two or more parties. For instance, when a business enters into a contract with a supplier to purchase goods, the terms and conditions, such as price and delivery dates, must be clear and enforceable. Understanding contract law is crucial for businesses to ensure that their agreements are legally binding and protect their interests in case of disputes.

Example 2: Employment Law

Employment law encompasses various regulations that govern the relationship between employers and employees. This includes laws related to hiring practices, workplace safety, wage and hour regulations, and employee rights. For example, a company must comply with the Fair Labor Standards Act, which sets minimum wage and overtime pay requirements. Familiarity with employment law helps businesses maintain compliance and foster a fair workplace environment.

Example 3: Intellectual Property Law

Intellectual property law protects the rights of creators and inventors regarding their inventions, designs, and brands. For example, a software company may apply for a patent to protect its innovative technology, or a fashion designer may register a trademark for their brand name. Understanding intellectual property law allows businesses to safeguard their unique creations and prevent unauthorized use by competitors.

Example 4: Consumer Protection Law

Consumer protection laws are designed to ensure fair trade practices and protect consumers from unfair or deceptive business practices. For instance, a company advertising its products must provide accurate information and not engage in false advertising. Violations can result in legal action and penalties. Businesses must be aware of these laws to maintain consumer trust and avoid litigation.

Example 5: Corporate Law

Corporate law governs the formation, operation, and dissolution of corporations. It includes regulations on corporate governance, shareholder rights, and fiduciary duties of directors and officers. For example, when a corporation issues stock to raise capital, it must comply with securities regulations and disclose pertinent information to investors. Understanding corporate law is essential for businesses to operate legally and ethically in the marketplace.

Practice Questions

Question 1

Which of the following is considered a legally binding contract?

A) An agreement made verbally between friends

B) A written agreement signed by both parties

C) A handshake agreement without any documentation

D) An email expressing intent to negotiate terms

Correct Answer: B) A written agreement signed by both parties.

Explanation: A legally binding contract typically requires an offer, acceptance, consideration, and the intention to create a legal obligation. A written agreement that is signed by both parties meets these criteria and is enforceable in a court of law. While verbal agreements can be binding, they are often more difficult to enforce due to lack of evidence. Handshake agreements and emails expressing intent are generally not considered legally binding unless they meet the criteria for a formal contract.

Question 2

What is the primary purpose of consumer protection laws?

A) To regulate employee wages

B) To promote fair competition among businesses

C) To ensure that consumers are treated fairly and protected from deceptive practices

D) To control prices of goods and services

Correct Answer: C) To ensure that consumers are treated fairly and protected from deceptive practices.

Explanation: Consumer protection laws are designed to safeguard consumers from unfair, deceptive, or fraudulent practices in the marketplace. They establish rights for consumers and impose responsibilities on businesses to provide accurate information about their products and services. While promoting fair competition (option B) is important, it is not the primary focus of consumer protection laws. Options A and D pertain to other areas of law, such as labor law and antitrust law, respectively.

Question 3

In corporate law, what is the role of the board of directors?

A) To manage the day-to-day operations of the company

B) To set overall policies and make significant business decisions

C) To represent shareholders in legal matters

D) To hire all employees in the organization

Correct Answer: B) To set overall policies and make significant business decisions.

Explanation: The board of directors is responsible for overseeing the management of a corporation and making high-level decisions that affect the company’s direction and policies. They are tasked with protecting shareholders’ interests and ensuring that the company adheres to its mission and ethical standards. While the board may influence the hiring of top executives, it does not manage day-to-day operations (option A) or directly hire all employees (option D). Option C is misleading, as while the board represents shareholders, their primary function is governance, not direct legal representation.