17+ Credit Agreement Examples

When the time comes where you and another party would like to document the terms and conditions that the two of you have come up with in order to do business, then you’ll need to create the proper agreement forms. The kind of agreement form will depend on the matter that the parties involved will need to agree on. For example, one would need to look up Commercial Agreement Examples to make the right document for commercial purposes.

Another would be the making of Management Agreements to ensure that business partners come to an understanding as to how a particular establishment should be managed. In the event that you would like to create an agreement which focuses on the terms and conditions of a loan, then you’ll need to create a credit agreement and this article will teach you how to make one.

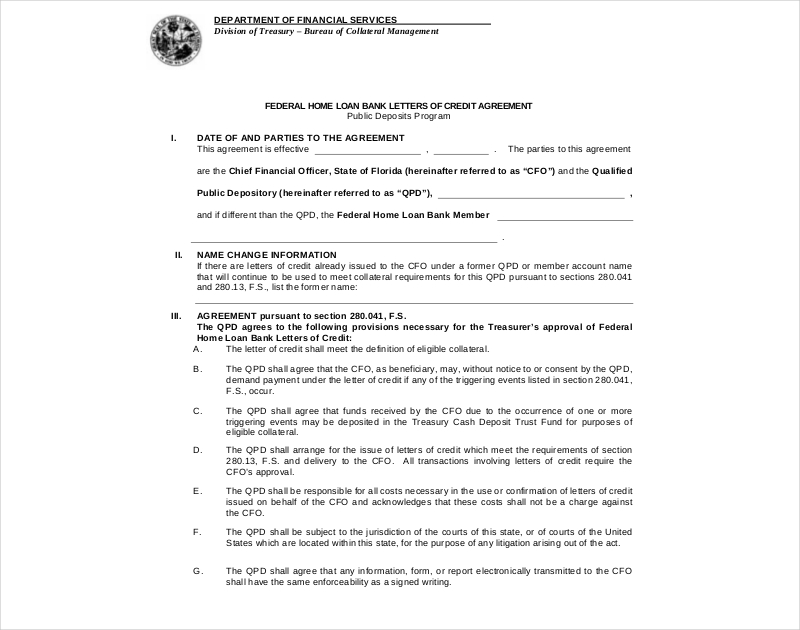

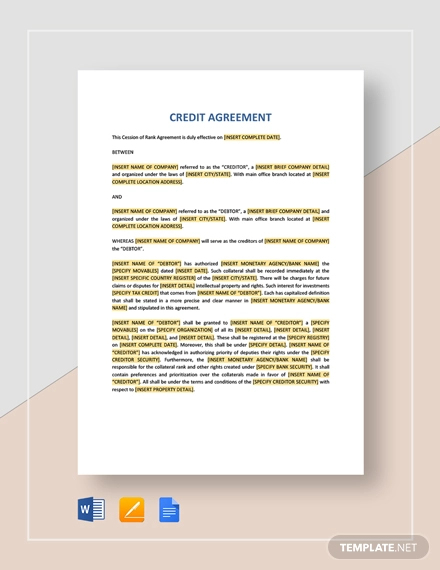

Credit Agreement Example

Credit Agreement Example

Credit Agreement

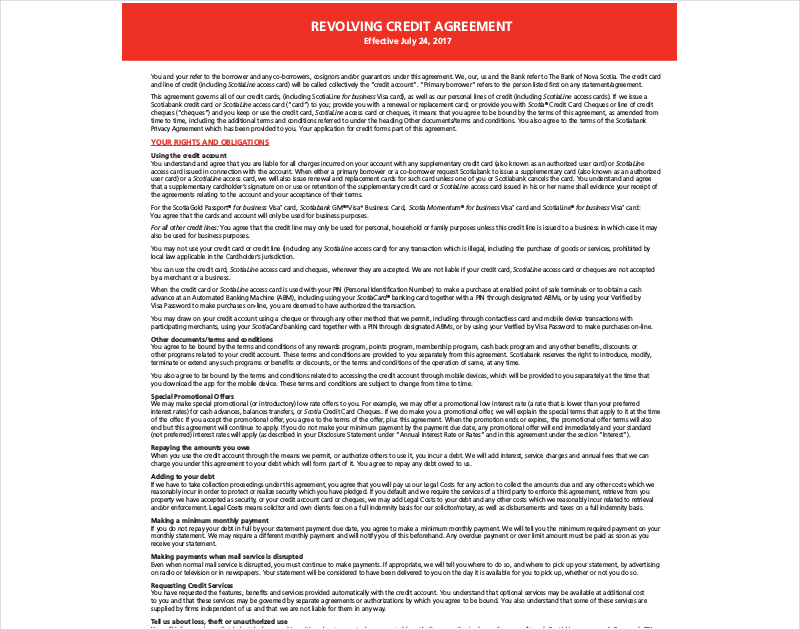

Revolving Credit Agreement

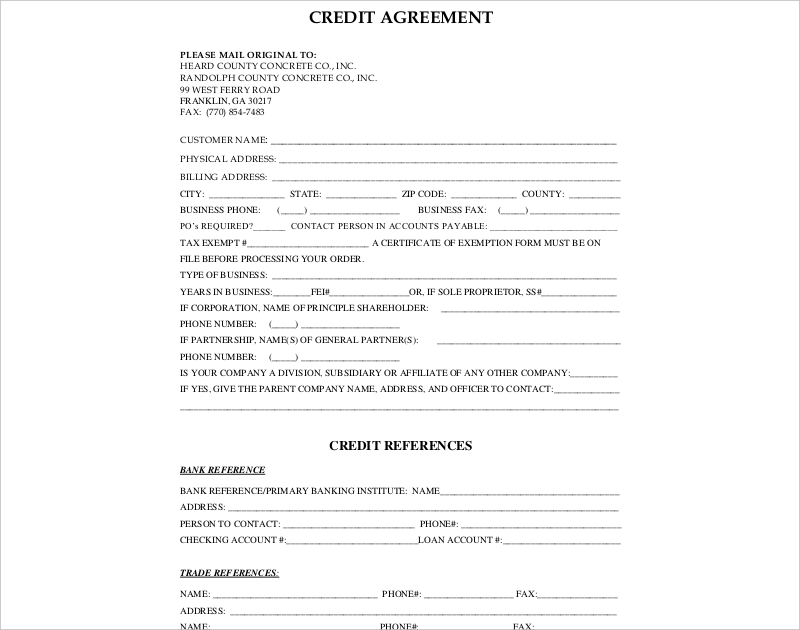

County Credit Agreement

How to Make a Credit Agreement

A credit agreement basically outlines all the details of a loan. And much like any other agreement document such as a Rental Agreement or Commission Agreement, a credit agreement will require certain pieces of information to ensure that the parties involved are able to fully understand the terms and conditions that need to be agreed to before any business can take place.

So here are the steps to help you create a proper credit agreement:

1. Title the Document Properly

You have to make sure that you give the legal agreement document its appropriate title so that any person who goes through it will immediately know what its purpose is. So just get straight to the point and write down “Credit Agreement” at the top of the document. This way, there will be no confusion or misunderstandings as to what this document may be.

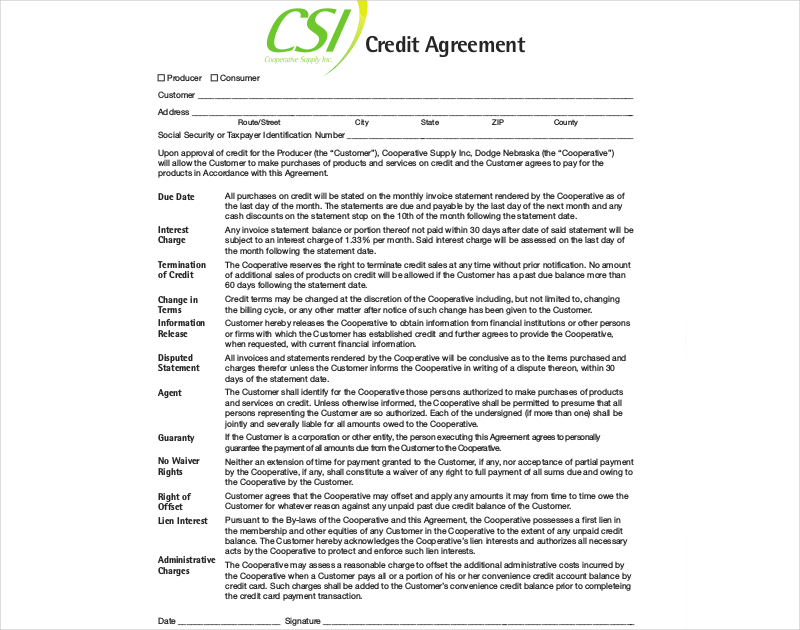

Cooperative Credit Agreement

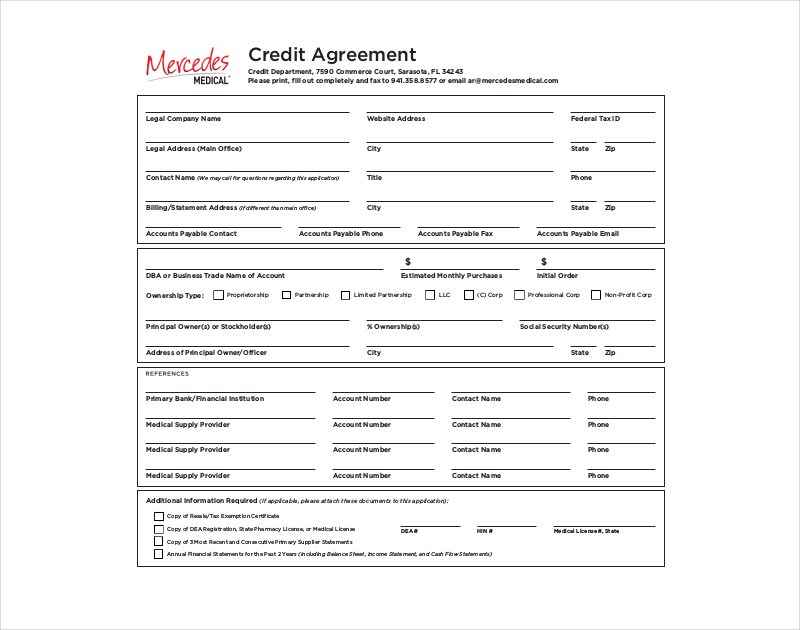

Medical Credit Agreement

Retail Credit Agreement

Company Credit Agreement

2. Identify the Parties Involved

If you’re making an Attorney Agreement, you’ll notice that there’s a section which describes the attorney and the client. This is something that you will also want to do in a credit agreement. You’re going to have to identify the parties that are going to be involved in the loan, as well as what their roles are. This means that you will need to write the complete name of the company or person who is willing to hand out a loan, and you must also write the complete name of the person or company agent that’s applying for it.

Be sure to identify each party by whether it is the “Borrower” or the “Lender” and you must not forget to write down the address of both.

3. Add the Date

This is something that you should never forget to include as providing the date as to when the simple agreement was made can help in the event that there are any issues regarding the agreement’s date of creation. Basically, it’s a very useful piece of information in the event of any legal disputes between both parties. So when you’re writing down the date into the document, be sure that you’re able to write down everything from the date, month, and year so that there will be no confusion.

Account Credit Agreement

Business Credit Agreement

Home Loan of Credit Agreement

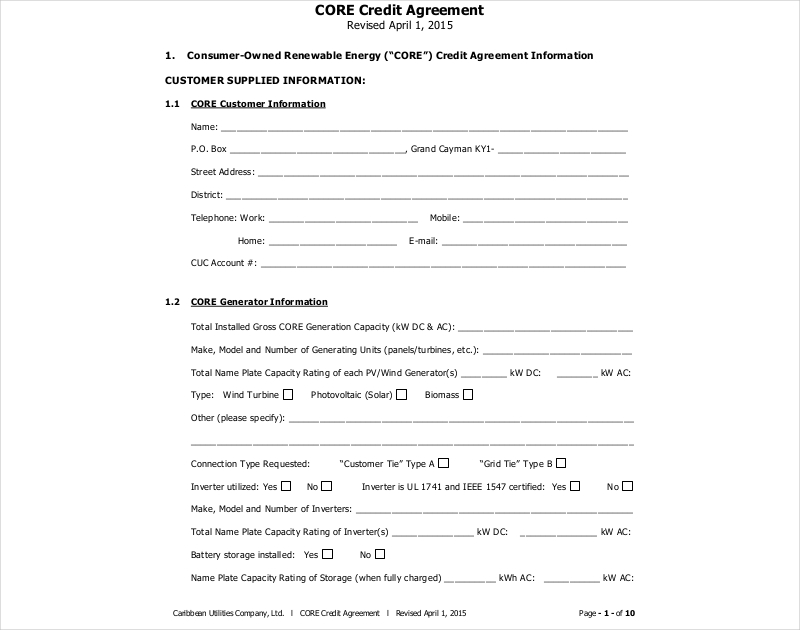

Core Credit Agreement

4. State the Amount of Money Borrowed

In a Services Agreement, there’s a section within a document which states the amount of money that one party has to pay in order to avail the services of the other party. In a credit or Loan Agreement, you will also need to provide the exact amount of just how much a particular company or person has loaned the other party. Think of the loan as the service that has been provided to the other party.

Just make sure that you’re able to write the exact amount of money that was loaned as the contract will be set in stone once both parties have placed their signatures on it; this means that you have to make sure that you’re not taking too much or giving too much money.

5. State the Interest Rate

Since the party availing the loan will need to pay it back eventually, you’ll want the agreement document to point out all the details regarding how much interest the other party will need to pay. You should state when interest begins to accrue and how the interest rate is calculated so that the client will fully be able to understand just how much interest he or she has to pay as well as ensuring that any questions regarding how the interest rate is calculated will all be answered. You may also see purchase agreement examples.

You can also check out our Trade Agreement Examples in the event that you need to take up a loan for a trade agreement.

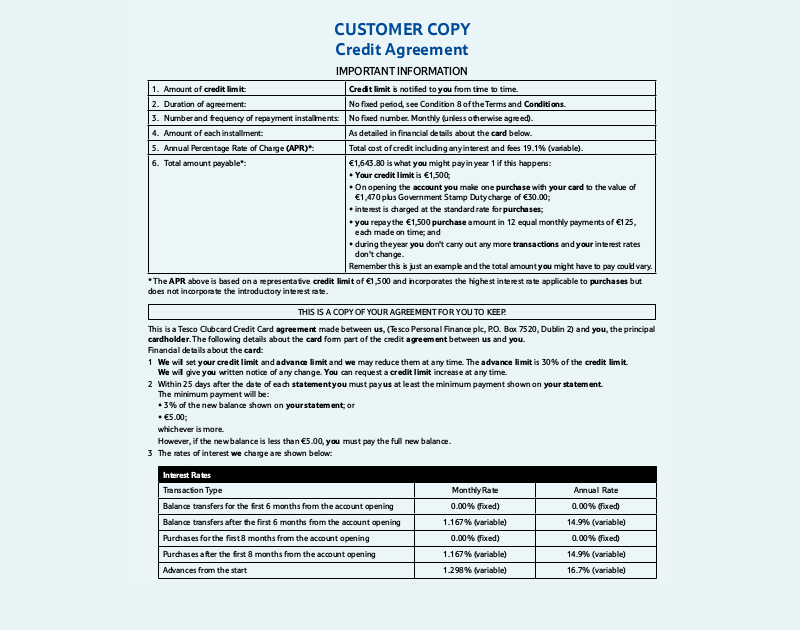

Customer Credit Agreement

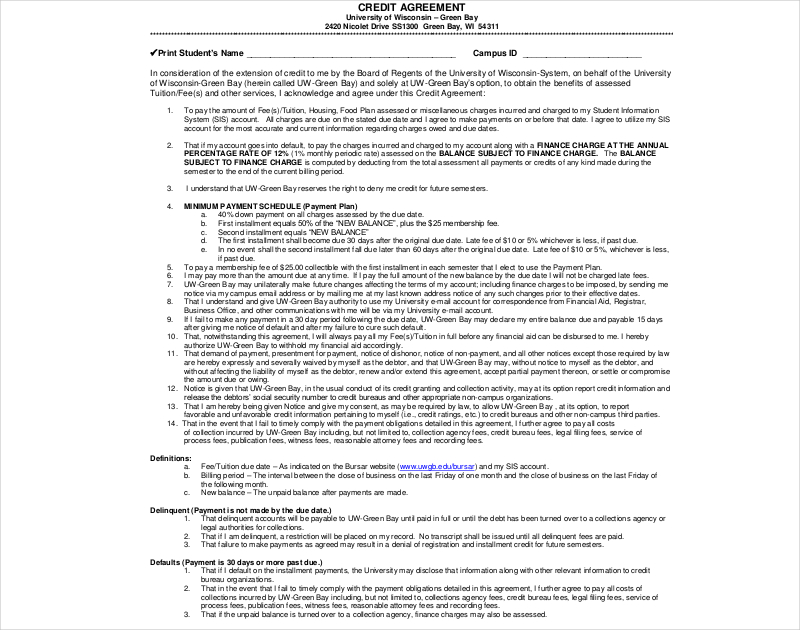

Student Credit Agreement

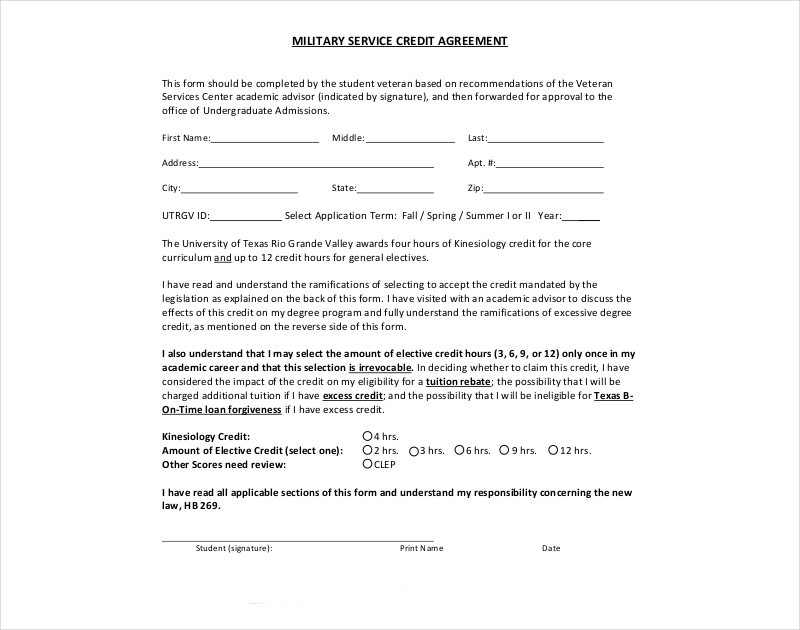

Military Service Credit Agreement

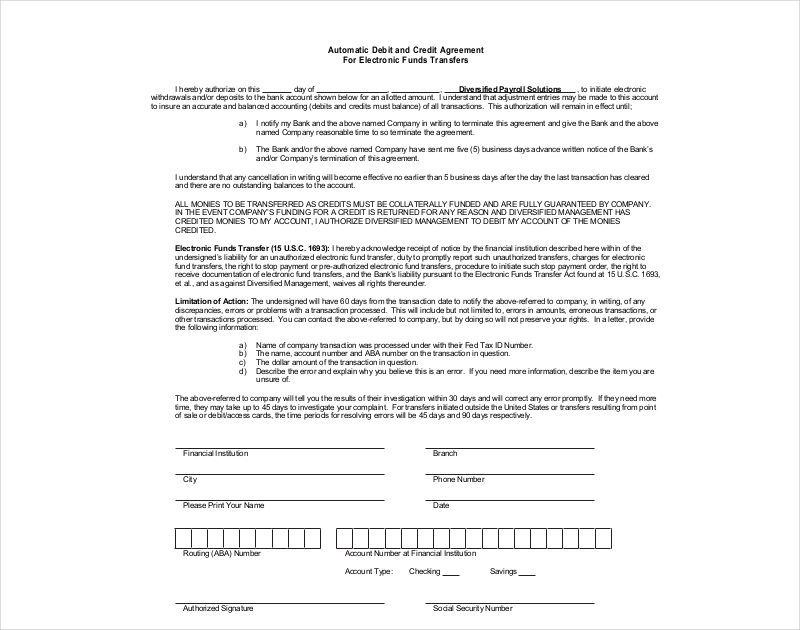

Automatic Debit and Credit Agreement

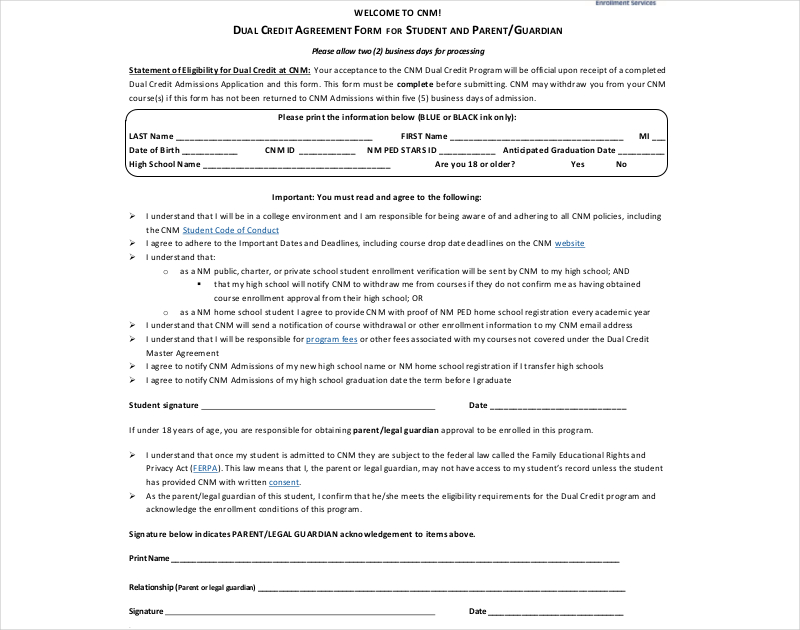

Dual Credit Agreement

6. Provide the Loan Repayment Schedule

You’ll notice that a ton of Examples of User Agreements have a section which describes the terms of how a particular action will need to take place. In the case of a credit agreement, you’ll need it to be able to provide details regarding when the loan payment has to be made, how often it has to be made, and when the first and the last payment is due.

Not only that, but you will have to point out just how much the borrower will have to pay to the lender whenever the due date comes. Remember that you have to be very specific in terms of the amount to ensure that the borrower understands just how much he or she has to pay and when it needs to be paid. You can also print out an amortization schedule after you have entered the information. You may also see sales agreement samples.

7. Insert a Clause on Late Fees

To induce the borrower to pay in a timely manner, you’ll want to include late fees. This way, you can guarantee that the borrower will pay on the due date as late fees will always be unwanted. You will also want to provide a grace period so that the borrower will have ample time to provide the money to pay back the loan. You may also see Partnership Agreement Examples.

8. Include a Clause Regarding the Loan Repayment

State whether or not a prepayment of the entire loan is allowable. If you’re going to allow it, then you will need to provide a statement which tells that the borrower that he or she has the right to prepay this Printable Agreement prior to the due date without incurring any penalties.

9. Add a Severability Clause

Let’s say that you’re already paying the loan, yet you’ve noticed that there’s a portion within the credit agreement document that’s considered illegal. By having the severability clause, it’s basically a way of protection for the borrower in the event that he or she is paying for a loan while under an illegal contract

It can also be used as a form of protection for the lender in the event that the borrower is using the money borrowed for any illegal activities. With the severability clause, the entire contract example could be voided in the event that there’s clear evidence of any illegal involvements with the agreement.

10. Add a Space for the Signatures

And lastly, you have to make sure that both the borrower and the lender are able to place their signatures within the document. This way, it will ensure that both have come to an understanding and service agreement to the terms and conditions that have been set, and it means that the document is legally enforceable. Be sure that you include the signatures, names, and the date as to when the agreement document was signed.

In the event that you would like to learn about the other types of agreement documents you can create like Partnership Agreement , Subscription Agreement, etc. then all you have to do is go through our site. It has all the articles you need to help you and your business with the situation that’s being faced. Just be sure that you read through the articles thoroughly to guarantee that you have the one that can actually help you.