13+ Small Business Investment Agreement Examples

Starting an own business is not as easy as deep frying chicken. If that were the case, companies would crop up everywhere and would be earning thousands daily. Owning a business does not only require extensive research, but also luck and having a keen eye for finding opportunities to earn. As true for all businesses, partnership and investment are needed not only to get the business up and running but to make sure the new business doesn’t go bankrupt within the first weeks or months of its operations. So, to make sure both parties comply with the investment, an agreement or contract is needed. Check out some examples of business investment contract agreement templates to know more about it.

13+ Small Business Investment Agreement Examples

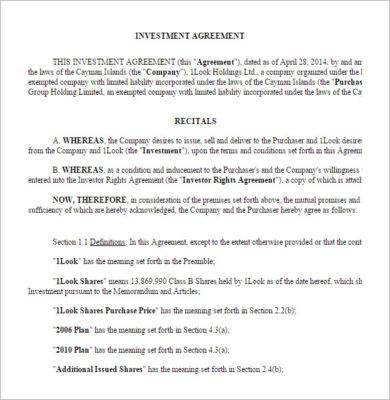

1. Investment Agreement Example

2. Business Investment Agreement Example

3. Business Investment Agreement Example

4. Investment Agreement Example

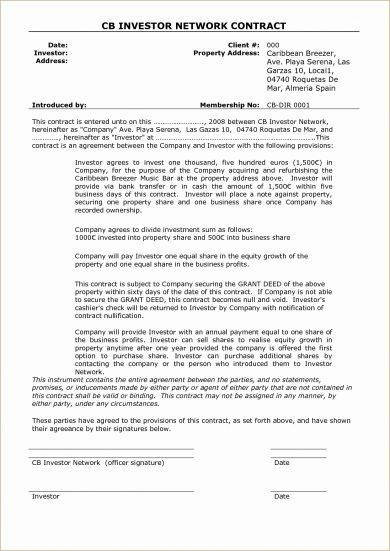

5. CB Investor Network Contract Example

6. Definition of Terms Investment Agreement Example

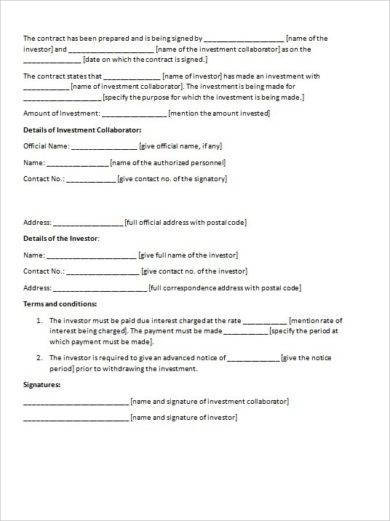

7. New Small Business Investment Agreement Example

8. One Page Small Business Investment Agreement Example

9. Outline for Small Business Investment Agreement Example

10. Shareholder Investment Agreement Example

11. Small Business Investment Agreement Example

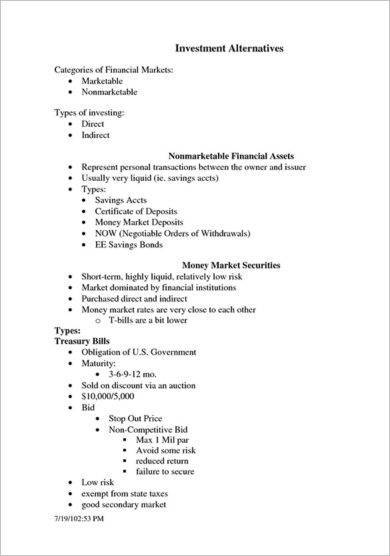

12. Small Business Investment Alternatives Example

13. Small Business Investor Agreement Example

14. Small Business Investor Financing Agreement Example

What Is a Small Business Investment Agreement?

An investment agreement is a simple agreement letter where an individual or business organization offers an investment. This is mostly cash or bank loan given to another business entity in exchange for cash plus interest or a share of the ownership of the business. The investor agreement, as similar to all other agreements and contracts, is always a written legal document and never a verbal one.

Starting a Business

According to a report analysis published by AARP, starting a small business costs $30,000 on an average in 2009. Not everyone can purchase a large corporation nor franchise a million-dollar business. Even if you have enough funds to start a company that employs 500 or more people, it is highly advisable to start small and use the remaining funds to develop a small business. McDonald’s was merely a small diner before businessman Ray Kroc turned into the world’s biggest fast-food chain. The lesson here is never to put all your eggs in one basket. Here, you have to diversify your investment portfolio and watch it turn into a financial juggernaut with time and proper research.

How To Make a Small Business Investment Agreement

Writing investment documents for startups is always frustrating. Remember, you have to follow the right and basic formatting to keep all terms reliable and credible. Since it needs to follow different elements, why not grab this chance to consider the items below? Read on and follow the list of steps to come up with a great plan.

1. Begin by Knowing What It is For

To begin writing a simple investment contract, always know what it is for. Since most investors are keen to details, let them understand the document just by looking at the title. Yes, you have to label it correctly. Is it a financial investment? Or perhaps, a small restaurant investment? By doing this, you are clearly defining the importance of this document.

2. Identify Two Parties Involved

Next, it is essential to know who are the people involve. Because you want to be clear about the terms for this investment partnership agreement, always start by acknowledging both parties. This should include the full name, and never the initials. With this, you will know to whom the terms and conditions are addressed. On the other hand, this helps investors identify who to contact.

3. List the Agreed Startup Plans

It’s vital to allow both parties to review the business plans that you have agreed upon during the discussion. Here, write them down clearly. For business partnerships, detail what are the roles of the two parties. Then, it should contain the profit sharing. Is it 30% and 70% sharing? Or, it could be a borrowed money with a 20% interest return. Because you do not want to share issues in the future, don’t forget to write down a complete list of limitations and expectations, too.

4. Include the Terms and Conditions

In this section, you have to be direct and precise. Investors do not take too much time reading the whole agreement letter. With this, it is best to separate the terms and conditions to different sub-sections. This should include the payment method and schedule policy, termination and cancellation of the agreement, validity and commencement dates, and legal terms. Because of this, parties involved can easily look for the terms that severely needs to be followed.

5. Add the Signature

Lastly, get the complete business investment agreement form by making the investor sign it. But of course, you have to place your signature as well too. If the other party fails to follow the terms and conditions, the signature can help you pose sanctions.

FAQ’s

What are the types of investment?

There are various types of investments. Among includes growth investments, defensive investments, property share, and fixed interest.

What investment gets the most money in return?

Gold and real estate are top of the line when it comes to investment’s easy money.

What are the ways to start an investment?

There are various ways to do so. But among the commonly followed is the real estate market and money in low initial investments.

While you are starting to grow your business, it is still essential to think ahead and outside the box. Don’t settle for anything less. You can grow and expand through investments. Here, you can start looking for a good partner. Make a deal and develop the business. Because of this, you need to secure a document of agreement. So, follow the steps above and conclude an excellent startup investment.