14+ Insurance Policy Examples to Download

Everything in this world is uncertain and unpredictable. Each day is a different day where you will have to face different challenges, different people, and different circumstances. With all the obscurity the world is laced with, we find the need to be prepared in some ways in order to brace for whatever that may happen to us in the next second we take a breath. Because of this uncertainty came about our idea to be prepared somehow and one of it is in the form of insurances.

Anything can happen, both good and bad, to you anytime and anywhere. The uncertainty of this world would not spare your hard work, let alone identify, that is why anything could also happen to the business you have workeInsurance Policyd so hard for so many years. You would surely face a lot of financial policy concerns that would figuratively turn your world upside down due to anxieties and worries about how you will be able to fix and solve all your financial problems. But the role of insurance plans would save you from ultimate destruction and distress; plus, you will be able to recover from all the possible losses that you will face.

However, there is also a need to manage our insurance plans and one way of ensuring it is to have an effective and efficient insurance policies. Insurance policies will help you effectively and keep you secure in whatever form of loss you and your business will face and will mitigate, reduce, or eliminate the risk of having your business go down to zero. In this article, we are giving you fifteen examples of insurance policies that will not just guide you in creating or updating our own but this will also guide you making sure that your privacy policy is effective enough to help you in case you will face one of this world’s uncertainties.

Business Insurance Policy

Motor Insurance Policy

Home Insurance Policy

Auto Insurance Policy

Sample Insurance Policy

Small Business Insurance Policy

Enterprise Business Insurance Policy

Business Insurance Policy

Reasons Why Insurance Policies Are Important in the Workplace

Insurance has proven to be useful as a shield in all the uncertainties that could happen in your business. Here are some the reasons why insurance policies are helpful in your business:

1. Protection and Security and Reduction of Business Losses

Insurance is a shield that protects and secures your business from any possible risks. For example, one of the branches of a popular fast food chain has turned into ashes due to a big fire. Even though millions have been lost, the business owners would be unable to feel the great impact of the loss of one of their branches because they have an insurance that will compensate from the actual loss the fire caused. Imagine if the business owners did not have an insurance; a lot of the company will be affected, particularly the best asset every business has–their employees.

Without an insurance, you would not be able to have a new construction or even put up a new branch of your business. If your business does not offer insurance to the employees, no one would like to apply for a job since one of the things that people look into when looking for a job is the insurance they will receive upon employment or regularization.

Business owners must always try to expect all the possible things that could happen for his business as well as what could happen with the people in the business and one of the things they could do is not only to have an insurance but as well as an insurance policy to manage it.

2. Business Becomes Productive and Effective

If you and your business are secured with an insurance, you will become productive since you would not anymore exert useless effort in worrying about what could happen for you and your business since you already have an insurance that will back you and your business up.

In this life, when we are assured of our safety and security, we free ourselves from the mindset of Murphy’s Law which states that “anything that can go wrong will go wrong” when we have insurances and especially if we have insurance policies that will manage such insurance plans. Since you and your employees are freed of that mindset, you and your employees tend to work well without worries, hence, you become productive and effective and that also includes your business and all your undertakings.

3. Business Continuation

There are some businesses that have two or more business owners. If you have business partners in your business, whether they leave the partnership or some unfortunate circumstances will happen, like death. You might think that since you were hands-on in the business, you can still do your former partner’s job and still continue doing the business operations. However, with the loss of a partner, you might have difficulties in restarting on your own since you might suffer both economically and in how you will be managing more role now in the business.

But with an insurance, plus an insurance policy to go with that, you will have funds that assist you when your partner leaves. With the help of an insurance, you and the business you two put up together is protected and will be able to continue whatever disastrous events that might bring you business to waste or more loss.

4. Employee’s Security and Welfare

You have to keep in mind that that best asset you have in your company is your employees and that is why you must, at all costs, protect and keep their security and welfare. That is not only your responsibility; that is what you are really ought to do. Do not repay their service to you and your business with a lousy insurance. Always have an insurance policy to back your employees’ insurance in order for them to feel secure and safe working for you.

There are some employees’ who have known how uncertain life could be due to all the extreme hardships they have faced. That is why with the presence of an insurance as well as an insurance policy to go with it, the employees will become productive as well. Who would want to clean the windows of your 15-floored company if they do not have an insurance? And who would be willing to go on a business trip without a travel insurance? This would also create harmony between the employers and the employees.

Sample Small Business Insurance Policy

Corporate Business Insurance Policy

Car Insurance Policy

Home Insurance Policy Document

Home Insurane Policy Booklet

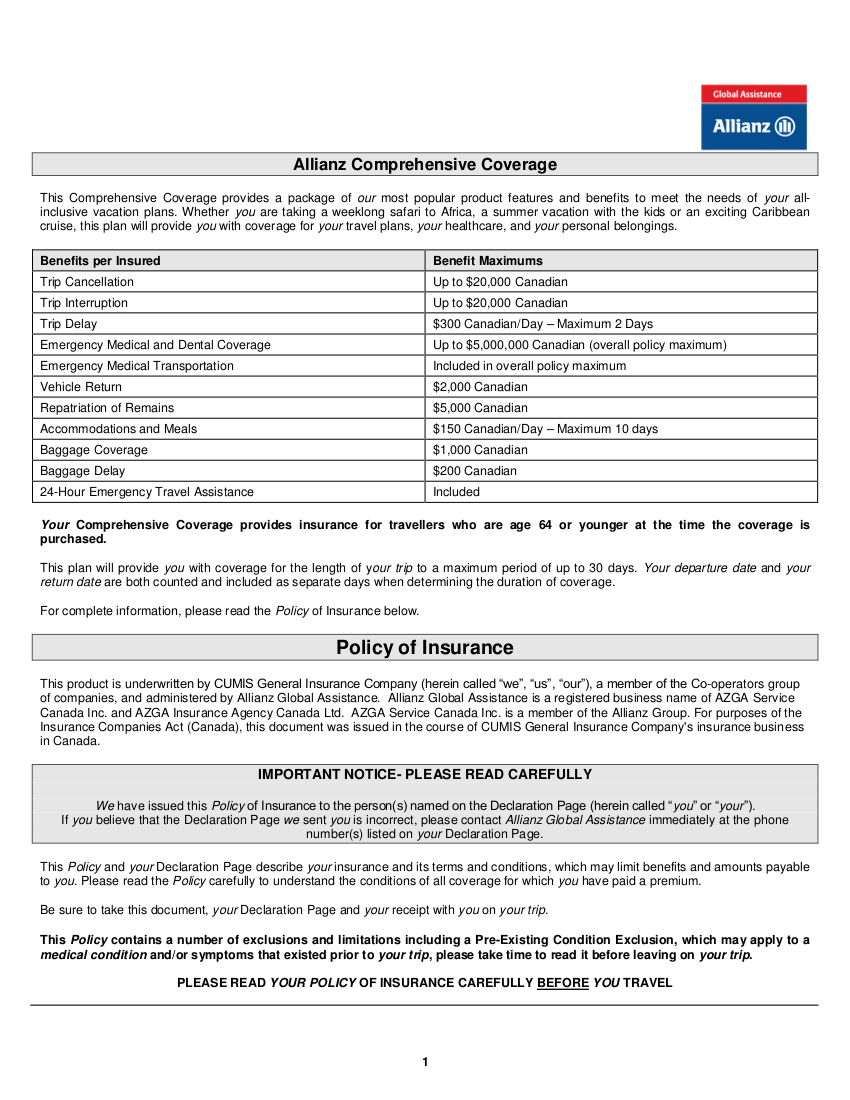

Travel Insurance Policy

Personal Travel Insurance

Benefits of Insurances Policies

Here are some of the benefits that insurance policies bring to you and your employees:

1. When your business would face losses, particularly on the finances, if you have an insurance, you will be able to compensate for your losses. Your employees will benefit from it, too.

2. Having insurance policies is in compliance with the law. You will not be able to put up your business or meet statutory and contractual requirements without an insurance.

3. Insurance policies mitigate risk and put risks at bay. Anything could happen that is why, with the help of your insurance policies, you would still be able to lessen the impact. Insurance policies can help in implementing an effective a loss control program that will aid you and your employees in case something bad will actually happen in the business.

4. Insurance secures your resources, and the common resource we know is financial. With an effective insurance policy, you will not only be able to secure your finances but you can also use it efficiently.

5. Insurance and insurance policies are actually a form of investment. An investment is defined as an asset or item that is purchased that is expected to be of use in the future.

6. Insurances decrease any kinds of the financial burden. Anything could happen to us, and that includes accidents. The hospital bills are also uncertain but if you have a secured insurance, even if it does not help in paying your entire bills in full, it would at least reduce your burden.

7. Insurances are seen, particularly by employees, as benefits. This would increase your employment opportunities since prospect employees would choose your company over a company that has no insurance policies since its absence would make them question the stability of your business.