5+ Debt Service Fund Examples to Download

Debt service refers to the cash that is used for paying the interest of a debt taken to a particular period defined. This is also applicable to student loans and other types of borrowings where the borrower is charged with such fund services monthly or annually. The companies ate held in no exception to this process and they are also required to meet the specified requirements in the debt services.

How the Debt Service Fund is Processed?

The process of the debt service fund says you have to serve the lender monthly or annually to compensate for the big amount that they have given you. This service would be a small certain amount that both the parties have agreed on and calculatingly is feasible for both ends.

After the capital is borrowed and is in your hand you have to maximize the shareholder value by utilizing it. The capital helps companies to invest without thinking much. But you should always remember that you should not even take more and more debt, as it’s harmful to your business‘ worth. It is not that investors will not invest in companies with debt. But companies that are able to manage their debt well are preferred on top of most of the investors.

Issuing bonds can also make you one of the excellent debt servicers in the eyes of the investors. Your company or firm just have to detail and provide pre-set interest and regular payments on dates as specified before to your bondholders. You can also convert the debt to equity if the situation in the business asks for so or you can also repay the debt before the specified time limit. It is also important to not to reveal and leak out the information that you might not be able to serve the debt. Because this can cause your stocks to go down in the economic index and getting financed for enterprises would be difficult.

What are Debt Service Coverage Ratio and its Purpose?

To improve the overall performance of the company a careful and critical analysis of debt service helps, especially in financial institutions. Thus while they analyze and focus on estimating the worth of a company the ratio they focus on is the debt service coverage ratio. In financial institutions, it helps in calculating the repayment capacity of the company.

Purpose

As mentioned above this is a significant way to measure the cash-producing ability and worth of firms for covering the debt payments. This analysis and measurement also help the lenders and the stakeholders to have the idea of the firm’s financial condition, cash flow, availability of the cash to pay the debt, etc. For this specific feature of the DSCR banks and other financial institutions show great interest in using it. In the context of business and firms, this measuring technique is useful for both the creditors and the investors. But it is often the creditors who analyze and calculate it.

Importance

- It helps in reducing risks for investors on debt securities.

- It reduces the effective interest rate that is required to sell the offering.

5+ Debt Service Fund Examples

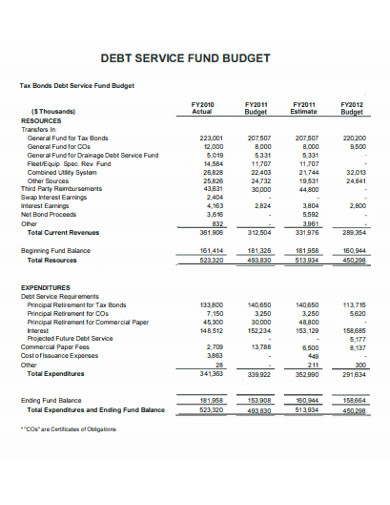

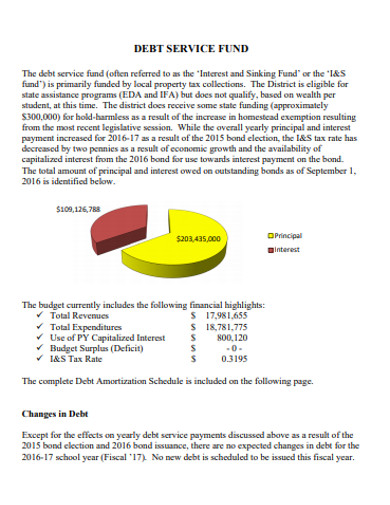

1. Debt Service Fund Budget Example

Understanding debt service reserve fund might be difficult at times as it is a complex process for any new business practitioner. But if you look inside it properly, it is not that tough. Getting a clear idea of the process you can become a good businessman utilizing the debt. You can also have a clear knowledge of the process and its different aspects by referring to this template framed on budgeting debt service fund. So, have a look at this template today!

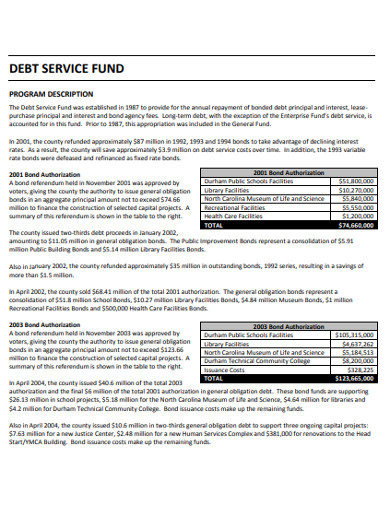

2. Sample Debt Service Fund Example

If you are preparing your company business plan with accounting for debt service fund in frame referring to this template might help. Framed with descriptive details on different aspects of the program, bond and authorization steps and regulations would give you the ideas you might require. So we would suggest you to choose this template and use the ideas for the need for capital funding. So, check the example out now!

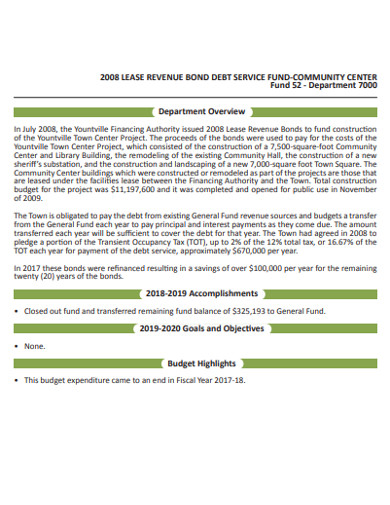

3. Lease Revenue Bond Debt Service Fund Example

No investor or lender would hand you capital or other stocks and securities with an agreement. Thus we suggest you should have a look at the example given framing a proper business plan with aim and objectives, budget and plan, etc. The plan designed in this template might impress you and give you ideas on different techniques. So, try this template today or you can also refer to our template on the funding agreement.