System and Organization Controls (SOC) engagements focus on evaluating the effectiveness of an organization’s internal controls over financial reporting, data security, and service delivery. These engagements provide assurance to stakeholders that critical systems and processes meet compliance, security, and operational standards. SOC reports are essential for entities that outsource key operations, helping them demonstrate accountability and transparency.

Learning Objectives

In studying "Considerations for System and Organization Controls (SOC) Engagements" for the CPA Exam, you should understand the different types of SOC reports, including SOC 1, SOC 2, SOC 3, and their purposes. Analyze how these reports evaluate internal controls over financial reporting, cybersecurity, and trust service criteria such as security, availability, and privacy. Evaluate the principles behind SOC Type I and Type II engagements, focusing on control design and operational effectiveness. Explore how SOC engagements are used to provide assurance to stakeholders, clients, and regulators, and apply your understanding to interpreting control deficiencies and audit scenarios on the exam.

SOC Engagements

SOC engagements focus on providing independent assurance about the quality and reliability of an organization's internal controls. They are particularly important for service organizations—companies that manage data or processes on behalf of other entities. The reports generated from these engagements provide clients, regulators, and stakeholders with insights into the organization's control environment.

Types of SOC Reports

SOC 1 Report – Internal Controls over Financial Reporting (ICFR)

Evaluates controls relevant to a client’s financial reporting.

Used by auditors during the financial statement audit to ensure outsourced processes do not compromise the integrity of financial reporting.

SOC 1 Type I: Focuses on the design of controls at a specific point in time.

SOC 1 Type II: Evaluates the operating effectiveness of controls over a period.

SOC 2 Report – Trust Services Criteria (TSC)

Focuses on non-financial controls related to security, availability, processing integrity, confidentiality, and privacy.

Commonly used by technology and cloud service providers to demonstrate their ability to manage data securely.

SOC 2 Type I: Reports on the design of controls at a specific point in time.

SOC 2 Type II: Reports on the operating effectiveness of controls over time.

SOC 3 Report – Public Version of SOC 2

Provides similar information to a SOC 2 report but is intended for public distribution. It includes a less detailed summary to ensure broader accessibility without revealing proprietary information.

Trust Services Criteria (TSC) for SOC 2 and SOC 3 Reports

Security: Measures to protect data and systems from unauthorized access (e.g., firewalls, encryption).

Availability: Ensuring systems are operational and accessible as agreed upon.

Processing Integrity: Ensuring data processing is complete, accurate, and authorized.

Confidentiality: Protecting sensitive information through access controls and encryption.

Privacy: Ensuring the proper collection, use, and protection of personal data in compliance with regulations like GDPR and HIPAA.

CPA’s Role in SOC Engagements

Planning the Engagement:

CPAs need to understand the nature of the service organization’s operations and identify key risks.

Engagement planning includes setting objectives, defining the scope of controls, and establishing criteria for testing.

Evaluating Controls:

CPAs test the design and operational effectiveness of controls.

They identify control deficiencies and determine their impact on stakeholders.

Reporting Findings:

For Type I reports, the CPA confirms that controls are properly designed.

For Type II reports, the CPA assesses whether the controls functioned effectively over a specified period.

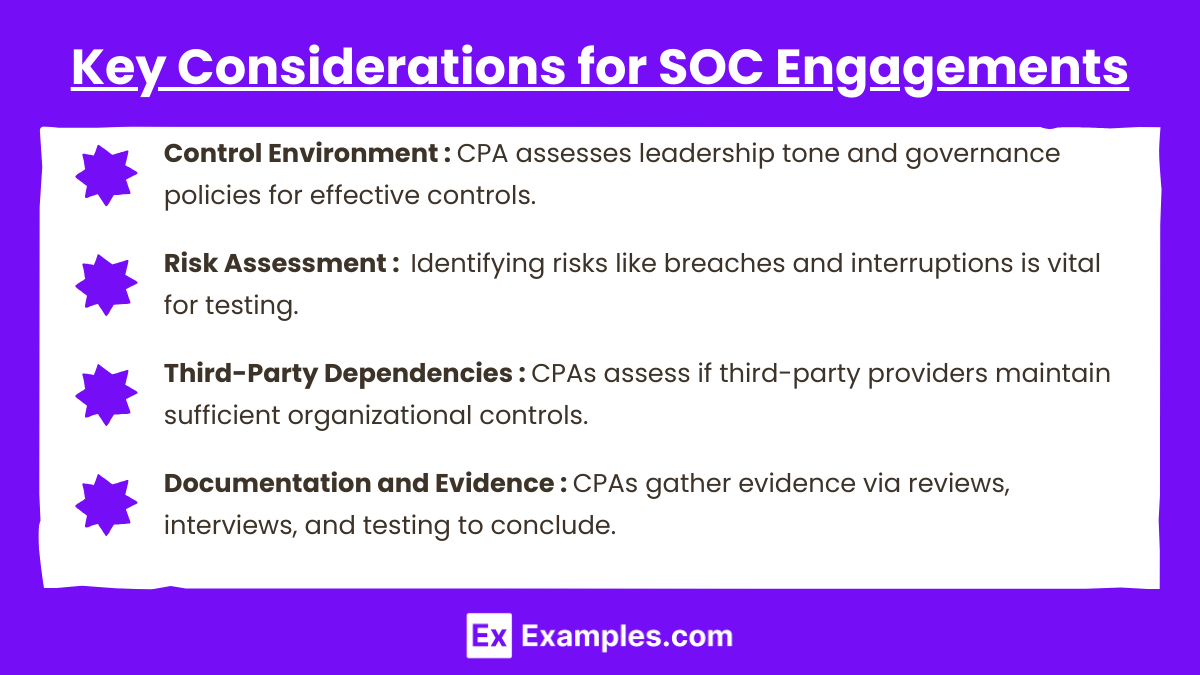

Key Considerations for SOC Engagements

Control Environment:

The CPA must evaluate the tone at the top and the effectiveness of governance policies in fostering strong internal controls.

Risk Assessment:

Identifying potential risks, such as data breaches, service interruptions, or unauthorized data access, is essential for effective testing.

Third-Party Dependencies:

Many organizations rely on third-party service providers, and the CPA must assess whether these external providers maintain adequate controls.

Documentation and Evidence:

CPAs must collect sufficient evidence through documentation reviews, interviews, and control testing to support their conclusions.

Examples

Example 1: SOC 1 Engagement: Payroll Processing Controls for Financial Reporting

A payroll service provider undergoes a SOC 1 Type II audit to demonstrate that its controls over salary calculations, tax withholdings, and disbursement processes are effective over time. This ensures that its operations do not negatively impact the integrity of clients’ financial statements, as auditors rely on the SOC 1 report to assess risks during financial audits.

Example 2: SOC 2 Engagement: Cloud Service Provider’s Security Controls

A cloud service provider completes a SOC 2 Type II audit, focusing on controls related to security, availability, and confidentiality. The CPA tests whether the provider consistently maintains firewalls, multi-factor authentication, and encryption throughout the reporting period. This engagement assures customers that their data is securely managed and systems remain operational according to service-level agreements.

Example 3: SOC 3 Engagement: Public Report for a SaaS Provider

A SaaS company publishes a SOC 3 report to build trust with its users by offering a high-level overview of its data security practices. This public-facing report is less detailed than a SOC 2 report but provides customers with confidence that the company follows best practices related to security and availability without exposing sensitive internal details.

Example 4: SOC for Cybersecurity: Healthcare Provider’s Risk Management Program

A healthcare organization undergoes a SOC for Cybersecurity engagement to evaluate the effectiveness of its cybersecurity risk management program. The CPA assesses the provider’s ability to prevent and respond to cyberattacks, particularly focusing on protecting sensitive patient information in compliance with HIPAA. This report helps the organization demonstrate readiness to stakeholders and regulators.

Example 5: SOC for Supply Chain: Manufacturing Firm’s Vendor Controls

A manufacturing firm engaged in producing medical equipment performs a SOC for Supply Chain engagement to evaluate the security and operational controls of its third-party vendors. The CPA reviews whether the vendors meet the required standards for security, availability, and processing integrity, ensuring that all parts and software integrated into the final products comply with regulatory requirements and do not introduce operational risks.

Practice Questions

Question 1

What is the primary focus of a SOC 1 report?

A) Non-financial controls such as security, availability, and confidentiality

B) Controls relevant to financial reporting for client organizations

C) Publicly accessible reports summarizing security practices

D) Evaluating the effectiveness of cybersecurity programs

Answer: B) Controls relevant to financial reporting for client organizations

Explanation: A SOC 1 report assesses the internal controls at a service organization that are relevant to a client’s financial reporting. It ensures that outsourced processes, such as payroll or accounts receivable, do not compromise the integrity of the client’s financial statements. SOC 1 reports are used by auditors as part of the financial audit process. Options A and D refer to SOC 2 and cybersecurity engagements, while option C relates to SOC 3 reports, which are public summaries.

Question 2

Which of the following is a key difference between SOC 2 Type I and SOC 2 Type II reports?

A) SOC 2 Type I focuses on operational effectiveness, while SOC 2 Type II evaluates control design only.

B) SOC 2 Type I assesses control design at a specific point in time, while SOC 2 Type II evaluates operational effectiveness over a period.

C) SOC 2 Type I reports are for internal use, while SOC 2 Type II reports are publicly accessible.

D) SOC 2 Type I focuses on availability only, while SOC 2 Type II covers all Trust Services Criteria.

Answer: B) SOC 2 Type I assesses control design at a specific point in time, while SOC 2 Type II evaluates operational effectiveness over a period.

Explanation: SOC 2 Type I reports examine whether controls are designed effectively at a given point in time. In contrast, SOC 2 Type II reports assess the operational effectiveness of those controls over a longer period (typically 6 to 12 months). Both reports focus on non-financial controls aligned with the Trust Services Criteria (TSC). Option C is incorrect since both SOC 2 reports are usually shared with specific stakeholders, not the general public.

Question 3

Which SOC report is intended for public distribution, providing general assurance about an organization’s internal controls?

A) SOC 1 Type II

B) SOC 2 Type I

C) SOC 3 Report

D) SOC for Cybersecurity

Answer: C) SOC 3 Report

Explanation: A SOC 3 report is a high-level summary of a SOC 2 report, designed for public distribution. It provides assurance about an organization’s security and confidentiality practices without revealing detailed proprietary information. This report helps organizations build trust with customers and stakeholders. In contrast, SOC 1 and SOC 2 reports are more detailed and intended for a limited audience, such as auditors and clients. SOC for Cybersecurity is specific to assessing cybersecurity programs, not public reporting.