11+ Advanced Financial Management Examples to Download

Financial management centers on debts, equities, and ratios. It has a lot of uses when it comes to raising capital, dividend distribution, managing portfolios, etc. Moreover, there is a higher concept of financial management, which is called advanced financial management. You have to master the basics of accounting and financial management to comprehend and keep up with this advanced type of management. Thus, learning how to be good in corporate financial management — or financial management in general — is one aspect of the finance essentials for business success.

11+ Advanced Financial Management Examples in PDF | DOC

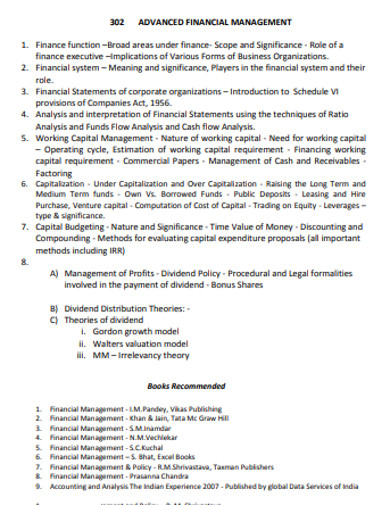

1. Sample Advanced Financial Management Example

2. Advanced Public Sector Financial Management

3. Basic Advanced Financial Management Example

4. Advanced Housing Financial Department Management

5. Simple Advanced Financial Management Example

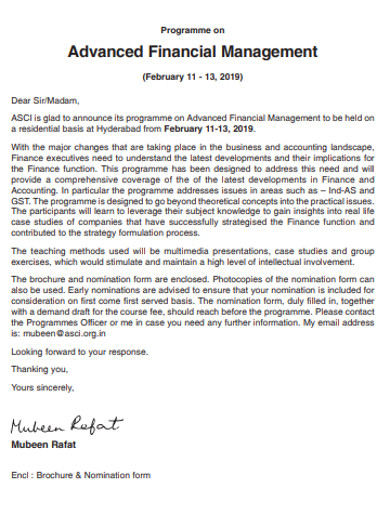

6. Advanced Financial Program Management Letter

7. Standard Advanced Financial Management Example

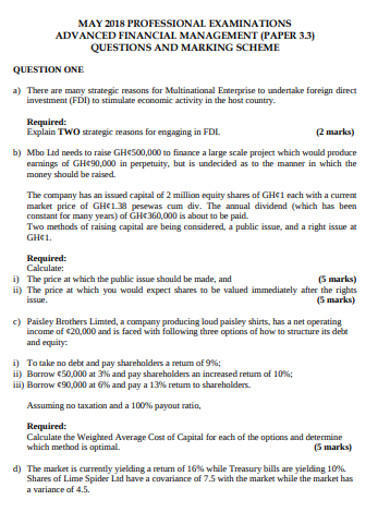

8. Professional Advanced Financial Management

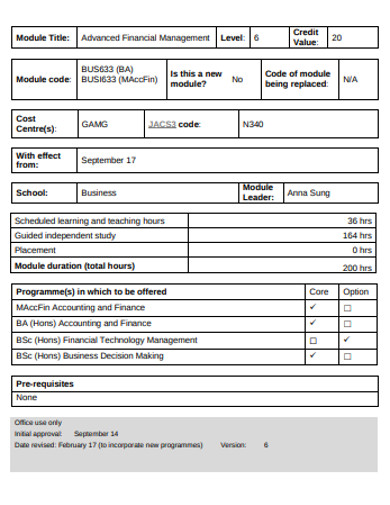

9. University Financial Management Example

10. Financial and Strategic Management Example

11. College Financial Management Example

12. Business Financial Management Example

Topics Involved in Advanced Financial Management

Advanced financial management has a broad scope. To understand further, you need to be knowledgeable enough when it comes to financial accounting & auditing, or the basics of financial management to wrap it up. Some of the topics that are covered by this type of management are as follows:

- Merger and Acquisitions – It pertains to the procedure of the consolidation of one business to another. The merger and acquisition transactions produce a considerable amount of profit for the investment banking industry. However, not all deals with mergers or acquisitions close.

- Advanced Capital Budgeting Techniques – This aspect is beneficial for financial managers for it provides a broad range of evaluation of various projects concerning their attainability to be absorbed for investments. Moreover, this helps in exhibiting the hazards and indefiniteness of such projects.

- Leasing – A lease, in the widest sense, is a contractual agreement that calls for the user to pay for the utilization of an asset to the owner. In finance, it is also called as capital or sales lease. It is when a company is a legal owner of an asset for the whole leasing period while the user has the operating control on the asset and some share of the risks and returns from the change in the worth of the fundamental asset.

- Basics of Derivatives – A derivative is a legal agreement — such as forward contracts, swaps, warrants, etc. — involving two or more parties whose worth are under the as agreed primary financial asset or assets. Derivatives can be utilized in hedging or risk assumption with the speculation.

- Startup Finance – In business, to get a full and strong grasp on money is a must because all the good things will follow afterward. Thus, to create significant decisions, commit lesser mistakes, and grow your money — and startup company as well — you need to be involved in doing the finances. Also, this is where financial reporting & analysis comes in.

The Importance of Financial Management

For a business to succeed, every business owner or manager must give their utmost attention to financial management. It is because being competent in handling the finances means the business is also running efficiently. Hence, financial management is essential when it comes to a company’s life cycle. Almost all businesses experience negative cash flows and as well as money loss during their starting time.

Therefore, managers should guarantee that they have enough funds to hand over to their workers amid the fast outgoing of cash. The business owner, as well, should do his part. He must create some financial projections from the negative cash flows to gain some ideas on how much money is needed to support the company until it becomes stable and profitable enough.

The Basics of Financial Management

Financial management is crucial in every business of any size. Moreover, it is the set of management function in an organization which involve cash and credit arrangement. Also, it is where the said organisation may have the methods to perform its goals and targets in the most satisfactory way possible. Thus, here are some basics of financial management that each business owners and manager needs to know:

- Budgeting – Budgets of any form — budget worksheet, budget plan, etc. — should be created to have a firm record on your money disbursements and income. Budgeting gives you the chance to make wise decisions when it comes to your funds for the benefit of your business.

- Trimming Expenditures – After creating a budget, you must proceed in cutting down your expenses. This aspect is advantageous to business owners with negative cash flows because this is where they can make adjustments and alterations when it comes to their spending.

- Being Free from Debts – This applies most especially to startups because they need to find ways to get some capital. However, the possibility of falling for debts does not end there. There are a lot of established and matured companies gamble on debts too. That said, freeing yourself from loans and credit cards is not that easy, especially if you are dealing with a high-interest rate. To get away with it, you must pay more than the required minimum amount every month.

The 5 Principles of Financial Management

For a better understanding and learning of financial management and finance in general, here are the five basic principles that you should know:

- Cash Flow is What Matters – Cash flow is essential in every business. It is the inflow and outflow of cash from a particular company; thus, it is crucial when it comes to a company’s operations, purchasing inventory, giving salaries to employees, taxes, etc. What a business owner must take a closer look at is the vulnerability of his companies cashflow and guarantee that it does not have a negative cash flow. A business must maintain a positive cash flow to keep it healthily operating in the long run.

- Money has Time Value – The money that is obtained in the present has more value or worth to the receiver compared to the money that will be obtained in the future.

- Risk Requires a Reward – Every investment brings risks of different kinds. The golden rule says that the bigger the risk, the bigger the potential return. However, no matter what kind of investment you are in, you should ponder the possible reward against the risk. It is to figure and sort out if the downfall is worth the possible gain.

- Market Prices are Generally Right – Financial markets are basically “information efficient.” It is because the prices typically reflect every information that is available to the public. Thus, if there are brand-new information, the prices immediately change so that it will reflect the said information.

- Conflicts of Interest Cause Agency Problems – The ownership and management split of firms commonly creates a problem in the agency. The objectives of both the owner and management may be different from each other, causing conflicts between them.

The Risk/Return Analysis

When it comes to investment, risk and return is not a new term to deal with. Risk and return are highly connected. An increase in the potential return typically goes together with the increase in risk. There are different categories of risks, such as industry-specific risk, project-specific risk, international risk, market risk, and competitive risk. Return, on the other hand, pertains to the losses or gains created from exchanging security.

The risk-return analysis looks for “efficient portfolios.” The said portfolios are those that offer the highest return on average for a provided stage of portfolio risk. Moreover, it evaluates and digs into the investment chances in conditions familiar to the financial professional: the investment portfolio risks and returns.

The Risk Analysis

The risk analysis — or financial risk analysis — is the process of evaluating the possibility of a detrimental event that is happening within the different kinds of sectors such as government, environmental, and corporate. Furthermore, it is the investigation of the primary uncertainty of a provided action plan and pertains to the uncertainty of the projected cash flow streams, the possibility of a project to fail or succeed, etc.

Risk Calculation

Risk calculation, as well as risk analysis, greatly contributes to the financial risk management of a company. It is because being aware of the risk to be taken and the consequences that go along with it is beneficial for a business. Thus, for further understanding, here are the steps in calculating the risk:

- Compute the Earnings Before Interest and Taxes – Calculate the EBIT by using the formula: SALES ? COST OF PRODUCT SOLD ? OPERATING EXPENSES = EBIT.

- Debt Capacity Ratio Calculation – Compute the debt capacity ratio with the use of the formula EBIT ? DEBT PAYMENTS DUE. Moreover, the debt capacity ratio is also known as the debt service ratio, which goes in the abbreviation DSR. It represents the number of debt payments that can be done with the present FCF or free cash flow.

- Interest Coverage Ratio Computation – The interest coverage ratio has the formula EBIT ? INTEREST EXPENSES. The interest expense must encompass a similar period with the calculation of the EBIT. All in all, a business establishment must meet its interest expenses two to three times at the very least to be called financially secured.