Select Transactions are fundamental to financial reporting, serving as key components in complex accounting scenarios. On the CPA Exam, you’ll explore topics like business combinations, consolidations, and leases. Understanding the recognition, measurement, and disclosure of derivatives, investments, and income taxes is essential. Mastery of these areas ensures proficiency in preparing and analyzing financial statements in accordance with accounting standards. These concepts are key to succeeding in the Financial Accounting and Reporting (FAR) section of the exam.

Learning Objectives

In studying "Area III – Select Transactions" for the CPA Exam, you should learn to account for various types of complex transactions, including business combinations, consolidations, and intercompany transactions. Understand the recognition, measurement, and disclosure requirements for these transactions under U.S. GAAP. Analyze how to apply acquisition accounting, including fair value measurement, goodwill recognition, and impairment testing. Evaluate the accounting treatment for foreign currency transactions, hedging activities, and derivatives. Additionally, develop the ability to identify appropriate reporting methods for non-monetary exchanges, leases, and government assistance, ensuring compliance with relevant accounting standards and frameworks.

Accounting for Complex Transactions

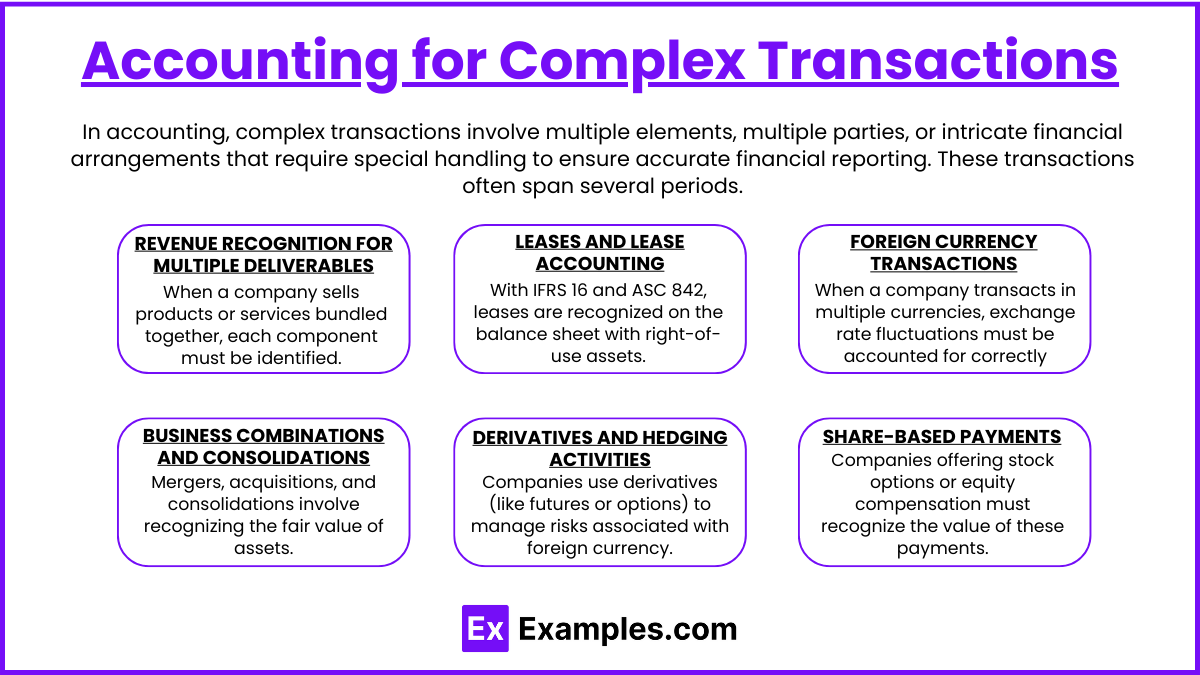

In accounting, complex transactions involve multiple elements, multiple parties, or intricate financial arrangements that require special handling to ensure accurate financial reporting. These transactions often span several periods, include non-monetary components, or require compliance with various standards (such as IFRS or GAAP). Proper treatment of these transactions is essential to maintain the integrity of financial statements.

Types of Complex Transactions

Revenue Recognition for Multiple Deliverables: When a company sells products or services bundled together, each component (or deliverable) must be identified and accounted for separately.

Example: A software company sells a license, training, and support in one package. Revenue from each component is recognized based on its standalone value and when performance obligations are met.

Leases and Lease Accounting: With IFRS 16 and ASC 842, leases are recognized on the balance sheet with right-of-use assets and corresponding liabilities.

Example: A company leases equipment for five years. The transaction is recorded as an asset and a liability at the present value of lease payments, with depreciation and interest recognized over time.

Foreign Currency Transactions: When a company transacts in multiple currencies, exchange rate fluctuations must be accounted for correctly, with gains or losses reported in financial statements.

Example: A U.S. company purchases inventory in euros. The transaction is recorded at the exchange rate on the date of purchase, and any gains or losses from exchange rate changes are recognized until settlement.

Derivatives and Hedging Activities: Companies use derivatives (like futures or options) to manage risks associated with foreign currency, interest rates, or commodity prices.

Example: A company enters a forward contract to hedge against currency risk. Changes in the fair value of the derivative must be recorded, with certain hedge accounting rules applied to offset gains or losses.

Business Combinations and Consolidations: Mergers, acquisitions, and consolidations involve recognizing the fair value of assets, liabilities, and goodwill.

Example: A parent company acquires a subsidiary. The subsidiary’s assets and liabilities are consolidated, and any excess purchase price is recorded as goodwill on the consolidated balance sheet.

Share-Based Payments: Companies offering stock options or equity compensation must recognize the value of these payments over the vesting period.

Recognition, Measurement, and Disclosure Requirements Under U.S. GAAP

1. Recognition Requirements

Recognition refers to the process of formally recording a transaction or event in the financial statements. A transaction is recognized if it meets the following criteria:

It is probable that future economic benefits will flow to or from the entity.

The item’s cost or value can be reliably measured.

Examples of Recognition Standards

Revenue Recognition (ASC 606): Revenue is recognized when a performance obligation is satisfied, i.e., when control of goods or services is transferred to the customer.

Lease Recognition (ASC 842): Lessees must recognize a right-of-use asset and corresponding lease liability for leases longer than 12 months.

Expense Recognition:

Expenses are recognized when incurred, following the matching principle, ensuring that expenses are recorded in the same period as the related revenue.

2. Measurement Requirements

Measurement involves determining the monetary amounts at which items are recognized in the financial statements. U.S. GAAP allows several measurement bases, depending on the nature of the transaction or event.

Common Measurement Bases

Historical Cost: Assets are recorded at the original purchase price (e.g., property, plant, and equipment).

Fair Value (ASC 820):

Some financial instruments, such as marketable securities, are measured at their current market value.

Fair value measurement includes Level 1, Level 2, and Level 3 inputs:

Level 1: Observable market prices.

Level 2: Inputs other than quoted prices, such as interest rates.

Level 3: Unobservable inputs, requiring estimation.

Amortized Cost: Used for long-term loans and bonds held to maturity, accounting for initial cost adjusted for interest and payments over time.

Net Realizable Value: Inventory is measured at the lower of cost or net realizable value (NRV) to reflect potential losses if selling prices decline.

3. Disclosure Requirements

Disclosures provide additional context and detail to the amounts presented in the financial statements. U.S. GAAP requires companies to disclose information that is relevant to users and helps them understand the financial position, performance, and risks faced by the entity.

Examples of Required Disclosures

Revenue Recognition Disclosures (ASC 606):

Breakdowns of revenue by product lines or geographical areas.

Information on significant judgments and contract balances.

Lease Disclosures (ASC 842): Terms of lease agreements, future lease payments, and right-of-use asset balances.

Contingent Liabilities (ASC 450): Disclose potential liabilities (e.g., lawsuits) if the likelihood of payment is reasonably possible, even if the amount is not certain.

Fair Value Disclosures (ASC 820): Explanation of how fair value was determined, including inputs used (Levels 1, 2, or 3).

Going Concern Disclosures: If the company’s ability to continue operations is in doubt, management must disclose the risks and steps taken to mitigate them.

Acquisition Accounting and Fair Value Measurement

Acquisition accounting is the process used to record and report a company’s purchase of another entity. It ensures that the assets, liabilities, and equity of the acquired company are accurately reflected in the acquiring company’s financial statements. Under U.S. GAAP and IFRS, the acquisition method must be used to account for business combinations, with an emphasis on fair value measurement to represent the true economic value of the acquired assets and liabilities.

1. Acquisition Accounting: Key Principles

Identification of the Acquirer:

The acquirer is the entity that obtains control over the acquired business.

Control typically refers to owning more than 50% of the voting shares or having significant influence over operations and financial policies.

Determination of Acquisition Date:

The acquisition date is the date on which the acquirer obtains control of the acquired business, and it serves as the point for recognizing assets and liabilities.

Recognition and Measurement of Assets and Liabilities:

All identifiable assets acquired and liabilities assumed must be measured at fair value as of the acquisition date.

Any previously unrecorded intangible assets, such as brand names, customer relationships, or patents, must also be recognized at fair value.

Goodwill Recognition:

Goodwill is recognized when the purchase price exceeds the fair value of the net identifiable assets acquired.It reflects the future economic benefits from the assets that are not individually identified and separately recognized (e.g., synergies or brand reputation).

Formula for Goodwill: Goodwill = Purchase Price−(Fair Value of Identifiable Assets−Liabilities Assumed)

Bargain Purchase: If the purchase price is less than the fair value of net identifiable assets, the difference is recognized as a gain on acquisition in the income statement.

2. Fair Value Measurement (ASC 820)

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Fair value reflects the exit price rather than the entry price, focusing on the current market conditions.

Fair Value Hierarchy:

Level 1 Inputs: Observable inputs, such as quoted prices in active markets for identical assets or liabilities (e.g., stocks traded on an exchange).

Level 2 Inputs: Observable inputs other than Level 1, such as prices for similar assets or market-derived interest rates.

Level 3 Inputs: Unobservable inputs based on management assumptions, typically used for unique assets without an active market (e.g., privately held companies or complex financial instruments).

Foreign Currency Transactions, Hedging Activities, and Derivatives

In today’s global economy, businesses frequently engage in foreign currency transactions and hedging activities to manage currency risks. Derivatives play a crucial role in hedging by helping companies mitigate the financial impact of currency, interest rate, and commodity price fluctuations.

1. Foreign Currency Transactions

Foreign currency transactions occur when companies engage in business activities that involve different currencies, such as purchasing goods, selling services, or borrowing in foreign currencies.

Key Aspects of Foreign Currency Transactions

Initial Recognition:

Transactions are initially recorded at the exchange rate on the transaction date.

Example: A U.S. company purchases inventory for €100,000 when the exchange rate is $1.10/€.The transaction is recorded at:

100,000×1.10 = 110,000 USD.

Revaluation at Reporting Date:

If the transaction is unsettled by the reporting date, the payable or receivable is revalued at the exchange rate on the reporting date.

Any difference between the original and new value is recorded as a foreign exchange gain or loss on the income statement.

Settlement: On settlement, the actual exchange rate is applied, and any additional gain or loss from currency fluctuations is recognized.

2. Hedging Activities

Hedging involves taking actions to offset potential losses from unfavorable price or currency movements. Businesses use derivatives to hedge against risks related to:

Foreign exchange rates (currency risk)

Interest rates (interest rate risk)

Commodity prices (commodity risk)

3. Types of Derivatives Used for Hedging

a. Forward Contracts

A forward contract locks in an exchange rate for a future transaction.

Example: A U.S. company expecting to receive €500,000 in three months can enter a forward contract to sell €500,000 at a specified rate, eliminating exchange rate risk.

b. Futures Contracts

Similar to forwards but traded on exchanges, offering more standardization and liquidity.

c. Options Contracts

Options give the holder the right, but not the obligation, to buy or sell a currency or commodity at a predetermined price.

Example: A U.S. importer buys a call option to purchase euros at $1.12/€ in case the euro appreciates beyond that rate.

d. Swaps

A swap involves exchanging one set of cash flows for another, typically used to manage interest rate or currency risks.

Example: A company swaps variable-rate interest payments for fixed-rate payments to reduce exposure to interest rate fluctuations.

Examples

Example 1: Real Estate Sales Analysis

In the real estate market, analysts may focus on selected transactions involving properties sold in a specific neighborhood over the last year. By examining these transactions, they can identify trends in property values, assess the impact of local amenities, and determine the average time properties spend on the market. This targeted analysis helps buyers, sellers, and real estate professionals make informed decisions based on relevant data.

Example 2: Retail Sales Data

A retailer might analyze selected transactions from a specific product category, such as athletic footwear, during a promotional period. By focusing on this subset of transactions, the retailer can evaluate the effectiveness of marketing strategies, understand customer preferences, and identify which styles or brands sold best. This approach allows for a deeper understanding of consumer behavior within a particular market segment.

Example 3: Stock Transactions for Portfolio Management

In finance, an investment manager may select transactions involving stocks from specific sectors, such as technology or healthcare, for performance analysis. By concentrating on these transactions, the manager can assess the sector's performance, identify potential investment opportunities, and adjust portfolio allocations based on market trends. This targeted analysis enhances the decision-making process in investment strategies.

Example 4: Insurance Claims Review

An insurance company may focus on selected transactions related to claims from a particular type of coverage, such as auto insurance. By analyzing these claims, the company can identify patterns in accidents or damages, assess risk factors, and develop strategies for improving customer service and claims processing. This analysis allows for a more efficient claims management process and better risk assessment.

Example 5: Supplier Transactions in Procurement

A company may evaluate selected transactions related to supplier purchases within a specific category, such as raw materials for production. By analyzing these transactions, procurement managers can assess supplier performance, negotiate better terms, and identify cost-saving opportunities. This focused approach enables the company to optimize its supply chain and ensure that it meets production demands efficiently.

Practice Questions

Question 1

In the context of selecting transactions for analysis, which of the following factors is most important to consider?

A) The historical performance of the transactions

B) The number of transactions in the dataset

C) The relevance of the transactions to the current market conditions

D) The geographic location of the transactions

Correct Answer: C) The relevance of the transactions to the current market conditions.

Explanation: When selecting transactions for analysis, it is crucial to consider their relevance to current market conditions. Transactions that reflect the present economic environment provide more insightful data and better inform decision-making. While historical performance (option A) can be informative, it may not accurately represent future trends. The number of transactions (option B) and geographic location (option D) are secondary factors that might affect analysis but are not as critical as relevance to current conditions.

Question 2

What is a key benefit of using selected transactions for market analysis?

A) It ensures a comprehensive view of all transactions.

B) It simplifies the data analysis process.

C) It allows for tailored insights specific to the target market segment.

D) It eliminates the need for further data collection.

Correct Answer: C) It allows for tailored insights specific to the target market segment.

Explanation: Selecting specific transactions for analysis enables analysts to focus on particular market segments, products, or consumer behaviors, allowing for tailored insights. This focused approach enhances understanding and strategic decision-making. Option A is incorrect because selecting transactions typically means not considering all data. Option B may be true to some extent but is not the primary benefit. Option D is misleading as further data collection may still be necessary for comprehensive analysis.

Question 3

When evaluating selected transactions, which of the following is a common pitfall to avoid?

A) Overemphasizing outliers without context

B) Including transactions from multiple relevant segments

C) Focusing on long-term trends

D) Utilizing qualitative data alongside quantitative data

Correct Answer: A) Overemphasizing outliers without context.

Explanation: A common pitfall in analyzing selected transactions is placing too much emphasis on outliers without understanding their context. Outliers can skew results and lead to misleading conclusions if not appropriately analyzed. It's important to investigate why outliers exist before making judgments. Options B, C, and D are generally good practices in data analysis, as they contribute to a well-rounded understanding of the dataset.