10+ Five Methods of Valuation Examples to Download

Valuation is a highly subjective process of determining and analyzing the current worth of any company or organization. This valuation is done analytically and referring to several techniques. The analysts look at several aspects of the company before adding any value like the management, capital, assets, performance and the probable future earning possibilities.

10+ Five Methods of Valuation Examples in PDF | DOC

1. Valuation Approaches and Methods Example

2. Methods of Customs Valuation Example

3. Methods for Valuation of Enterprises

4. Commonly Used Methods of Valuation

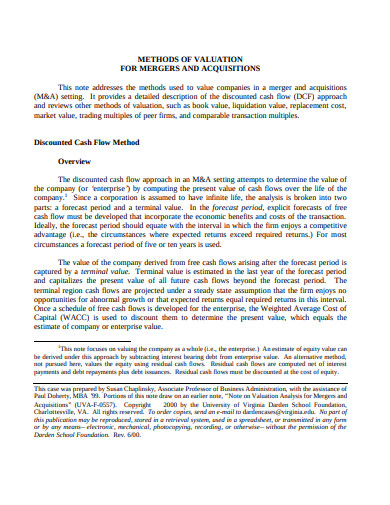

5. Methods for Valuation for Mergers and Acquisitions

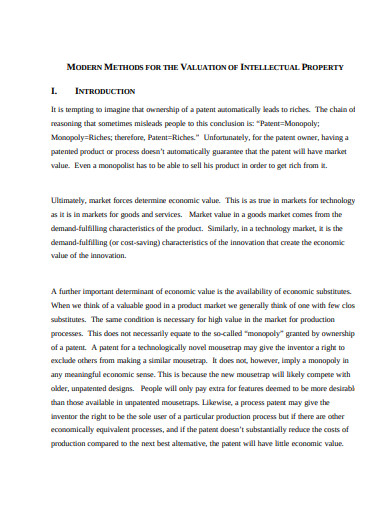

6. Methods for Valuation for Intellectual Property

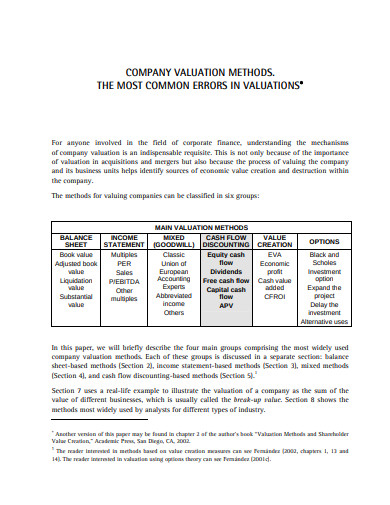

7. Company Valuation Methods Example

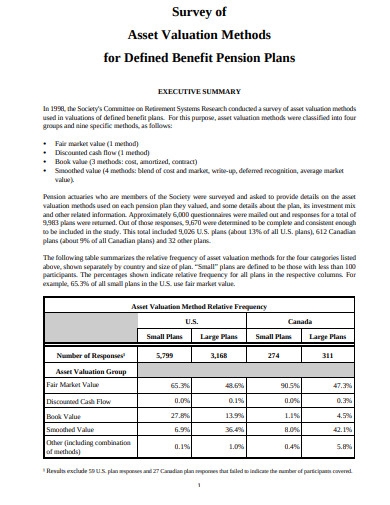

8. Survey of Asset Valuation Methods Example

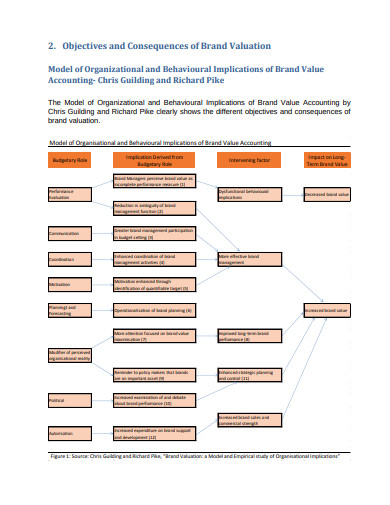

9. Methods of Brand Valuation Example

10. Methods for Valuation of a Target Company

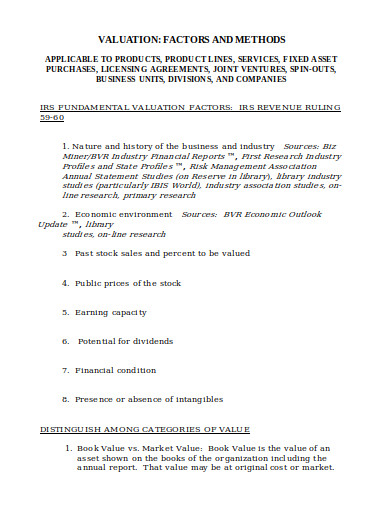

11. Valuation Factors and Methods Example

What is the Importance of Valuation in Business?

Valuation, either of company or business, is the process that evaluates and determines the economic value of the firm. A business valuation is more specifically used to determine the total value of the business house including and studying all its assets and liability details. Its importance lies in the fact that it introduces the owner with his or her trade’s performance and multiple facts and figures in the competitive market space. Some of the most common and strong points as the benefits and importance of this valuation can be specified as:

- It provides better knowledge about the assets and capital and revenue-generating rate of the company or business and releases the information in the market to inform its stakeholders and public.

- It helps to have a proper understanding of the company’s worth is very important for selling it. This process should be done much before the business indulge in trading as it would keep on adding more value to it.

- It shapes the knowledge and shows the income and valuation growth of some years in one document. This can help to attract potential buyers who have an interest in the sort of firm you have.

- It helps to calculate and show the interested buyers or mergers to check the various level growth and the possibility of more growth in the future. Buyers would like to negotiate with little money but once you know your business worth you can make your demand knowing your worth.

- It can also help in getting more investors for the business or company because investors would surely ask for a complete valuation report. Thus the valuation process can help to have you one such report that can convince them that the company can do well and give great returns.

What are the Five Methods of Valuation Process?

When you have decided to sell your business or the company or if you are approaching investors to invest money in your business the valuation report can help you the most. For designing this report several methods are followed by the practitioners the most popular among them are the following five methods.

Valuation of the Assets

The number of assets the company or business, either it is tangible or intangible, needs to be recorded in a proper document with its intrinsic values. It needs to record all the cash, inventories, stocks, patents, real estate items, or other cash equivalents. This should also read out the customer- seller relationship as it also adds a lot of value as a whole.

Relative Valuation

Relative valuation is a method used to determine and measure to what extent businesses of the same sort can give the benefits if it is being sold. This speculation is made by comparing the assets of your business with the value of other assets in the market to put a reasonable price to fit your organization’s worth.

Future Valuation Forecast

Any business may have some ups and downs in its path and existence, thus traders try to read and understand the business properly to make the speculations. The speculations help to forecast the probable future performance of the assets of the firm or the organization. Traders also make speculations about future performance profitability in the business to calculate and maintain the business maintainable earnings. This is done by employing the method of future maintainable earnings method. This method can be used while profits may be forecasted to remain stable. This method evaluates the sales, expenses, gross, profits, expenditures, liabilities, of the past three years which helps to calculate the present business value.

Historical Earnings Valuation

A business’s value is best decided by their strength of producing capital, net income, assets, revenues, ability to pay the debts, etc. The value drops when the business is not able to pay or any of these required components of the business. That is why while evaluating and adding value to any business firm the historical records of its earnings of the firm play a significant role. Thus determine these factors of the historical earnings to maintain a positive cash flow within the firm to increase its value.

Discount Cash Flow Valuation

When forecasting future earnings tells the future profits might not be stable, the discount cash flow valuation method can be an option to rely on. This method helps to calculate the net cash flow of the future of the business and discounts them in the present period. This method can help you to have an idea of the discounted cash flow valuation. Using this method, you may also track or forecast the result that your assets can give in the future.

These methods are some of the best and mostly used business valuation methods. Business valuation gives way to the traders to decide the goals for working more on the company’s values to increase it to the level as decided within a decided period. You should always make out some time and compare the current year’s value growth with past years to work for improvements and bigger targets.