10+ Trust Agreement Examples

A real estate property such as a land or a house is one of the important assets of any individual. Unlike other assets, ownership of this type of property can be passed on to later generations. One way to do so is to get into a trust agreement. It is some sort of a partnership that transfers the property owner’s legal possession, tax declaration, and other aspects of a property to another party, usually a beneficiary. It is also one way to satisfy a collateral agreement’s requirements. The process requires a written document that details the transaction. To know more about it, check out our relevant article and a variety of examples below.

10+ Trust Agreement Examples

1. Trust Agreement Template

2. Source Code Trust Agreement Template

3. Source Code Trust Agreement Licensed Program Template

4. Source Code Trust Agreement Development Template

5. Voting Trust Agreement Template

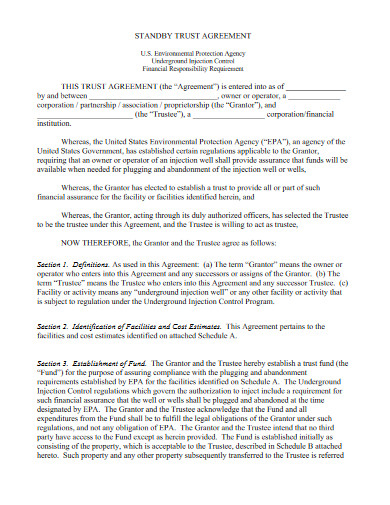

6. Standby Trust Agreement Template

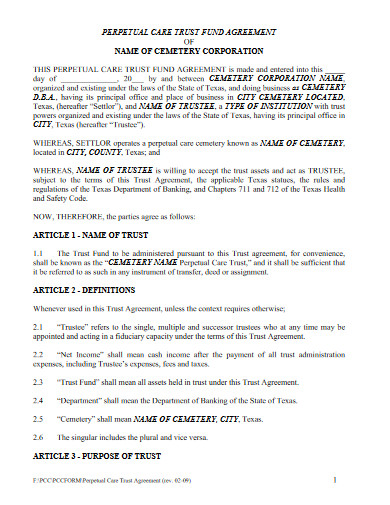

7. Trust Fund Agreement Template

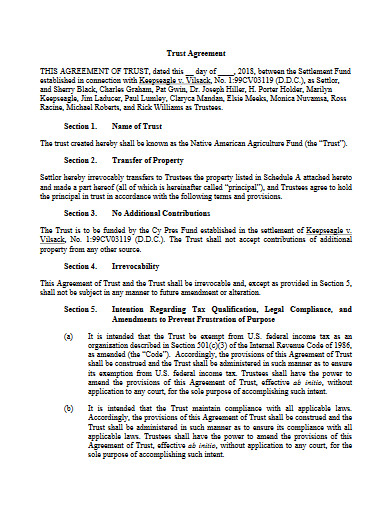

8. Trust Agreement Example

9. Simple Trust Agreement

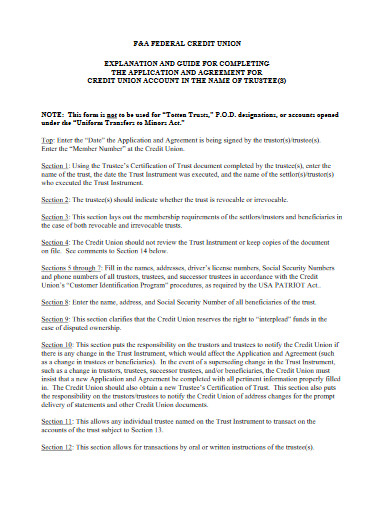

10. Master Trust Agreement

11. Trust Agreement in PDF

What Is a Trust Agreement?

A trust agreement is a legal document that details the handing over of a trustor’s ownership rights of any of his or her property to a trustee. The reason for the endeavor is for the trustee to conserve and protect the said property on behalf of the beneficiaries. But according to The Fiduciary Group, it also serves the following purposes:

– Ensures the proper management and distribution of assets with accordance with the trustor’s intentions

– Provides confidentiality to the turning over of wealth

– Give lifetime income to beneficiaries

– Protect assets from creditors

– Reduce income taxes

– Execute charitable objectives

– Protect assets from becoming a marital property when divorce happens

Probate

Probate refers to the process that determines whether a will is valid and authentic. It also has another function, which is to manage a deceased individual’s will or the deceased’s property, which doesn’t have a will. Once an asset-holder passes away, the court calls for the executor appointed in the deceased’s will to handle such a process. If the deceased does not have a will, the court appoints an administrator. The executors’ or administrators’ work is to collect the deceased’s assets to pay their remaining liabilities and distribute what’s left to the beneficiaries.

How To Create a Trust Agreement?

Many people would rather hire an estate planning attorney to make a trust agreement for them, but that is an expensive option and is not always necessary. If you’re planning to make one on your own, you will need a good walkthrough on how to do it without missing the most important points. With that, we offer you our standard-based outline of the guidelines below.

1. Present Purpose

There are many agreement documents that involve trusts, such as real estate investment trust, trust fund, and many more. So, it is just right to start your documentation procedure with the statement of purpose. For your information, there are two main types of a trust agreement, revocable and irrevocable. The revocable agreement allows the trustor to change, alter, or terminate the trust. On the contrary, irrevocable agreement denies the trustor of any revocation on the document.

2. Describe the Assets

After presenting the purpose, thoroughly describe the assets that you want to entrust. Take note that these assets should meet the general requirements. The assets, tangible or not, have to exist, are transferable, and should be valid under certain circumstances.

3. Name the Involved Parties

In a trust agreement, there should be at least two parties. They should consist of the trustor, trustee, and the beneficiaries. The trustor is the asset-holder who turns to the trustee to uphold and execute the agreement’s specifications. There are times that the trustor is, at the same time, the beneficiary when the purpose sets to reduce tax while he or she is still alive. Trustees could also become beneficiaries when the trustors decide to advance the trust and transfer the asset rights to the beneficiary once they pass away. Before these parties get into the said agreement, they have to validate their identities and legal capacities. Perhaps, through a verification letter.

4. Propound Trust Details

The next step is to give out the details of the trust thoroughly. This should include the trustor’s wishes and recommendations on handling the asset, as well as the reverter, conditions, limitations, decision criteria, shares, and commission plan for the beneficiaries. This section has to expound the trustor’s voluntary transfer of the assets to the trustees and the spendthrift trust or the precautionary steps to keep the trust in the beneficiaries’ hands.

5. Fix Approval

Like an investment agreement, commission agreement, guardianship agreement, and others alike, the trust agreement needs approval from the involved parties. And, the most common way to present such approval is by affixing the participants’ signatures.

FAQs:

How much will it cost me to create a trust agreement?

If you opt to get a lawyer to set up the trust agreement, you will most likely pay from USD 1,000 to USD 7,000. The price depends on the document’s complexity and your financial situation.

What is the difference between a trust and a will?

While both trust and will are acts of entrusting a certain property, there is a slight difference between them. A will takes effect after the testate, or the creator of the will dies. On the contrary, a trust carries out its effect right after a trustor creates it.

What is a living trust?

A living trust is the common form of agreement created by a certain living individual to entrust his or her assets and the responsibilities that comes with it to someone else, also called the trustee. Part of the responsibilities is to manage these assets for the beneficiaries who are usually the trustor’s family members.

We don’t know what the future holds, and we know that we can’t bring the possessions we have once we leave this world. The very least we can do is leave them behind to the people who we think deserve to have them. To ensure that such an intent is executed according to our interest, we have to give our trust to a certain individual. It’s just like what the American satirist, essayist, and journalist Henry Louis Mencken said, “It is mutual trust, even more than mutual interest, that holds human associations together.” But, make a trust agreement, just for protection.