Boardroom Financial Essentials

Boardroom finance essentials is a course designed for the corporate training of the corporate aspirants. The course is designed by the directors only to give a perfect idea of the boardroom environment to the aspiring future directors. A boardroom is the meeting place of the different board members to discuss, plan, strategize, compensate execution of the plans, and risk management. Such a practice is a very crucial part of corporate good health of a firm.

3+ Boardroom Financial Essentials Examples

1. Sample Boardroom Financial Essentials Example

2. Financial Literacy for the Boardroom Example

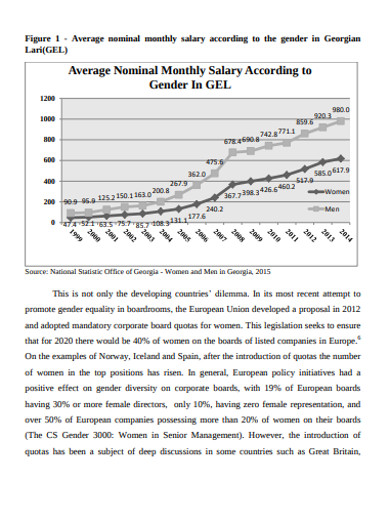

3. Monthly Financial Boardroom Essential Example

4. IT Financial Boardroom Essentials Example

What is Boardroom?

A boardroom is a perfect place for the corporate employees and board members to gather and discuss and plan different actions for the good of the firm. The main purpose of the board meeting is to design a good corporate financial budget and management plan to plant the products and services in the market properly. To adopt proper measures for controlling the corporate risks in the ongoing or about to begin plans. It also has to do with how the company would perform in the upcoming days to achieve the targets and designs the finance and other essentials required.

What does the Course teach?

The course boardroom financial essential course gives a lot of lessons to the students. It allows the participants to tackle the different financial agenda components which the participants and the directors have to face and work on.

Such practice includes:

- Planning both for finance and actions.

- Linking both the plans together to strategize the actions.

- Making the audit and reporting and directions on the non-audit committee roles.

- Linking strategies with and risk possibilities with the finance available and the expenses.

- Compensating execution and other capital.

- Financial issues.

What are the Finance Essentials for the Directors?

Financial statements help in briefing and showing the company’s cash flow and different other money movements in different situations. The board members are given the financial reports and statements that the directors need to study and detect the problems and rectify them. Such potential of detecting and identifying elements in financial statements is called reading financial reports in the corporate language. Several elements are often inherent in such statements they are:

1. Balance sheet

A balance sheet shows the record of different sorts of transactions and remaining of a company with its parties. it maintains the record properly with the date and time of the transaction. It also holds the record of the assets, liabilities and shareholders equity of a company. The most fundamental formula to calculate the accounting entry and other details-

ASSETS = LIABILITIES + EQUITY

2. Income Statement

The income statement keeps a record of the profit and loss of a company by showing the capital the firm has earned and spent at a particular time. The revenue of goods and services on the top of the statement sheet is referred to as the ‘top line’. Next, it frames the deductible Costs and expenses to define the net profit as the ‘bottom line’. the income statements are calculated in two ways single-step method or multi-step method.

3. Cash Flow

The cash flow of any company records the amount of money being transferred to several departments for different purposes and tasks of the company. It records both the inflow and outflow of the cash. The cash flow statement of the company decides whether a company performed positive or negative in a particular business period based on the cash exchanges.

4. Ratio Study

Ratios are used to frame accounting data and figures in comprehensive and instructive directions and which can communicate well. It needs to show different details, measure goals, performance, etc of a company or organization. This also helps to measure the success and failure of a company as it expresses the elements of financial statements. Regular ratio reports can be given to the directors who can keep the company on track by monitoring the progress. Different ratios are practised by different institutions like growth ratios, profitability ratios, operating efficiency, leverage ratios, liquidity ratios, etc.

What is Boardroom Support?

Boardroom support can be understood by understanding the following points:

1. Succession Planning

Many board members and directors wish to have CEO-succession planning for the better planning of the plan and its execution. Such practice is becoming more visible in different companies for its successive approaches.

2. The Right Stuff

The decision of choosing the leader needs to be done carefully with focus given on the skills, knowledge, and experience of the candidate. The directors should meet and decide the criteria according to which the leader would be selected.

3. Skilled Leaders

The board of management needs to take some measures and to adopt good practices for leadership development. Perfectly skilled and well-managed leadership programmed companies forecast their opportunities and weaknesses and give the members a chance in rotations to participate in leadership.

4. Constantly Standing with the CEO

Board members are powerful when they stand together and so does the CEO is if he is supported by the board members. Thus the board should stand by the side of the CEO while he takes decisions and for the firm.