Preparing for the CPA Exam requires a comprehensive understanding of Area III – Entity Tax Planning. This segment covers strategies for minimizing tax liabilities and ensuring compliance at the entity level. Key topics include understanding the tax implications of business structures (corporations, partnerships, and LLCs), handling entity transactions such as mergers, acquisitions, and liquidations, and applying tax credits and deductions specific to entities. Mastery of this area is essential for optimizing business tax planning, ensuring compliance with tax laws, and making strategic financial decisions crucial for achieving a high CPA score.

Learning Objectives

In studying "Area III – Entity Tax Planning" for the CPA exam, you should understand the tax strategies, laws, and compliance requirements affecting different types of business entities. Analyze entity-specific tax strategies, such as income allocation, deductions, credits, and restructuring to minimize entity tax liabilities. Evaluate entity-level tax forms, filing requirements, and the implications of recent tax legislation. Additionally, explore advanced tax concepts such as corporate mergers, acquisitions, liquidations, and partnership allocations. Apply your understanding to interpreting entity-related tax scenarios, making informed decisions, and solving case-based questions in CPA exam practice sections.

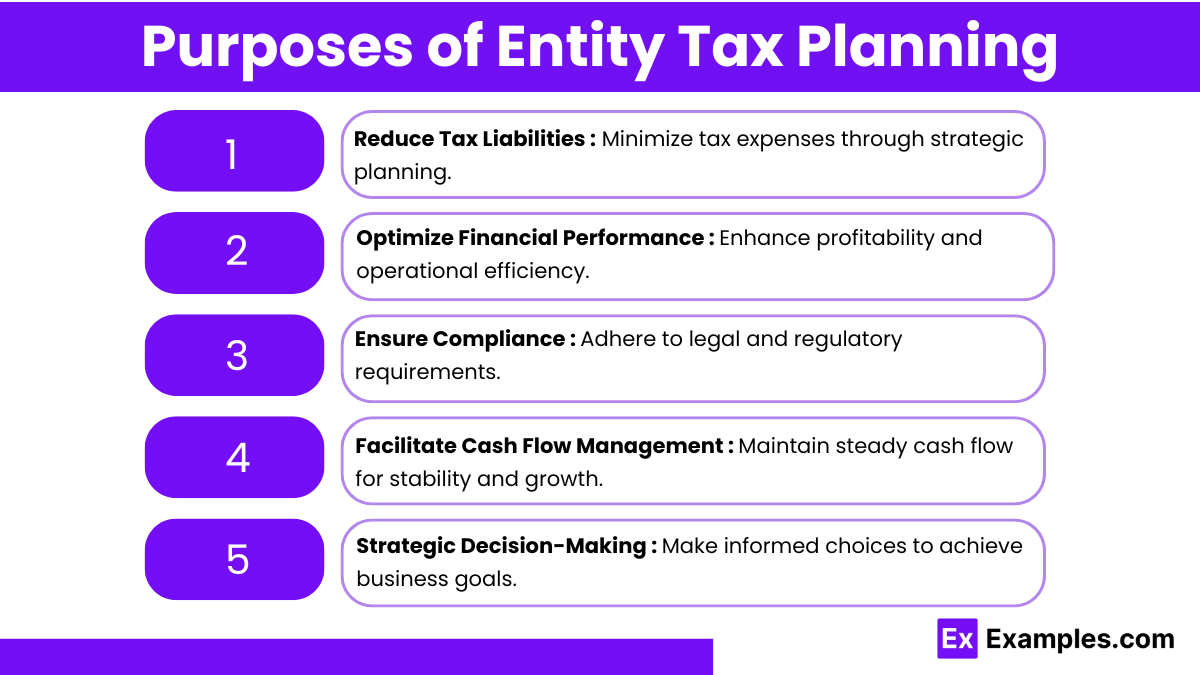

Purposes of Entity Tax Planning

Reduce Tax Liabilities: The primary purpose is to minimize the taxes payable by entities, allowing more funds for growth and development.

Optimize Financial Performance: By implementing tax-saving strategies, entities can allocate more resources to investment and operations, increasing overall profitability.

Ensure Compliance: Proper tax planning ensures that entities comply with tax regulations, avoiding penalties and legal complications.

Facilitate Cash Flow Management: Effective tax planning improves cash flow management, enabling better budgeting and financial planning.

Strategic Decision-Making: Tax planning supports decision-making regarding investments, mergers, acquisitions, and other financial strategies.

Types of Entity Tax Planning

Corporate Tax Planning:

Focuses on corporations, especially C-Corporations and S-Corporations.

Strategies involve deductions, credits, and entity restructuring to minimize corporate taxes.

Partnership Tax Planning:

Involves tax planning for partnerships (general, limited, and LLPs).

Strategies include income allocation, partner compensation, and profit-sharing agreements.

LLC Tax Planning:

Limited Liability Companies (LLCs) offer flexibility in tax planning.

Strategies focus on pass-through taxation, deductions, and benefits of choosing taxation as a corporation.

Multinational Tax Planning:

Involves planning for entities operating in multiple countries.

Strategies include transfer pricing, foreign tax credits, and tax treaties to minimize global tax liabilities.

Real Estate Entity Tax Planning:

Concerns entities in the real estate sector.

Involves leveraging deductions, capital gains treatment, and tax-deferred exchanges like 1031 exchanges.

Importance of Entity Tax Planning

Tax Savings and Efficiency:

Proper entity tax planning reduces overall tax liability, enabling entities to save significant amounts of money. This efficiency allows businesses to retain more income, which can be reinvested into growth, research, or other strategic initiatives.Maximization of After-Tax Income:

One of the primary goals of tax planning is to increase after-tax income. By strategically managing deductions, credits, and deferrals, entities can enhance net profitability, which directly impacts financial health and sustainability.Informed Decision-Making:

Entity tax planning informs key strategic decisions such as mergers, acquisitions, expansions, and capital investments. Understanding tax implications helps decision-makers assess the potential benefits or drawbacks of financial strategies, ensuring optimized outcomes.Regulatory Compliance:

Effective tax planning ensures compliance with complex tax laws and regulations. It helps prevent legal complications, penalties, or audits by maintaining transparent, accurate, and lawful tax reporting, which is critical for maintaining the entity’s reputation and operational stability.Improved Cash Flow Management:

By reducing tax liabilities, entities can manage their cash flow more effectively. This supports better budgeting, debt management, and liquidity, enabling the entity to handle financial obligations more efficiently and invest in future opportunities.

Examples

Example 1. Effective Entity Tax Planning

In "Area III – Entity Tax Planning," businesses focus on maximizing tax benefits by analyzing various strategies to minimize taxable income. This area helps entities identify opportunities for deductions, credits, and other tax incentives. The strategies ensure compliance while reducing the overall tax liability, allowing businesses to retain more resources for reinvestment and growth. It also involves planning for future tax implications of current decisions, aligning with long-term business goals.

Example 2. Structuring Transactions in "Area III – Entity Tax Planning"

This area guides businesses on structuring transactions in a tax-efficient manner. Whether it involves mergers, acquisitions, or other significant business deals, "Area III – Entity Tax Planning" ensures that transactions are structured to optimize tax outcomes. It involves understanding the implications of each deal, assessing potential tax exposure, and implementing strategies that align with both legal compliance and financial goals.

Example 3. Capital Investments and "Area III – Entity Tax Planning"

In "Area III – Entity Tax Planning," entities analyze how capital investments can be leveraged for tax savings. By exploring various investment options, businesses can identify assets that provide depreciation benefits, tax credits, or other incentives. This analysis is crucial for making informed decisions that align with both business growth and optimal tax outcomes, contributing to sustainable profitability.

Example 4. Strategic Business Decisions and "Area III – Entity Tax Planning"

"Area III – Entity Tax Planning" plays a key role in guiding strategic business decisions, such as entity selection, expansion, or diversification. It helps entities evaluate the tax implications of different business models and operational strategies, ensuring that decisions not only enhance growth but also minimize tax exposure. This proactive approach allows businesses to plan ahead, anticipating future tax liabilities and opportunities.

Example 5. International Considerations in "Area III – Entity Tax Planning"

For businesses operating globally, "Area III – Entity Tax Planning" involves analyzing international tax regulations and treaties. This area emphasizes compliance while exploring strategies to reduce global tax burdens. It involves assessing transfer pricing, cross-border transactions, and foreign tax credits to ensure that international operations are structured in the most tax-efficient way possible, maintaining competitiveness in global markets.

Practice Questions

Question 1

Which of the following strategies is primarily used to reduce a C corporation’s taxable income?

A. Distributing dividends to shareholders

B. Accelerating income recognition

C. Deferring income and accelerating expenses

D. Increasing retained earnings

Correct Answer: C. Deferring income and accelerating expenses

Explanation:

The primary goal of tax planning for a C corporation is to minimize taxable income to reduce tax liability. This can be achieved by deferring income (e.g., by postponing revenue recognition to a later year) and accelerating expenses (e.g., by paying for expenses early or taking advantage of bonus depreciation). This approach reduces the current year's taxable income, resulting in a lower tax burden. Distributing dividends (Option A) does not reduce taxable income, and increasing retained earnings (Option D) reflects how profits are retained, not a tax reduction strategy. Accelerating income (Option B) increases taxable income, contrary to the goal.

Question 2

In the context of entity tax planning, what is the main purpose of utilizing a pass-through entity structure, such as an S corporation or partnership?

A. To double the taxation on income

B. To achieve tax deferral benefits

C. To allow profits to be taxed at the individual level

D. To eliminate all forms of taxation on profits

Correct Answer: C. To allow profits to be taxed at the individual level

Explanation:

Pass-through entities, such as S corporations, partnerships, and LLCs (treated as partnerships), do not pay federal income tax at the entity level. Instead, income, deductions, credits, and other tax attributes pass through to the owners, where they are taxed at the individual level. This avoids double taxation, which is common in C corporations (where income is taxed at both the corporate and shareholder levels). While pass-through entities offer tax benefits, they do not eliminate all forms of taxation (Option D), nor do they aim to defer taxes (Option B). Double taxation (Option A) is a characteristic of C corporations, not pass-through entities.

Question 3

Which tax planning strategy can help minimize a closely-held corporation's exposure to the accumulated earnings tax (AET)?

A. Paying out substantial salaries to owner-employees

B. Increasing investment in taxable securities

C. Retaining all earnings for business expansion

D. Reducing capital expenditures

Correct Answer: A. Paying out substantial salaries to owner-employees

Explanation:

The accumulated earnings tax (AET) is designed to discourage corporations from retaining earnings beyond reasonable business needs. Paying out substantial salaries to owner-employees reduces accumulated earnings, which can help avoid the AET. It’s a legitimate way to distribute profits while deducting the salaries as business expenses. Retaining earnings (Option C) increases exposure to the AET, while increasing investment in taxable securities (Option B) may not sufficiently reduce retained earnings. Reducing capital expenditures (Option D) does not address accumulated earnings directly and may even increase taxable income.