9+ Year End Report Examples to Download

Every end of the fiscal or financial year, businesses will want to know how well or how badly they did during the year. Executives and decision-makers of a company or organization will want to know accurate data that will reflect the progress of the company or organization throughout the entire year. They will also want to know the developments in the projects they have started within the year—where it is currently at, what is the current status, how much has it grown, etc. It is important that they know these kinds of information since running the business or organization involves loads and loads of cash, unending efforts, and time.

Executives and decision-makers of a company or organization demand that they are updated of the progress that the business has made every end of the year. This is so that they can measure the return of investment, profit, etc., to know if the business is doing well or not. Presenting them with a consolidated and comprehensive document containing all the relevant and needed information will help them during the process of deciding whether to continue with the business or simply end it especially when it only accumulates cost but not revenue.

How to Prepare for Year End Reporting

Preparing and actually the making the year end report is such a tedious and demanding task. It requires all relevant details that may be included in the report, be it from one month or 11 months ago. Therefore, it is an excellent idea to always prepare and account the needed information before the end of the year approaches. With that in mind, here are useful tips that can help you prepare for the year end reporting:

- Pay Vendors and Contractors: Make sure that you have already fully paid your vendors and contractors. In order to determine if your contractors need to submit a W-9 form, you have to check with your accountant in advance. In addition, a filled out 1099-MISC form should be submitted by each of your contractor by January 31.

- Prepare Payroll Records: You have to gather all the relevant information before you start to make your year end report. Although there are options available for you should you need extra sets of hand to carry out this task, you can partner with payroll experts to make sure you get to avoid issues and complications as well as making sure you are complying with all the regulations.

- Profit and Loss Report: You also have to generate a profit and loss report, as well as a balance sheet, and identify what your business did well and what could be done better for next year. That way it will be easier for you to just input these information to your year end report.

- Review Profitability: Create an income statement and review each revenue-generating item. In addition to that, you also have to make a tax deductible expense. These reports are very important for your year end report since cash flow reports are vital documents for your business. Cash flow reports tell you how much cash your business has readily available.

- Estimate Taxes: You have to make sure that you are on track with the taxes you have already paid especially if you pay you taxes quarterly. Doing so will help you determine what you will need to pay at the end of the year. Other taxable amount such as employee bonuses should not be disregarded since they are still also subject to any taxes applicable to regular pay.

- Review All Employees: By this time, you still need to make sure that the your payroll contains verified information of your current current employees. You also need to ensure that those reflected in the payroll are still with the company or are current employees.

- Tax Deadlines: Tax dates will vary depending on the structure of your business. You can verify your business’s deadlines through the IRS’s calendar.

- Tax Payments: Your tax payments should be secured separately. And always remember to make sure that you include enough to cover both state and federal taxes.

- Review Clients: All client contact information must be reviewed and confirmed that all details included are accurate.

- Goals: What you have accomplished on the current year must be reviewed and start developing new goals for the following year so that there is a constant flow and direction for your business. This will also help keep you inspired and motivated to work harder so that you and your business can grow even more.

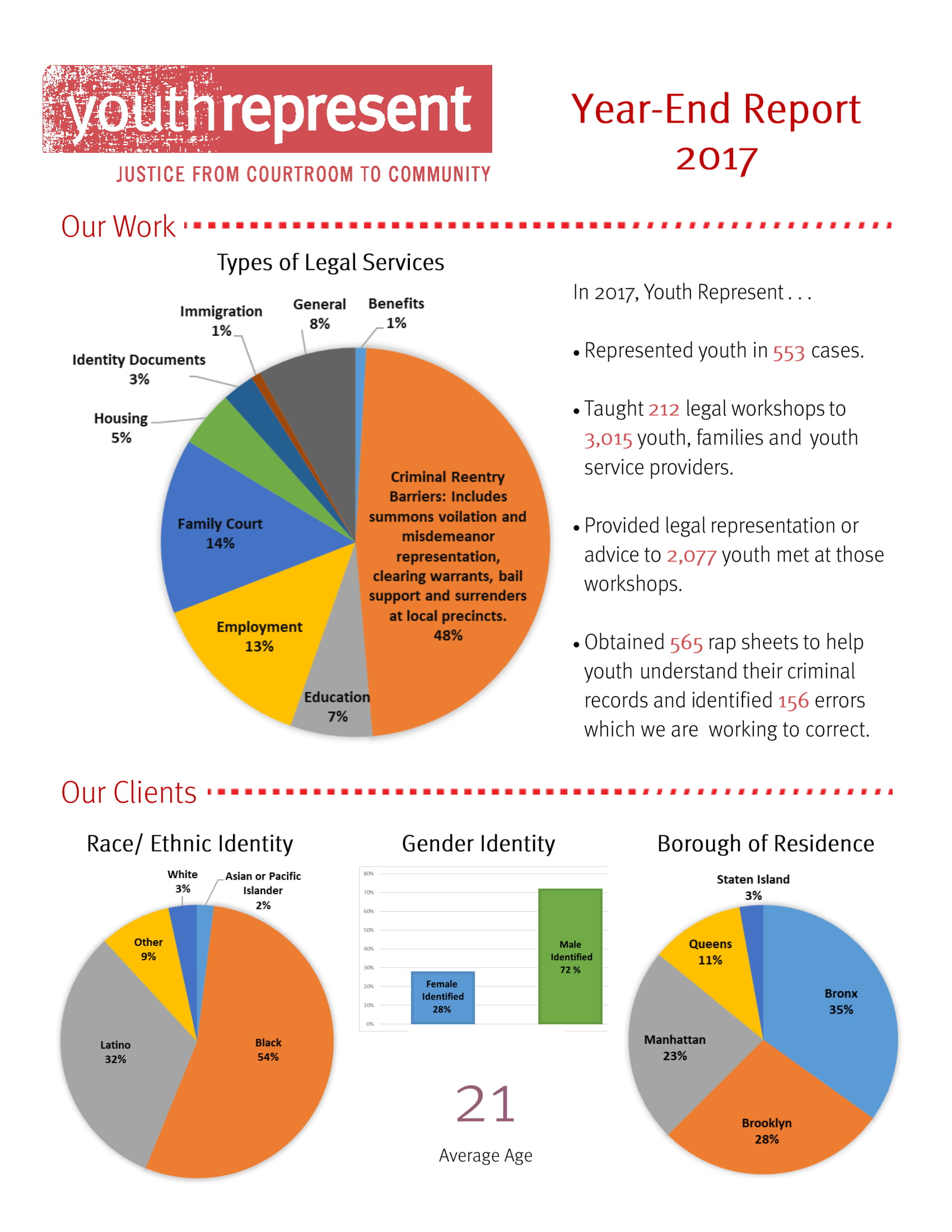

Brief Year End Report Example

Scientific Organization Year End Report Example

Fire Company Year End Report Example

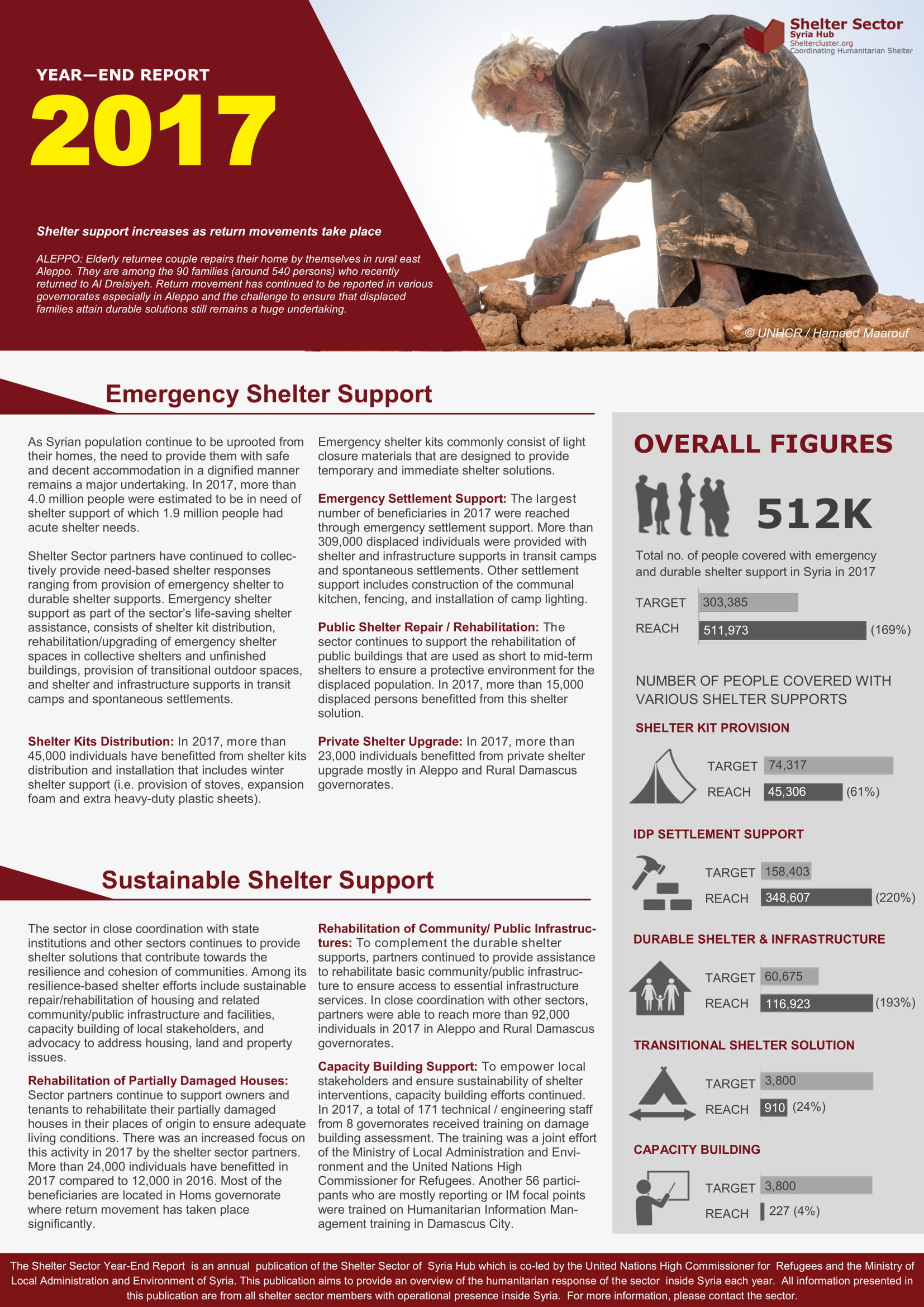

Shelter Sector Year End Report Example

Humanitarian Response Plan Year End Report Example

Information Included in a Year End Report

Although you know how to prepare for year end reporting, you still need to know what significant information you should include. With that said, here are some of the information you should include in your year end report:

About Your Company Tax Return

Your company tax return contains details of your turnover, expenses, tax allowances and profit, in the form of the company’s statutory accounts. The information included in the company tax return is then used to calculate how much you owe in corporation tax.

About Your Statutory Accounts

The statutory accounts of your business or also know as annual accounts. It is usually made up of the following parts:

- Income Statement – This is the profit or loss for the accounting period of your company.

- Statement of Financial Position – This is the overall value of your company.

- Director’s report – This pertains to the report on the state of the company according to the board of directors. This is not a requirement for micro-entities.

- Footnotes – These are additional information intended to clarify the other sections.

Although there other elements to a year end report, what has been discussed above are the important ones that you need to make sure to cover. It is always better to inquire or ask help from a professional in order to make an effective year end report and to avoid further hassle.

Fire District Year End Report Example

Association Year End Report Example

Tips in Making Year End Reporting Easier

With the complexity of what it takes to make an accurate and effective year end report, you might get discouraged and demotivated to continue. However, submitting a year end report every end of the fiscal year is a legal requirement; failure to submit one may make you liable to an even bigger mess. Therefore, you need to allot and dedicate time to prepare and making your year end report. Listed below are some useful tips that can make year end reporting easier:

1. Prepare in advance and frequently stay in contact with your accountant

It is definitely harder to wait for the end of the year to start preparing your year end report. It will be easier for you to incorporate the tasks needed for making the year end report into your daily tasks. Preparing the necessary reports ahead of time will decrease the stress when the deadline is fast approaching. In addition, staying in contact with your accountant frequently will help you make sure you have prepared all the needed documents and information.

2. Be vigilant with your records

If you want to avoid the hassle of fixing records and accounts, make sure that they are constantly checked and updated. If you don’t give enough time in keeping records it can lead to a lack of detail and supporting documentation. Consistently audit your needed data so that you can avoid panicking and forgetting important information.

3. Assign year-round tasks

Divide the necessary tasks into smaller parts that can be done all year round. You have to make sure that every member of your team has tasks to do. You can also assign some people to have primary responsibilities to help you stay on track. One way of doing this is through assigning a small team every month to review the accounts payable in order to make sure that records are updated and reconciliation can be performed. It is also cost-effective to cross-train every team member so that they are flexible to perform other tasks when there are sudden absences or leave.

4. Know and familiarize the law

The law with regards to tax can sometimes become too overwhelming and confusing. In order to avoid mistakes, it is very important that you study and familiarize the law governing this requirement. Since state and federal tax legislation, rates, and forms constantly change, it is very important that all those involved in making the financial reports are also up-to-date with the changes. Knowing and being familiar with the law will help you keep up with the requirements as well as how to avoid becoming legally liable.

5. Verify employee and contractors’ status

Knowing and double-checking the tax filing classifications of everyone on your payroll is very important. It is also very important that before you enroll someone on your payroll that you have all their relevant and necessary documents. Also, keep in mind of state-specific filing rules and tax calculations for out-of-state workers as this aspect can get tricky and confusing. Always aim to provide the necessary forms before the end of the year so that you can avoid penalty for late submission.

6. Seek professional help

Lastly, even if you have spared quite some time for your preparations, there will be instances where it can be really challenging. In this case, it is better to ask professional help so that you can make sure that you have completed all the requirements before it is even due. You can also make sure that all you have done, complied, and included are within the regulations. Seeking help from a professional will surely help you avoid more stress and hassle.

The Haig Report Year End Report Example

Economic Consulting Agency Year End Report Example

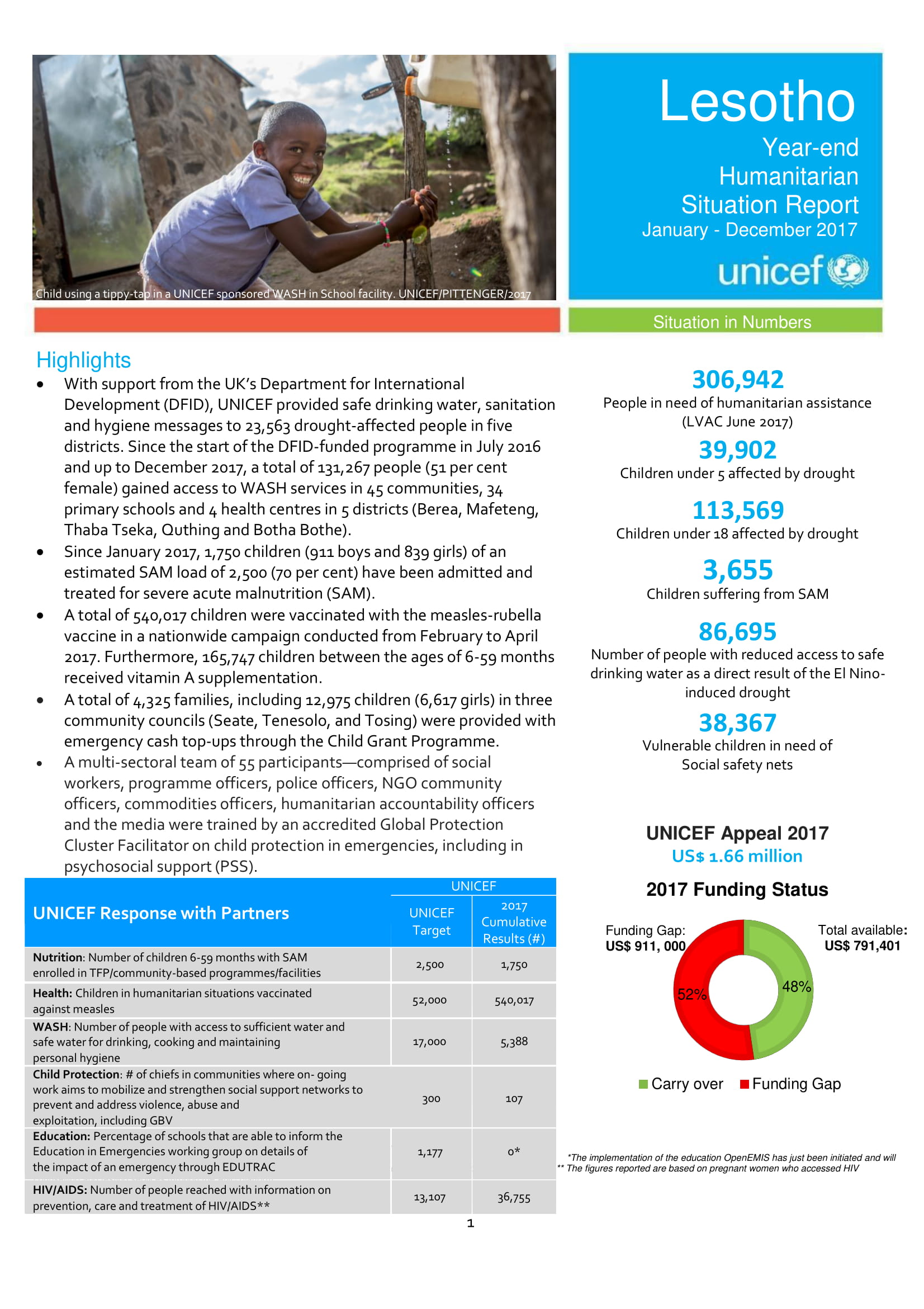

Year End Humanitarian Situation Report Example

We hope that you have learned useful information about year end reports through the contents of this article. The year end report examples above can be your basis in making your own.