11+ Balanced Investment Strategy Examples to Download

The balanced investment strategy is a way of balancing the risks and returns in portfolio allocation and management. It manages the portfolios which deal with the equities and fixed-income securities. But a balanced investment strategy itself causes risks to the process and is best suitable for the long-term investments which are more capable to tolerate more risks.

11+ Balanced Investment Strategy Examples

1. Sample Balanced Investment Strategy Example

balanced investment strategy is used by the traders to balance the risk and returns in a business. It mainly focuses on the return scope and possibility in a long-term investment attempt. If you want to prepare some strategies of this sort for your business plans, choose this template and simplify your tasks.

2. Balanced Shares Investment Strategy Example

Investing in shares might might be unpredictable that is why people employ balanced strategies to maintain the business as expected. If you feels interested too invest in shares look at this template for once and you would get ideas on the risks and returns you might get investing in such assets. And if you feel this is useful you can have it for your strategy design.

3. Balanced Tax Investment Strategy Example

Balanced investment is a way of strategizing the investment in certain businesses that might contain greater risks than normal. Such risks also carry greater rewards but the planning to achieve them needs to be done properly. The mentioned template has focused on balanced tax investment strategy to detail the portfolio details. Have it if it fits to your requirements.

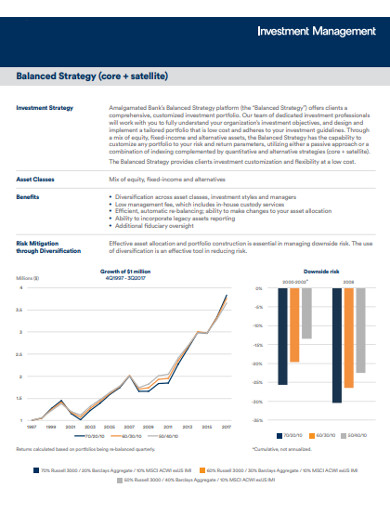

4. Balanced Investment Management Strategy Example

While investing in a business you need to strategize the way would place your investment in different stocks and assets. And once you have done the investment you need to maintain a growth and risks of the business that comes along. You can choose this template to understand the fact as it has portarayed it very well with graphic representation.

5. Simple Balanced Investment Strategy Example

Every trader or investor should make some strategies before investing their capital in any asset or stocks or shares. And if you are following balanced investment strategy you should focus on strategizing the return scope as this strategy itself contains some extent of risks. This template can explain the fact so have a look at this template today!

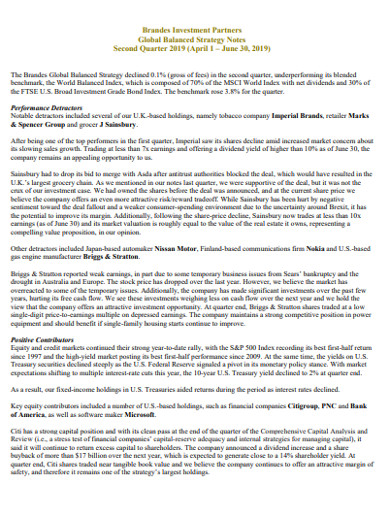

6. Balanced Partners Investment Strategy Example

Investment strategies needs to be designed focusing primarily the return scope of the investments and the risks it comes with. If you need to frame a balanced investment strategy among partners this template might reduce some of your work load. So have a look at this template and if it looks helpful to your trade plan this template is only one click away!

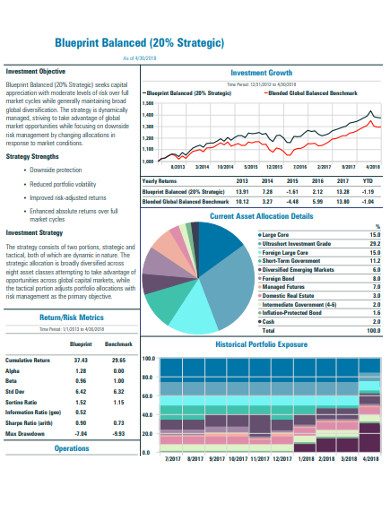

7. Balanced Investment Risk Return Strategy Example

Balanced investment deals with the risks and the returns in the business and focuses on the strategies to minimise it to the minimum possible level. A business underlies several risks that need to be given proper margin of security to tolerate for the returns. This template has explained the relevance of risk and return in balanced investment strategy have a look at this today!

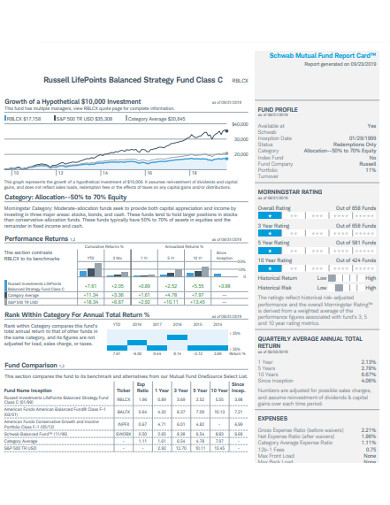

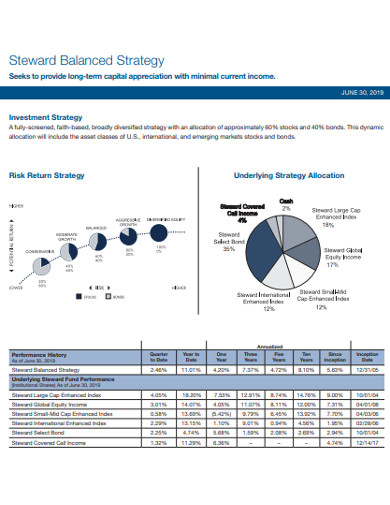

8. Balanced Investment Strategy Fact Sheet

The given sample of the fact sheet contains the description and key elements that is required in a balanced investment strategy. This template has explained the facts of the strategy in both descriptive and representative patterns. You can try this template and if it suits to the requirements to your investment strategy, download it according to your convenience.

9. Standard Balanced Investment Strategy Example

Investment strategy refers to the techniques and tactics applied to the spending capital in the different asset and instruments for the trade. And a balanced strategy focuses mainly on balancing the risks and higher return chances of the investment. If you want to have some more insights into the topic the mentioned template can help you to process your study have a look at it.

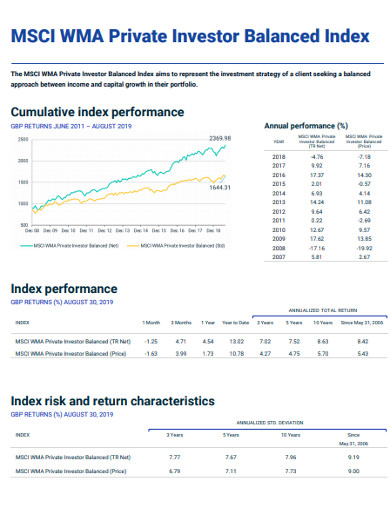

10. Balanced Private Investor Strategy Example

Investor refer to the different strategies while designing their investment portfolio. The performance of the assets and the investments are calculated in different types of indexes have a look at them in this template. This template has covered several performance, risk and other indexes, understand them and manage your private investment strategy.

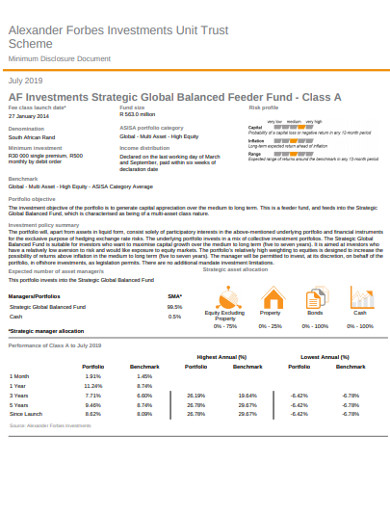

11. Global Balanced Investment Strategy Example

Balanced investment strategy is a little advanced version of the investment strategy that mainly tries to maintain the maximum profit in the return of the investment. The global balanced investment strategy needs to be shaped with some different and schemes and trade regulations applicable on all the members. Download this template if you want to understand the global balanced investment strategies and process.

12. Balanced Annual Investment Strategy Example

What is Investment Strategies?

Investment strategies are often designed based on different analyses of the business that helps to decide which strategies and approaches can help the business best. The common strategies of business in the market are:

- Fundamental Analysis- This analysis uses research and analysis approach and reads the past and present performances of a firm to choose the best and quality stocks.

- Technical Analysis- This focuses on the technical data, market trends, indexes, and price patterns to forecast the probable future market movements.

- Value Investing- This investment strategy buys stocks when they are available at the cheapest price in the market. They focus on the stocks which they believe are undervalued, add value to them and way for the perfect time to release it in the market to achieve greater profit.

- Growth Investing- This suggests that the investment is best in its matured stage and where all the investors are investing only in the growth stocks.

- Buy and Hold- The investors applying this strategy focuses on long term returns by buying stocks and holding it for long when it is matured enough to give higher returns they release it.

Investment is the most important thing in trade but it involves a lot of risks that is why market research is important to analyse the risk and manage it. The mention sample of template is based on annual investments that can help you to simplify your task. You can also use it after editing and customization it the way you want as it is available in DOC format.