11+ Basic Accounting Skills Examples to Download

Basic accounting skills refers to the idea of or skills of preparing the monthly, half-yearly or annual financial statements. This sort of accounting can be done by organizing the sum of income minus sum liabilities and the sum savings during an accounting period. Such financial records should be framed with all the assets and liability along with loss and profit details so to manage the final accounts statement.

11+ Basic Accounting Skills Examples in PDF | DOC

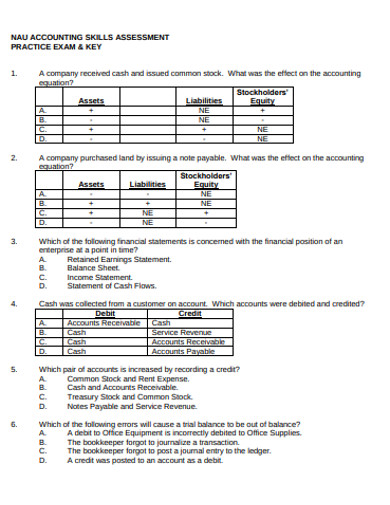

1. Accounting Assessment Skills Example

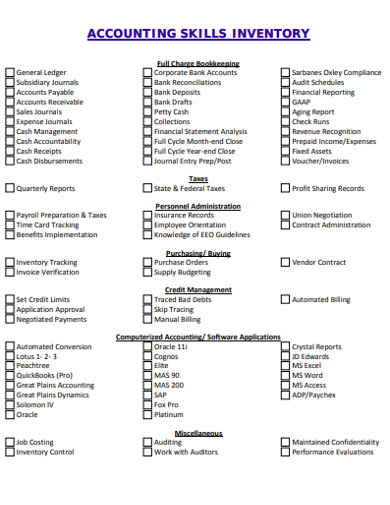

2. Accounting Skills Inventory Example

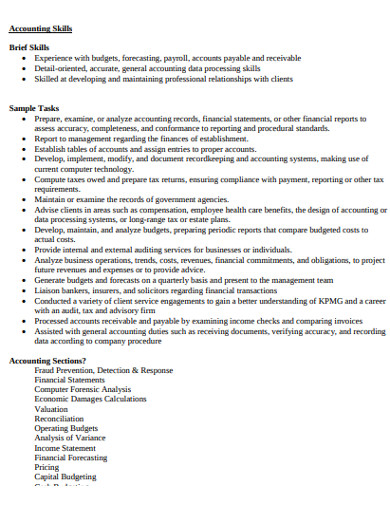

3. Sample Accounting Skills Example

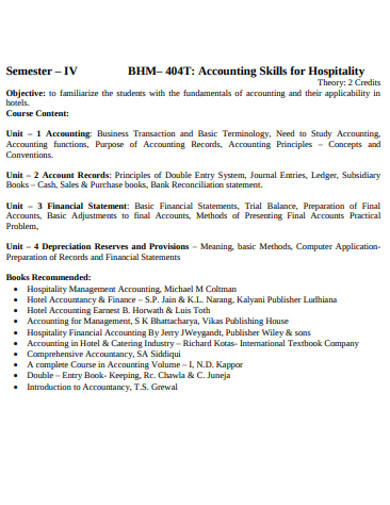

4. Accounting Skills for Hospitality Example

5. Accounting Auditing Skills Example

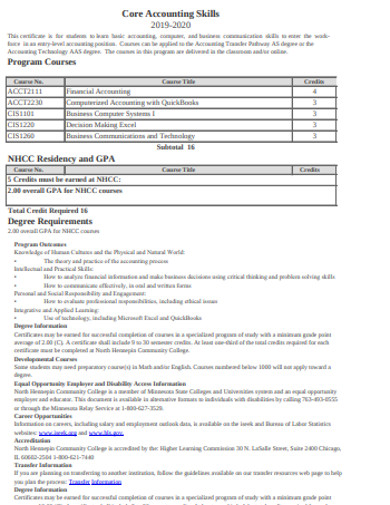

6. Core Accounting Skills Example

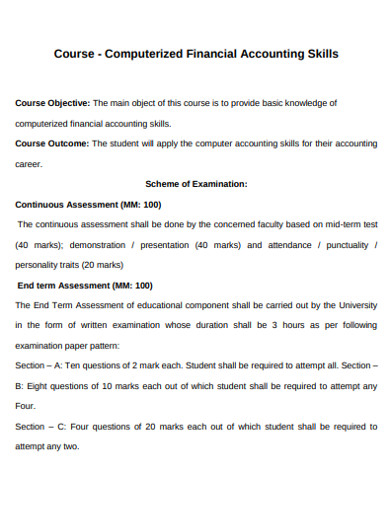

7. Financial Accounting Skills Example

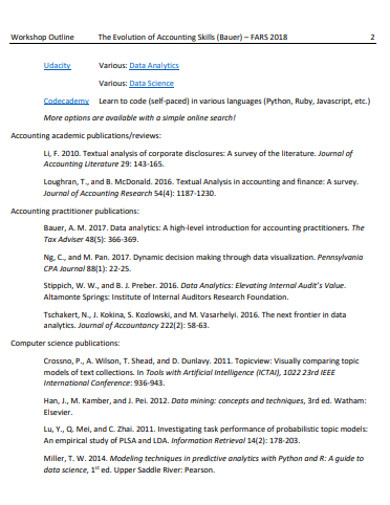

8. Evolution of Accounting Skills Example

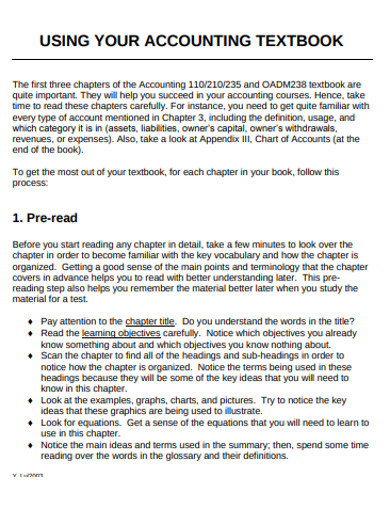

9. Accounting Skills Textbook Example

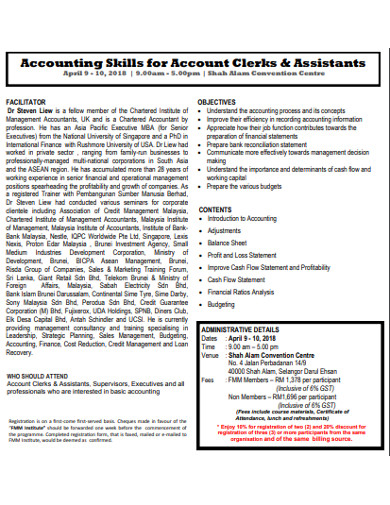

10. Accounting Skills for Account Clerks

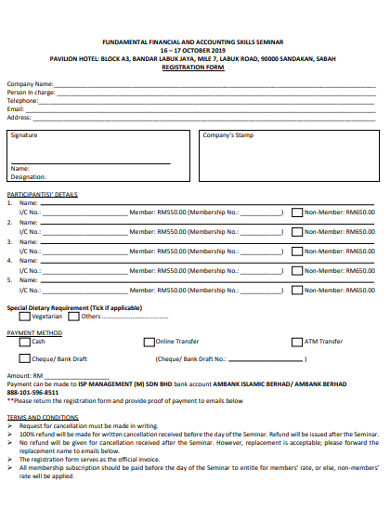

11. Fundamental Financial and Accounting Skills

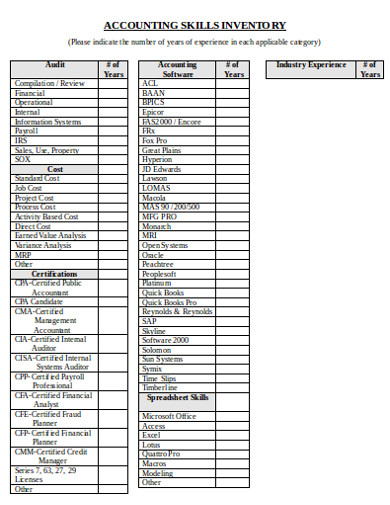

12. Accounting Inventory Skills Examples

What are the Important Accounting Guidelines?

Accounting guidelines or rules are nothing but some techniques using which you can design an effective account statement. The guidelines involve the ways of entering several transaction details of one account holder. Often in personal accounts, this process gives a more reliable financial statement.

Step 1: Illustration of the Debit and Credit details

The accounting statement should add all the transaction details by adding the credit amount to the giver’s account and by deducting the cost amount from the gainer’s account book.

Step 2: What Comes in and what Goes out

Often in the case of the real accounts, the guidelines are the best and most helpful in preparing the startup financial modeling. Because such accounting details count the details of the default debit balance which gets increased and decreased by transaction details.

Step 3: Calculate the Capital

Often happens with the nominal accounts there is already some amount of capital kept for the business. This capital is used for all sorts of asset gaining and liability payments. The final sum-up of all the gains and profit misusing all the loss, expenses and liability makes the final balance sheet.

What are the Basic Principles of Accounting Skills?

Cash Inflow

Before starting to prepare an accounting statement it is important to recognize the sum amount of revenue or gross inflow of cash you have in your organization. This revenue may include all the receivables, revenue generated by the assets or sale of goods, etc.

Cost of Assets

The next principle of accounting is to record all the history of the amounts you have spent on any sort of assets. The one you have got for free should not be counted in the list as you are calculating your total expenditure and profit.

Accrual Principle

All the financial statements should be framed with an accrual basis that says all the account transactions should be recorded during the period of accounting. It is a great aspect of framing the financial statement.

Transparency

The financial book or statement must be designed with transparency stating all the relevant data. It should convey reliable facts and hide nothing.

Objective Entry

The data added in the transaction records should not be biased from any angle. It should be based upon facts or supportive and adequate evidence. Thus the data added in the transaction sheet needs to be verified before being stated.

What are the Practical Approaches to Accounting

The income statement refers to the document prepared to highlight the details of all the incoming and outgoing capital. It needs to be prepared and calculated with all the revenue and expenses details and net profit details. the best way to record the details is to use Excel file for the financial analysis.

Balance Sheets

A balance sheet is a financial statement that one can prepare at any point for certain periods. This sort of record sheets contains all sort of details taken place between the parties involved. Balance sheets help to prepare financial risk management. That is why keeping a check of it is important.

Cash flow Statement

The cash flow statement or the statement of cash flow is a crucial part of financial accounting. This statement highlights how different ups and downs in the balance statement affects the cash flow of the organization by affecting the investments of different activities. This approach is used to record the data of both the in-house and outside business details.

What are Some Tips for Learning Accounting?

- Daily Records – The accounting process can be easiest if you keep dumping the everyday transaction in a rough document that can help you to design the final statement file later.

- Retain all Invoices – All the receipts and invoices of all the purchase ad transactions should be retained for validating and verifying the record.

- Make all Invoice Details entry – All the invoices collected from the different transactions and other finance essential details should be jotted down specifically.

- Profit and Loss Statement – The financial accounting should be done by summing up all the profit and revenue details by deducting all the loss, expenditure and liability details.

- Calculate Taxes details – Avoid tax mistakes and never forget to collect the taxes while dealing with the party to be safe from paying heavy taxes annually.