Preparing for the CPA Exam requires a deep understanding of "Area III – Performing Further Procedures and Obtaining Evidence." Mastery of audit procedures and evidence gathering is essential. This knowledge equips you to verify financial statements, assess compliance, and ensure accuracy in reporting, critical for achieving a high CPA score.

Learning Objective

In studying "Area III – Performing Further Procedures and Obtaining Evidence" for the CPA Exam, you should aim to master the various audit procedures and evidence-gathering techniques essential for validating financial statements. Learn to critically analyze and implement these procedures to detect and address discrepancies or fraud. Explore techniques like sampling, inquiries, observations, and confirmations to collect and evaluate audit evidence. Additionally, understand the significance of substantive and compliance testing in audit practices. Apply this knowledge to assess risk, enhance audit effectiveness, and confidently interpret and report on the financial statements in CPA exam scenarios and professional auditing practice.

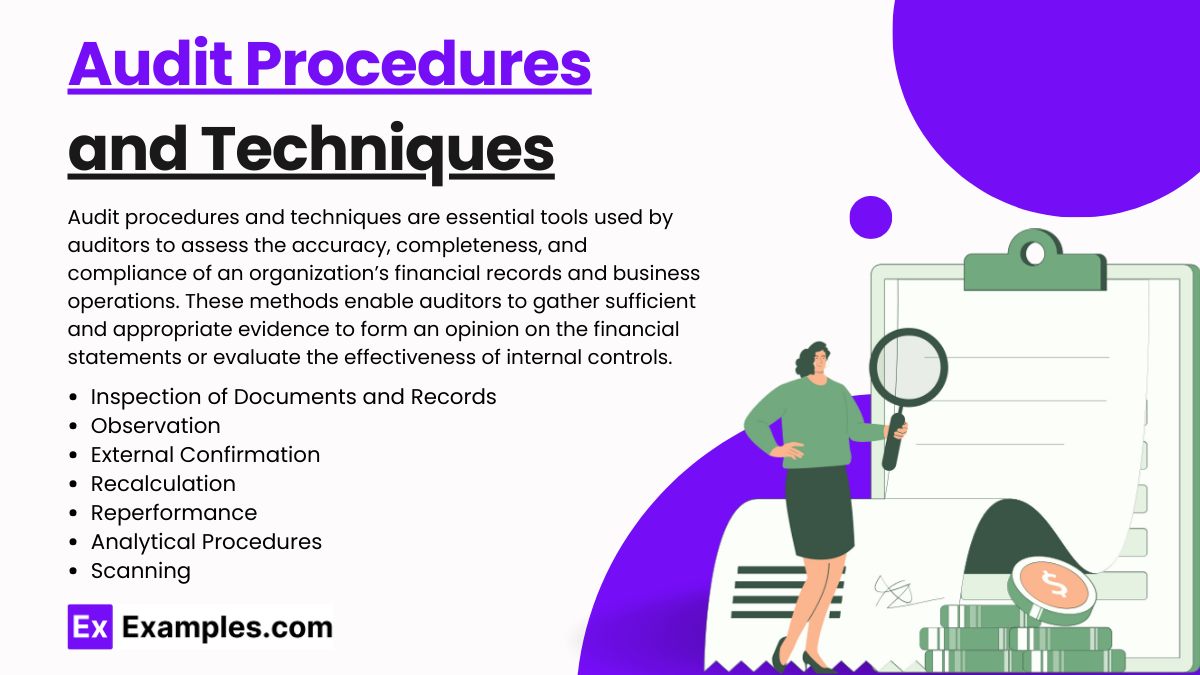

Audit Procedures and Techniques

Audit procedures and techniques are essential tools used by auditors to assess the accuracy, completeness, and compliance of an organization’s financial records and business operations. These methods enable auditors to gather sufficient and appropriate evidence to form an opinion on the financial statements or evaluate the effectiveness of internal controls. Here's an overview of the main audit procedures and techniques:

Inspection of Documents and Records: Examining physical and electronic records to verify transaction accuracy and asset existence.

Observation: Watching processes being performed to evaluate the actual implementation of procedures.

External Confirmation: Receiving direct verifications from third parties like banks or customers to confirm account balances and other financial data.

Recalculation: Re-performing calculations to verify numerical accuracy within the financial records.

Reperformance: Independently executing controls or procedures to test their effectiveness.

Analytical Procedures: Evaluating financial information by analyzing relationships among data to identify unusual transactions or trends.

Inquiry: Gathering insights from knowledgeable individuals inside or outside the entity to clarify or expand upon information in the accounts.

Scanning: Quickly reviewing records to identify significant or unusual items needing further investigation.

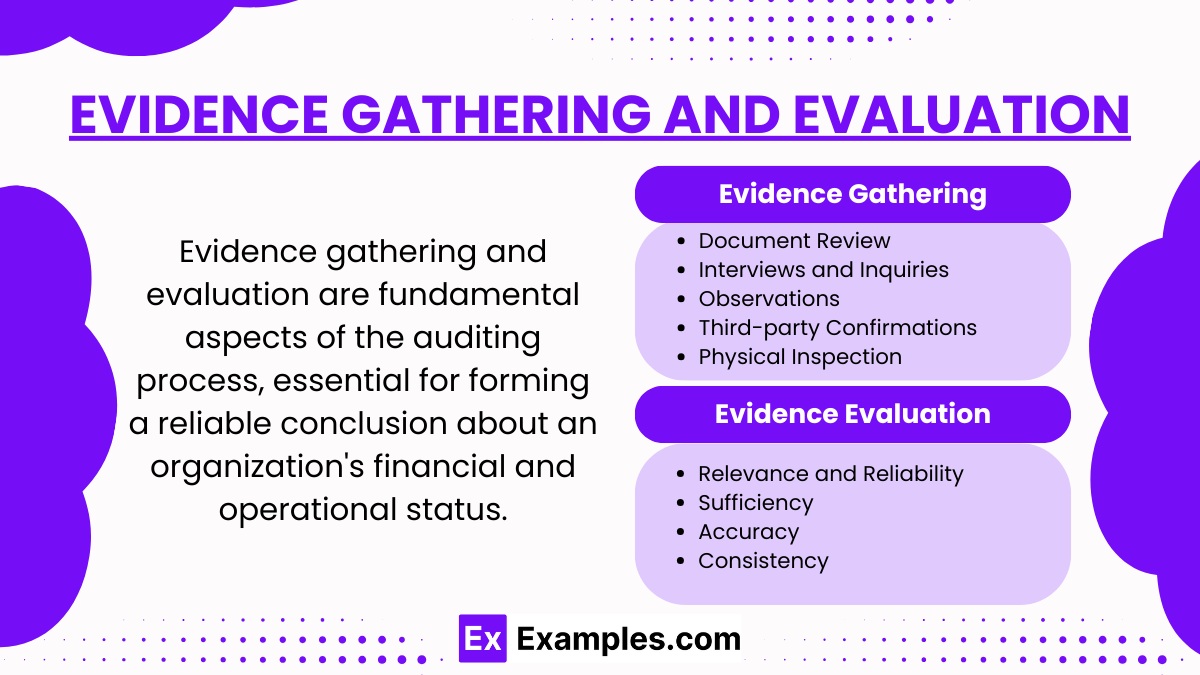

Evidence Gathering and Evaluation

Evidence gathering and evaluation are fundamental aspects of the auditing process, essential for forming a reliable conclusion about an organization's financial and operational status. Here's a concise overview of how auditors gather and evaluate evidence:

Evidence Gathering

Document Review: Auditors examine documents such as contracts, invoices, and bank statements to verify the accuracy and authenticity of the information recorded in the financial statements.

Interviews and Inquiries: Discussions with management and staff provide insights into internal processes and can confirm information obtained through other means.

Observations: Direct observation of processes and procedures helps verify how activities are actually carried out and whether they align with documented policies and controls.

Third-party Confirmations: Confirmation requests sent to external parties, like banks or major customers, validate account balances and other financial data.

Physical Inspection: Checking physical assets verifies their existence and condition, which is crucial for asset valuation.

Evidence Evaluation

Relevance and Reliability: Evidence must be both relevant to the audit objectives and reliable. For instance, externally sourced documents or directly observed processes are typically more reliable than internally generated information without independent verification.

Sufficiency: The quantity of evidence gathered must be sufficient to form a reasonable basis for an audit conclusion. This often means collecting more evidence in areas with higher risks of material misstatement.

Accuracy: Checks for numerical accuracy in financial records and recalculations of selected transactions ensure that the financial statements are free from errors.

Consistency: Comparing current year data with prior periods, as well as with industry standards, helps detect inconsistencies that might indicate errors or fraudulent activity.

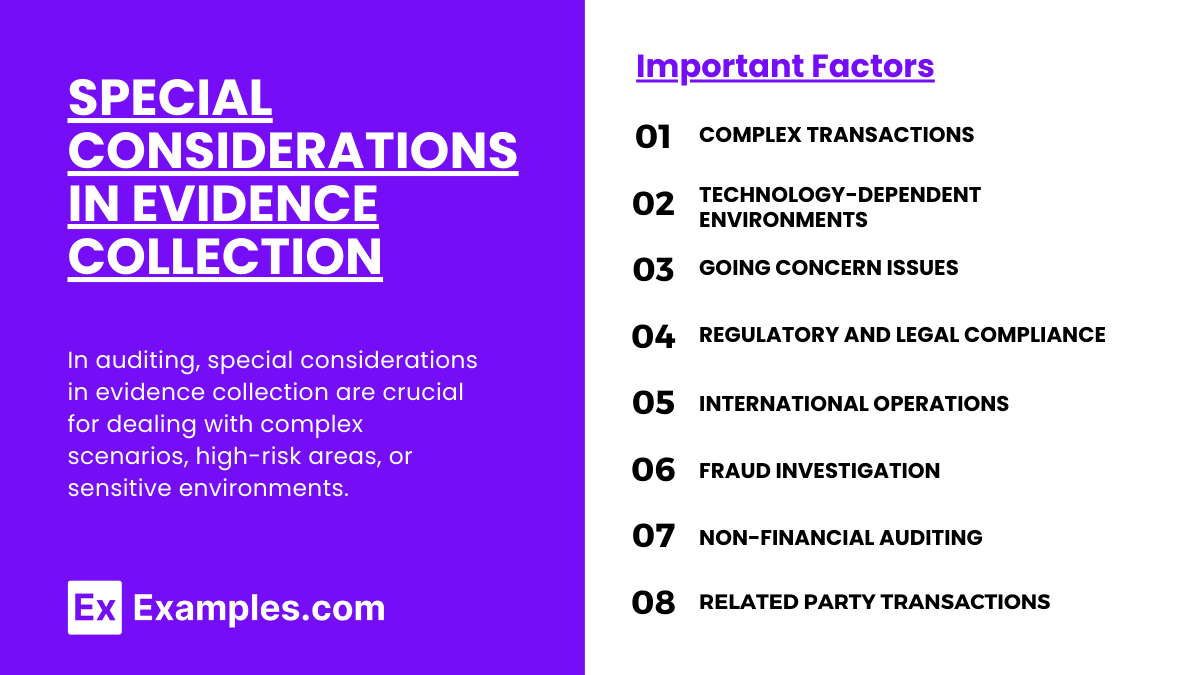

Special Considerations in Evidence Collection

In auditing, special considerations in evidence collection are crucial for dealing with complex scenarios, high-risk areas, or sensitive environments. Here’s an overview of important factors that auditors need to keep in mind:

Complex Transactions: Require specialized knowledge or experts to understand and verify.

Technology-Dependent Environments: Utilize computer-assisted audit techniques (CAATs) for effective data handling and system integrity tests.

Going Concern Issues: Gather evidence on liquidity, debt compliance, and future revenues to evaluate the entity’s viability.

Regulatory and Legal Compliance: In highly regulated industries, evidence must specifically demonstrate adherence to relevant laws.

International Operations: Coordinate with local auditors and experts to navigate different accounting standards and legal environments.

Fraud Investigation: Employ forensic auditing techniques focused on investigating and analyzing anomalies.

Non-financial Auditing: Collect both qualitative and quantitative evidence and use specialized frameworks for evaluation.

Related Party Transactions: Scrutinize the terms and conduct detailed examinations to ensure transactions are at arm’s length.

Reporting Audit Findings

Reporting audit findings is a critical step in the audit process, where the results of the audit are communicated to stakeholders. This report must be clear, comprehensive, and provide a truthful representation of the organization’s financial condition and compliance with applicable standards. Here are the key elements involved in reporting audit findings:

Summary of Audit Findings:

Clarity and Precision: Findings should be clearly and precisely described, providing stakeholders with an understanding of what was audited, the nature of any findings, and their implications.

Quantification of Findings: Whenever possible, findings should be quantified to provide a clear sense of their magnitude and potential impact on the financial statements.

Audit Opinion:

Type of Opinion: The audit report will include the auditor’s opinion, which typically falls into one of four categories: unqualified (clean), qualified, adverse, or disclaimer.

Basis for Opinion: The report should clearly state the basis for the opinion, referencing the financial reporting framework used for the preparation of the financial statements.

Recommendations:

Improvements Suggested: Auditors often provide recommendations for improving processes, controls, and systems to address deficiencies identified during the audit.

Action Plans: It may also be beneficial to suggest action plans for implementing these recommendations, including priorities and timelines.

Examples

Example 1: Inventory Count Verification

An auditor attends an end-of-year inventory count at a client’s warehouse. The auditor's role is to observe the count procedures, take independent counts for comparison, and ensure the inventory quantities match those reported in the client’s financial records.

Example 2: Bank Reconciliation Analysis

During an audit, the auditor performs bank reconciliations to verify the consistency and accuracy of cash records in the client’s ledger compared to bank statements. This process helps identify discrepancies like outstanding checks or unrecorded deposits that could indicate errors or fraud.

Example 3: Loan Agreement Compliance

An auditor reviews the terms of loan agreements to confirm that the client is complying with all conditions, such as debt covenants. The auditor tests transactions and balance sheet accounts to ensure compliance, which is critical for maintaining the validity of the audit opinion.

Example 4: Electronic Data Interchange (EDI) Transaction Testing

In auditing a company that uses EDI for sales transactions, the auditor uses specialized IT audit techniques to assess the integrity and security of the EDI system. This includes testing for unauthorized access and verifying that transactions are recorded correctly in the accounting system.

Example 5: Legal Compliance in Environmental Regulations

An auditor investigates a manufacturing client’s compliance with environmental laws and regulations. This involves assessing the adequacy of the client’s internal controls over environmental reporting and testing for potential liabilities or fines that could impact the financial statements.

Practice Questions

Question 1:

What is the primary purpose of performing external confirmations during an audit?

A. To test the effectiveness of internal controls

B. To obtain high-quality evidence regarding the existence of assets

C. To ensure the completeness of the trial balance

D. To assess the adequacy of the allowance for doubtful accounts

Answer: B

Explanation:

Step 1: Understanding the Question

This question addresses the objective of using external confirmations as a part of audit procedures.

Step 2: Analyzing Each Option

A is incorrect as confirmations primarily serve to verify account balances and transactions with third parties, not directly test internal controls.

B is correct because external confirmations provide reliable audit evidence directly from third parties, enhancing the credibility of the existence assertion of assets such as receivables and bank balances.

C and D are specific objectives but are not the primary purpose of external confirmations.

Step 3: Conclusion

External confirmations are crucial for obtaining direct and reliable evidence from third parties regarding the existence and accuracy of asset accounts.

Question 2:

Which of the following is an example of analytical procedures used during an audit?

A. Comparing current year sales figures with those of the previous year

B. Verifying the mathematical accuracy of the inventory count

C. Examining signed contracts to confirm revenue recognition

D. Observing the client's inventory counting procedures

Answer: A

Explanation:

Step 1: Understanding the Question

Analytical procedures involve evaluating financial information through analysis of plausible relationships among both financial and non-financial data.

Step 2: Analyzing Each Option

A is correct as it involves comparing financial data across periods to identify significant fluctuations or trends that might indicate misstatements.

B, C, and D are tests of details, not analytical procedures.

Step 3: Conclusion

Analytical procedures, like comparing sales figures year over year, help auditors understand trends and patterns that may indicate areas requiring further audit attention.

Question 3:

Why would an auditor perform a test of details on a client’s payroll expenses?

A. To confirm that payroll expenses are not materially overstated

B. To verify that all employees exist and are correctly compensated

C. To assess the operational efficiency of the payroll system

D. To determine the impact of payroll expenses on cash flow

Answer: B

Explanation:

Step 1: Understanding the Question

This question relates to the objectives behind conducting detailed tests on payroll expenses during an audit.

Step 2: Analyzing Each Option

A is typically concerned with understatement rather than overstatement in the context of expenses.

B is correct as it focuses on verifying the existence and accuracy of transactions and balances related to payroll, ensuring that payments are made to actual employees and in the correct amounts.

C and D are beyond the typical scope of an audit, which is focused more on financial accuracy than operational or cash flow analysis.

Step 3: Conclusion

Testing details of payroll expenses ensures the accuracy and legitimacy of the transactions recorded, which is essential for a reliable audit.