10+ Business Partnership Agreement Examples

Victory becomes an even sweeter treat when achieved not only with skill, perseverance, and cleverness but also with teamwork. Winning is another thing, but sharing the experience with other people makes it a worthwhile and memorable experience. This is true for business as well. Having a reliable and contributing partner to help you manage, make decisions, and provide the necessary resources is huge leverage in making it in the industry. Seal your alliance with a trusted business partnership agreement. Make use of this advantage and bose through our collection for your use. You can also learn how to make it through our article below.

10+ Business Partnership Agreement Examples

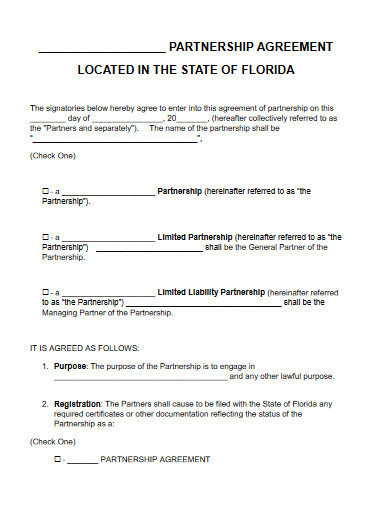

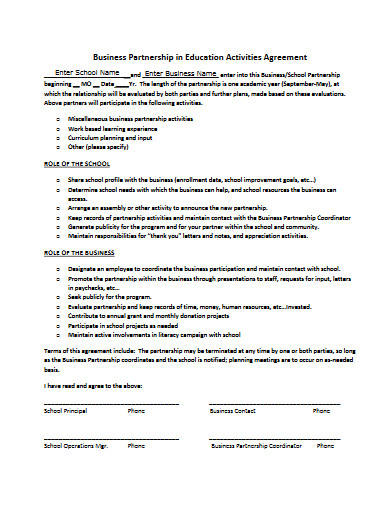

1. Custom Software Business Partnership Agreement

2. New Business Partnership Agreement

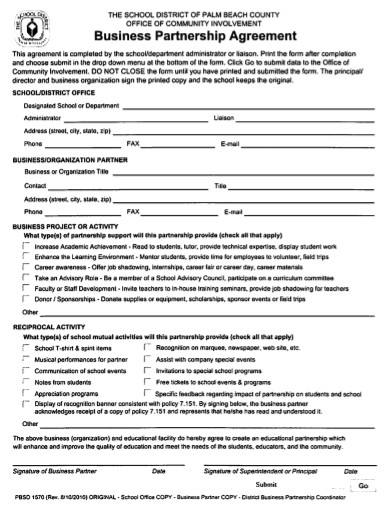

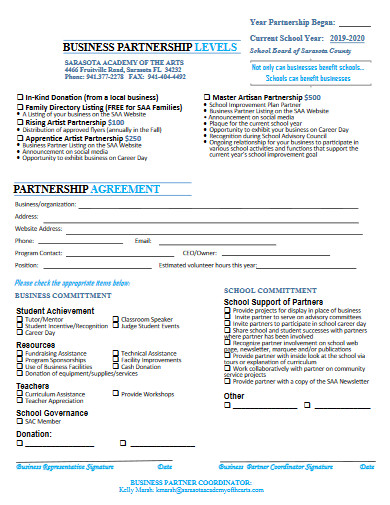

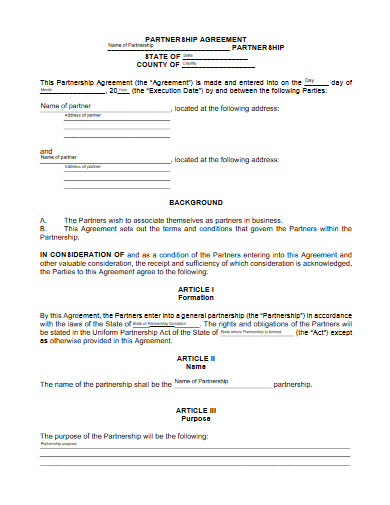

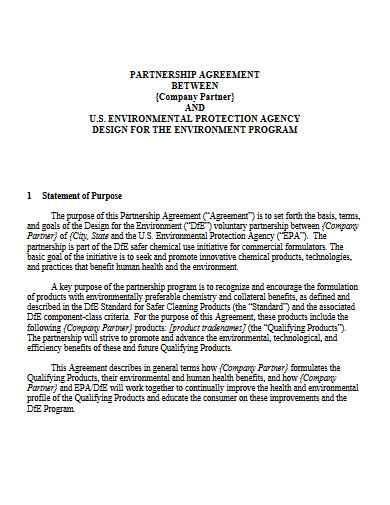

3. Business Partnership Agreement

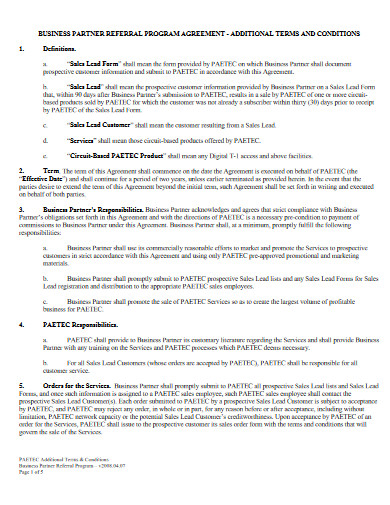

4. Business Partner Referral Program Agreement

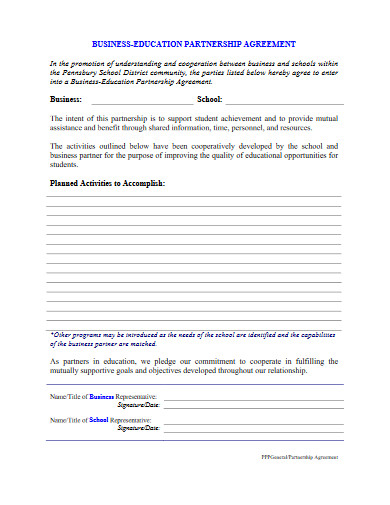

5. Business Education Partnership Agreement

6. Startup Business Partnership Agreement

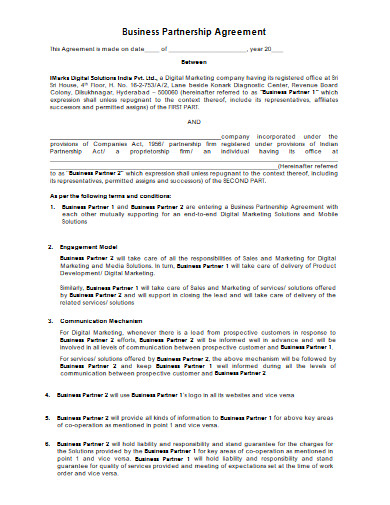

7. Small Business Partnership Agreement

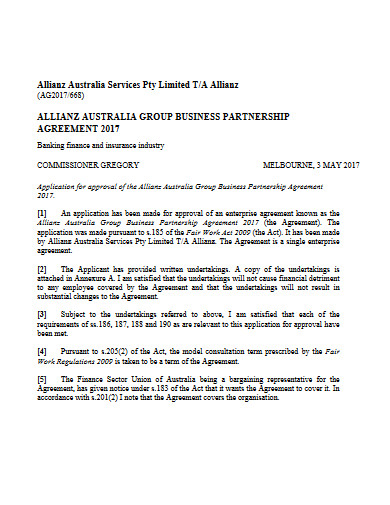

8. Group Business Partnership Agreement

9. Business Partnership Agreement in PDF

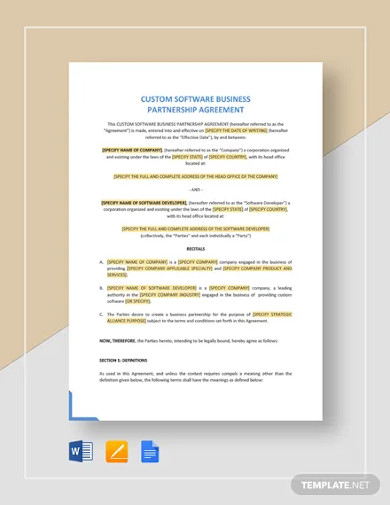

10. Business Partnership in Education Activities Agreement

11. Commercial Business Partnership Agreement

What Is a Business Partnership Agreement?

A business partnership is a legally binding document between two or more partners who decided to establish the term of their company in running a business. A partnership agreement contains their designated contributions, their share in the profits and losses, and the management authority they have over the organization. This set-up is a common practice in business nowadays as more and more business people seek networks and integrate a fellow entrepreneur’s expertise and resources to form a promising business venture.

Why You Should Be in a Partnership

When John Donne quoted that “No man is an island” in 1624, he might have known that the world is a tough field to plow unless you have someone with you. This is significantly true in business. Managing an enterprise in today’s day and age is becoming more complex as people have evolved their preference very far from the basic necessities of the past. With this, you might think more people will lean on partnerships for support. On the contrary, sole proprietors still rule the United States, according to the Tax Foundation.

While it definitely feels great to be your own man in your own show, there are several reasons why you should be in a partnership, as written in the Globe and Mail. According to the article, partnerships allow you to depend on another party’s resources, support, labor, which produces a significant increase in your productivity. Aside from that, it also states how it’s so much better to share your goals with someone who can do it with you. A shared goal-setting sparks mutual interest and encourages inter-partner motivation.

How to Make a Business Partnership Agreement

If you’re unsure of how to start with your partnership agreement, start with this following guidelines:

1. Cite the Contributions

There is no partnership without the designated contribution that the partners expect to share and benefit from their agreement. Make a list of every party’s assigned contribution to the partnership. It’s important to clarify who’s going to what in their alliance. Disputes over the financial situation, workforce, material supply, and other forms of contributions can be fatal to your partnerships. When parties see that the business agreement is causing more conflicts that benefit, this may severe your signed contract.

2. Determine the Distribution of Gains and Losses

It’s important to pay attention to how you and your partner decide to split the business’s gains and losses. This is where you’ll discuss if profits and losses are distributed according to the party’s interests. This is also where you decide when it will be given. This is a critical area in ever partnership contract as this might spark misunderstanding and feelings of maltreatment. Before laying out your terms regarding this matter, assess your needs and the nature of your distribution. You should also look into your business plan and your financial analysis to gain a more objective perspective.

3. Clarify the Authority and Decision-Making

In most partnerships, the one with the most contribution usually has the highest authority, among others. This is how corporations nail their decision-making processes by getting their investors’ votes. Without clarifying this matter before writing it down your agreement, this might be a source of complications. Decide who is involved in making decisions and how you’re going to do it. If it’s a small business partnership agreement, there might be fewer decisions to make, so you might just have to share the operational authority. However, if it’s a large company, there might be more factors to consider.

4. Discuss Management Responsibilities

How will each party run the business? What are their responsibilities? Essentially, every partner owns a part of the enterprise based on their contributions, and more often than not, they need to perform certain management tasks. For example, if it’s a restaurant, make a clear organizational chart of who’s in charge of the human resources, the marketing plan, the food choices, and the customer service. Identify how you’ll divide management responsibilities that will enable you to work all together in harmony.

5. Include Details on Withdrawal, Death, and Adding New Partners

As grim as it may sound, you should address partnership withdrawals and death early on your agreement. You might have started on a strong foot, but changes are inevitable. There might be unforeseen circumstances that might cause you or your partner to remove their involvement in the business. Decide on what to put on your contract’s termination clause and the process outline that comes with it. It’s also important to stress what the withdrawing partner should receive.

FAQs

What is the maximum number of partners in every company?

According to the Companies Act or 2013, a partnership firm can have up to 100 members. However, it’s different for companies. A private company can have up to 200 members while there’s no minute for public companies.

What are the different types of partnerships?

The common types of partnerships include general partnership, limited partnership, limited liability partnership, and public-private partnership.

What are some disadvantages of a business partnership?

Some disadvantages of a business partnership include:

- You get a share of your partner’s debts

- You’re involved with your partner’s misdemeanors in the business

- There might be conflicts of interests within the partners in the organizations

You might think of yourself as highly-skilled and more than capable of accomplishing your goals but it’s nothing like having someone to lean on for difficult decisions and resource support. You have enough competition; it’s time to get yourself a valuable ally. Establish connections and seal it using our business partnership agreement. They all contain comprehensive agreement terms that you can easily customize. Download now!