12+ Financial Certificate Examples to Download

Finance students and even professionals know that finishing a bachelor’s degree in financial management is not enough to land in a high-paying job position, such as a financial analyst. Because of that fact, these individuals turn to get more knowledge, training, and experience through certification programs of an academy. The completion of these courses will be rewarded with certificates or licenses that can be used as proof of the holders’ credentials. Besides, getting a hold of these attestations is a must in compliance with most businesses’ specifications in handling a customer or client account. Get a glimpse of our 11+ Financial Certificate Examples in PDF and Microsoft Word file formats to have an idea of what they look like.

12+ Financial Certificate Examples

1. Financial Corporation Stock Certificate Template

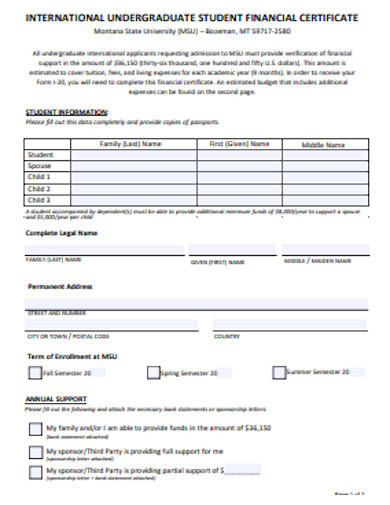

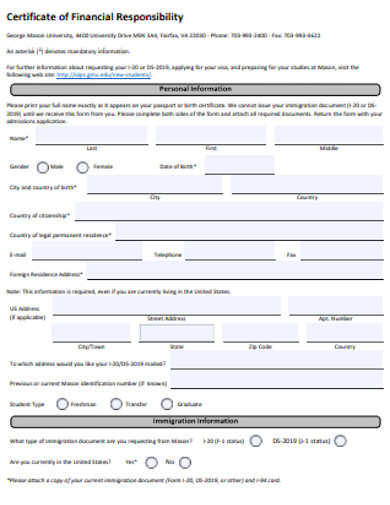

2. Undergraduate Student Financial Certificate

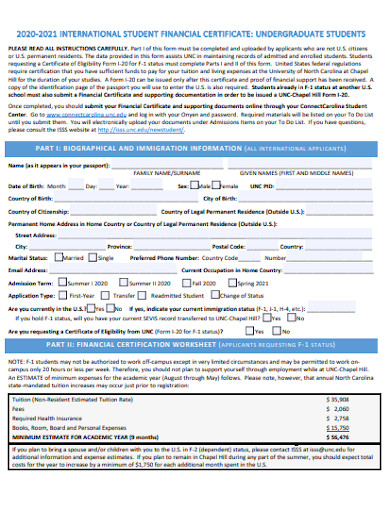

3. Financial Certificate Example

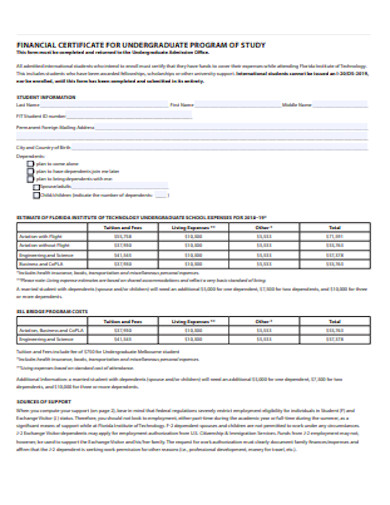

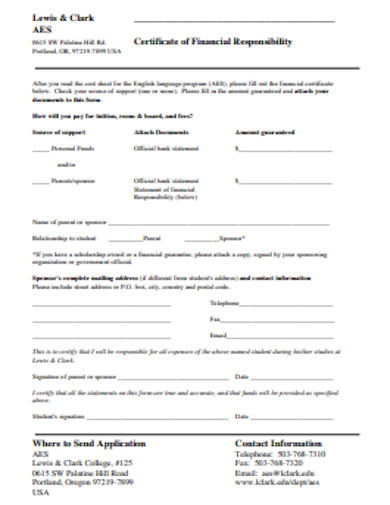

4. Student Financial Certificate

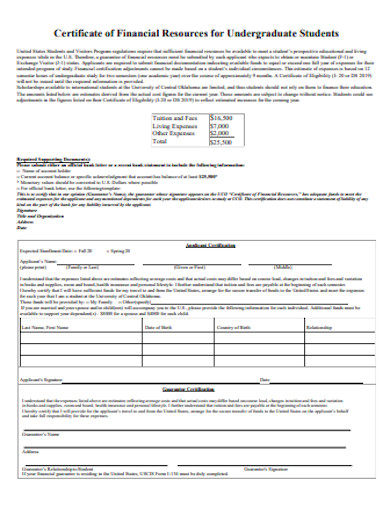

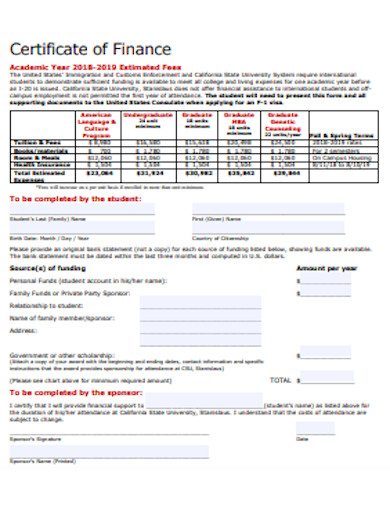

5. Certificate of Financial Resources for Undergraduate Students

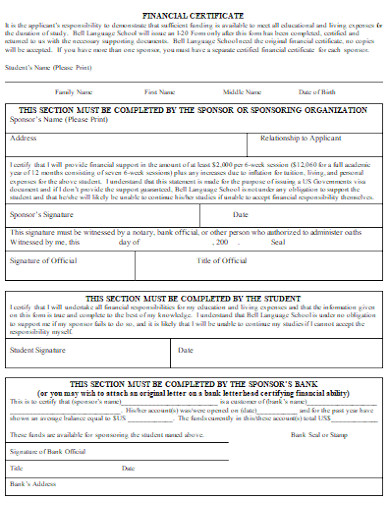

6. Financial Certificate Format

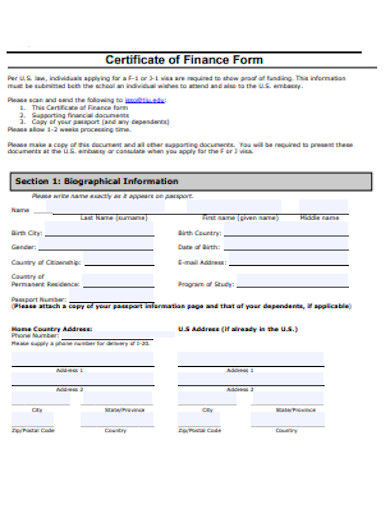

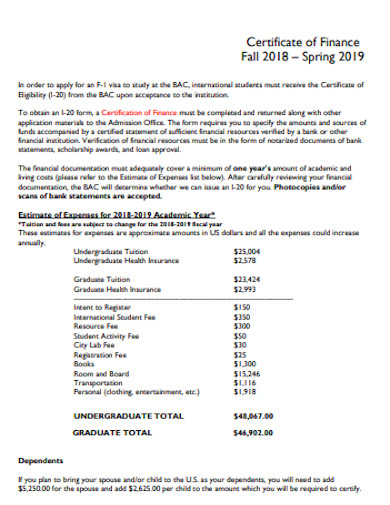

7. Certificate of Finance Form

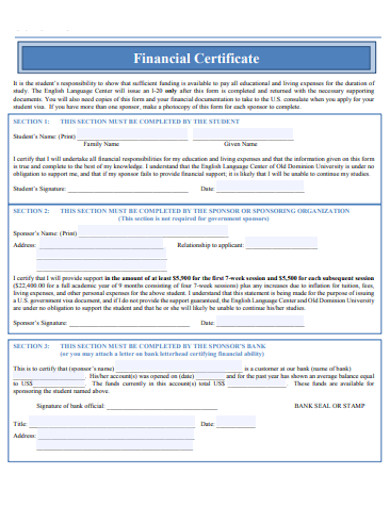

8. Financial Certificate Sample

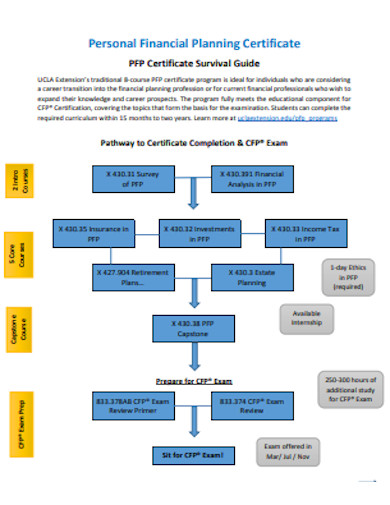

9. Personal Financial Planning Certificate

10. Certificate of Finance Format

11. Certificate of Financial Example

12. Certificate of Finance Example

13. Financial Certificate in DOC

What Is a Financial Certificate?

A financial certificate is a document that signifies the level of mastery that a certain professional holds in terms of finance-related activities. Daniel Klimashousky stated in his January 2020 article for the SmartAsset that people who seek to be certified have to accomplish hours of studies and then pass assessments. Not only that, but he also said in the same article that there is a need for these persons to comply with professional and ethical standards. In line with those, the Financial Management Association articulated that literate investors recognize people who hold certificates more than those who do not, mainly for their proof in meeting the highest measures concerning ethics and professionalism.

Not-So-Fun-Facts About Financial Advisors

Finance is a very complicated subject. So, it is not surprising if many people do not completely understand financial advisors at all. For starters, the title financial advisor is very broad and has been generalized by many newbie investors. With that being the case, there should be countless times when these advisors wish investors would know what they want to be handled and that there are many kinds of financial advisors. Another fact about them is that they do not earn as much as you think they do. According to USNews, the average annual salary of financial advisors is USD 88,890, with USD 157,710 being the highest-earning and USD 57,920 for the lowest.

How To Create a Financial Certificate

Individuals who went through financial certification programs faced many challenges in their studies and took different levels of examinations to prove their worthiness. If walking in their shoes, I would surely say, “It should better be worth it.” And, there is no better way to start justifying their efforts than rewarding them with a worthwhile financial certificate. Learn the important steps on how to make one by taking heed on our prepared list below.

Step 1: Imprint Academy Name

The first step in making a financial certificate is to imprint your academy’s name. Set it in the upper part of your design and make it big enough for people to read. The name of the school is very important since it showcases the institution’s prestige.

Step 2: Specify the Certification Program

Below the imprinted academy name, specify the certification program that the awardee took. This is to display the particular course and to notify people concerned in just a glimpse.

Step 3: Introduce Awardee’s Achievement

Slowly build up the excitement by briefly creating an introduction for your awardee’s achievement before mentioning his or her name. In preparing this part, you have to make sure that all the details are accurate and true. The details must include the certification date, venue, and reasons why the awardee deserves to receive the document.

Step 4: Embed the Accomplished Title

The most important part of a certificate is the statement of the accomplished title. After all, this is the very award that the awardee worked hard to get. Just like the academy name, highlight the title by making it big or even a little bit bigger.

Step 5: Statement of Title Benefits

Do not forget to state the benefits that come with the title in summary. With so many financial service specifications, certificates only have limited spaces. Therefore, making the statement short and sweet is necessary.

Step 6: Engrave Signatures

Signatures are very important in validating a document, as well as the terms and conditions in it. By engraving your signatures in the financial certificate, your company or organization recognizes the awardee’s skills and knowledge on a particular field of financing. Moreover, you accredit them as an authorized professional in conducting financial activities in relevance to the title he or she acquired.

Step 7: Stamp Seal

To further strengthen the authenticity of your financial certificate, you can stamp your common seal. This act has been used in many generations. The main purpose of a common seal is to indicate that a document has gone through legal judgment. Involving the law makes your certificate more legit.

FAQs

What are the best financial certifications?

According to Corporate Finance Certifications (CFI), the best financial certification are as follows:

1. Chartered Financial Analyst ® Certification

2. Certified Public Accountant Certification

3. Chartered Alternative Investment Analyst ® Designation

4. Certified Financial Planner ® Designation

5. Financial Risk Manager ® Certification

6. Financial Modeling & Valuation Analyst ® Certification

Do I need a degree to become a financial advisor?

Though most financial advisors hold a degree in finance, accounting, economics, and other related fields, becoming a financial advisor does not require so. Employers tend to recognize the certifications or licenses and experiences more than academic degrees.

When is the best time to hire a financial advisor?

There are many situations where you should employ a financial advisor. However, the best time to do so is when you are about to retire, when you try to manage your investments, and when you have children.

Financial certificates have advantages for entrepreneurs, individuals, and financial advisors or consultants. For entrepreneurs, it serves as an important criterion to choose who to hire as a financial advisor. The same goes for individuals. In a financial advisor’s case, it is an important document that helps in advancing their career, growing their clientele, and increasing their profitability.