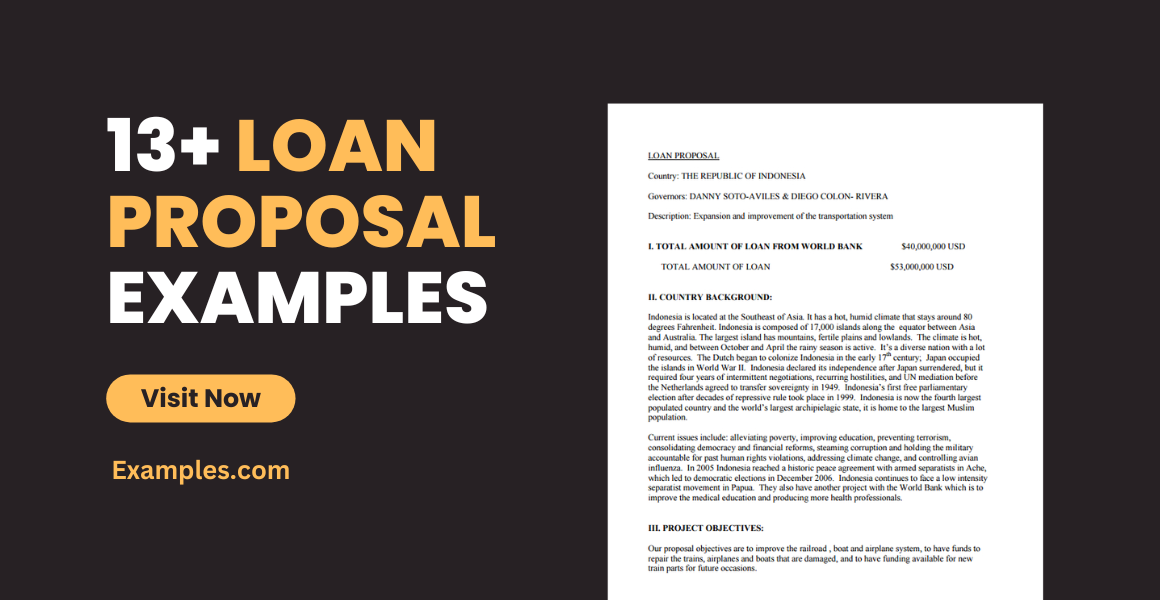

13+ Loan Proposal Examples to Download

Entrepreneurship is a challenging field, but it’s a lucrative venture. If you’re hoping to establish a startup and work your way from the ground up, you will need all the funding you can get. If you’re applying for a personal loan to start a small business, you need a loan proposal to help you. A financing proposal will comprise all your plans and purposes on why you intend to apply for a loan request. It contains your business objectives as well as a fact-based reason why you deserve your business’ loan request approval.

13+ Loan Proposal Examples

1. Business Loan Proposal Template

2. Restaurant Loan Proposal Example

3. Loan Proposal for Startup Template

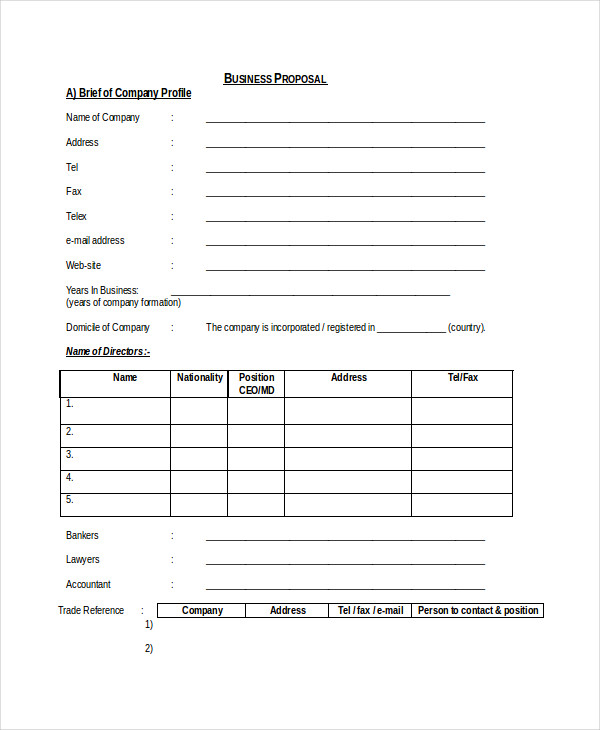

4. Small Business Loan Proposal Template

5. Business Loan Proposal

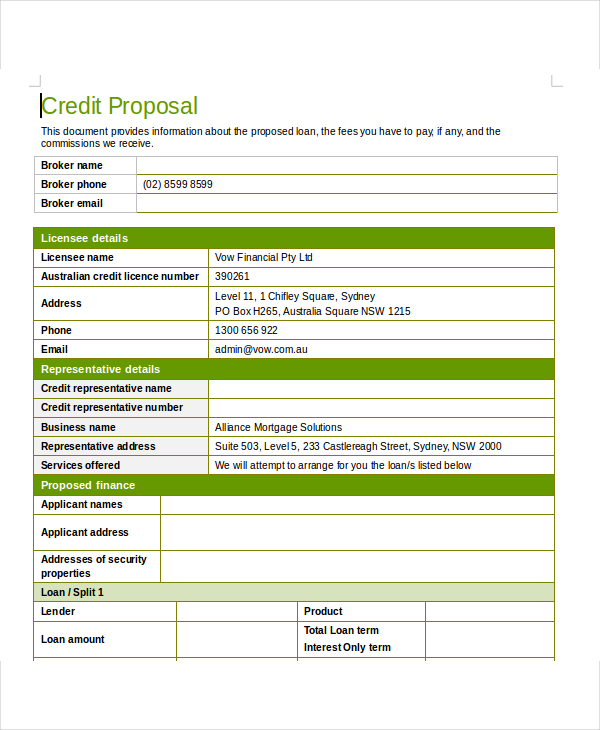

6. Credit Proposal Example

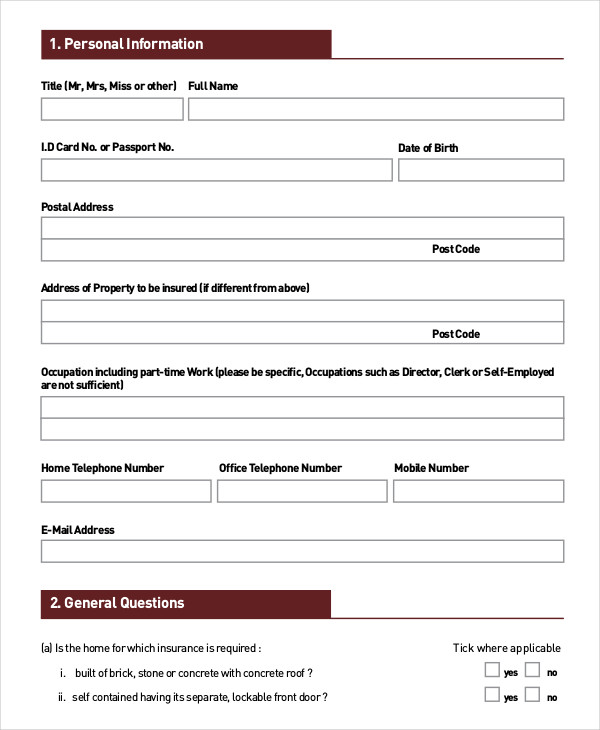

7. Home Loan Proposal Sample

8. Bank Loan Sample Proposal

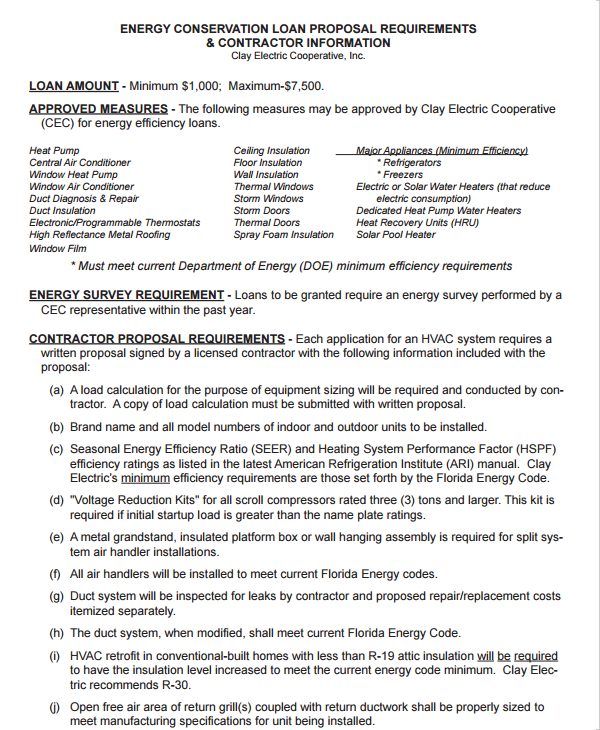

9. Contractor Loan Proposal

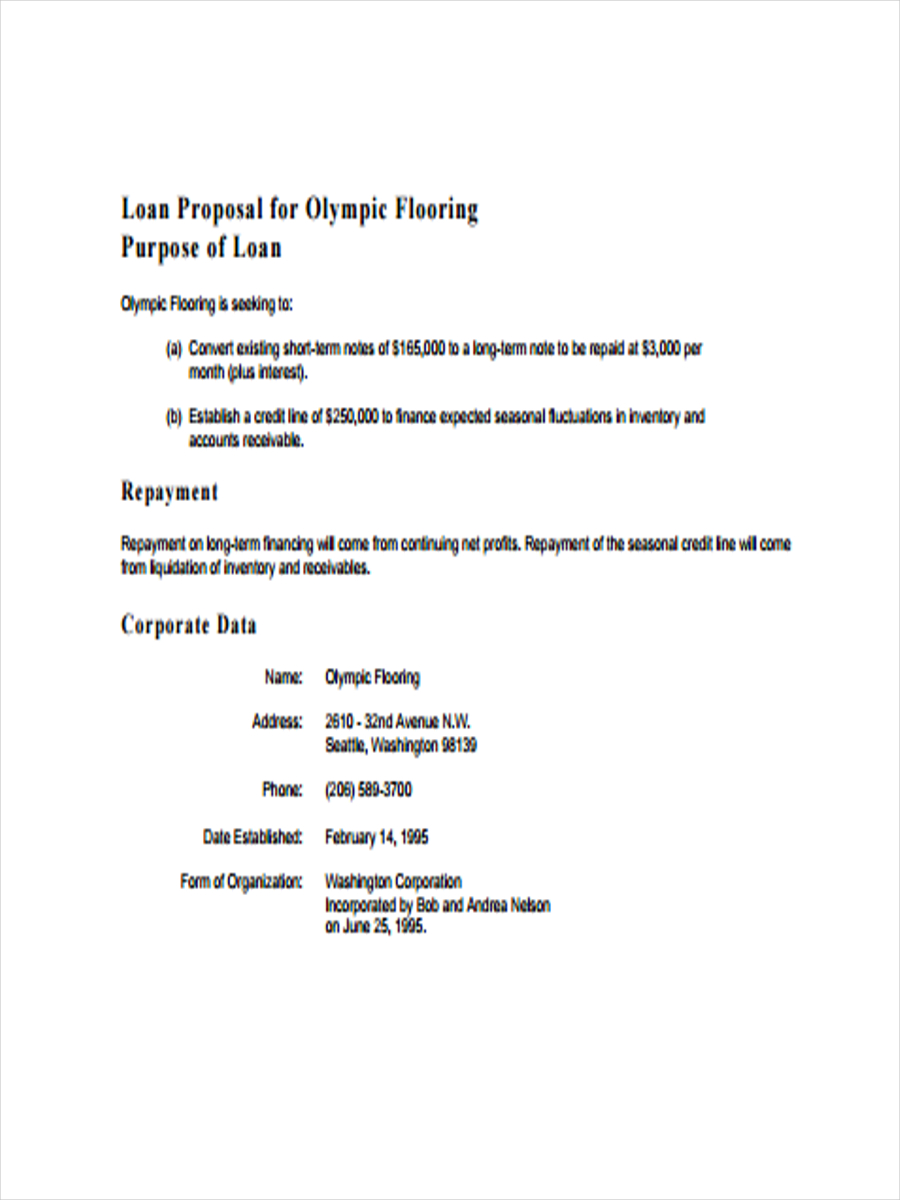

10. Sample Loan Proposal

11. Land Loan Proposal

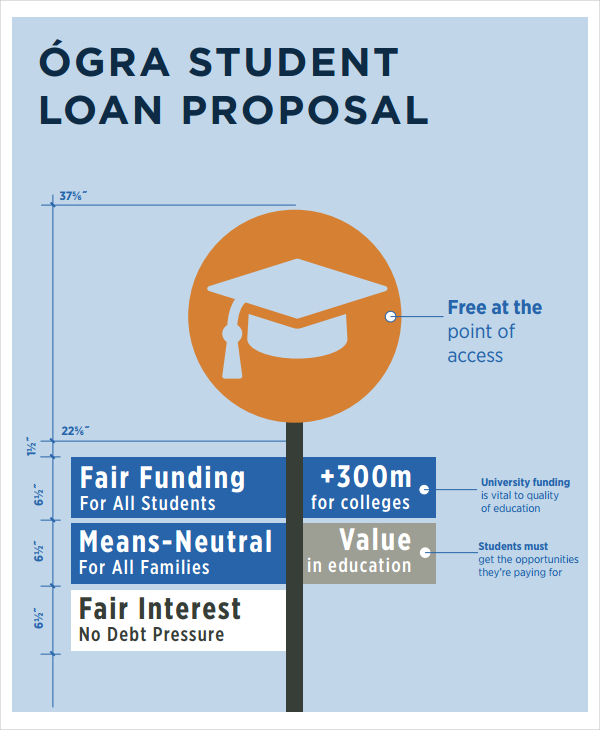

12. Student Loan Proposal

13. Simple Loan Proposal

14. Loan Fund Proposal

What Is a Loan Proposal?

A business loan proposal is a required document when going through a loan application prepared by aspiring borrowers. It includes not only the details of their loan but also their business description where they intend to use the money. Lenders demand a loan proposal to see if the loan candidate can pay for the credit and fulfill the loan agreement, and if his or her purpose is reasonable enough for a loan release.

How to Write a Loan Proposal

Development needs funding, and sometimes, even when your business is doing so well, there’s not just enough for expansion or building a new branch or a manufacturing facility. That and some other valuable purposes are among the viable reasons to take a business loan. The idea of a huge financial burden might be intimidating, but with the right management, they can result in great profits.

Before that happens, you need a good loan proposal to back you up. Here are some guidelines to help you:

1. Start with a Comprehensive Executive Summary

To introduce yourself and your purpose, start your proposal with a comprehensive executive summary. An executive summary employs the characteristic of a cover letter that contains you and your business’ introduction. This will help whoever will review your proposal to identify who you are easily and the nature of what you do. You can include in the summary a brief description of your business, whether or not you’re a veteran in the field or finding ways to build a new business. State the reason why you’re appealing for a loan and how it will help you achieve your objectives.

2. Provide a Business Profile

Loan requests are a big deal. Lenders and bankers need to know that the person coming to them for help is credible and trustworthy. A copy of your company profile will add significant value to the validity of your appeal. Your business profile should include a summary of your business activities and the products or services that you put out into the market. It should also provide a narrative of your target customers and the marketing strategies that you use. In many ways, your business plan contributes to the most reasons why you need loan approval.

3. State Your Loan Request

Clearly state how much you want to borrow and how you exactly plan to use the money. General statements such as “I want to raise my sales, and an added fund would help me” won’t make the cut. Be specific. How will you raise your sales through additional funding? Will you buy more equipment and increase your production? Are you building another factory because your demands are piling up? This should come in detail as the bank won’t be content with a mere statement. Provide documents showcasing your intentions and the cost it entails. Present your need by showcasing facts and a promising plan waiting to happen.

4. Introduce a Proof That You Can Pay

A business loan proposal constitutes a huge sum of money. Without any repayment assurance, your bank would probably give you a negative result. Show them how you plan to pay your loan according to your agreed timeline. Provide a copy of your income statement, projected cash flow, and budget sheet, and explain how you will customize your financial plan in order to repay the loan. A concrete plan will help you provide them with a perspective on how you will manage your debt.

FAQ’s

What are the elements of a loan proposal?

A loan proposal has numerous elements, but they are generally classified as loan description, business description, financial statements, and references.

What supporting documents does your loan proposal need?

A loan proposal needs the support of a business plan, profit and loss statement, cash flow statement, balance sheets, and financial projections.

What are viable collaterals for a personal loan?

Among the most common types of viable collaterals for a personal loan are real estate properties, vehicles, home equity, cash, savings account, and investments.

Fulfilling your business objectives requires you to overcome some of your life’s most challenging obstacles. This includes getting your loan proposal’s approval. It’s not easy, and there’s a lot of considerations that go into the planning and making of your proposal presentation. If you’re thinking about doing it to enhance your business operations, here’s your cue—do it! Start with a selection of our solid loan proposals. Make the most out of a great day and download now!