Area II – Technical Accounting and Reporting is a crucial section of the CPA Exam, focusing on the principles, frameworks, and standards that govern financial reporting. This area tests your understanding of GAAP, IFRS, revenue recognition, lease accounting, consolidations, deferred taxes, and governmental/not-for-profit accounting. It emphasizes the preparation, presentation, and analysis of financial statements, ensuring compliance and transparency. Mastering this section is essential for handling real-world accounting scenarios, interpreting complex financial data, and ensuring accurate financial reporting in both public and corporate environments.

Learning Objectives

In studying Area II – Technical Accounting and Reporting for the CPA Exam, you should understand the frameworks governing financial reporting, including GAAP and IFRS, and how they apply to different business scenarios. Analyze key principles behind topics such as revenue recognition, lease accounting, consolidations, and deferred taxes. Evaluate how financial statements are prepared, including required disclosures, and explore fund accounting for governmental and not-for-profit entities. Additionally, learn how these techniques are used in both public and corporate accounting to ensure compliance and transparency, and apply this knowledge to interpreting financial data and answering CPA practice questions effectively.

Financial Reporting Frameworks (GAAP vs. IFRS)

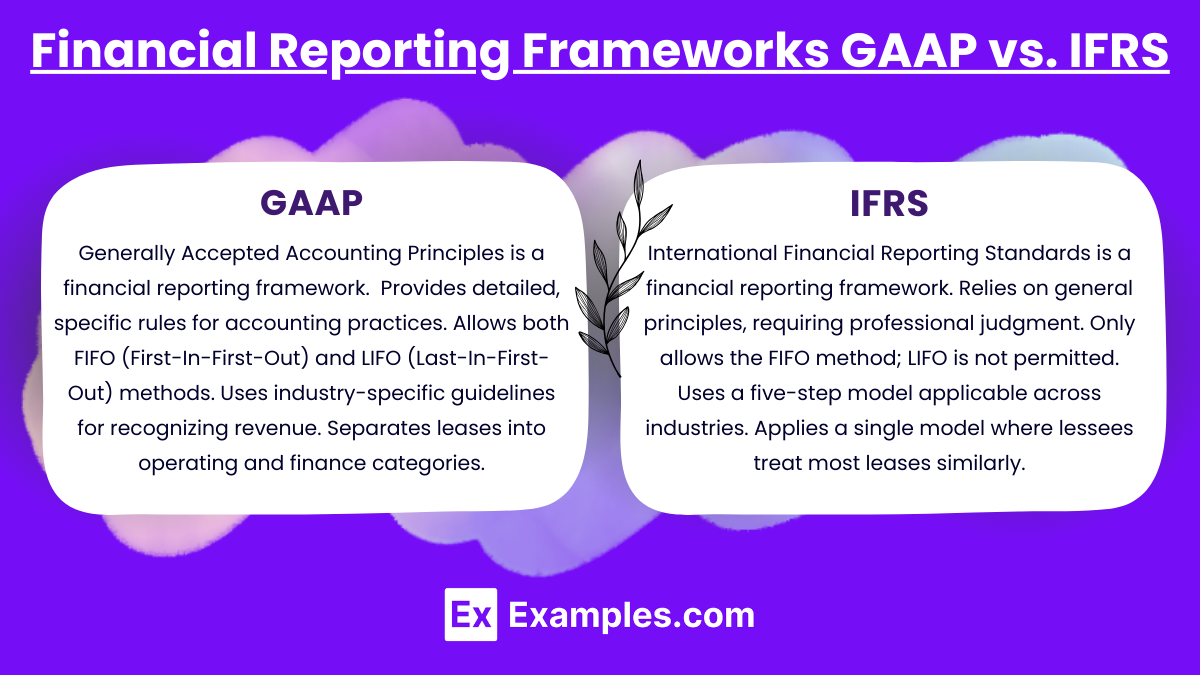

GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) are the two primary financial reporting frameworks used worldwide. GAAP, used primarily in the United States, is rules-based, providing detailed guidelines for financial reporting. In contrast, IFRS, adopted by many countries globally, is principles-based, offering broader frameworks that require professional judgment. Key differences include revenue recognition, inventory methods (FIFO vs. LIFO), and lease accounting. Understanding these frameworks is essential for CPAs to accurately prepare, analyze, and interpret financial statements across international and domestic markets.

GAAP

- Rules-Based Framework: Provides detailed, specific rules for accounting practices.

- Inventory Accounting: Allows both FIFO (First-In-First-Out) and LIFO (Last-In-First-Out) methods.

- Revenue Recognition: Uses industry-specific guidelines for recognizing revenue.

- Lease Accounting: Separates leases into operating and finance categories.

- Adoption: Primarily used in the United States.

- Disclosure Requirements: Emphasizes compliance through detailed disclosures.

IFRS

- Principles-Based Framework: Relies on general principles, requiring professional judgment.

- Inventory Accounting: Only allows the FIFO method; LIFO is not permitted.

- Revenue Recognition: Uses a five-step model applicable across industries.

- Lease Accounting: Applies a single model where lessees treat most leases similarly.

- Adoption: Used by over 120 countries worldwide.

- Flexibility: Provides broader guidance, allowing greater interpretation in complex scenarios.

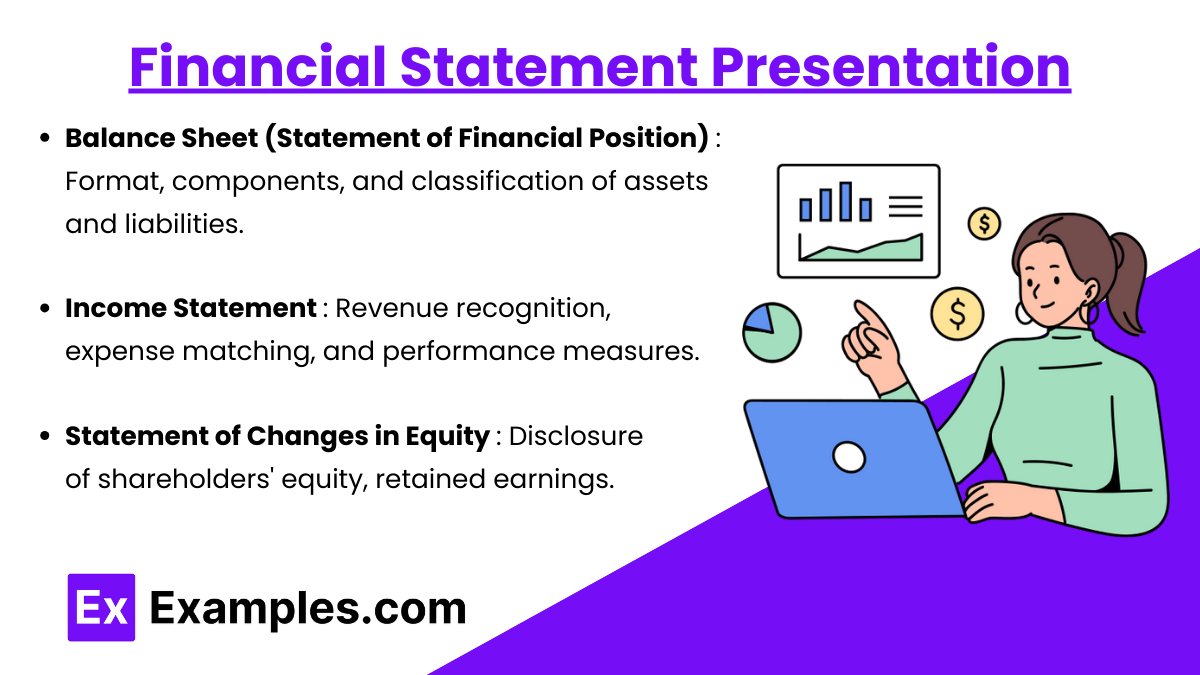

Financial Statement Presentation

- Balance Sheet (Statement of Financial Position): Format, components, and classification of assets and liabilities.

- Income Statement: Revenue recognition, expense matching, and performance measures.

- Statement of Cash Flows: Direct vs. indirect method, classification of cash activities (operating, investing, and financing).

- Statement of Changes in Equity: Disclosure of shareholders’ equity, retained earnings, and comprehensive income.

Revenue Recognition (ASC 606)

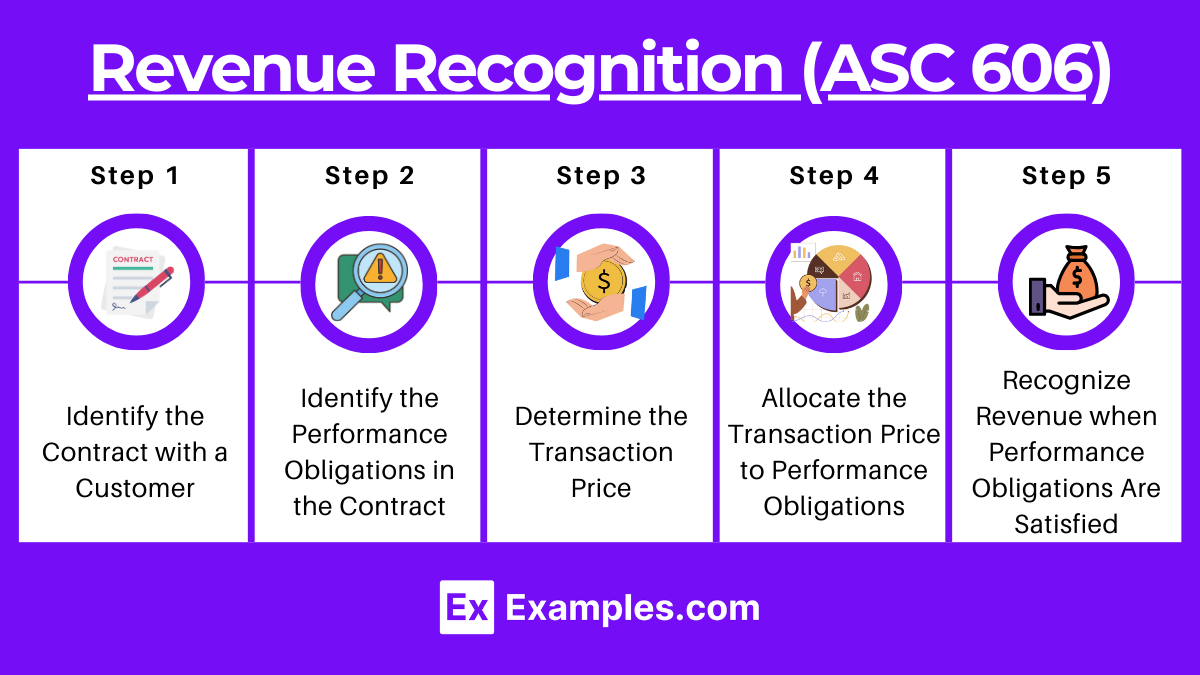

ASC 606 and IFRS 15 aim to enhance transparency and consistency in how companies recognize revenue. Both frameworks follow the five-step model to ensure that revenue is recognized when performance obligations are fulfilled and control of goods or services transfers to the customer. While the frameworks are aligned, there are some nuanced differences in certain areas, such as licensing and disclosure requirements.

Five-Step Model for Revenue Recognition

- Identify the Contract with a Customer

- A legally enforceable agreement that outlines the terms of goods or services provided and the rights and obligations of both parties.

- The contract must have commercial substance, and payment must be probable to be collectible.

- Identify the Performance Obligations in the Contract

- Performance obligations are distinct goods or services that can be sold separately or provide standalone value.

- Contracts may contain multiple performance obligations, such as product delivery and subsequent maintenance services.

- Determine the Transaction Price

- The transaction price reflects the amount of consideration the entity expects to receive in exchange for transferring goods or services.

- Variable components like discounts, rebates, or performance bonuses must be estimated using either the expected value or most likely amount approach.

- Allocate the Transaction Price to Performance Obligations

- If the contract includes multiple obligations, the total price must be allocated based on the standalone selling price of each component.

- Companies must use relative selling prices to allocate discounts across performance obligations, unless a specific discount applies only to one component.

- Recognize Revenue When (or As) Performance Obligations Are Satisfied

- Revenue is recognized over time if the customer simultaneously receives and consumes the benefits (e.g., services).

- At a point in time, revenue is recognized when control transfers (e.g., when goods are delivered or risks and rewards transfer).

Lease Accounting (ASC 842)

ASC 842 and IFRS 16 are the new lease accounting standards aimed at improving transparency by requiring companies to recognize most leases on the balance sheet. Both frameworks require lessees to report right-of-use (ROU) assets and lease liabilities but differ in classification and treatment of certain leases. Below is an overview of the key principles and differences between ASC 842 and IFRS 16.

- Distinction between finance leases and operating leases for lessees.

- Criteria for lease classification (e.g., transfer of ownership, purchase option, lease term, and present value).

- Recognition of lease liabilities and right-of-use assets.

- Key differences between lessee and lessor accounting.

Accounting for Income Taxes (ASC 740)

- Temporary vs. permanent differences in accounting for income taxes.

- Deferred tax assets (DTA) and deferred tax liabilities (DTL).

- Valuation allowances and recognition thresholds for tax positions.

- Accounting for net operating losses (NOL) and uncertain tax positions.

Strategies for Area II: Technical Accounting and Reporting

- Master GAAP and IFRS Differences: Focus on areas like leases, revenue recognition, and financial statement presentation, where differences are most prominent.

- Practice with Case Studies: Apply knowledge through real-world financial statement analysis and business combination scenarios.

- Use Mnemonics for Standards: Develop memorization aids for the hierarchy of fair value, lease classification criteria, and revenue recognition steps.

- Understand Disclosures and Reporting Requirements: Know what must be disclosed in the notes to financial statements for complex topics like derivatives, taxes, and impairments.

- Time Management: Technical accounting can be detail-heavy, so prioritize topics based on historical exam patterns (e.g., revenue recognition, leases).

Examples

Examples of Area II – Technical Accounting and Reporting (CPA)

Example 1: Revenue Recognition under ASC 606

A software company sells a bundle including a software license, installation services, and one year of technical support for $100,000. Each component must be evaluated to determine if it constitutes a separate performance obligation. The company allocates the transaction price based on standalone selling prices and recognizes revenue for the license upon delivery, while installation and support revenue are recognized over time as services are provided. This example tests the application of ASC 606’s five-step model and how to properly allocate revenue.

Example 2: Lease Classification – Operating vs. Finance Lease (ASC 842)

A company signs a 5-year lease for office equipment where the present value of payments equals 90% of the equipment’s fair value, and ownership transfers at the lease’s end. Since it meets the criteria for a finance lease, the lessee records a right-of-use asset and lease liability on the balance sheet, with interest and amortization expenses recognized over the lease term. This scenario tests your ability to classify leases and properly account for them under ASC 842.

Example 3: Business Combinations and Goodwill (ASC 805)

A company acquires another entity for $10 million, with the fair value of identifiable assets at $8 million and liabilities at $3 million, resulting in goodwill of $5 million. The acquisition method requires the recognition of assets and liabilities at fair value, with intercompany transactions eliminated during consolidation. This example examines your understanding of goodwill calculations and how to consolidate financial statements post-acquisition.

Example 4: Deferred Taxes – Temporary Differences and Valuation Allowances (ASC 740)

A company uses straight-line depreciation for financial reporting but accelerated depreciation for tax purposes, creating a temporary difference and a deferred tax liability (DTL). If the company anticipates future tax savings from deductible differences but is uncertain about realizing them, it may need to establish a valuation allowance against deferred tax assets (DTAs). This example tests knowledge of DTLs, DTAs, and when valuation allowances are appropriate.

Example 5: Governmental Accounting – Fund Accounting (GASB Standards)

A city receives a federal grant to build a public park, which must be recorded in a special revenue fund to ensure the money is used exclusively for that purpose. The city applies modified accrual accounting, recognizing revenue when available and measurable, and tracks expenditures separately to maintain accountability. This example demonstrates the correct use of fund accounting and modified accrual principles in governmental financial reporting.

Practice Questions

Question 1

Which of the following conditions must be met for a lease to be classified as a finance lease under ASC 842?

A. The lease payments are variable and based on the lessee’s usage of the asset.

B. The lease term represents 75% or more of the remaining economic life of the asset.

C. The lease contains a non-cancellable termination clause.

D. The lessor retains ownership of the asset at the end of the lease term.

Correct Answer: B. The lease term represents 75% or more of the remaining economic life of the asset.

Explanation: Under ASC 842, a lease is classified as a finance lease if any one of several criteria is met, including: (1) the lease transfers ownership of the asset to the lessee at the end of the lease term, (2) the lease contains a purchase option that the lessee is reasonably certain to exercise, (3) the lease term is 75% or more of the economic life of the asset, (4) the present value of lease payments equals or exceeds 90% of the fair value of the asset, or (5) the asset is so specialized that it is unlikely to have alternative use to the lessor. Options A and D are incorrect because variable lease payments and ownership retained by the lessor do not determine lease classification. C is incorrect since a non-cancellable clause alone does not change the lease type.

Question 2

A company purchased 80% of the voting stock of another entity and recorded the acquisition using the acquisition method. How should intercompany transactions between the parent and subsidiary be reported in consolidated financial statements?

A. Intercompany transactions should be reported as related-party transactions with appropriate disclosures.

B. All intercompany transactions and balances should be eliminated in full.

C. Only intercompany revenues and expenses need to be eliminated, while assets and liabilities remain.

D. The subsidiary’s financials should be reported separately from the parent’s financials in a combined statement.

Correct Answer: B. All intercompany transactions and balances should be eliminated in full.

Explanation: In consolidated financial statements, the parent company and subsidiary are treated as a single economic entity, meaning that intercompany transactions, balances, and unrealized gains/losses between the two entities must be eliminated to avoid double counting. For example, if the parent company sells goods to the subsidiary, neither the sale nor the resulting receivable should appear in the consolidated financials. A is incorrect because intercompany transactions are not disclosed as related-party transactions in consolidated statements. C is incorrect since all intercompany transactions (revenues, expenses, assets, and liabilities) are eliminated. D is incorrect because consolidated statements do not present the parent and subsidiary separately.

Question 3

How should a not-for-profit organization classify a contribution with donor-imposed restrictions that are met within the same reporting period?

A. As net assets with donor restrictions, regardless of when the restriction is satisfied.

B. As net assets without donor restrictions, since the restriction is satisfied in the same period.

C. As deferred revenue until the restriction is satisfied.

D. As an expense in the period the funds are used.

Answer: B. As net assets without donor restrictions, since the restriction is satisfied in the same period.

Explanation : Under FASB standards for not-for-profit accounting, if a contribution has donor-imposed restrictions that are satisfied within the same reporting period, the contribution can be classified as net assets without donor restrictions in the financial statements. This simplifies reporting by recognizing the contribution as unrestricted since the restriction was met before the end of the period. A is incorrect because contributions with satisfied restrictions do not remain as net assets with restrictions. C is incorrect, as deferred revenue treatment applies to conditional contributions, not restricted contributions. D is incorrect since contributions are recorded as revenue, not expenses.