5+ Mortgage Broker Business Plan Examples to Download

It’s a never-ending battle to come up with new ways to improve the company. Corporate think tanks conduct extensive market research to assist executives in making important decisions. Report documents are always on people’s desks, urging them to make changes. With all of the facts and figures in hand, planning begins to ensure that the present and future situations are under control. Consider the mortgage broker business, which is always looking for new ways to increase profits, gain more partners, improve their small marketing strategies, and even expand to serve more people. Also, make sure that planning will never stop in your industry.

5+ Mortgage Broker Business Plan Examples

1. Mortgage Broker Business Plan Template

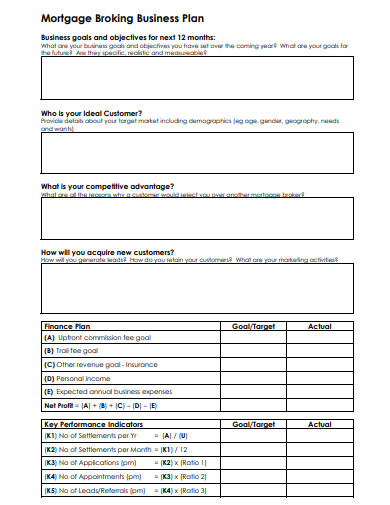

2. Mortgage Broking Business Plan

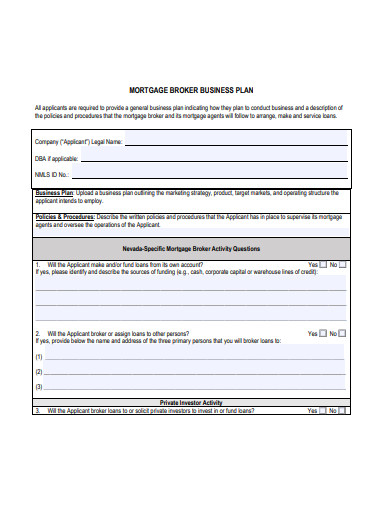

3. Sample Mortgage Broker Business Plan

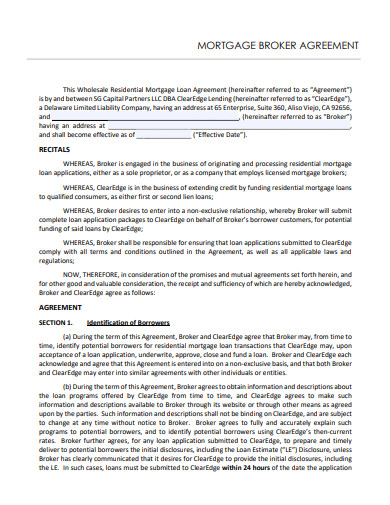

4. Wholesale Mortgage Broker Business Plan Agreement

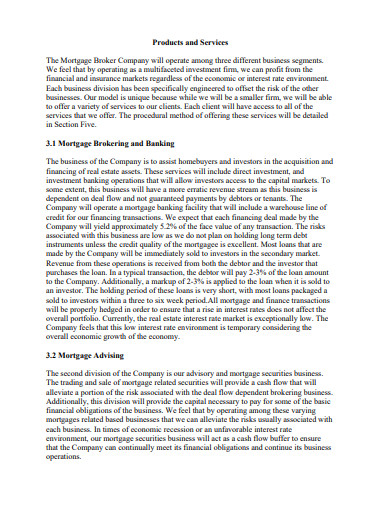

5. Mortgage Broker Business Plan Example

6. Mortgage Broker Business Plan in PDF

What Is a Mortgage Broker Business Plan?

A sample business plan contains a list of guidelines and processes that assist businesses in achieving their goals. Some business plans are in place for years, while others are only in place for a few months. Mortgage business plans follow the same path but with more specifics. The strategy focuses on methods and systems that make mortgage programs, projects, and proposals relevant to the target market—homebuyers and property investors. The primary goal of most mortgage business plans is to increase sales while reducing losses.

How To Create a Mortgage Broker Business Plan?

Being a mortgage broker entails being in the thick of the transaction. You have clients or customers on the one hand and lending companies on the other. The lending agencies could be a commercial real estate company or a bank that makes bank loans. Additionally, as a broker, you serve as a convenient intermediary. Therefore, begin by presenting your business plan to agencies by following the simple steps outlined below.

1. Recognize the Parties Involved

When you know who you’re dealing with, you’ll be able to make property investments and get financial assistance. You can change your plans depending on the nature of the institution, whether it’s a local bank, a rental property agency, or a real estate company. Make sure you understand their process so you can properly align your comprehensive proposals.

2. Define your Company’s Branding

Any business suffers from chaotic and incomprehensible branding. If your customers and viewers are unclear about the purpose of your advertisement or the contents of your website, you will lose credibility and, unfortunately, audiences. So, plan and develop a well-organized and professional brand for your company. Before your launch dates, choose your color palettes and create your logo. Then, using the selected color patterns as a guide, create alternate outputs. When creating flyers or leaflets, make sure that the advertising materials have a specific direction.

3. Select Your Marketing or Advertising Campaigns

Each marketing strategy and advertising campaign serves as the super-strong thread that connects the business plan. These strategies—approaches that mortgage businesses must adhere to are the business’s driving force. Through these concepts, companies gain a clear understanding of the path forward for the enterprise’s development. However, keep in mind that the marketing and advertising strategies chosen for the business plan should align with the company’s vision.

4. Make it Possible

An impossible plan isn’t worth making, and it’s certainly not worth sharing. You may have objectives, but keep both feet on the ground so that the implementation phase is the next priority. You can either run a feasibility test or give it a dose of common sense. Your ideas must produce results, and the best course of action is to make them feasible. Whether it’s a strategic plan or an action plan, your company deserves to know where it’s going. Don’t forget to set aside time to plan for improvement and betterment, as this will benefit everyone.

FAQS

Is it true that mortgage brokers are a dying breed?

During the recession, many brokers were forced to close their doors. Many people declared mortgage brokers to be a dying breed. Today, however, reality contradicts them. Brokers are becoming increasingly important in the housing market because they bridge the consumer and the appropriate lending institution gap.

Is it possible to haggle mortgage broker fees?

When shopping for a loan, you’ll come across a dozen different types of mortgage fees — and sometimes even more. Most of them, however, can be negotiated by asking for a lower price or a waiver.

How long is it necessary for a mortgage broker to keep files?

For three years, a broker must retain copies of all documents relating to transactions, trust accounts, and other documents executed or obtained in connection with any transaction requiring a broker’s license.

A mortgage company requires a foolproof and efficient business plan in addition to hard work and dedication. Businesses must set goals, objectives, and standards to ensure proper management sample. In some ways, business plans serve as a blueprint for how to run a company. Companies should use this information to create a business plan that fits their needs and proposed end goals. Have you gained any insight from the advice given above? So, what exactly are you waiting for? Now is the time to get the templates!