Basics of Forex Trading

Forex trading refers to the foreign exchange that is a network of sellers and the buyers who engage in trading exchanging the currencies of their respective nations. It can be understood by the fact that when people travel to a foreign country, they exchange their currency to the traveled nation’s. This is called the Forex transaction. As much as such a transaction takes place, the chances of volatility for other currencies rise. This Forex exchange gives high rates of profit to nations, but alongside it also increases some sort of risk. Thus, traders attracted by the Forex with greater hope of profit increases risks too.

What is Forex Exchange Market?

For understanding this you first have to understand the currency market. This market is run by the global network of banks of different time-zoned four major forex trading centers. Those are London, New York, Sydney, and Tokyo. For understanding this you can read about the three different types of forex markets.

1. Spot Forex Market

Such market refers to the exact place the trade is settled in as the name suggests ‘on spot’. This is a physical currency exchange often done within a short period.

2. Forward Forex Market

It is a pre-planned forex exchange market in which an agreement or contract is signed to buy or sell a set amount of currency at a mutually set price. Often on mutually agreed dates

3. Future Forex Market

This is also a pre-planned contract or agreement with a legal bond to buy or sell a set amount of currency at a set price and on a future date.

5+ Basics of Forex Trading Examples in PDF | DOC

1. Sample Forex Trading Example

Forex trading is a global market activity that apart from exchanging or buying and selling commodities and stocks, buys and sells currencies. It requires understanding different terminologies and trading systems. It follows different rules and regulations for certain currencies too. You can refer to this template to understand the trading rules and system better and prepare your Forex trading strategies. So have a look at this template today!

2. Forex Platform Development Trading Example

People before engaging themselves in forex trading takes forex trading tutorial or some go for several courses to be expert in the field. We suggest adding this template to your list to get more advanced knowledge of the forex platform development trading process. Following the template that is framed describing several important facts of forex trading, you might clear your confusion. So, check the template out today!

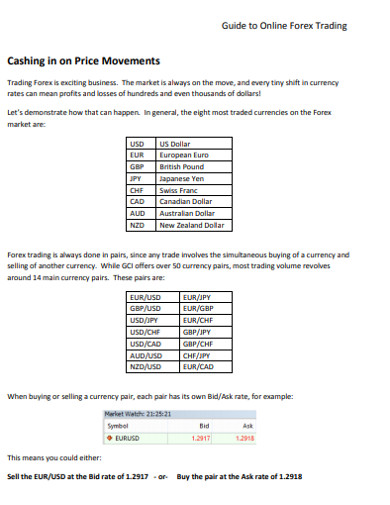

3. Online Forex Trading Example

With the advancement of technology, the era of online and offline platforms has been demarcated in two spheres. The mentioned example on forex trading shows the system of online cashing in on price movement in the trade. You can also get ideas on trade agreement by following our other example templates on forex trading with one click. So, check them all out today!

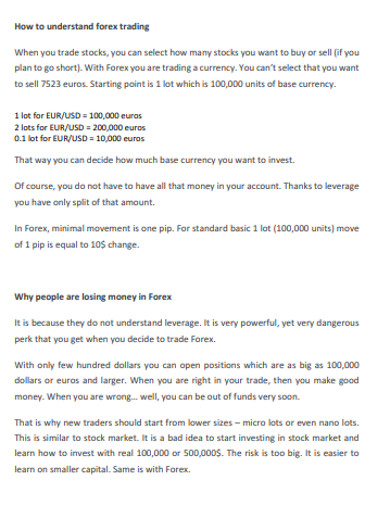

4. Forex Trading for Beginners Example

5. Forex Trading System Development Example

6. Solid Forex Trading Strategies Example

What are the Basics of Forex Trading?

Currency and its value keep on fluctuating relative to the other currencies as per its demand in the global market. Before you engage in the global foreign exchange market, we have some basic ideas of Forex trading here for you that might benefit you.

Currency Pairs Primer

Forex market is run by using symbols for each currency in the market like USD for US Dollar, EUR for EURO, AUD for Australian Dollar, etc. Forex trading always takes place in pairs. There is always one currency down and one up. In forex trading, for instance, if the exchange is needed to be made between USD and EUR, you have to see how many USDs were required to buy one EURO. This helps to know the value of both currencies. Each forex pair, like EUR/USD, retains a certain market price associated with it. This price refers to how much of the one currencies were required to buy the other currency.

Market Pricing

Learning Forex trading requires to learn all the small and great terminologies of the market to trade and calculate the trade profit. Many currencies move about 50 to 100 pips or Point on Percentage that suggests the second or fourth decimal place in a currency pair if the other currency in the pair is JPY. Buying the currency at 1.3600 and selling it in 1.3650 makes you achieve a 50-pip profit. This profit also depends on how much currencies did you buy and sell. By first currency in Forex trading, it means the directional currency on a Forex price chart.

Shorten the Learning Curve

To trade with less risk at your capital, learning the price move in real-time and place curve is important. While in the learning period, you can use fake money by having a certain type of account called the paper-trading account. This might reduce the financial risks of yours, and you will learn your Forex trading lessons.

Forex Market

The mentioned descriptions above on different aspects of Forex trading might help you to understand the price fluctuations and value movement in the market. Understanding these aspects, you can understand the difference between pips and price points and calculate the profit potential in your exchange moves.

You can also have a look at the templates and examples provided below to know more and understand Forex trading. So, have a look at them today!