10+ Cash Flows in Finance Examples to Download

Cash Flow or CF refers to the capital fluctuations in a business, company, institution, or in any individual’s account. in business, the focus is always on how much capital production or revenues were generated by a firm within a pre-decided time frame. It also counts all the ins and outs of cash or cash equivalents in a business account. The ability of a business to generate positive cash flow determines its ability to create value for the shareholders.

What are the Different Types of Cash Flow?

There are different types of cash flow in the business, each is used for their different and peculiar quality in financial analysis and hence for running the business.

- Cash from Operating Activities: The cash generated by the company itself without any investment of another party.

- Free Cash Flow to Equity: FCFE is the capital available for and in business operations after the reinvestment.

- Free Cash Flow to the Firm (FCFF): Used often for financial valuation and modeling, this is a measure that holds that the firm has no leverage or debt.

- Net Change in Cash: In the bottom of the cash flow statement, changes in the cash flow amount is marked among different accounting periods.

What are the Different Uses of Cash Flow in Finance?

Cash flow is a crucial part of running a business, operating it and for its financial analysis. Thus we have discussed some of the most common and used uses of cash flow in finance and business.

- Net Present Value (NPV): Calculating the NPV by calculating the business value which used or built a discounted cash flow (DCF) model.

- Cash Flow Yield: It measures how much cash a business could generate in an enterprise per share as compared to its share price. And this yield is communicated in a percentage system.

- Cash Flow Per Share: CFPS is the cash obtained by the business operations and the result is received after its division by the total number of shares outstanding.

- P/CF Ratio: CFPS is, many a time, used as an alternative for the P/E ratio or the price-earnings.

- Dividend Payments: Dividend payments refer to the use of the cash flow to fund the dividend payments to the investors.

- Capital Expenditures: Cash flows are used to fund the operations and invest in the business.

- Internal Rate of Return: Internal rate of Return or IRR is the center of focus for the investors for investing.

- Liquidity: It assesses how smoothly a firm is able to meet its short-term financial obligations.

- Funding Gap: This measures the gap that a company needs to cope up with.

- Cash Conversion Ratio: Its the measurement of the time required in business paying for its inventories and receiving the payment back from the customers.

Here we have attached several examples and templates that can give you a clear idea about the process. Have a look at them.

10+ Cash Flows in Finance Examples

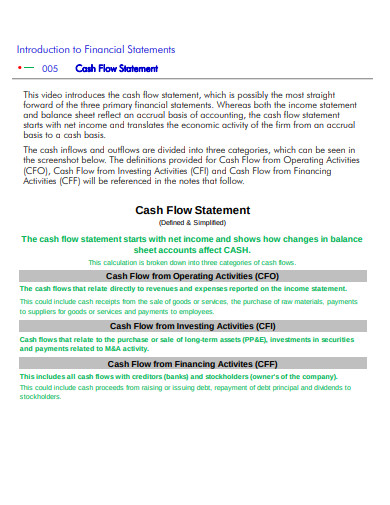

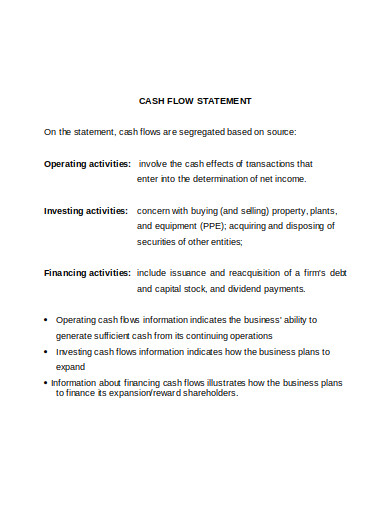

1. Statement of Cash Flows in Finance Statement

If you are about to open a business or if you are an entrepreneur you should focus on what is cash flow in finance. Because this is one of the most crucial aspects of the business that you should understand before you start expecting investors and profit. Balancing and managing your cash flow can help you to climb the ladder of success in business. You can refer to this statement on cash flows in financing activities to get a clear idea of the process.

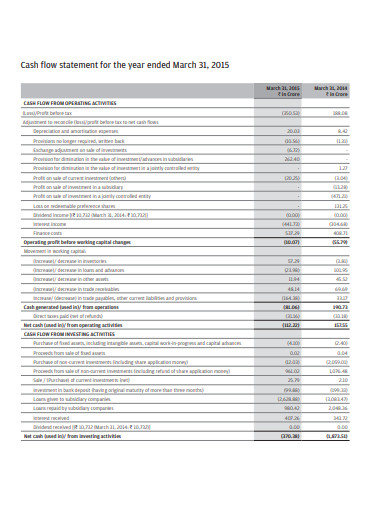

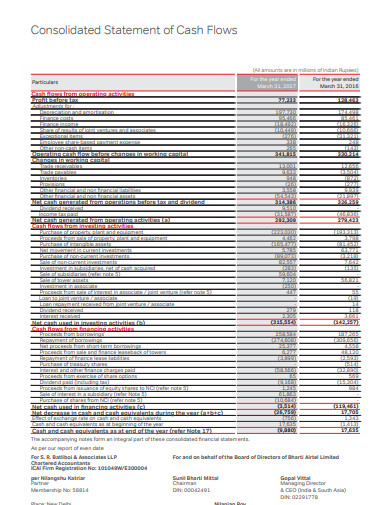

2. Cash Flows Statement of the Year Ended

Preparing a cash flow statement needs to highlight several things and business operations in the final statement document. Annual cash flow always ends on March 31st and starts on April 1st. If you are focusing on an annual cash flow statement referring to this template might give you some ideas on the process. So, have a look at it before you get confused and stuck on any of its processes.

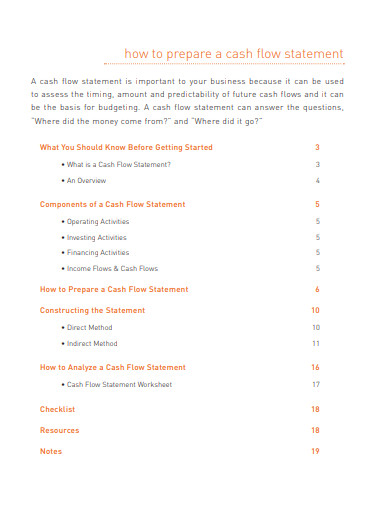

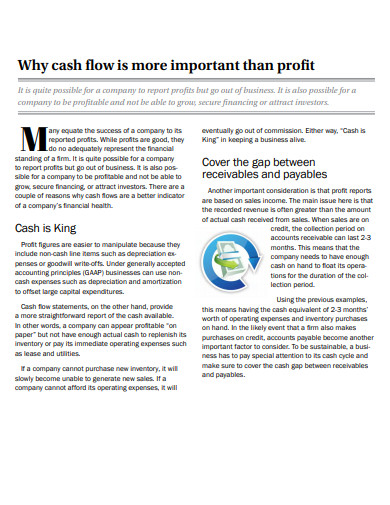

3. How to Prepare Cash Flows Statement in Finance

Cash flow statement preparation is a step by step process that needs to be done systematically to meet the ends. It might get confusing at times as it involves huge numerical data. You can check out this template on the cash flows financing section which very clearly talks about how the statement can be prepared following certain minute steps. So grab the template today!

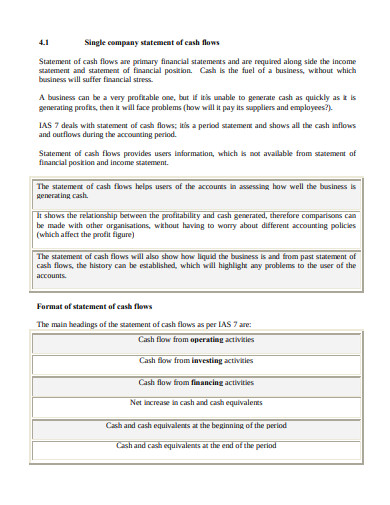

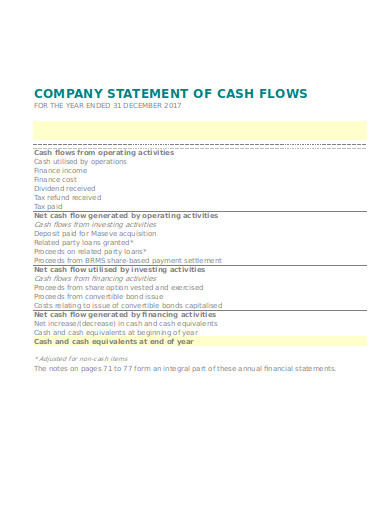

4. Cash Flows from Financing Activities

Preparing a cash flow statement is a process summarizing all of your financial activities taken place in the business. It helps to let you and your investors know about the payments and yield you made in one business session and how much gap you need to cope up with. The mentioned descriptive template can give you a proper idea about the relevance of having a statement of cash flows financing activities of the business. So have a look at it today!