10+ Closed-End Funds Examples to Download

A close-ended fund is a model of collective investment that raises a fixed amount of shares or capital using initial public offering (IPO) which can not be redeemed from the fund. Close-ended funds are observed overseeing the activity of trading the assets. It trades like equity, like ETFs because of the fluctuation in the price on the trading day!

What Advantages and Disadvantages Closed-end Funds Offer?

Advantages:

- In closed-end funds, the investors are allowed to redeem their units only after the maturity of the fund expires. It helps the portfolio managers to prepare an investment strategy easily on a stable base without the disturbance of fluctuations.

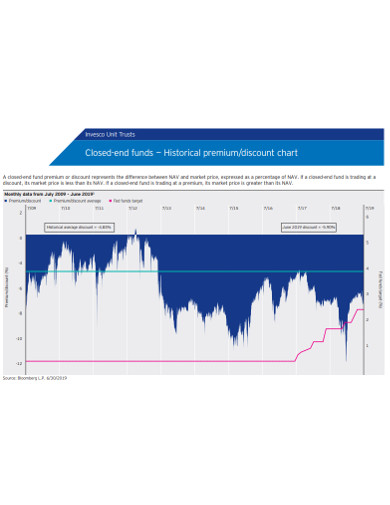

- The plus point that closed-end funds trade like equity shares helps the investors to use real-time prices to buy and sell their units, either it is a premium or discount rate of the fund’s NAV (Net Asset Value). They are not limited to it but can also use margin trading.

- Investors, in close-ended funds, easily liquidate stocks utilizing real-time prices. They can buy and sell their fund units at the contemporary market price with the help of real-time prices and real-time information.

Disadvantages:

- Fund managers are often restricted to making and changes in trade. Even the lock-in period in which the managers are allowed the flexibility to allocate funds without any fear of outflows couldn’t help ion generating rewards.

- Close-ended funds can expose you sometimes to bigger risks as it asks the investor to pay a lump sum to get some fund units when they get launched. But many investors can not afford lump sum investments always.

- Close-end funds do not give any track record which results in the uncertainties for investments and the only thing the investors can rely on are the managers.

What is the Difference Between Closed and Open-end Funds?

Open-end funds allow investors to trade continuously and enter and exit the market whenever they want. The trade also can be done anytime as per the convenience of the investor at the NAV as declared by the fund. This helps to determine the market value of the assets at the end of the trading day. The NAV in open-end fund changes every day as per the fluctuation of the stock and bond prices in the fund. NAV is important in open-end funds as it helps in determining the holdings in the mutual funds. NAV is also important for it is the price new shares are purchased and redeemed at which.

Whereas in closed-end funds there are professional managers who try to manage and assemble the investment portfolio following the set goals and objectives of the fund. Closed-end funds do not trade at the NAVs as their main focus in on the share prices that are based on demand and supply for their funds. They are, sometimes, run at premium and discounts to their NAVs. Closed-end funds can be followed easily by following the financial papers or financial web sites. It requires brokers for trading and buying and selling purposes.

10+ Closed-End Funds Examples

1. Market Closed-End Funds Examples

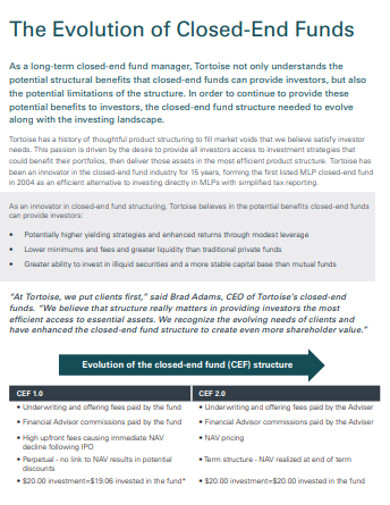

The closed-end fund market might be a little complex to the amateurs that is why following a better-planned idea is important. There are too many theories out their on the closed-end fund that might be or not be of your use but we suggest that the mentioned template will surely help you. The example template frames minute descriptions on different aspects of the closed-end fund market. On choosing this template you would be able to understand the closed-end mutual funds too.

2. Closed-End Fund Risk Disclosure Statement Example

The closed-ended fund might cause risks at different times for different reasons as it gives the need to invest in a lump sum. Mitigating any sort of risks requires you to first know it properly and referring to this template can help you to understand that. The precise description in the template frames a disclosure statement on closed-end funds risks. Having chosen this template you might get a clear idea of the risks that it might make your face. It will be easier for you to mitigate that even if you face or you can also choose our other templates on closed-end municipal bond funds.