15+ Loan Schedule Examples to Download

A loan is a type of liability that a person or other institution takes on. The creditor collects a sum of money from the lender, typically a corporation, financial institution, or government. He or she also commits to several conditions, including finance costs, interest, a maturity plan, and other terms. The lender may provide collateral to protect the loan and guarantee repayment in certain situations.

It is how the loan application process works. When anyone requires financial assistance, applying for a loan from a bank, company, government, or other institution is necessary. Also, they should provide basic information, such as the justification for the loan, their financial background, their Social Security Number (SSN), and other specifics.

To get more info about this topic, check some templates and guidelines below:

15+ Loan Schedule Examples

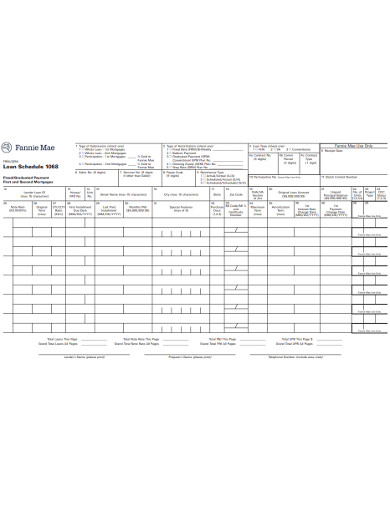

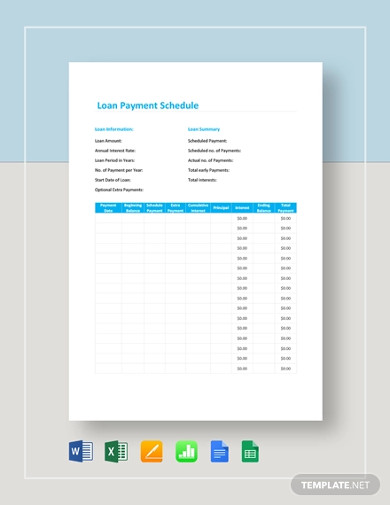

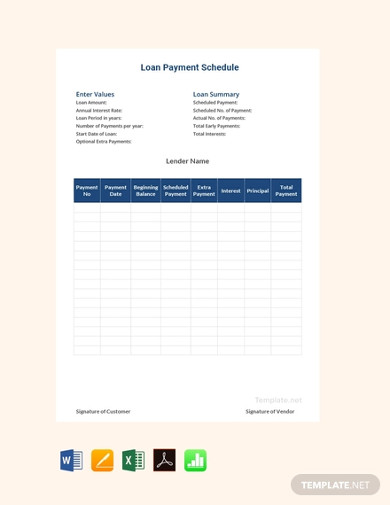

1. Loan Payment Schedule Template

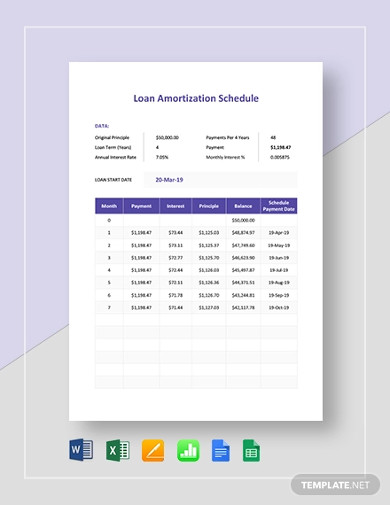

2. Loan Amortization Schedule Template

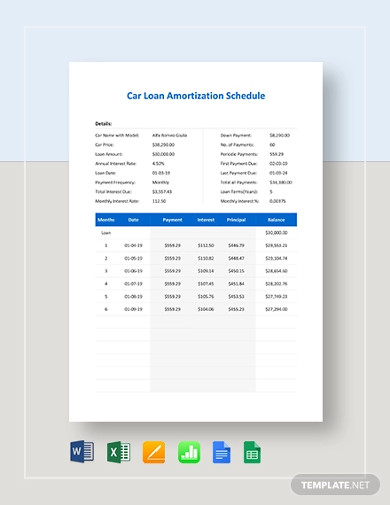

3. Car Loan Amortization Schedule Template

4. Free Loan Payment Schedule Template

5. Free Load Panel Schedule Template

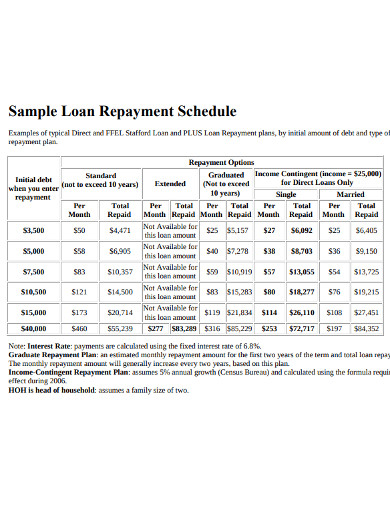

6. Sample Loan Repayment Schedule

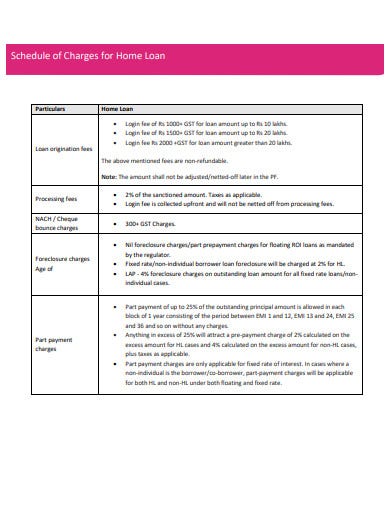

7. Schedule of Charges for Home Loan

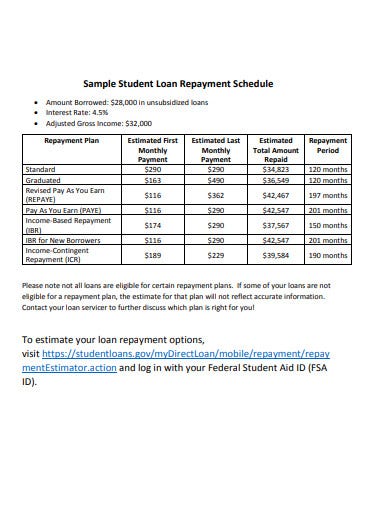

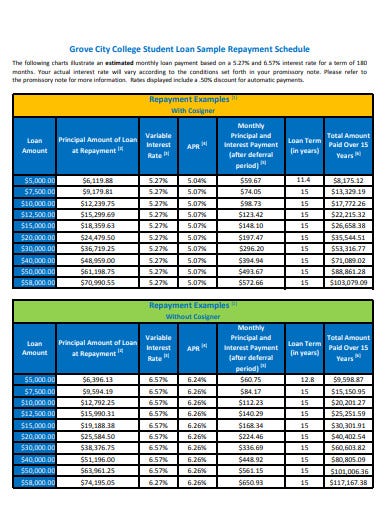

8. Sample Student Loan Repayment Schedule

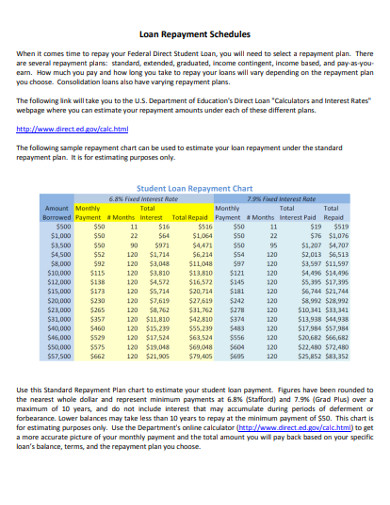

9. Loan Repayment Schedules Example

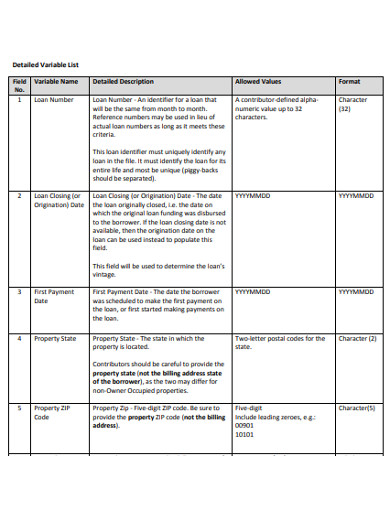

10. Format of Loan Schedule Example

11. Simple Loan Payment Schedule

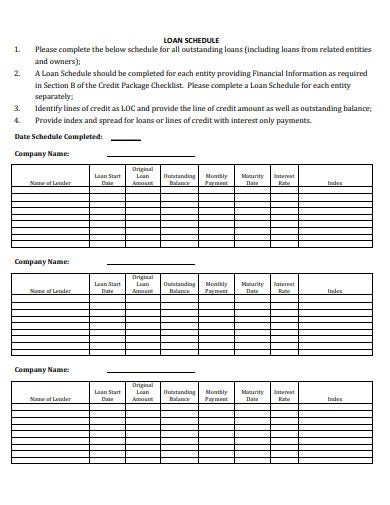

12. Loan Schedule Template

13. Loan Amortization Schedule Example

14. Residential Loan Schedule Example

15. Student Loan Repayment Schedule

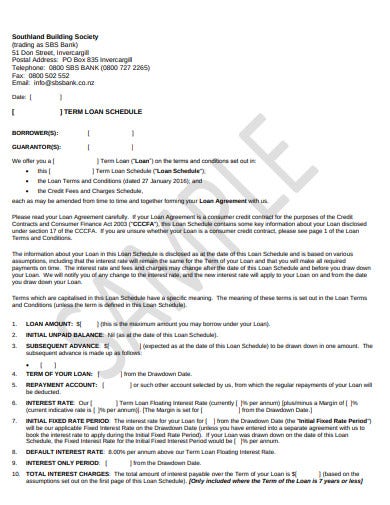

16. Term Loan Schedule Template

What Is a Loan Schedule?

When you lend money to someone else in exchange for repayment of the loan principal plus interest, it is considered a loan. However, before the payment, all parties must agree on the loan terms. A secured loan, such as a mortgage, or an unsecured loan, such as a credit card, are two types of loans. Tare loans with a fixed rate and a fixed payment that can be invested, repaid, and expended again.

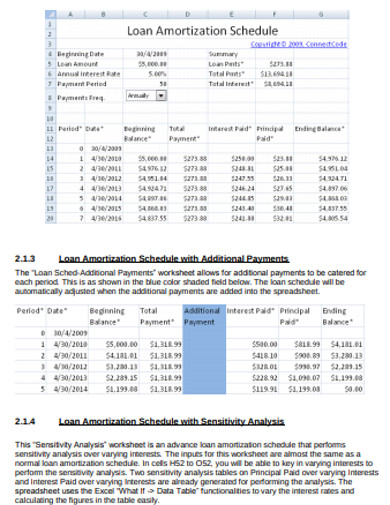

How to Calculate Amortization?

If you want to build your amortization table, you’ll need to know how to do the equations, either by hand or on a spreadsheet. Follow these steps to measure the loan’s amortization:

1. Make Your Monthly Payment Calculator

You’ll need to see how much you owe, how long you owe it for, and what your interest rate is to sort out your monthly payment. These three factors will determine the extent of your mortgage payment as well as the total amount of interest you will pay for your loan.

2. Calculate the Rate of Interest

The next step is to figure out how much interest you’ll have to pay. Calculate your starting balance by multiplying it by your monthly interest rate. Divide your annual interest rate by 12 to determine your monthly interest rate.

3. Calculate the Principal Fee

Subtract your interest charge from your monthly bill and get your principal cost. For instance, subtract your $375 interest charge from your $506.69 monthly rate. It means that you need to pay $131.69 in principle for the first month.

4. Calculate The Final Number

Finally, you’ll work out your month’s finishing balance. How? It’s simple. Deduct the amount of interest you pay per month from the loan balance.

FAQs:

What Is Amortization and How Does It Work?

Amortization is the method of adding interest fees on particular forms of debt. The monthly amount is usually the same, as it is split into interest rates, lowering the loan balance, and other expenditures such as property taxes.

How much does a loan interest cost?

Interest is a proportion of the loan balance charged to the lender regularly in exchange for the use of their funds. Although you can express interest as an annual average, you can also measure it for periods longer or shorter than a year.

What are the three different forms of loans?

Whether you’re a present or potential college student, you’re probably considering taking out a student loan. Before you make any choices, it’s necessary to grasp the fundamentals of borrowing. There are three components of all loans: interest rate, security component, and term.

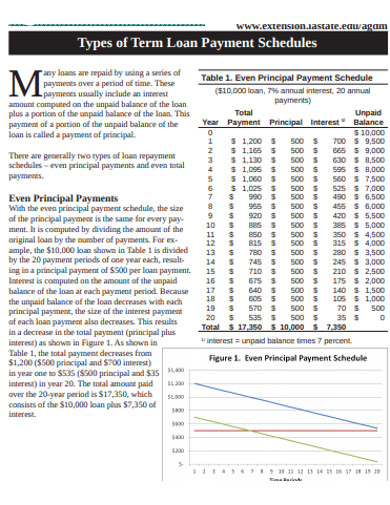

What are the conditions for loan payments?

Many loans get paid with several installment payments. A deposit of principal is the payment of a part of the loan’s outstanding balance. Both principal payments and even cumulative payments are the two most common debt repayment schedules.

Taking out a loan should not be a humiliating or frightening experience. In reality, without the affordability of a regular mortgage payment or any monthly debt payment, many big-ticket products like homes or cars will be impossible to buy. This once-frightening undertaking isn’t so difficult to handle after all, especially if you keep your budget carefully and realize what you’re getting.