12+ Business Investment Agreement Examples

All types of businesses need investment to achieve long-term sustainability. Whether your business is a small enterprise or a large corporation, it needs investment nonetheless. These days, investments are no longer achieved through mere handshakes and verbal agreements. Investments are now quasi legal activities and are achieved or accomplished through a written agreement or contract.

To help with your investment ventures, here are some business investment agreement examples (in PDF format) to guide you.

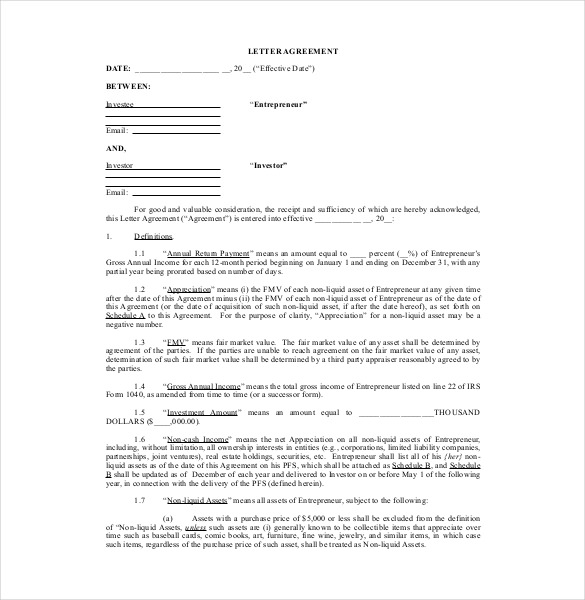

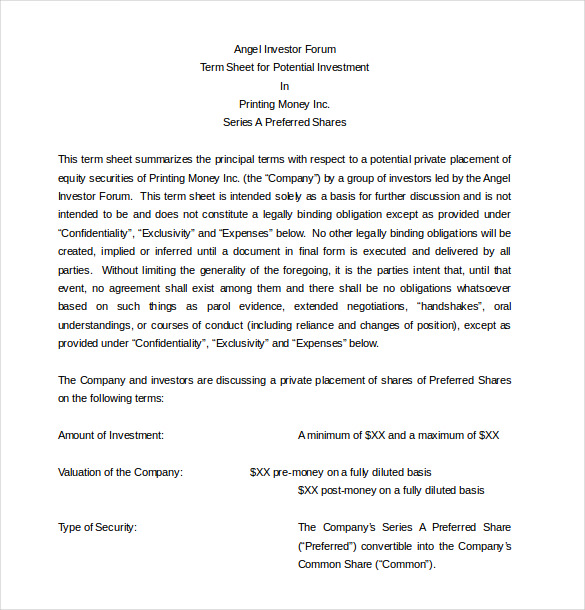

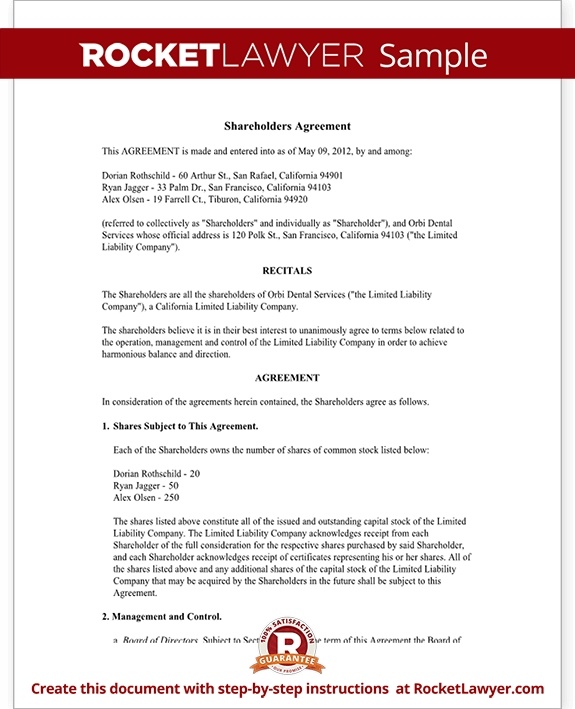

Business Investment Agreement Example

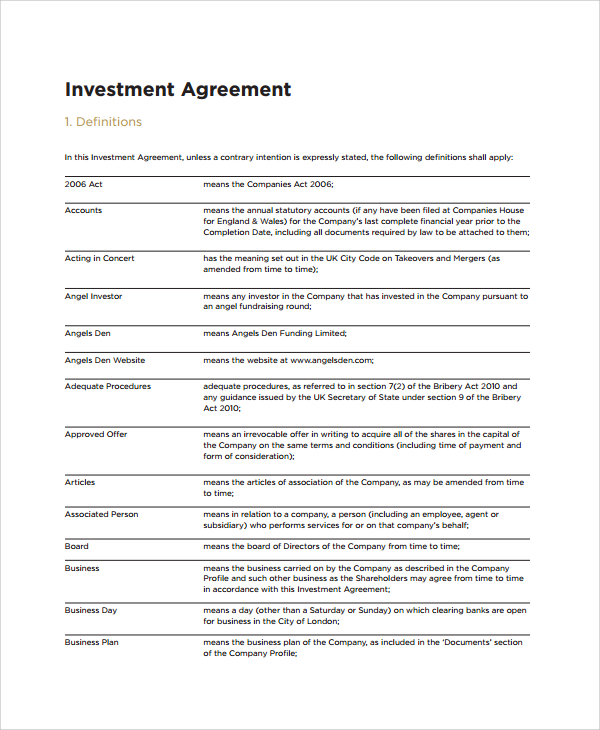

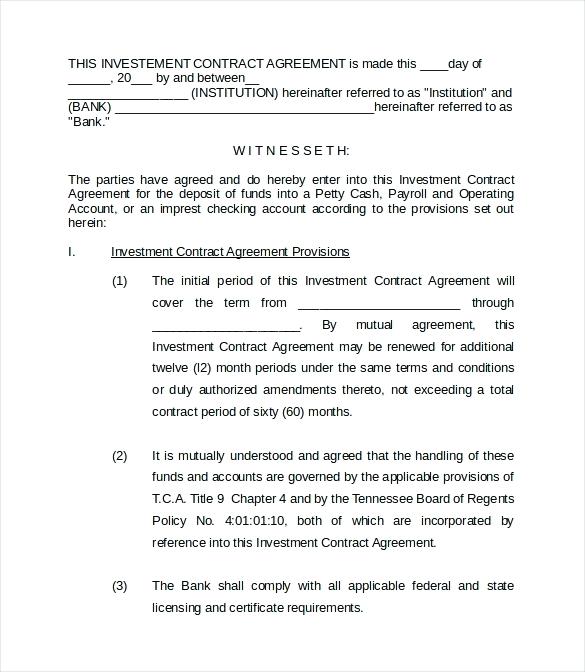

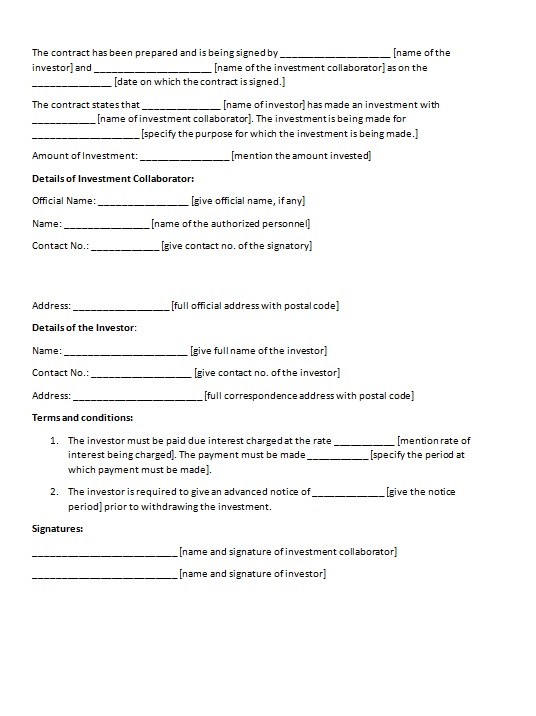

Investment Agreement Example

Business Investment Agreement Example

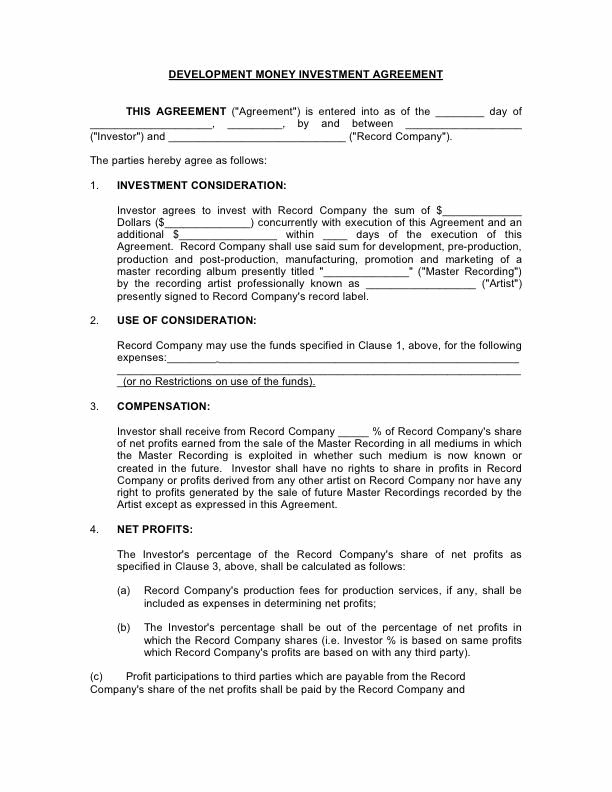

Artist Business Investor Agreement Example

Investor Agreement Terms Definition Example

Essential Components of a Business Investment Agreement

When writing a business investment agreement, take note of the essential components that you should incorporate in your investment agreement.

1. Basic information of parties involved

The investment agreement should always begin with the basic details of your company. The basic details of your company includes your company name, company address, organizational structure, summary of products and services, and online portfolio (website, social media pages). If a partner or investor is involved, also list down the same exact details in the agreement.

The basic information listed in the business investment agreement adds to the legitimacy of the agreement and also to the legitimacy of the parties involved. The last thing that the parties want to be involved in is a scam or fraud, so listing down the basic information is highly important. You may also see sales agreement samples.

2. Payment and investment terms

The most important section of a business investment agreement is the payment and investment terms. The type of investment and the the payment terms should not only be listed in theory but should be explained in detail. This allows the parties in the general agreement to be fully in-sync with each other on what they want to achieve in the agreement.

Most of the time, there is payment involved in a business investment agreement. One party invests in the other party’s project, and that party doesn’t only retrieve the money it initially invested, but also gets interest that comes with the agreement. The type of investment (ownership investment, lending investment, cash equivalents) should also be discussed in detail. You may also like letter of agreement examples.

3. Lifespan or duration of the agreement

The agreement should also include the lifespan or duration of the agreement. Even if the agreement is effective for more than 5 years, the end date should be exactly stated in the agreement. This allows the parties to renew the agreement or general contract especially if both parties are satisfied with how the investment goes.

Development Money Investor Agreement Example

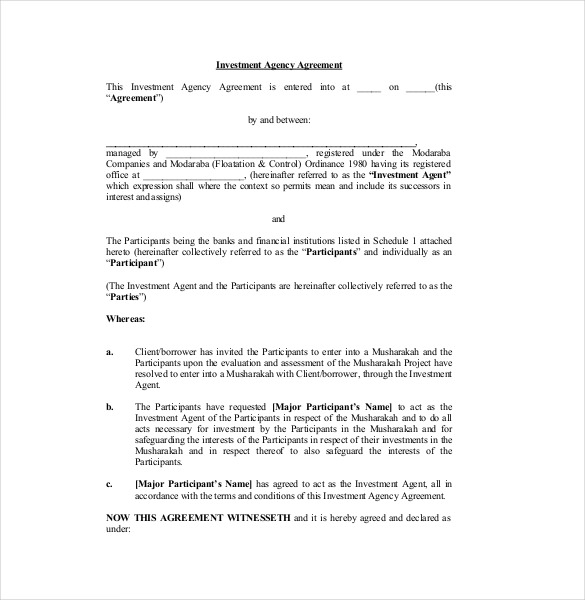

Business Investment Agency Agreement Example

The Importance of Business Investments

The importance of business investments cannot be understated for any company. Investment is crucial if companies want to achieve long-term profitability and sustainability. There are similarities between personal investment or business investment, although there are also glaring differences. You may also see purchase agreement examples.

Personal investment is investment relating to savings and earning interest from those savings. There are numerous types of personal investment: retirement plan, mutual funds, home-based businesses, and income properties.

Retirement plan is basically saving up until you retire (probably around the ages 50–65 years old), and using the funds you accumulated for leisure activities or investment purposes. But most of the time, after the individual has saved enough for his retirement fund, he mostly uses the funds mostly for leisure activities (hobbies, personal interests, family activities). You may also like simple agreement letter examples.

Individuals working for 30–40 years in corporate environment will surely want to retire and ride off the sunset on a high note, spending most of their funds in activities in which they weren’t able to enjoy when they were still full-time employees. You may also check out what is a business agreement?

Mutual funds is also a type of personal investment that involves investing in financial securities. Among the popular mutual funds include money market funds, fixed income funds, equity funds, and balanced funds.

Money market funds are government bonds, treasury bills, banker’s acceptances, commercial paper, and certificates of deposit. These are short-term fixed income securities yet low-risk and low-return investments. Fixed income funds meanwhile also include government bonds and corporate bonds (investment-grade and high-yield bonds). You might be interested in professional services agreement examples.

Compared to money market funds, fixed income funds are riskier since money is expected to come in on a regular basis through interest that is being earned.

Stocks mostly comprise mutual funds. These funds grow faster than money market and fixed income funds, and there are huge amounts of money being involved in stocks. Since large amounts of money is being involved, there is also great chances of risk. You may also see consulting agreement examples.

In the stock market, you can lose all your investments in a single day especially if you have minimal experience in investing. Balanced funds meanwhile are a combination of equities and income securities. Most of these funds follow a formula to split money among the different types of investments, and they tend to have more risk than fixed income funds, but less risk than pure equity funds. You may also like credit agreement examples.

Investments are not just about profitability and sustainability. Investment is also about learning how to manage your funds. You definitely don’t want to lose funds in the middle of your daily operations which will result in you loaning from banks or other financial institutions. You may also check out partnership agreement examples.

Being smart in handling funds will also help you in prioritizing which expenses are important and which expenses need to be spent at a later time. Take for example receiving investment for starting a restaurant business. You definitely don’t want to use all your funds designing the interior and completely forget purchasing initial inventory for the restaurant. You might be interested in transfer agreement examples.

Investment and risk always come together. Take a look at this scenario: you have the funds and you want to invest in equity funds (specifically stocks). The stock market is very volatile, meaning stock prices rise and fall on a daily basis. After you buy stocks, you either risk to sell the stocks before the prices drop but not gain maximum revenue, or wait it out even for the prices to rise again but you are already losing a large chunk of your investment. You may also see assignment agreement examples.

When taking on risks when investing, you are either risk-averse or risk-tolerant. Risk-averse is the avoidance of risk while risk-tolerance is basically taking on risk (the risk level will depend on how much of your investment you are willing to lose). If you are risk-averse, you can always increase your risk levels so that you can be taking more high-risk opportunities in the future. You may also like marketing agreement templates and examples.

Angel Investor Agreement Example

New Business Investment Agreement Example

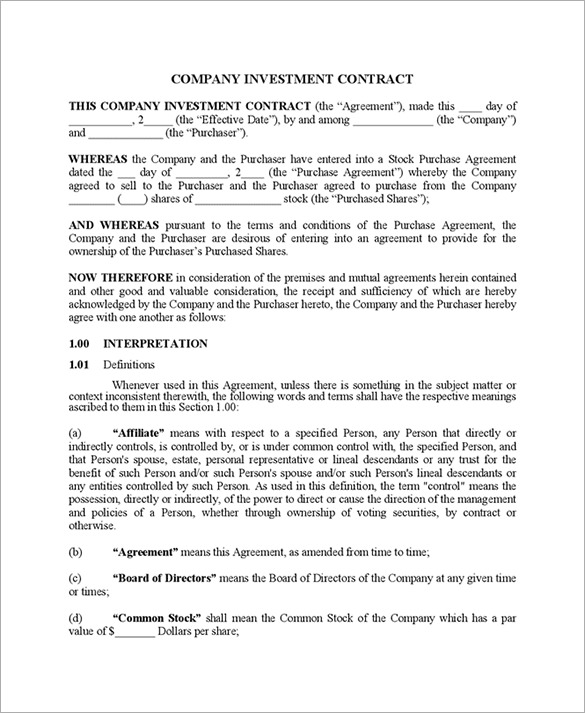

Company Investment Agreement Example

Types of Business Investments

1. Ownership Investment

Ownership investment is the most common type of investment and involves the individual having ownership of the asset. The main purpose of ownership investment is for the individual to let his investment grow. Ownership investment includes real estate, stocks, precious objects, and business investments. You might be interested in service agreement examples.

The great thing about ownership investments is that you already own the asset, you just need to develop so that you can meet its maximum financial potential.

Real estate is one of the biggest revenue-earning businesses these days, as various commercial and residential properties are being established at a high rate. Even developing countries like the Philippines, India, and Thailand have seen a great spike in real estate investments in the past decade. You may also see contractor agreement examples.

2. Lending Investment

In a lending investment, you are basically the banker or the lender. Bonds, savings accounts, and treasury securities are all lending investments and your role in a lending investment is essentially absorbing debt with the hope of the debt being repaid.

Even for savings accounts, you can still consider yourself as an investor. You are basically lending your money to the bank, in which the banks lend out your savings via loans. Bonds meanwhile are more tricky. As the bond that can be issued by a company will pay a fixed amount or increasing amount over a certain period, or it can lose heavily which causes the company to go bankrupt. You may also like maintenance agreement examples.

3. Cash Equivalent

Money-market funds are cash equivalents. Basically, cash equivalents are anything that is easily convertible to cash.

As previously mentioned, money-market funds are low-risk and low-return investments (returns are only 1%–2%). Most of the time, individuals do not invest long-term in cash equivalents as returns are low compared to other forms of investment in which returns can get as high as 500%, although the risk is much more greater. You may also check out management agreement examples.

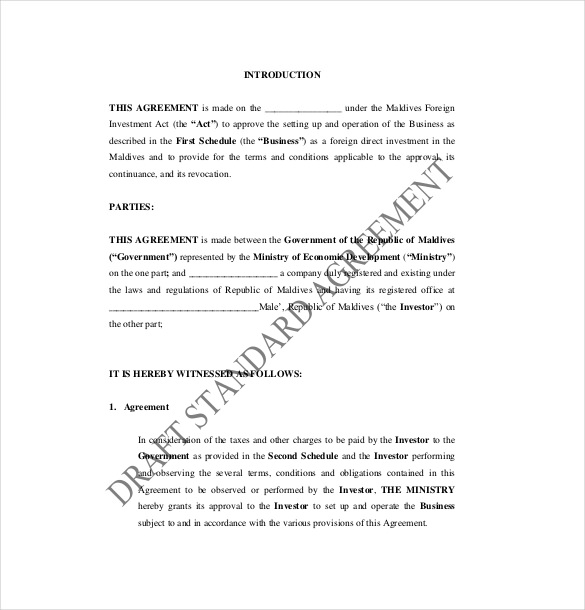

Business Investment Agreement Introduction Example

Basic Business Investment Agreement Example

Outline for Investment Contract Example

Investing is difficult if you don’t know what you’re doing. You just don’t throw your money at every business opportunity expecting to receive that same amount after a few months or a few years. Be careful with investing as you might lose your hard-earned savings in a bad investment. You may also see commercial agreement examples.

We hope you found this article to be informative and helpful as you will formulating your own business investment agreement.